Media Worth Consuming – February 2022

Top 5 Articles

Whilst American politicians love to talk about bringing drug prices down, Mark Cuban is starting a business that will actually deliver it.

Seven weeks ago Chinese property developer Zhenro boasted about its liquidity and its bonds traded near par, now its bonds trade at 25% of face value.

Employees have the whip hand in the US with a record high number of quits and job openings and record low number of firings.

The RBA’s claim that households are net borrowers is deliberately misleading and wrong.

Like the Obamas and the Clintons before him, Donald Trump has been cashing in on his presidency though in much tackier ways.

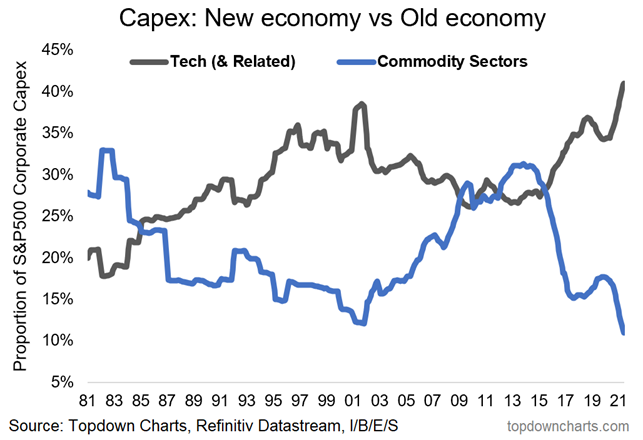

Chart of the month – The cyclicality of capital allocation

The cyclicality of investor sentiment and asset classes has been a strong theme in recent months. The sell-off in high growth stocks and SPACs, rising bond yields and the jump in energy prices all involve a reversal of previous trends. Many investors struggle to stand back from a trend and consider history and future profitability when allocating capital. Running with the herd always seems to be the safest option in the short term.

The chart below from Callum Thomas at Topdown Charts highlights the cyclicality in capital expenditures in technology and commodity sectors for S&P 500 stocks. Note the bump in tech investment in the late 90’s and early 2000’s and the subsequent bump for commodities in 2009-2015. These bumps align with the tech boom and the oil price boom respectively, an example of capital chasing historical returns.

Arguably the most major recent cyclical change is rising bond yields. After 30 years of seeing yields trend lower, we could be on the cusp of a substantial break higher. As inflation readings have consistently printed above expectations, markets have upped their expectation of where central banks will lift interest rates to. Most stark has been the jump in short term yields as central banks pivot from ignoring inflation to responding to it. However, long term yields have moved far less than they could have, still around 2% for 10 year government bonds in Australia and the US.

This disconnect was noted by Philip Lowe in a recent Q&A session. He observed that markets were essentially saying that US inflation could fallback from 7.5% to 2% without needing positive real interest rates, which is a rather heroic assumption. He then went on to say that he hoped to see positive long term real interest rates, as that has historically been associated with higher levels of economic growth and productivity.

This is something I have been writing about for years but it is the first time I can recall a central bank leader stating this obvious point. We should want higher interest rates because low rates promote speculative rather than productive activity, with an increase in productive activity the key to long term prosperity. (The other 2 P’s in the 3 P’s of economic growth, population and participation, are largely exhausted for Australia without incurring substantial costs.)

Market pricing says that the current batch of central bankers don’t have the nerve to increase rates significantly to address inflation. Whilst this is probably right, the possibility of long bond yields getting back above 4% has gone from remote to realistically foreseeable. Central banks have strayed so far from their targets that they risk political pressure being poured on them to act. If a politician is under pressure from voters because of elevated and widespread CPI, why wouldn’t they hold central bankers to account for failing to act? A small example is the change in tone from Jerome Powell and Lael Brainard after they were announced as the Fed Chair and Vice Chair late last year.

Turning back to the cyclicality of capital allocation, one additional point to remember is that for investment markets demand creates its own supply. (This might sound strange coming from a supply side economist.) If the last few years have taught us anything about high growth investments (or more cynically, investments that hold out a dismal prospect of generating lottery type returns) it is that markets will create something to satisfy the appetite.

If enough people want something that could theoretically be the next Google or Facebook, entrepreneurs will create a money losing meal delivery service or scooter rental business to sell to them. The same principle applies to SPACs with the strong early returns attracting a flood of capital that could overpay for money losing meal delivery services and scooter rental businesses. We now appear to have passed the turning point on these high risk endeavours with long shot companies and SPACs copping a pasting in recent months.

Here’s the long list of the most interesting and under the radar articles I came across this month.

Finance

There’s now over 1,000 venture capital backed companies with a valuation of $1 billion or more (unicorns) with an average of one more added to the list each day. The counter-consensus arguments that higher long term interest rates will have little impact on tech stocks. UK stocks trade at a comparatively cheap forward PE ratio of 12, with activist investors looking to take advantage. The CEO of a roofing products manufacturer explains how messed up the supply chain is for his key inputs. Goldman Sachs is punishing departing employees by stripping vested and unvested stock awards, poisoning relationships with people who would normally be a great source of future revenue for the bank.

One short seller has been raided and another 30 are on a list with the FBI and Department of Justice investigating unknown issues. Short seller Muddy Waters has “debunked” the research of the academic driving the campaign against short sellers. A long article on the firm that scored 5 of the top 10 short calls in 2020. How distressed debt investors change tack when there isn’t enough distressed debt to go around. Multi-strategy hedge funds are grabbing the lion’s share of new capital. The ECB threatens to raise capital requirements for banks making leveraged loans and US regulators warn of the risks building in the sector.

Politics & Culture

The government report on the US involvement in Afghanistan contains many lessons for those who think government has the answers. Seattle imposed a soda tax, residents responded by switching to beer. After making climate “promises” in 2021, many politicians are backsliding on them in 2022 as cost of living pressures kick in. US intelligence officials accuse Zero Hedge of publishing pro-Russia disinformation which prompted a response from Zero Hedge. The CIA has been accused of undertaking a massive, illegal and unconstitutional spying program on ordinary Americans.

Justin Trudeaus is having a Ceausescu moment with elite leftists having turned against working class truckers and their expression of discontent. Canada’s excessive crackdown on the protesting truckers is the best argument yet for cryptocurrencies. New Zealand used sprinklers and Barry Manilow music to try to get their freedom seeking protestors to move on.

The anti-defamation league has changed its definition of racism after the old definition was criticised as racist. The success of Asian Americans highlights the fallacy of critical race theory. Corporate wokeness is mostly about tricking consumers so a business can make more money. A Swiss man changed his legal (but not physical) gender to female so he could access retirement payments a year earlier. A Finnish MP has been charged with incitement for tweeting Bible verses in a discussion about a gay parade.

Economics & Work

The US took over two hundred years to rack up the first $10 trillion in federal government debt, nine years to get to $20 trillion and less than five years to get to $30 trillion. Balanced budgets are good, reducing government spending is better. Despite the evidence against it, economists are increasingly comfortable with big government and big deficits. Europe has more welfare than the US and taxes low and middle income earners more to pay for it. Special Economic Zones are supposed to be about free markets, but they often end up being dominated by government interference, waste and corruption. Economics starts and ends with scarcity, which makes MMT anti-economics.

With ongoing fast growth in the money supply, inflation is set to continue at high levels. The latest US CPI reading has inflation spilling over into services. After substantial adjustments to US employment data from 2021, it looks like surges in Covid had little impact on job growth. Through luck, inheritance or hanging around a long time, a small portion of New Yorkers pay rent far below average.

China may never become the world’s largest economy with debt problems and a declining population working against them. The claims that China is a great long term planner are easily disproven. India has seen an increase in growth after partial economic reforms in the 1990’s, but it could have been much more. Turkey’s President has sacked the head of the country’s statistics agency after it reported an inflation rate of 36.1%.

Miscellaneous

As shown by Europe, the transition to renewable energy is more difficult than expected. UK commercial office buildings with high energy ratings use more energy than those with lower ratings, making the rating system look to be a sham. Italy offered incentives for building owners to undertake green initiatives but has ended up paying out over $5 billion to scammers and has created and a construction bubble. Small scale nuclear power generation could help counter climate change, but current regulation doesn’t contemplate it. How a Zambian national park reintroduced rhinos and revived the ecosystem.

Russia is the runaway champion for getting busted for doping at the Olympics, with Ukraine and Belarus taking the minor medals. The PGA Tour was under threat from a Saudi Arabian breakaway tour, until Phil Mickelson told some hard truths about human rights in Saudi Arabia. China has recruited foreign athletes for its winter Olympics, with many retaining their citizenship elsewhere. The strange way the order of nations at the opening ceremony is determined. Winter Olympians describe how they deal with their hatred of cold weather.

Each year Hertz reports thousands of Americans to police for theft even though many have done nothing other than validly renting a car from them. A scientist knighted for his work on Alzheimer’s Disease has a history of defrauding his employer and lying about his research. Regular exercise can build your brain as well as well as your body.

A meta study from John Hopkins University found that “lockdowns have had little to no impact on Covid mortality” but they did have substantial negative economic consequences. Delayed medical screenings and/or vaccine injuries are being pointed to as the potential causes for a spike in deaths of younger Americans in 2021. Government responses to Covid have led to a spike in drug and alcohol deaths and addition. Two cruise ships that fled the US to avoid arrest over unpaid bills have been seized in the Bahamas.

What happened at an IT company when the person who interviewed was different to the person who showed up for work. If you aren’t using ad-blockers for your browser, your internet experience is awful. SpaceX lost 40 out of 49 recently launched satellites during a geomagnetic storm. Some ideas on how to deal with the growing the problem of space junk. Jetpacks are functional, freely available and super cool, but no one seems to care.

3 topics