Mixed signals on inflation: What do they mean for Aussie stocks and bonds?

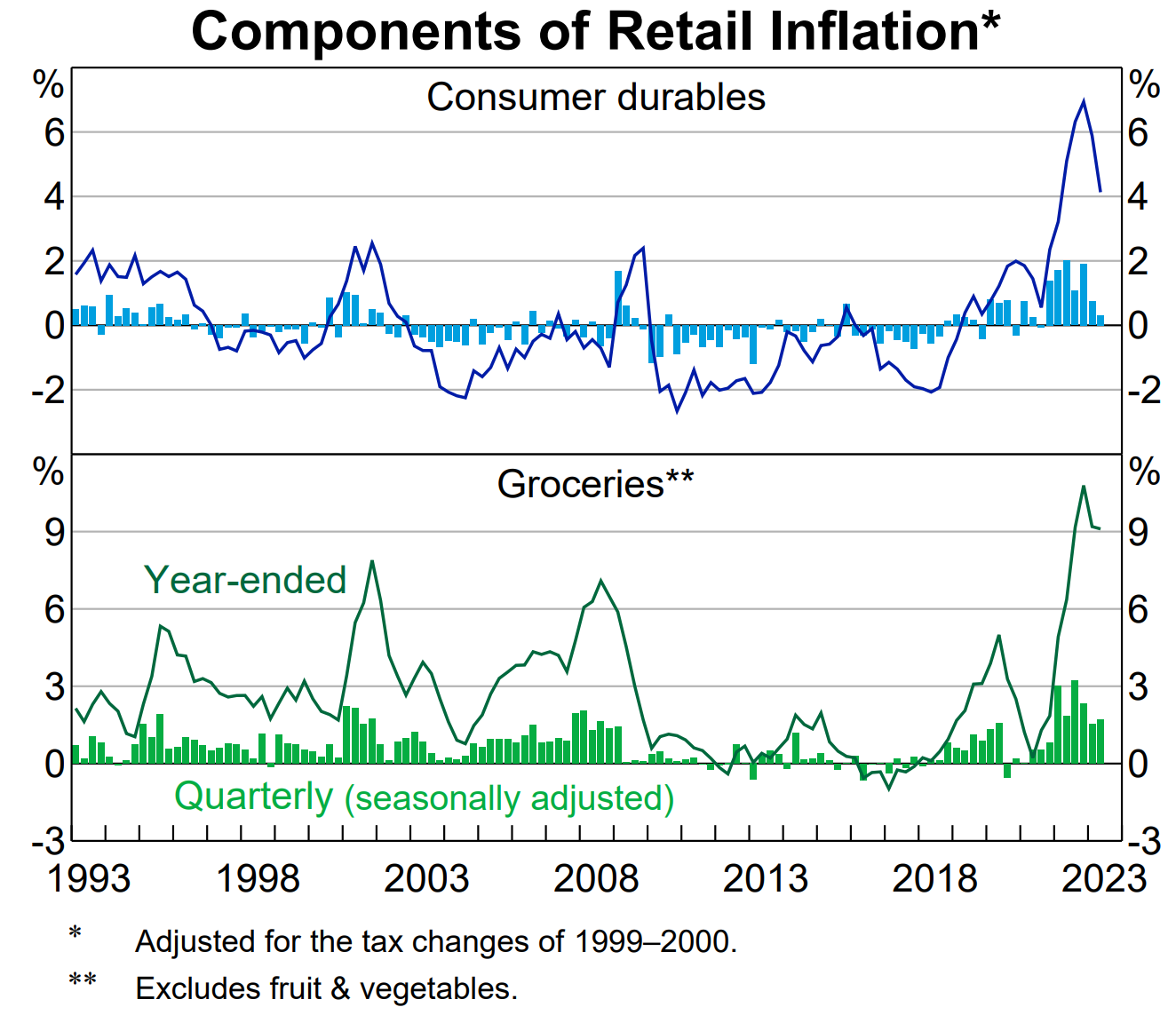

The latest RBA Statement on Monetary Policy indicates the Consumer Price Index (CPI) increased by 0.9% in the June quarter (in seasonally adjusted terms) and by 6% over the year.

“This was less than expected three months ago. As such, inflation continued to decline from its peak of 7.8% in the December quarter of 2022, but it remains high,” the RBA statement says.

For most of us, the price of consumer staples is perhaps the most noticeable measure of what’s happening on the inflation front. Grocery prices (excluding fruit and vegetables) increased by 1.7% in the June quarter, bringing to 9% the total increase in the year.

So, food price inflation has started to slow, with “prices for fruit and vegetables and meat and seafood [increasing] a little” in the June quarter, according to the RBA statement.

Services inflation is the kicker

But as my colleague Hans Lee writes, “while goods inflation is essentially flat, services inflation is anything but.”

“The increase in rents, along with more demand for experiences post-COVID, has created a spike in services inflation around the world,” Lee says.

He makes the point, based on his conversations with several economists and other macro-minded professionals, that this could have easily seen the RBA opt for another 25bps interest rate rise last Tuesday.

“It’s far too early to celebrate”

John Likos, a director at BondAdviser, holds a strong view that we’re not out of the woods yet.

“We’re in a period of disinflation, which is not by any means a signal of success. It’s far too early to celebrate a return to target [inflation],” he says.

“We’re on the right track, mainly with goods inflation, but in my view, we’re going to remain in an elevated period of inflation, as per the RBA’s guidance, for at least another 18 months to two years.”

He says all eyes are currently on employment in most parts of the developed world.

“Employment remains robust because there’s still a lot of intended fiscal stimulus, which I think will continue to prop up demand,” Likos says.

The strong potential for continued energy price rises, as we’ve seen in Australia more recently, also drives this narrative.

Likos also sees strong potential for continued upward pressure on wages, with the “wages catch-up” still having a way to go.

“The big issue for me is the erosion of real purchasing power. For all this talk about inflation…that’s the real consequence for a lot of the population,” he says.

“With more money now spent on mortgage financing, on shopping for food, on bills – and there is no way that the majority of the domestic population has had a proportionate increase in wages to match that.”

What does this mean for investors?

In the fixed-income portion of your portfolio, taking high-conviction views on where interest rates are headed is particularly difficult in this environment. That’s according to Likos, who says that deciding the appropriate allocation between long- or short-duration assets – bonds with 10-year or 30-year maturities versus those with 1, 3 or 5-year maturities – remains challenging.

"Rates are difficult to predict. Many so-called experts have called them incorrectly. If unemployment comes out and beats consensus, everyone adjusts their interest rate expectations upward and investors get hit on duration – which they in recent weeks,” Likos says.

“And if they come in under, rate expectations will fall and duration will outperform. How do you predict that? That’s why we tend not to take big duration decisions,” Likos says.

BondAdviser’s flagship Financial Capital Income Fund holds between 30 and 40 individual assets and remains heavily skewed towards floating-rate note securities. In deciding which credit assets make it into the portfolio, the team treats government bonds as any other bond instrument that they assess absolute and relative value analysis.

“ We trade the premiums or the discounts across the capital structure between credit ratings,” Likos says.

What does this mean for equities?

MLC Asset Management portfolio manager Anthony Golowenko, who’s part of the managed accounts team, provided his insights.

His team models various scenarios, including one around a milder disinflationary environment with steady growth, which he describes as “a more normal environment where Quality can shine through".

Golowenko mentions the strengthening view that inflation-taming has been priced into markets. “And if you look into medium and long-term bond yields, they’re pretty confident [a recession] is going to happen."

He’s not buying the “convenient view” that recession is fully priced into equity markets. A couple of current examples he mentions include the latest results from Resmed (ASX: RMD) and Credit Corp Group (ASX: CCP), whose share prices have fallen around 10% and 15% in recent days.

“I just think there’s a little bit too much optimism in equity markets going into this reporting season,” Golowenko says.

He also explains how this current environment defies many forecasts because “we’re far from a textbook recession”.

“Even from here, double interest rates and people are still buying the ultra-luxury Penfolds brand from Treasury Wines – there’s been no change in that, and that’s quite different,” Golowenko says.

How is MLC positioned?

Golowenko and his team have been tilting more towards the Quality Growth names more recently, with CSL Limited (ASX: CSL) one company he mentions.

“They disappointed the market in a recent update but we’re happy on the three- to five-year view to own that business. That’s one of the names that we’ve added,” he says.

He also highlights the insurance sector as his preferred way of getting exposure to ASX financials, with QBE Insurance (ASX: QBE) another name they’ve added.

In terms of trimming positions, some of the names he’s been reducing include supermarkets, including Coles (ASX: COL) and Woolworths (ASX: WOW), with Golowenko expecting margin pressures to continue playing out into 2024.

He is also looking at reducing his exposure to Seven Group (ASX: SVW) and James Hardie (ASX: JHX), largely because of the “bumpy situation” in the US.

3 topics

8 stocks mentioned

3 contributors mentioned