Morgan Stanley's seven big questions for energy investors

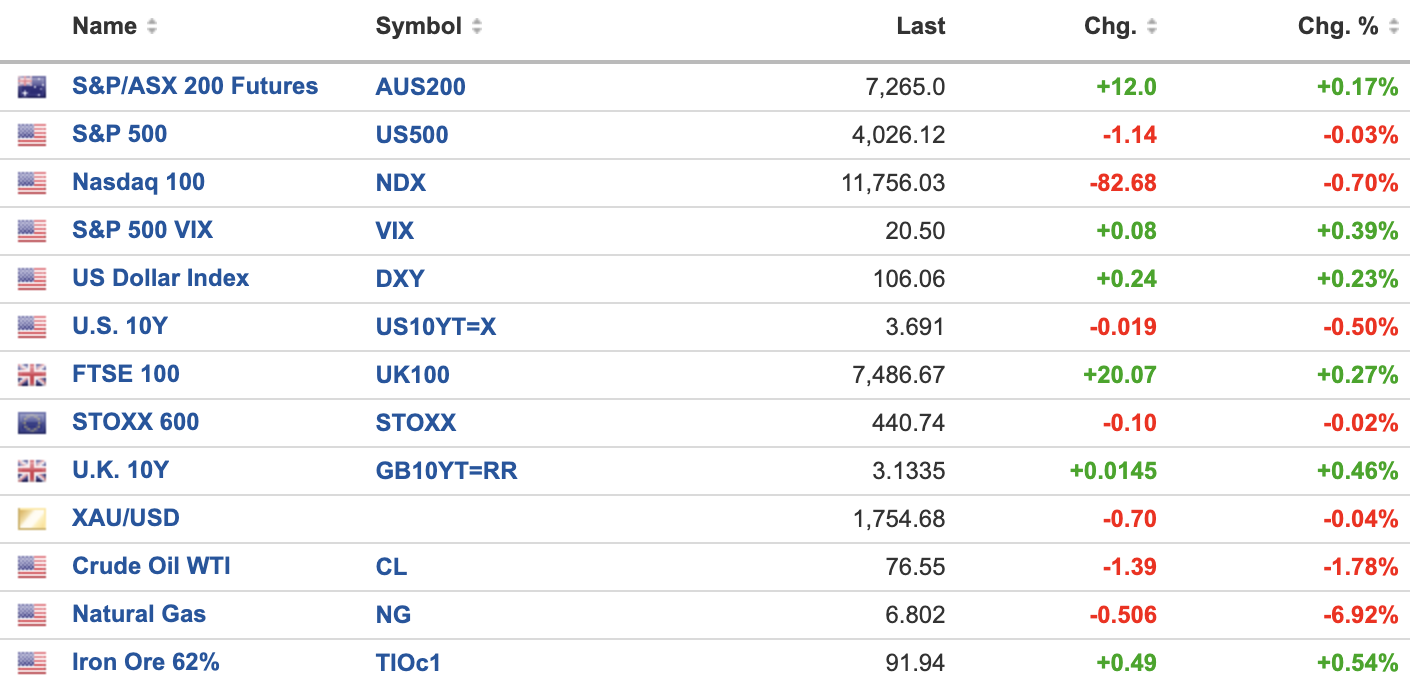

MARKETS WRAP

Note: The US had a half-day trading day on Friday due to the Thanksgiving holiday.

S&P 500 TECHNICALS

THE CALENDAR

It's no quiet week for local data, with monthly CPI and GDP partials coming in on Wednesday and Thursday. Overseas, this week also brings about the traditional end-of-month consumer confidence data stateside before leading into labour force data (first, job openings then payrolls on Friday evening).

Outside of the US labour force data, we get core PCE inflation. A decrease in that figure month-to-month will give the Fed the breathing room for a 50 basis points hike instead of a 75 basis points hike.

In Europe, all eyes will be on the monthly OPEC meetings in Vienna. Will they change the current output rate given China's lockdowns or the Russian oil embargo? Finally, two lots of central bank speak from ECB President Christine Lagarde and one round of comments from Fed Chair Jerome Powell.

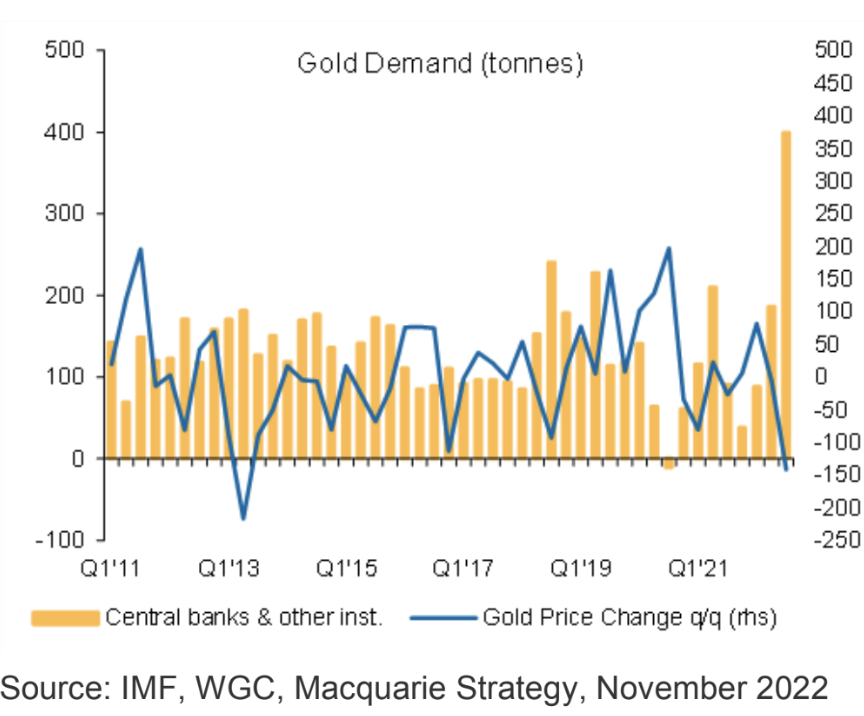

THE CHART

Who's buying all the gold? Today's chart is taken from a new report by Macquarie and the World Gold Council. The council reported demand is up 18% year-on-year, with third-quarter demand increasing 28% on the prior corresponding period. But considering the gold market is in a minor deficit, the question has to be asked.

Who's buying all the gold?

The answer? Emerging market central banks. In fact, most of the buying in the last five years has come from places like Russia, Turkey, and even Poland. But it's still the United States who has the most gold in its reserves - nearly three times as much as second-place Germany.

So the next time you see action in the gold price, you might now want to think about who's moving the pieces on this proverbial chess board.

ENERGY IN FOCUS

Heading into 2023, the team at Morgan Stanley have some questions they want to ask investors who are still bullish on oil. Although they believe a deficit will return to market by the latter half of 2023 (hence why they have a US$110/barrel call for the end of next year), they note there are seven key risks to this thesis.

If you own any of the major energy stocks on the ASX, these are seven questions worth asking yourself heading into next year.

STOCKS TO WATCH

Two quick upgrades to share with you all:

Ord Minnett believes Nanosonics (ASX: NAN) is still on track to beat its own sales growth guidance after its most recent update showed a 42% lift in sales so far this fiscal year. The new rating is a HOLD (upgraded from lighten) and the price target is $4/share (which is incidentally, below where the share price is right now).

And despite profit downgrades for FY23 and FY24, Morgans are still backing a strong balance sheet and solid forward revenue pipeline at Smartgroup (ASX: SIQ). The company's now an ADD (read: a weak buy) with a price target of $5.65/share.

THE STAT

US$1,400: Rare protests have broken out at the world's largest iPhone factory in China. FoxConn, who runs the factory in Zhengzhou, are now offering workers cash to keep quiet or quit. (Source: The Verge)

The figure is equivalent to two months' worth of pay and follows complaints over working conditions in the plant as well as the city's wider COVID-19 lockdown which has now been going on for two months.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 topics

2 stocks mentioned

1 contributor mentioned