Morningstar’s two most undervalued sectors and six stocks to play them

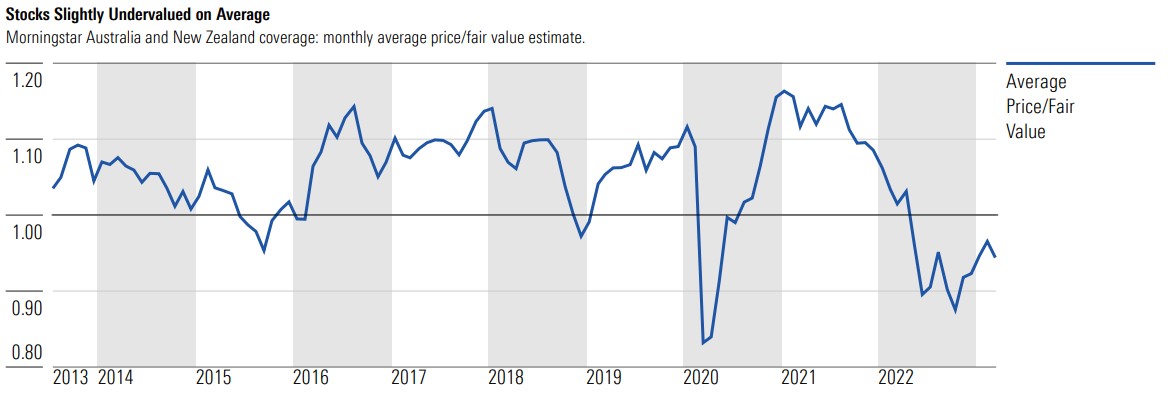

In its ANZ Market Outlook for Q2 2023, Morningstar placed the market as as trading at a 5% discount. You can compare this to the fact that on average the Australian market has been priced at a 5% premium over the last decade.

Source: Morningstar. Data as at 21 March 2023

This all sounds good until you consider that in September 2022, the research house had the market at a 15% discount. The opportunity to find value isn’t over, investors may need to be more selective - or take greater risks to find that value.

The data used in the Outlook are as at 31 March 2023. The market continues to change and has moved since then. Any information expressed in this wire should be used to assist in generating ideas for further company research and not used as the basis for investment decisions.

Certain sectors offer greater value at the moment

Growth sectors like technology were the hardest hit in market sell downs last year, though it's fair to say all sectors saw losses. Unsurprisingly given market uncertainty, certain sectors and stocks have recovered more than others.

“High quality stocks with defensive earnings are expensive, while those with less certain near-term outlooks are being heavily penalised by the market,” says Peter Warnes, Head of Equities Research ANZ for Morningstar.

While Morningstar is finding pockets of value across all sectors, there are two particular standouts.

“The real estate and financial services sectors screen as most undervalued after sell offs caused by market fears of contagion from bank and REIT failures in the U.S. and Europe,” Warnes says.

Morningstar has also found a high proportion of undervalued stocks in energy, technology and communication sectors.

Morningstar’s top undervalued stocks in real estate and financial services

The top three stocks for each sector based on Morningstar’s star rating and assessment of price to fair value follow (in alphabetical order).

Financial services

AUB Group (ASX: AUB)

The insurance broker recently acquired Tysers, a brokerage in the UK. It has a four-star rating from Morningstar and analysts Nathan Zaia and Shaun Ler assess its price-to-fair-value at 0.88.

“We expect AUB Group to benefit from rising insurance premiums, insurance brokers continuing to take share from the direct channel, and increased ownership interests in brokers within the network,” they said.

Pinnacle Investment Management (ASX: PNI)

While the investment firm faces high uncertainty in its outlook, Morningstar believes the market is underestimating Pinnacle’s asset class diversity and ability to grow with higher margin funds. It has a four-star rating from Morningstar and an assessment of price-to-fair-value at 0.71.

Westpac Group (ASX: WBC)

Westpac is currently the cheapest of the big four banks and has suffered from business divestments like BT Financial Group and customer remediation in the past year. Morningstar does however see Westpac as having a wide MOAT (that is, competitive advantage to sustain revenues and barriers to entry for competitors) and believes it will return to strong profits over time. It holds a four-star rating from Morningstar and price-to-fair-value assessed as 0.75.

Real estate

Dexus (ASX: DXS)

Real estate and infrastructure asset manager Dexus has had some setbacks in recent times, including missing out on some AMP mandates and office portfolios near lows. However, Morningstar views these as short-term concerns noting continued strong performance in the industrials properties held by Dexus. It holds a four-star rating from Morningstar and price-to-fair-value assessed as 0.69.

Charter Hall Group (ASX: CHC)

Morningstar expects the property fund manager to benefit from trends towards institutions using specialised managers for property investments rather than directly. While higher interest rates are a challenge in terms of Charter Hall’s fees and returns, Morningstar argues it is well positioned for tougher times.

“We think the securities overly discount expected weaker operating conditions, and its development pipeline is likely to continue to add to funds under management,” said analyst Alex Prineas.

Charter Hall holds a five-star Morningstar rating and price-to-fair-value is assessed as 0.68.

Mirvac Group (ASX: MGR)

Mirvac’s residential development business is one of Australia’s largest. This may seem like a downside to investors in what is viewed as a difficult time for residential property, however, Morningstar sees this as a future opportunity.

“High interest rates are likely to further pressure house prices, but Australia appears headed for a dwelling shortage, which should leave Mirvac well placed to make sales into an eventual recovery,” says Prineas.

He also noted government policy for accelerated levels of immigration.

Mirvac holds a five-star Morningstar rating and price-to-fair-value is assessed as 0.67.

Finding value in technology

Keen-eyed readers would have noted that technology was referenced by Morningstar as an area it is seeing a lot of value opportunities. Value-hunters are often wary of the growth sector with good reason. The sector as a whole has performed well in the start of 2023, but will this continue?

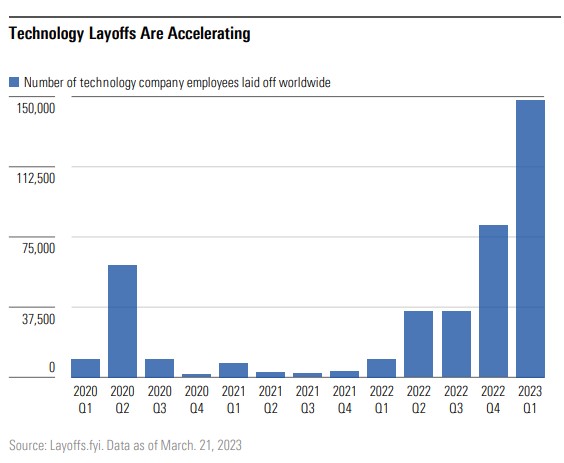

Morningstar analysts Roy van Keulen and Shaun Ler expect technology companies, particularly fintechs, to focus on profitability this year and layoffs will continue to be a theme. The sector remains undervalued in their view.

A few companies they highlight include Megaport (ASX: MP1), Fineos (ASX: FCL) and WiseTech Global (ASX: WTC). Both Fineos and Megaport have five-star ratings from Morningstar, while WiseTech has a four-star rating.

Morningstar believes that Megaport is on the cusp of generating cash and will benefit from increasing reliance on data traffic. It currently assesses its price-to-fair-value at 0.32.

It believes the market has underestimated cloud software adoption by insurers and the potential revenue stream from this in the case of Fineos which it assesses as having a price-to-fair-value ratio of 0.39.

In the case of WiseTech, Morningstar holds the view that using WiseTech’s technology offers a client a competitive advantage over its peers. In turn, this will encourage more of the market to use WiseTech’s technology solutions.

“We consider WiseTech presents a rare combination of a large, highly winnable addressable market with attractive unit economics,” said van Keulen.

Investing in the current market

Investors might be feeling the whiplash of market concerns moving from the pace of interest rate rises to speculation over when the first rate cuts might begin. It’s an uncertain time and Morningstar argues that the market is glossing over coming consequences of the tightening cycle, pre-empting better times too soon.

“Caution is recommended in the near term until a more certain environment emerges, which may take several quarters. In the meantime, cash is a useful alternative and provides optionality. Companies generating maintainable free cash flow should be favoured,” said Warnes.

Do you view these companies as undervalued? Or where are you seeing opportunities? Let us know in the comments.

9 stocks mentioned