Moving Averages: What are they and are they useful?

The moving average is one of the most popular technical indicators available to market participants. It is calculated by averaging share prices over a specific period. As new data points become available, the oldest data is dropped from the calculation. The result is a constantly updating data series, that provides directional information about recent price action. This piece will focus on the 200-day moving average, in particular, the implications for investors when the market is trading beneath it.

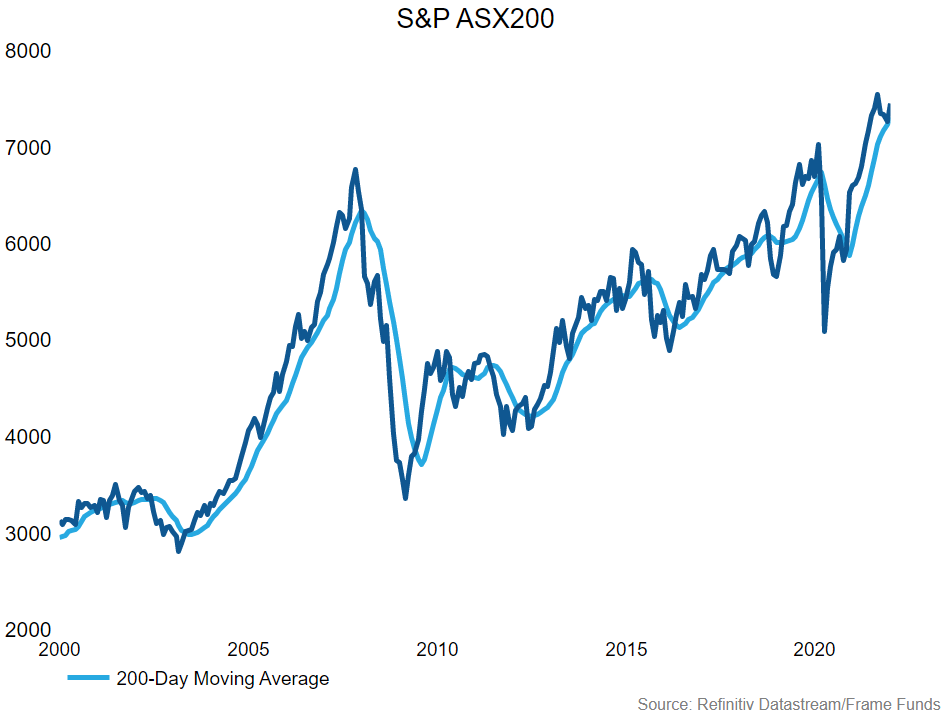

The 200-day moving average

The 200-day moving average is seen by many as a good indicator of the strength of the trend of the overall market. Many market participants will use the 200-day moving average for directional analysis, stop loss determination, and position sizing. Simply, if a stock index is trading above its 200-day moving average, the trend is bullish and the market is moving higher, whereas an index trading below its 200-day moving average is chopping lower with more volatility.

Does the market really trade differently below its 200-day moving average vs when it is trading above it? Is there an increase in volatility?

Deep dive

For our investigation, let’s consider market volatility. We will use standard deviation as a measure of market volatility, with the ‘market’ proxy being the S&P/ASX200.

From January 1, 2000, until December 31, 2021, the annualised standard deviation of market returns is 16.1%. Now we split our standard deviation into 2 categories: a market that trades above the 200-day moving average and a market that trades below the 200-day moving average. We find the annual standard deviation of the ASX200 is 11.4% when trading above its 200-day moving average. This is compared to a standard deviation of 20.4% when trading below its 200-day moving average. While this simple calculation does have some issues*, there is clearly an expansion of volatility when the ASX200 trades below its 200-day moving average.

Because of this expansion in volatility, a self-fulfilling prophecy is created. Market participants (fund managers, professional investors, wealth managers et cetera) know there is increased risk when the market is below its 200-day moving average. As a result, most decide to decrease exposure, allocate into shorter-term strategies, or increase hedging. This in turn means more selling and more volatility. Furthermore, systematic risk models such as Value at Risk (VaR) will show a portfolio carrying more risk as volatility increases. This will lead to deleveraging as theoretical risk moves outside an investor or portfolio manager’s risk tolerance. Again, the natural result of deleveraging is more selling pressure on the market.

Lessons

Taking all of this into consideration, here are five things investors can do to manage a portfolio more effectively when the market is trading below its 200-day moving average:

1. Reduce position size

When volatility expands, smaller positions have the same profit potential as the positions which were larger when the market was trading above its 200-day moving average. For example, if the average daily trading range on a given index has doubled from 1% to 2%. Trading half the size has the same profit potential due to the increased swings in the market. It also means your downside risk has been reduced by decreasing your position sizing.

2. Adjust time frame

It becomes more difficult to have a high conviction long-term investment thesis when volatility is elevated. Even if the thesis is valid, it can be a painful ride and aggressive drawdowns may have to be endured. Shortening your trade horizon will allow more conviction behind trades

3. Be open to trading short (if you have the ability to)

Taking short positions on themes that are counter-trend can be a useful way to add value in a volatile, declining market. A good example of this would be shorting airline/travel stocks during the covid crash. The travel industry was among those hits the hardest by restrictions and lockdowns, so they provided a good opportunity.

4. Define a maximum risk level

Before entering any trade, setting maximum risk levels will ensure excessive losses will not be suffered. Risk levels can be set by dollar amount or by the percentage of the account. It is important to remember to be disciplined with this approach – once the level is hit the position must be exited.

5. Remember markets are not linear

All investments or trades will not be profitable, and markets never go straight up or straight down. Keeping this in mind will allow investors to be in a better mental position to make clear, logical decisions when under stress.

*Since all market crashes take the index below its 200-day moving average, we are succumbing to an element of data selection bias. We are also not claiming this relationship is causal, meaning a cross below the 200-day moving average does not necessarily cause more volatility in the index.

5 topics