My recollections of the greatest ever one-day crash

20th October 1987 probably doesn’t mean a lot to anyone who wasn’t in the market – but for those who were - it was a day no one ever forgets...

- The actual day in Australia was Tuesday 20th October 1987 (Monday 19th October in the US). Today is Tuesday & the day it happened was a Tuesday (this week). So what happened..?

Leading into that day...

- So it was 30 years ago that all those in the Aussie market went home on Monday night, the 19th of October 1987 & wondered what the Dow would do that night, it had fallen -10.4% over the previous 3 days leading into the weekend.

- Here in Australia - we were only down about -5.5% over the previous 3 days (but market had been hammered -3.7% on the day before the crash) - but we all went to bed wondering if it’d continue down or as we all hoped & expected - would bounce back hard that night ??

- I had bought some $22 Newscorp call options the previous day (on Monday as News had fallen -7.8% to $20 that Monday from $24 the previous week) as this was the greatest bull market many could remember – this was surely just a small correction – nothing to really worry about – everyone else was buying…

The morning of the crash...

- Well, having only been on the insto dealing desk at Ord Minnett for 10 mths (after a stint in London from 1985 to Dec 1986) I was unsure what to expect (young, naïve & gullible back then). So I woke up at 6.00am & checked to see the Dow was down -200 points, had a shower & put on my 3 piece suit (yes in the late 1980’s there were plenty wearing those shocking things) & by the time I had buttoned up my inner piece the Dow was down -300 pts.

- I got the bus to work & saw the Dow was then down -400 pts& when mkt closed that day at 8.00am Sydney time that Tuesday 20thOctober 1987 (Monday 19thOctober in the US) the Dow had collapsed -508 points or -22.6% to 1738…

- To put that into perspective – it’s like seeing the Dow today drop -5,162 points…

- I did read recently about a broker talking about making 4am phone calls due to the crash – BUT at 4am the Dow wasn’t down -500 points – at that stage the Dow was only down around -200 points (it was only12pm in New York) - so at that stage it was bad - but got really ugly from 6am to 8am when Dow went off a cliff..

That morning on the insto dealing desk ...

- Everyone on the desk was in shock – no one had ever seen - nor even heard of this happening before - it was unprecedented (the Oct 1929 crash day was about -10%)

- The bloke sitting next to me – Bruce Skelton (who – at the time – was much older & more experienced than me) – looked sick & stunned - like everyone else on the desk …

- A lot happened that day, it was ugly & unprecedented.

Buy gold was the call ...

- Sorry I probably got all the gold bulls excited with that headline...

- I remember our economist running in & saying “buy gold” .. “buy gold stocks” - as gold was going to soar.

- He & another guy from research ran to the bank to BUY gold...

- Gold looked good - on the day it rose +US$10 or +2.1% to US$481.70 ...

So he was right ... ???

- No .... there is another dynamic that goes on in these situations...

- When the stock market opened everything got smoked –except the gold stocks that held up initially - since gold was trading up +2%..

- But as a lesson that is universal & repeats again & again (and we saw it in the GFC as well) – when people are losing money in one stock or sector & another one is holding up or giving them a profit – they will hit it as hard as they can in an attempt to lock in cash.

- When you need cash you will sell anything that is liquid & better if holding up (as it will eventually fall when everyone else picks up on this)

- Also, these sectors were the ones everyone thought was a good place to invest in – so they also provided a huge help to many - who sold them early before they too were clobbered.

- For the record (and I know the present gold bulls will really hate this) ...

BUT...

- Gold that day was up +2.5% BUT the Australian Gold Index closed down -28%....

... LIQUIDITY

- Never underestimate how important liquidity is when markets are falling.

- In the GFC the stock markets across the globe were smashed as they were “liquid” while other asset classes were not (many had frozen up)

- That was a big reason we saw the falls of -20% in world stockmarkets after Lehman’s’ – simply because they were “liquid” and the stock market could deliver cash in 3 days – while many other asset classes were all seller no buyer – with no way to even get your cash out...

Back to 1987...

- Newscorp that day closed at $13.00 down -35% (and were trading at $9.60 8 days later) so that was an“expire worthless” option notice coming my way .. (funnily enough that was not the only one I have received)

- I’d gone from (potential) hero to zero in just 8 days (a lesson most I suspect have also experienced)!!

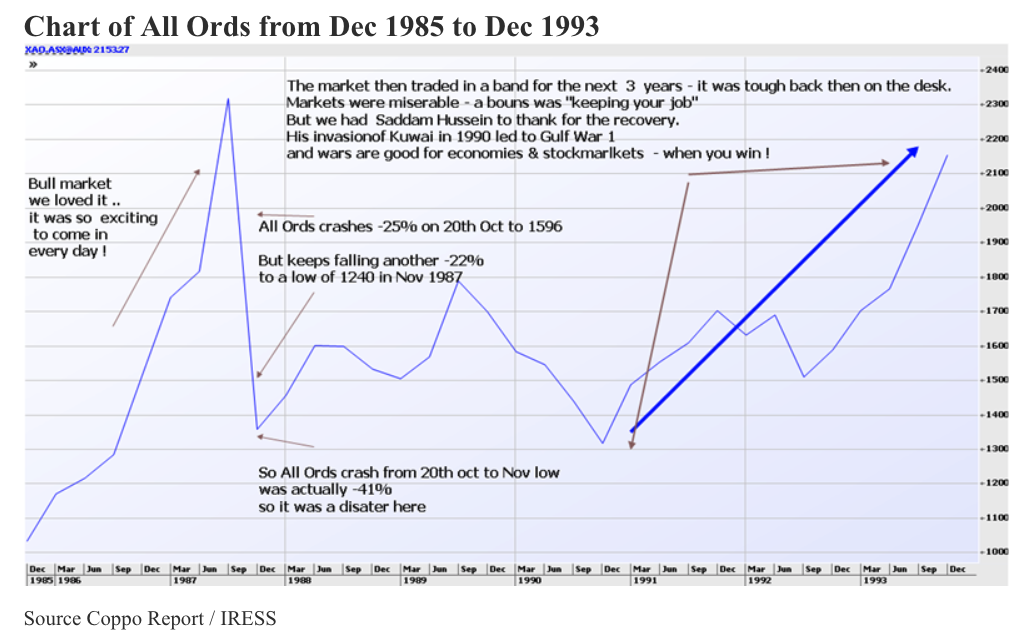

So after a tough day, the All Ordinaries closed down -532 points or -25% to 1596, value that day was a RECORD at $686m.

The immediate aftermath

- In the months that followed the crash things did get tough as clients traded less.

- The boss of Ord Minnett - Giles Kyrger – who had employed myself & 2 others as “graduate trainees” in 1986 – called me & a guy named Rob Keldoulis into his office.

- We looked at each other – where was Alex?

- Giles then said that in this job we “throw you into the deep end & you either sink or you swim – Alex sunk – you guys are still swimming – so get back out there to your desks.”

- There was no lovely HR protection back then – it was sink or swim – no second chances.

- The effects of the crash were felt across broking & later the economy for years to come in Australia (due to the high number of spivvy companies that littered our Top 20).

- Every year from 1987 to 1990 – I got a really special “Bonus” – the bonus was: “ Richard you still have your job”!!

The Coppo Report

This article is an excerpt from The Coppo Report contributed to Livewire by Richard Coppleson, Director - Institutional Sales and Trading, Bell Potter. You can find out more here.

Not an existing Livewire subscriber?

Register here to get access to the Livewire website and to start receiving the Trending on Livewire daily note.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Richard authors “The Coppo Report”, a highly regarded market newsletter. He has over 30 years’ experience in financial markets, beginning his career at Ord Minnett where he worked for 15 years, before moving to Goldman Sachs.

5 topics

Comments

Comments

Sign In or Join Free to comment