NSW shocks bond markets by slashing $22 billion in debt

In the AFR today, John Kehoe reports on another huge shock for bond markets with the NSW government sensationally announcing late Friday afternoon that it will be suspending $11 billion in projected taxpayer revenue contributions to the NSW Generations Fund's (NGF) Debt Retirement Fund. This is on top of the unprecedented $11 billion in debt repayments that Premier Dominic Perrottet announced on 20 September, which will be made using the capital accumulated in the Debt Retirement Fund. The latter is a unique creation of Perrottet's and had increased in size from $15 billion in May to $26 billion following the sale of the second-half of WestConnex in September. By rediverting this $11 billion of taxpayer revenue from the fund back to NSW's budget and repaying $11 billion in debt, new Treasurer Matt Kean, a long-time ESG advocate, will both radically reduce NSW's fiscal pressures and cut taxpayers' debt burden by a never-before-seen $22 billion. The AFR's Kehoe reports:

The NSW government will stop borrowing billions of dollars to pay for inflows into its $15 billion financial market investment fund, in a U-turn that will help the state manage debt pressures from the pandemic.

NSW Treasury Corp announced the state government had decided to “temporarily suspend” certain contributions to the NSW Generations Fund, because of the economic impact of COVID-19.

The decision to stop leveraging up the state government’s balance sheet for the NSW Generations Fund (NGF) follows a series of stories in The Australian Financial Review warning the plan had raised concerns among credit rating agencies, bond investors, Labor and public finance experts.

NSW Treasurer Matt Kean said on Sunday, “given the unprecedented impact of COVID, it is appropriate to consider the right policy settings of the NGF going forward and that’s what the government is doing.

“The government’s approach to funding the NGF going forward is expected to be set out at the 2021-22 half-yearly review in December, once a final decision is made.

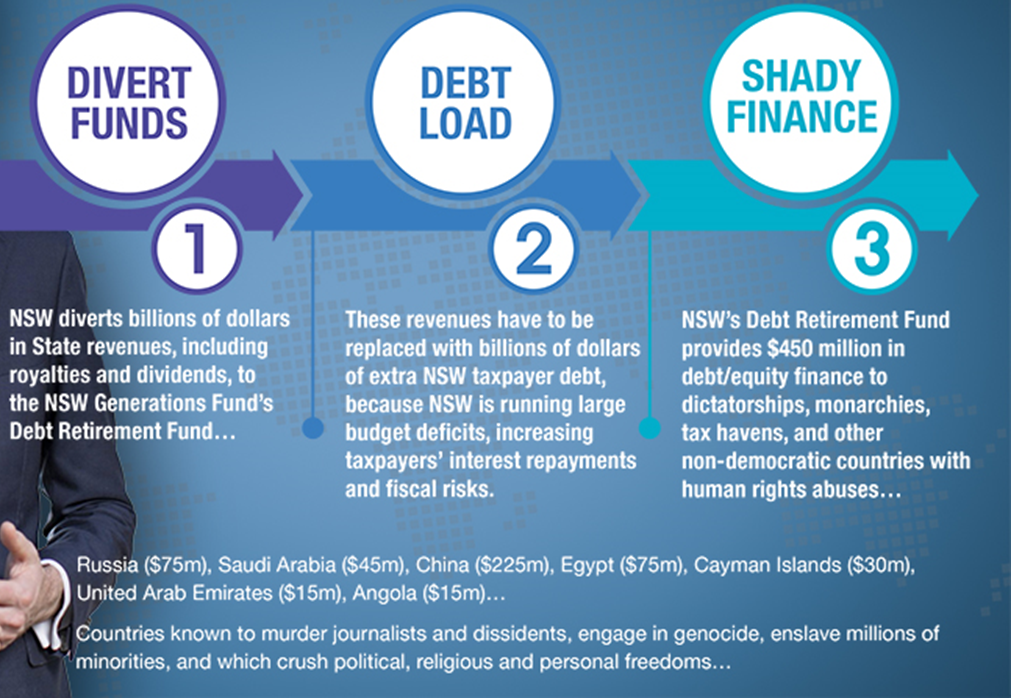

In Coolabah's own ESG activism campaign (see here, here and here), we had argued that NSW should stop diverting scarce taxpayer revenues to the NGF's Debt Retirement Fund, which have to be replaced with additional debt issuance given NSW is running budget deficits. That is to say, this approach to funding the Debt Retirement Fund would have paradoxically increased NSW debt---and hence the fiscal risks the state faces---at the worst possible time.

Prior to the COVID-19 shock, NSW had made the policy decision to divert all state royalties and state-owned corporation dividends to the NGF's Debt Retirement Fund. The AFR's Kehoe reveals today that this was forecast by Treasury to sum to an enormous $11 billion of de facto taxpayer debt funding into the Debt Retirement Fund this financial year and over the forward estimates in what was equivalent to running a huge leveraged carry trade (by raising debt and betting this money on equities and junk bonds). By suspending these funding commitments, NSW Treasurer Kean has, therefore, saved taxpayers $11 billion of future debt issuance on top of the $11 billion Premier Perrottet has promised to repay:

Dividends paid to the government from NSW state-owned corporations (SOC) and mining royalties had been forecast to add almost $11 billion to the fund over the four years to 2024-25.

But because the government’s budget is deep in deficit due to COVID-19, the diversion of SOC dividends and mining royalties to the fund would have added to the state’s $120 billion-plus gross debt bill.

The decision to freeze the inflows comes after the government announced in September that the $11 billion received from the privatisation of the remaining 49 per cent share of WestConnex would be used to repay state debt, and not be retained in the Generations Fund.

During the week, Treasurer Kean also announced a review of the Debt Retirement Fund's approach to ESG following incredible revelations in The Guardian that it was providing debt and equity funding to dictatorships and tax havens, including Russia ($75 million), Saudi Arabia ($45 million), China ($225 million), UAE ($15 million), Cayman Islands ($30 million) and Angola ($15 million).

Michael West Media also reported last week that a number of the asset managers selected by NSW's investment and debt issuance agency, TCorp, to run money for the Debt Retirement Fund had direct exposures to China Evergrande bonds, which have infamously missed their interest repayments. It is unclear, however, whether the Debt Retirement Fund allocates to the specific vehicles that own Evergrande securities.

The AFR today also carries comments from Labor's indomitable shadow treasurer Daniel Mookhey, who correctly notes that “NSW’s debt would have skyrocketed had the Treasurer carried out Mr Perrottet’s plan to bet the state’s operating income on global stock markets, instead of using the money to pay the government’s bills". One clarification here is that this was not Perrottet's plan per se, but rather a proposal developed by his bureaucracy.

There remain some important outstanding policy issues for the NSW Treasurer Kean to resolve in respect of the NGF's Debt Retirement Fund. These include:

- What to do with the circa $2.3 billion of debt-funded contributions NSW previously made to the fund in the 2021 financial year. These should self-evidently be harnessed for infrastructure funding and/or debt repayment (otherwise they will just represent NSW leveraging-up taxpayer money to punt on markets); and

- What to do with the circa $15 billion of capital (including the $2.3 billion of abovementioned contributions) left in the Debt Retirement Fund once NSW repays its $11 billion in debt. Rather than gambling this on financial markets, the $15 billion should be deployed to pay for the $108.5 billion in infrastructure spending that Premier Perrottet has signed-up for. After all, the $7 billion from the sale of the first-half of WestConnex that seeded the Debt Retirement Fund in 2018 was committed by Perrottet to pay for new infrastructure spending. This could be easily achieved by the Debt Retirement Fund buying bonds issued by the NSW to pay for future infrastructure spending, which is permitted under the NGF's legislation.

Make no mistake, the $26 billion Debt Retirement Fund is an extraordinary innovation. Premier Perrottet had the exceptional foresight to create it in 2018 when NSW's budget was recording huge surpluses and the state had negative net debt. Perrottet's vision was to use the Debt Retirement Fund to accumulate reserves to repay debt whenever the budget lurched into deep deficit, which of course it did in 2020 during the 1-in-100 year shock wrought by the pandemic.

And it is because of Perrottet and now Treasurer Matt Kean, who has a long track-record as an ESG advocate, that NSW is in the remarkable position whereby it can draw-down on the Debt Retirement Fund during this crisis to slash taxpayer debt by $22 billion or more.

Importantly, the Debt Retirement Fund can be replenished by Kean when the NSW budget returns to surplus via future reserves and asset sales. Taking profits on stocks when they are trading at all-time highs while interest rates are near record lows is also a very smart move.

As a lender to all the major state governments, Coolabah and our stakeholders, including super funds, believe that these are responsible ESG decisions that we would strongly support.

The flow chart below comes from Michael West Media.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $8 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 16 analysts and 5 portfolio managers. Click the ‘CONTACT’ button below to get in touch.

3 topics