Our First 2017 Anti-forecasts

Ellerston Capital

1) The oil price will not finish the half higher than where it started.

The old adage "the best cure for high prices is high prices" works best when the lag between rising prices and a new supply response is short.

Historically oil exploration was a slow moving and complex exercise. Commitment to developing new oil fields involved intense engineering studies to justify the massive capex required.

Those rules went out the window with the discovery of vast shale oil reserves and how to extract them. The Bakken, Permian and Eagle Ford US formations that stretch from Canada to Mexico have minimal exploration costs, low capex and quick paybacks.

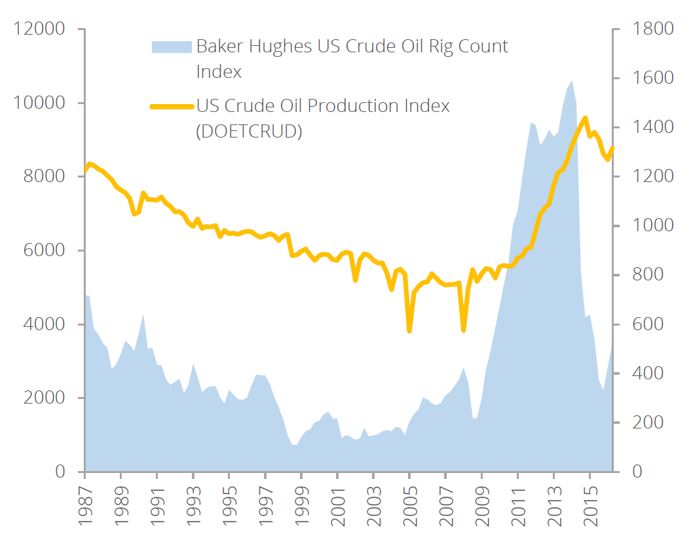

Their ability to ramp up production quickly is exemplified by the steady rise in the Baker Hughes Rig Count Index.

Figure 1 - Baker Hughes Crude Oil Rig Count Vs Crude Oil Production

Sources: Bloomberg, Team Analysis

The low oil prices of 2016 and 2015 have also seen extraordinary advances in drilling technology and productivity. Production costs in the best parts of the shale provinces may one day break the USD 10 a barrel level, and rig utilization will not need to come close to historic levels to bring production to a new record.

2) Emerging Markets will not outperform Pakistan

After its strong performance for over a year, it may seem foolhardy to tip further strong gains for the Pakistani stock market, but we think the best is yet to come.

Our reasons for optimism are little changed from those we advanced in our last Half Yearly Report: (VIEW LINK)

Corporate earnings growth is robust, and valuations remain low in an absolute sense as well as compared with other Emerging Markets countries like India.

What impresses us is that so far, the market has been rising on local enthusiasm - and indeed foreigners have been taking profits steadily. We think that will reverse when Pakistan formerly migrates from largely overlooked "Frontier Market" status to the intensely watched MSCI "Emerging Market" Indices in June.

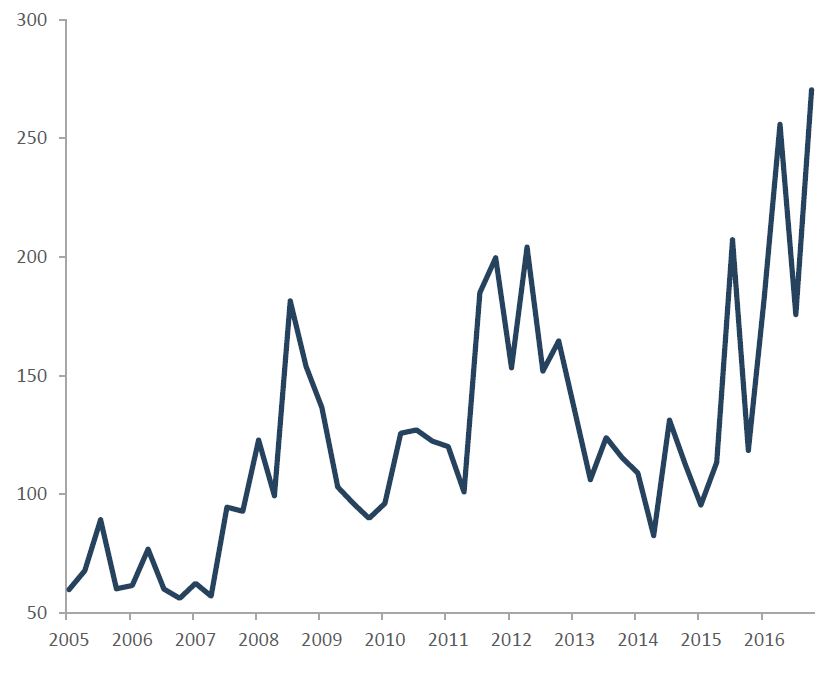

3) Economic policy uncertainty will not abate

The new Trump administration is a regime change for the global economy. Established values and approaches are exposed to material change. One of the big challenges for markets in 2017 is digesting and pricing and the evolution of new policies (see Figure 2 below).

Figure 2 - Global Economic Policy Uncertainty Index

PPP Adjusted GDP Weights

Source: Bloomberg, Team Analysis

4) Negative rates will not disappear

The negative rate experiment soured through 2016 as banks struggled to adapt and pushed back on policy makers. Central bankers listened and changed tack on new policies. However, we do not expect them to fully retrace and hike rates back to positive.

5) Europe (Eurostoxx 600) will not underperform the US market (SPX)

Europe has been a graveyard for contrarian investors post the 2008 recession. Earnings are now back to where they were in 2004 and margins back to 2005 levels for Europe. With nothing to show for their prior patience, investors threw the towel in on Europe in 2016, with 38 consecutive weeks of outflows up until November.

It is with this backdrop that we make the call that 2017 should see better returns for European investors. A falling Euro helps both GDP and EPS growth for exporters; positioning is light; monetary policy is supportive; and there will be no wage pressure on margins. On the other hand, US wage growth is accelerating as the economy nears full capacity and rising interest rates will hurt margins and offshore earnings.

Written and contributed by Chad Slater, Joint Chief Investment Officer at Morphic Asset Management: (VIEW LINK)

4 topics

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.

Expertise

Chad co-founded Morphic Asset Management in 2012. As a stock picker Chad is also a generalist but has strong regional knowledge of Europe and the Americas. He has also been awarded the CFA Charter.