Plato's long/short net-zero strategy drives change — and profits

There's no reason to wait for 2050 — net-zero investing is possible now, says Dr David Allen, head of long/short strategies at Plato Investment Management.

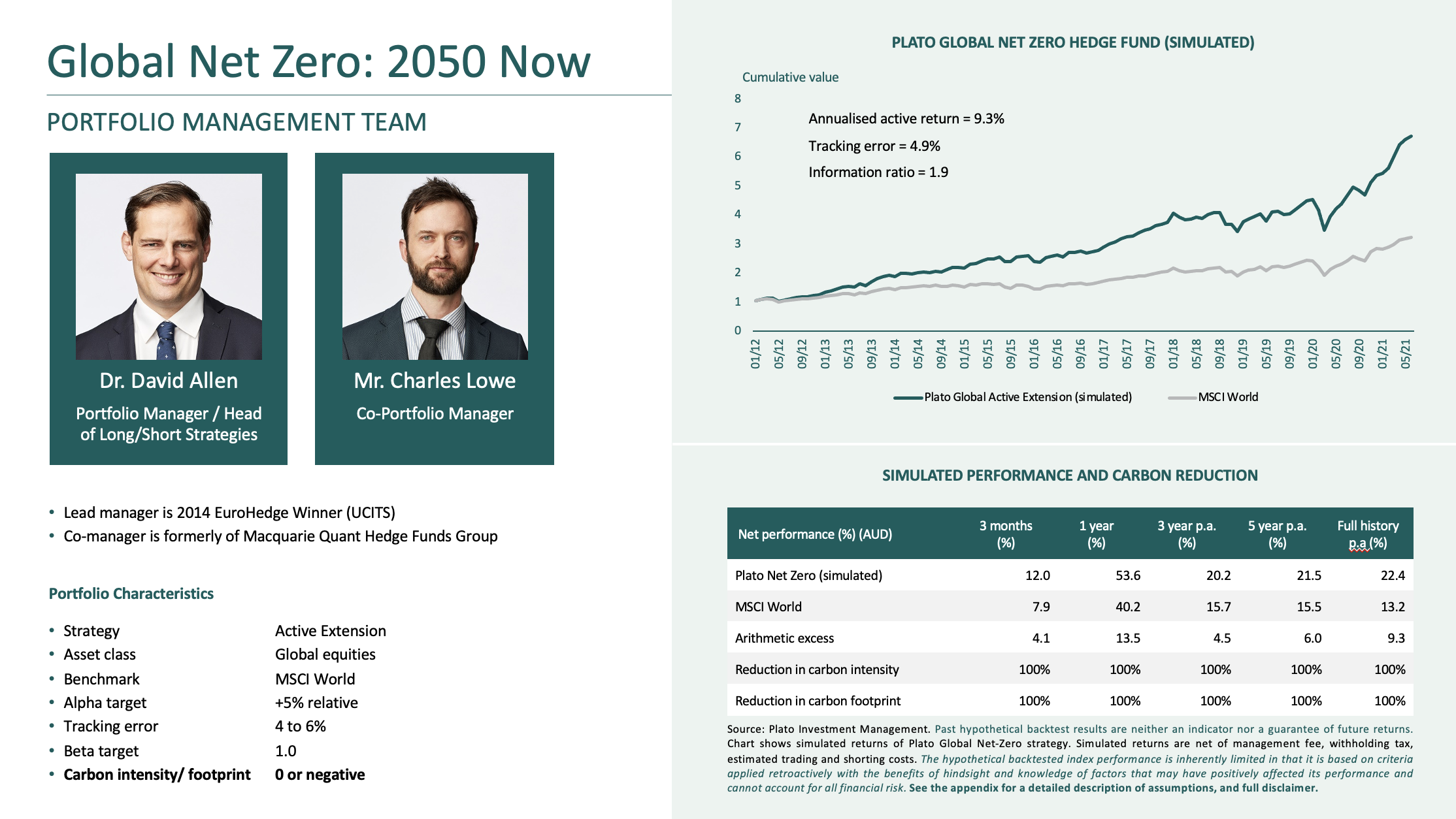

The Plato Global Net Zero Hedge Fund, launched in September, is already doing just that, and has returned about 3% for its first few months of operation.

"We talk about it as achieving the 2050 net-zero target, not in 30 years time, but today," Allen says.

He and the his team believe theirs is the first fund to meet that target without buying costly carbon credits.

Plato are able to invest in companies leading the push to net-zero emissions and short-sell those laggards that are slowing progress.

"We've got 50% more exposure to the names we like and the ability to generate alpha also on the short side," Allen says.

He sees decarbonisation as the most important investment theme of the next three decades and says it will touch every aspect of our lives.

In that sense, Plato's interest in decarbonisation is a matter of rational capital allocation. "We have very much at Plato an alpha-centric approach," Allen says. "We don't want to generate low carbon in a way that's going to compromise the returns we can generate."

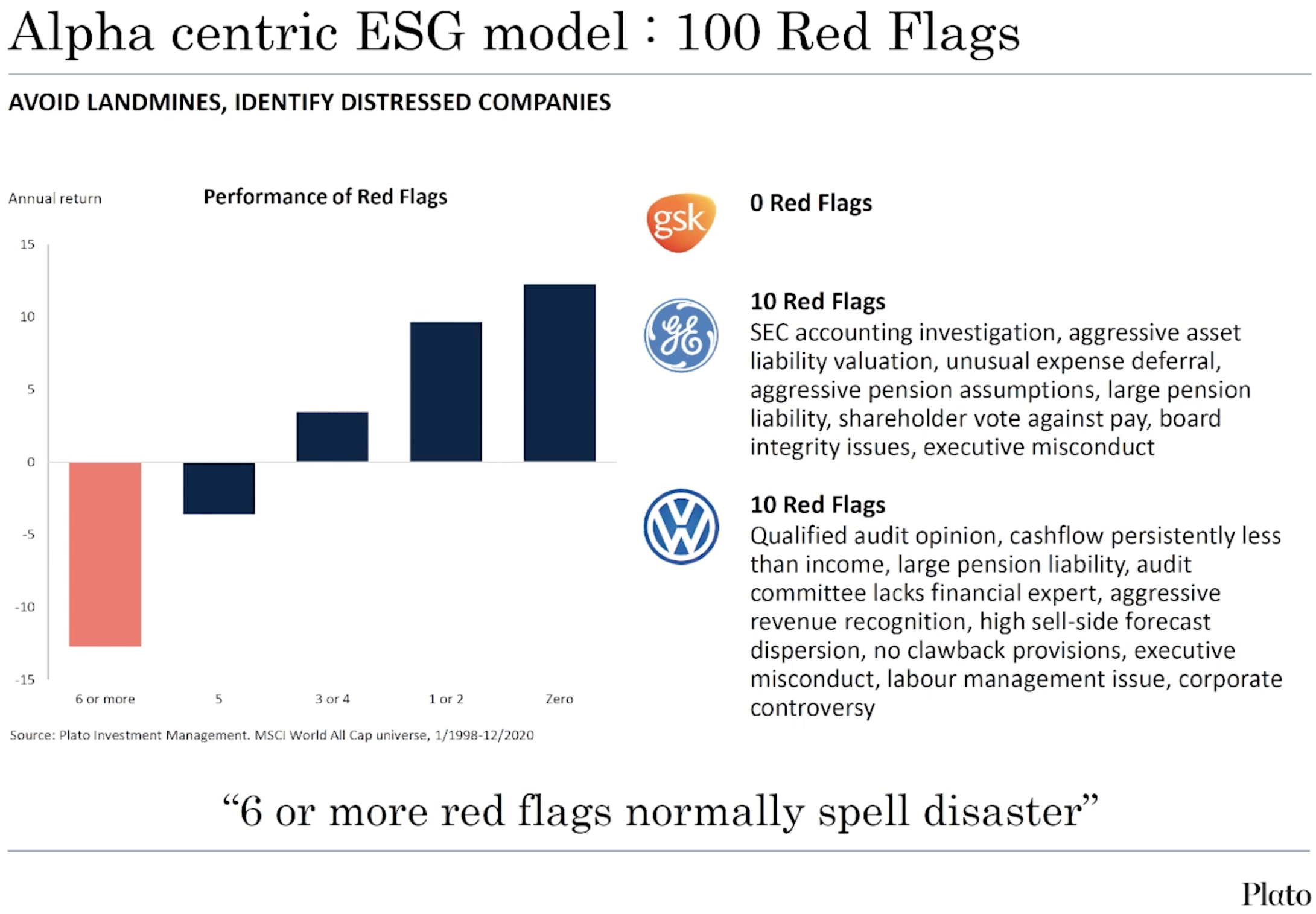

The fund's approach relies heavily on Plato's 100-point red-flag system, which identifies companies that are too lacklustre to invest in and those that deserve to be sold short.

Pharmaceutical company GSK, for example, passes the test with no red flags.

GE and VW, however, trigger 10 alerts each for reasons such as high pension liabilities and aggressive accounting. That makes them candidates for Plato's short list.

For more detail on the Plato Global Net Zero Hedge Fund, view the video or transcript below.

Edited transcript

My name is David Allen. I'm head of long/short strategies at Plato Investment Management. Before that, I was 15 years at JP Morgan Asset Management in London, where I was head of research. I've been back with Plato three years.

Today we're going to talk about the Plato Global Net Zero Hedge Fund. It's a fund that we're very excited about. As far as we know, it's the first fund of its kind, not just in Australia, but globally.

It actually achieves a net zero carbon footprint, which is the first of its kind that we know of that achieves that without buying expensive carbon credits.

It's quite a obviously important thematic in the world today, so I'm very much looking forward to taking you through that.

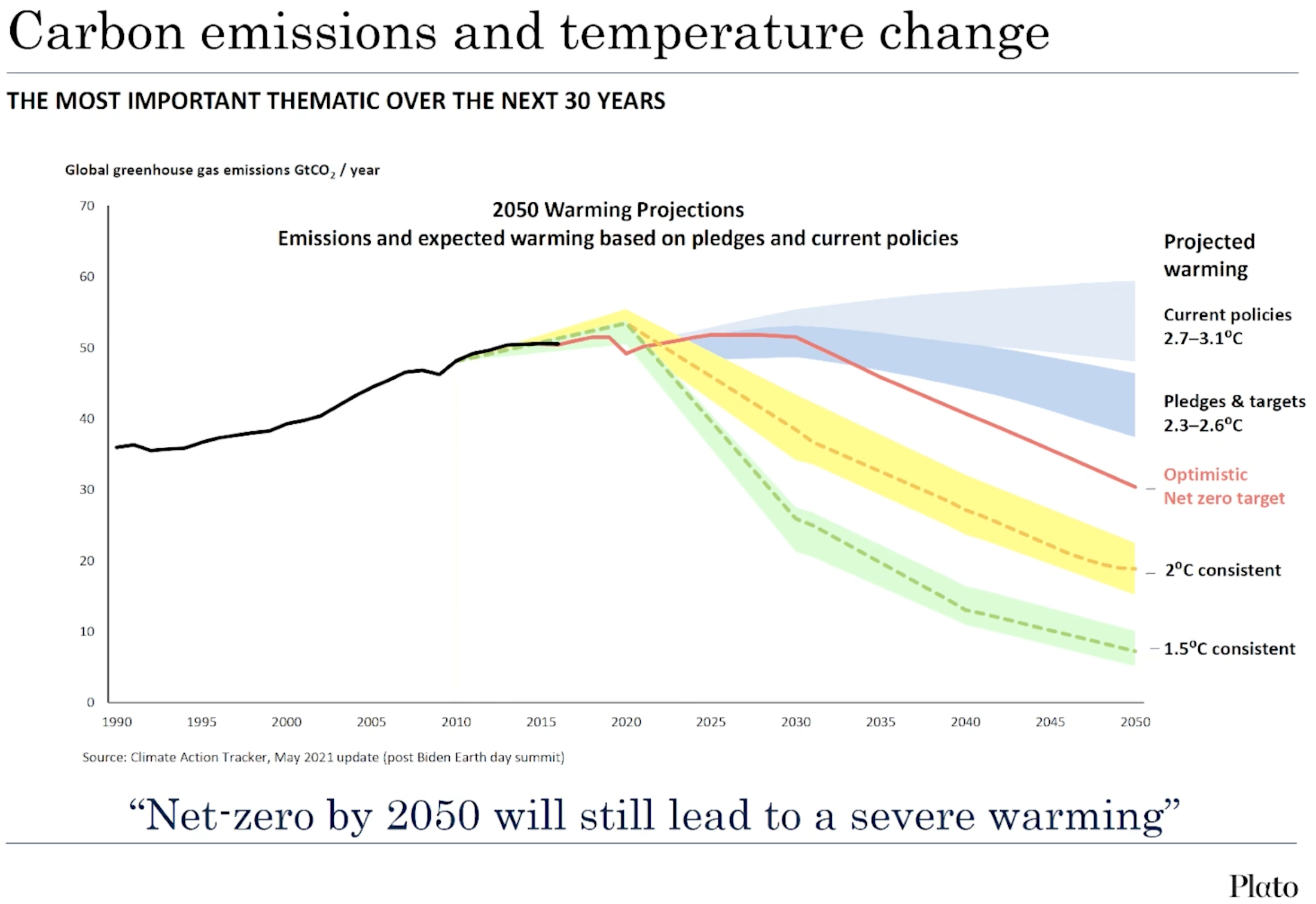

When we look at the trajectory of carbon in the world today, it's quite a sad state of affairs, despite a huge amount of news in the media and some progress.

We're looking at a situation where even with today's pledges, we're looking at over two degrees of warming. Now that obviously is consistent with a huge amount of ecological damage, and also that's the very best case scenario if we meet our pledges and obligations.

What we recognise at Plato is if we really want to make a difference, we need to get to net zero not by 2050, but by much earlier than that, and that's a big part of what this fund is trying to do.

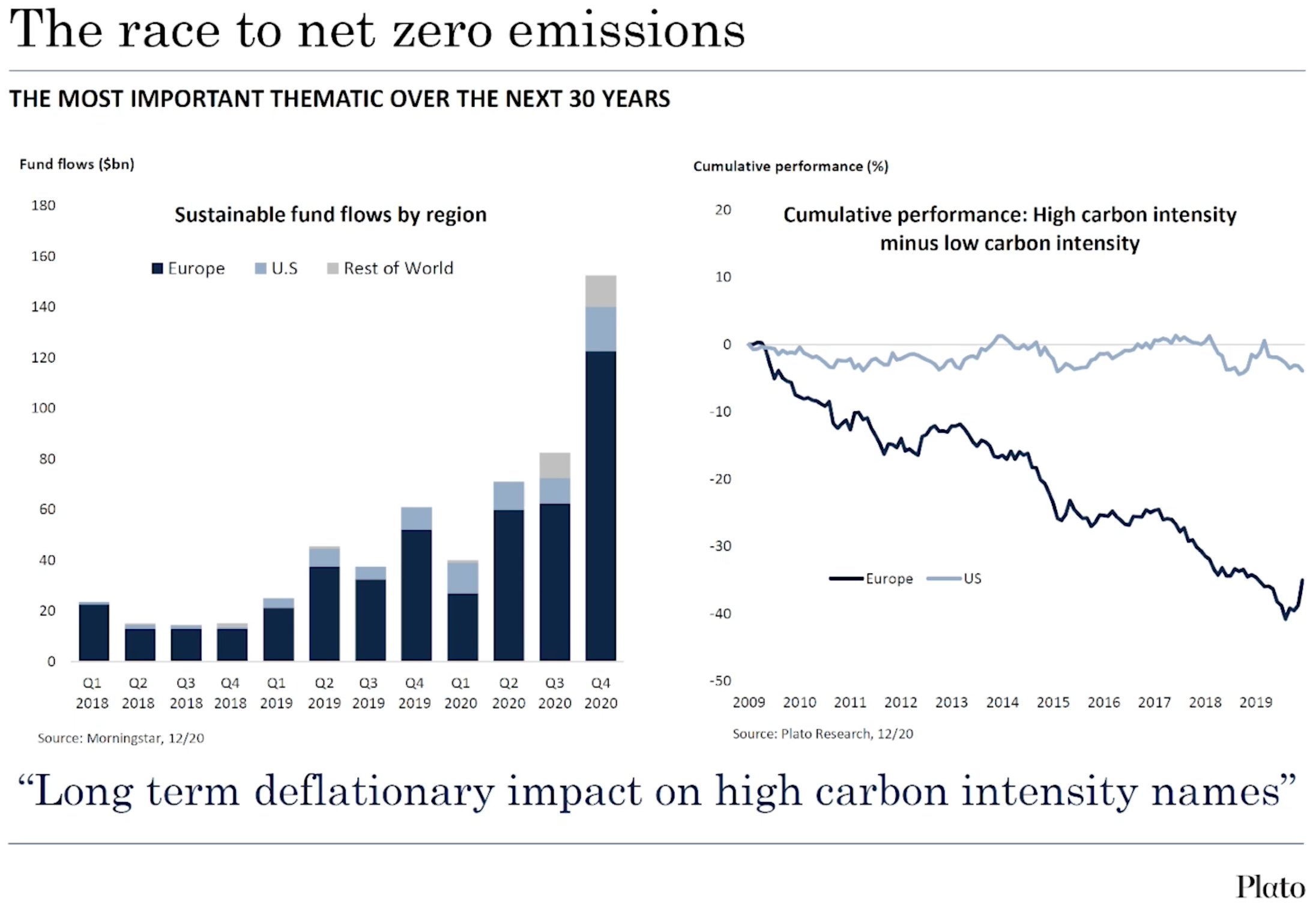

If I can, I'd just like to give you a bit of a window into perhaps what the future holds. If we look at within Europe, Europe is probably five or 10 years down the track of where the rest of the world is when it comes to decarbonisation and attacking this challenge head on.

You can see that on the left hand side of this chart where the fund flows into sustainable, low carbon type funds has been extraordinary in Europe, but very muted elsewhere.

On the right hand side, what we show is the performance of low carbon emission companies relative to high carbon emission companies.

What you can see in Europe, where they've been aggressively looking to decarbonise, there's been this huge tailwind to low carbon emission companies. And this line has trended downward very consistently.

In the US, where that hasn't been the case, there hasn't been that tailwind. If Europe is five or 10 years ahead of the rest of the world, then this very much could provide a lens into the future as to what will happen to asset prices once that decarbonisation starts to take place in earnest.

So what is this fund? What are we talking about today? It's the Plato Global Net Zero Fund. We talk about it as achieving the 2050 net zero target, not in 30 years time, but today.

How do we do that? Well, it's actually not your run of the mill long-only fund. This is actually a long/short fund. It's an active extension fund, or in the old terminology, a 130-30 fund.

This is actually a 150-50 fund. What that means is you've got 50% more exposure to the names that you like, and 50% to generate alpha through betting against companies that you don't like, that you think are going to not succeed.

This is the type of fund that I've run very successfully in the past. I designed and launched at JP Morgan their first active extension fund in Europe, and it was the top-performing fund between 2009 and 2015 in that strategy.

This is very much a natural extension of that strategy, but achieving that carbon neutrality. So not just achieving our financial goals, but also our non-financial goals.

This is the simulation of that strategy over time. What you see is it's an aggressive fund in terms of the alpha that we're shooting for, so 4 or 5% tracking error.

It's ideally suited for those individuals in their out-and-out accumulation phase that are trying to grow their retirement savings.

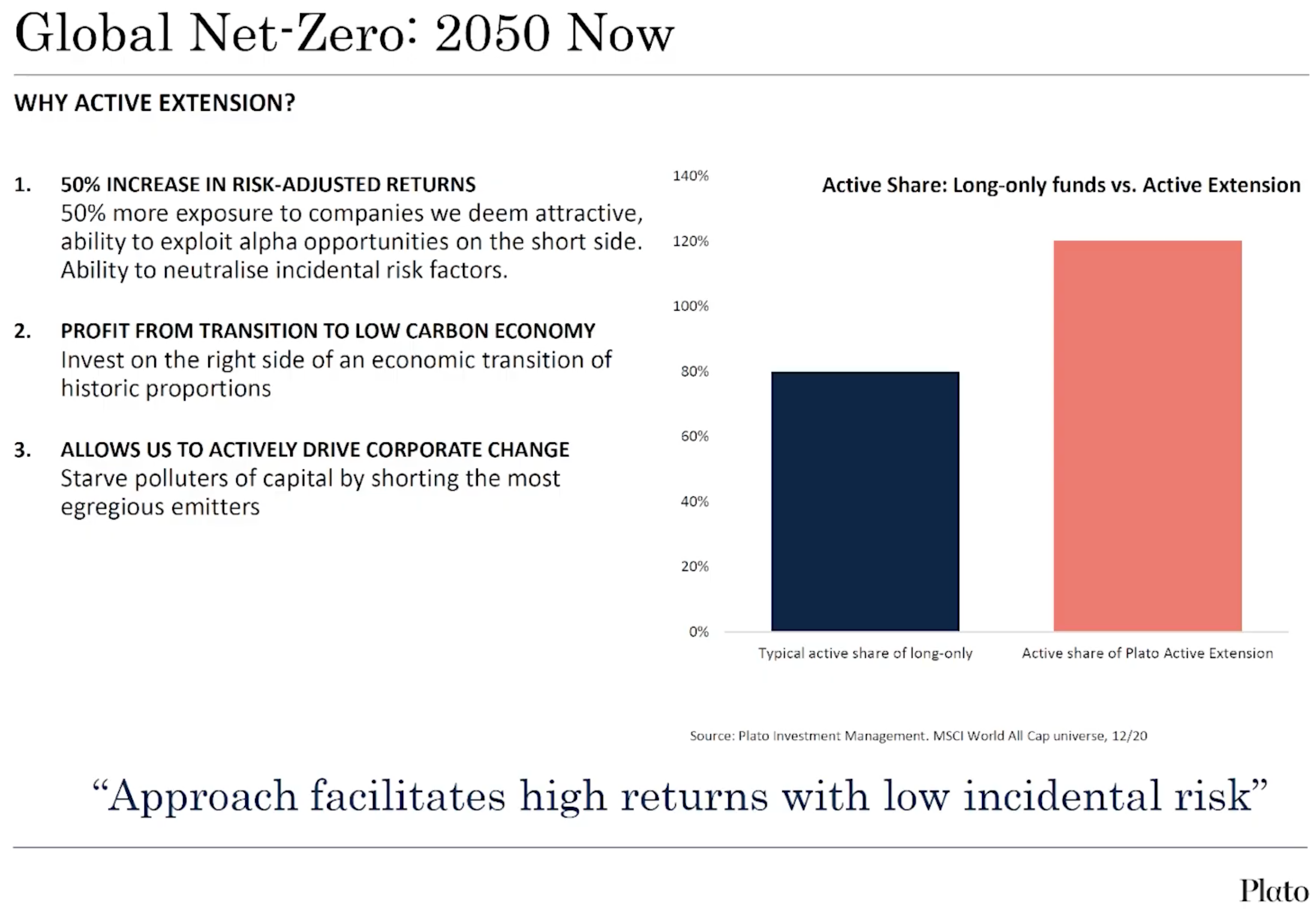

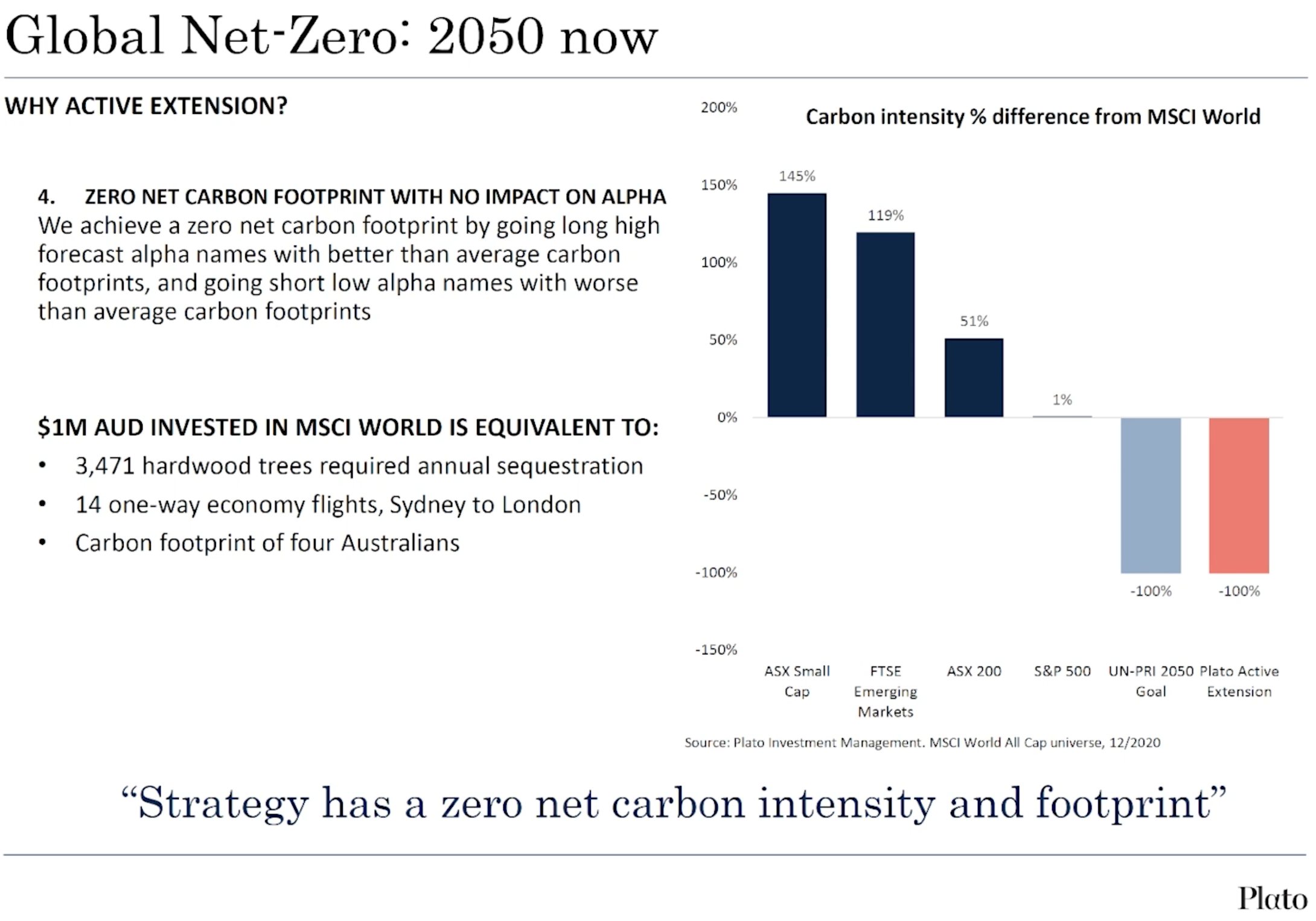

Why global active extension, why this long/short strategy, why is this so suited to what we're trying to do here?

Well, I mentioned the first thing — we've got 50% more exposure to the names we like and the ability to generate alpha also on the short side.

But the second thing is the ability to profit from the transition to this low carbon economy.

This decarbonisation thematic, it's going to touch every single part of our lives from not just how we get to work or how we go on a holiday or how we fly, but the food we eat, how we build our homes — nothing is untouched.

We have the ability, because we can go long and short in this fund, we can benefit from the winners on the long side, but also profit from the companies who are going to suffer as we move to this decarbonised world.

The third one is a really important point, I think. It's not just a financial goal, but it's helping us be part of the solution.

What we can do as the fund gets to size, we can, through our short positions, do two things. Firstly, engage really effectively with corporates. The common approach of just excluding these high carbon names isn't very effective, because you're not on the share register. It really limits your ability to engage.

I can tell you through firsthand experience, by being short companies, you can have a very active dialogue. They're asking, "Why are you short?" And you can explain that high emissions is a big part of that.

As well as that, as the fund gets to a meaningful size, the short positions actively drive down the prices of those very high emission names and helps cut off their sources of capital.

The fourth point that I think is very important to note is, okay, it's great to decarbonise our portfolios.

When we think that just a million Australian dollars invested in the MSCI World Index, for example, it's equivalent to 14 one-way flights from Sydney to London. The carbon footprint of our investment activities often dwarves our day to day activities.

While decarbonising our portfolios is important, we don't want to do so in a way that in any way, shape, or form will impact our ability to generate alpha.

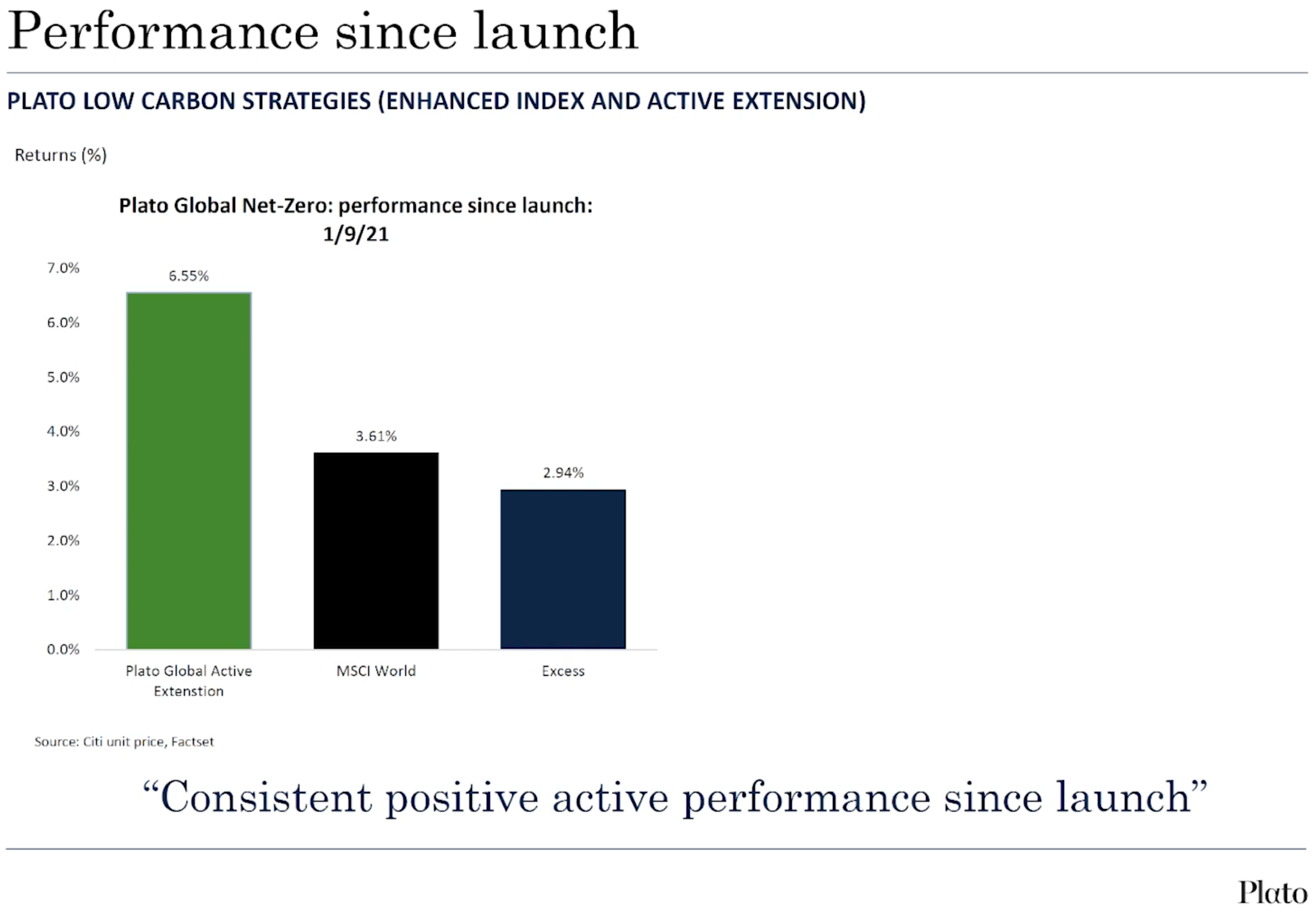

And this is the good news here. All of our research demonstrates that we can achieve those decarbonisation goals, that net zero, without compromising our ability to generate returns. The proof is in the pudding, as you say, and we've actually been running low carbon money in Australia for the last five years, 30% decarbonised against the benchmark, and outperformed that benchmark domestically.

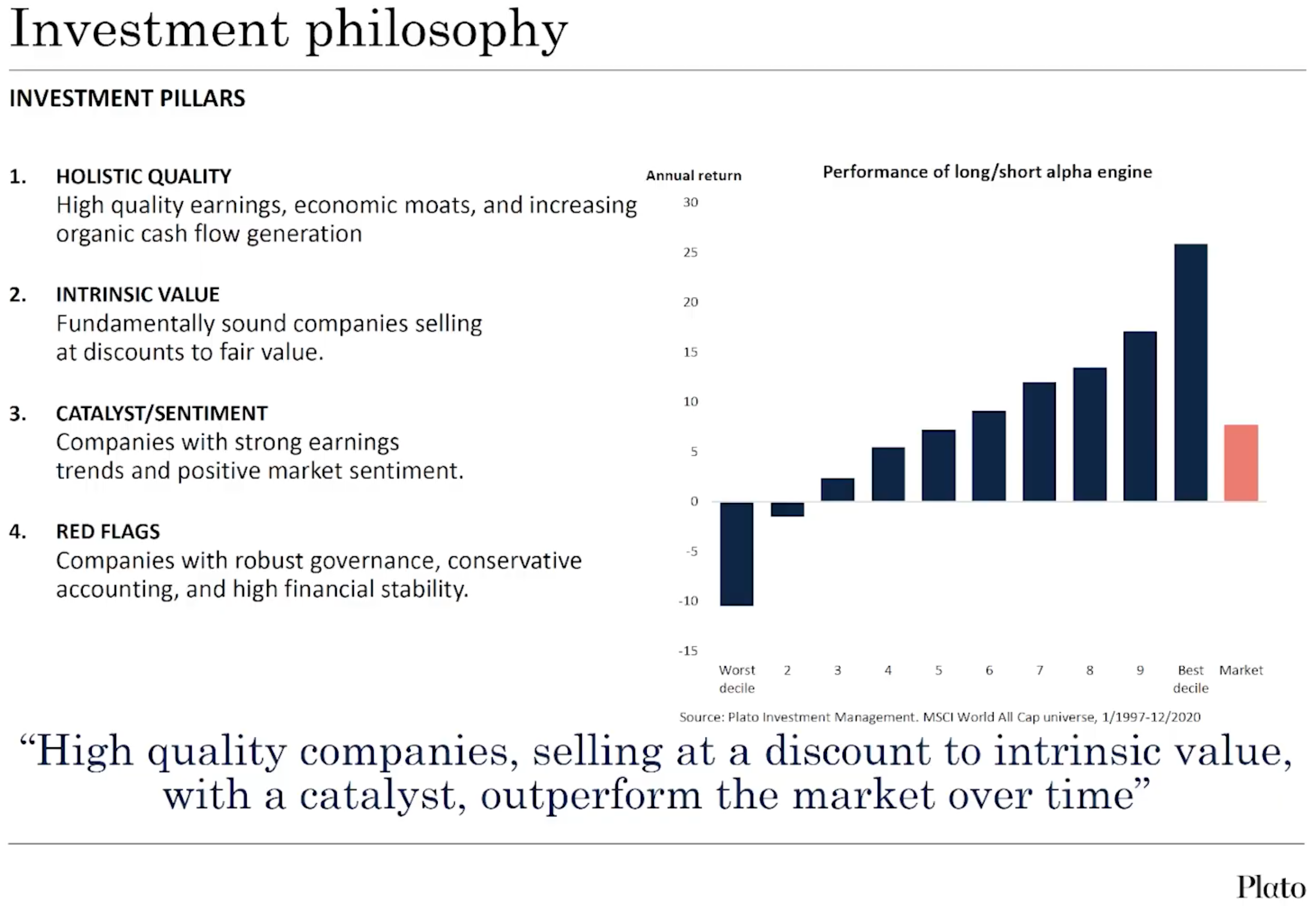

What is our investment philosophy? Well, one thing I think that's very important, if I can get this point across, is that this just isn't purely a low carbon strategy.

We have very much at Plato an alpha-centric approach. We don't want to generate low carbon in a way that's going to compromise the returns we can generate.

The investment process that underpins everything that Plato does has a very long pedigree behind it from the work that Plato has done since 2006, my time at JP Morgan in London, and other team members from GMO and from the Macquarie Quant Hedge Funds group have come together to build an extremely potent alpha engine, which is absolutely key.

We don't want to compromise the returns we can generate just to be able to decarbonise our portfolios.

One novel aspect of our alpha model is a hundred red flags that we have. There's actually over 100 red flags that each stock must be evaluated on before we look to invest.

This ranges from everything to, has there been any directors selling stock in recent times? Is there an absence of clawback provisions? Is there severance vesting? Are there directors on the board that have been involved in historic corporate failures?

This expansive set of red flags allow us to do two things. One, identify landmines on the long side of our portfolio that we want to stay away from, but also on the short side.

If a company has six or more of these red flags that we look at, it is pretty much going to be an excellent short, particularly if it is also a high carbon name.

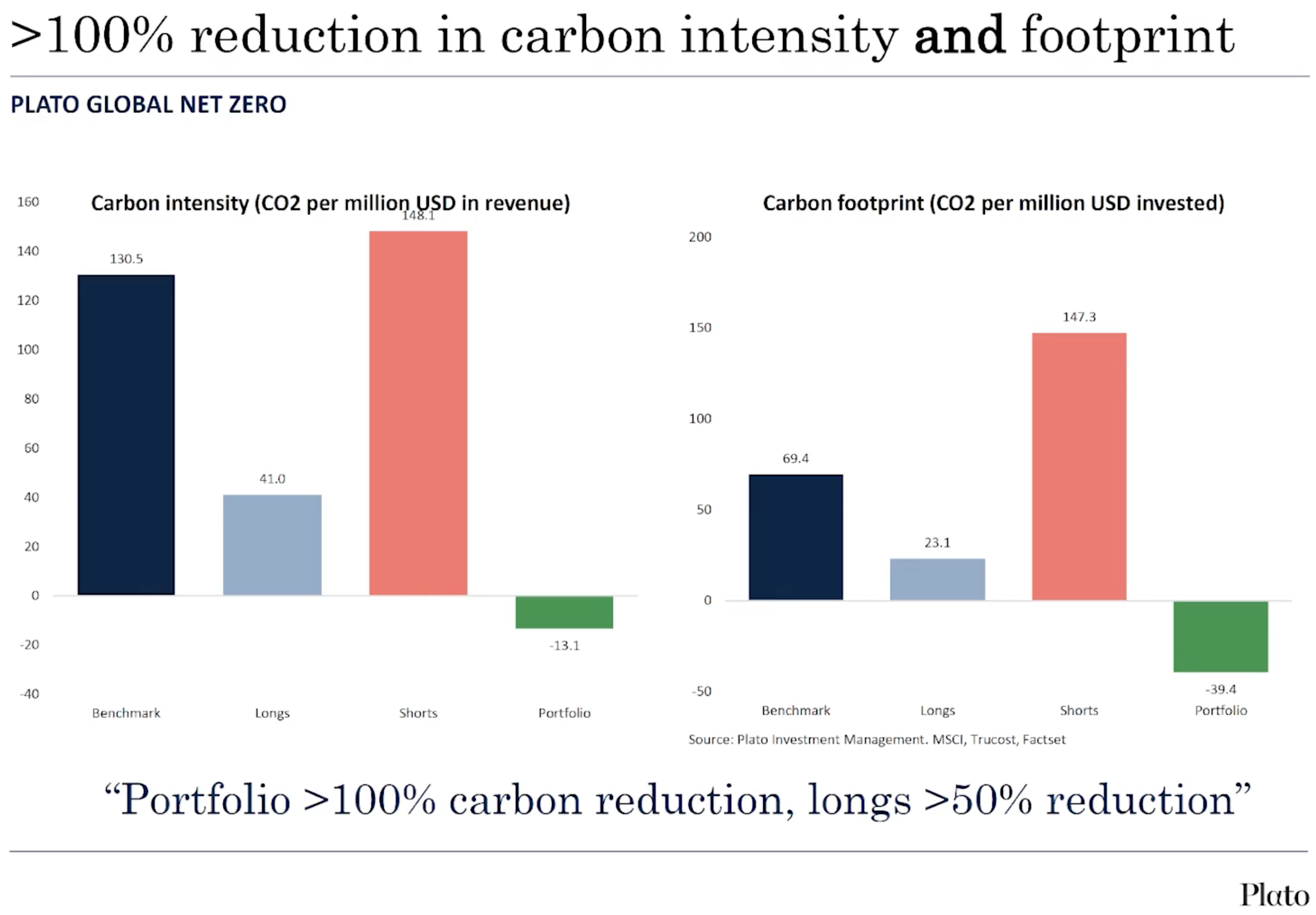

If you look at the portfolio, what does it currently look like? Well, on the long side, you can see that the carbon intensity and the carbon footprint is much lower than the benchmark. Fantastic. That's exactly what we want.

And what about in terms of the actual performance to date? Well, the fund launched just on 1 September, so it is brand new, but performance has been very strong.

We're actually up around 3% since inception, which is a period of under three months, so it's a good start, but entirely within the scope of our expectations of what this fund can deliver.

In conclusion, decarbonisation, it is without a doubt the most important investment thematic over the next 30 years that touches every single part of how we live.

Plato is one of the few companies that has a superb track record. Not many investment managers have actually done this for a period of time, which we have done very successfully.

That gives us very strong confidence we can do so without compromising that all important ability to deliver performance and returns for our investors.

Then finally, what does it all end up with? It's a global net zero strategy. As far as we know, it's the first of its kind not just in Australia but globally, helping achieve that net zero carbon footprint, not in 30 years time, but today.

If I can just draw you to this last slide which shows the contact details of our various distribution team. We'd love to have the opportunity to talk with you further. Thank you.

Reduce your carbon footprint to zero now

The Plato Global Net Zero Hedge Fund is a long-short global shares fund, holding a portfolio of equities with a net zero carbon intensity and net zero carbon footprint. To learn more, visit the Plato website.

3 topics

1 contributor mentioned