Ray Dalio: Which investment themes are hot (and not) as the bubble pops?

- Are equity markets in a bubble?

- If so, when will they pop?

- Which parts of the markets – both sectors and regions – will wear the resulting splatter?

These questions and more were answered by Ray Dalio, founder and co-CIO of Bridgewater Associates in his latest monthly newsletter.

Who is this guy?

And what gives him the authority to air such forthright views? Dalio has around 50 years of experience as a professional investor, buying his first stock (with money earned as a golf caddie) when he was just 12 years old. He founded the world’s largest hedge fund firm (the above-mentioned Bridgewater) in 1975 and built it into a US$154 billion FUM business.

The fund manager has returned an average of 11.5% a year over the last 28 years – which is almost double the average annual return of the S&P 500. Dalio also gained fame partly for his radical philosophy

and his simple steps for achieving investment success. The "radical" part refers to the unique workplace culture Dalio has sought to instil at Bridgewater. The simple investment steps include:

- Decide how much you can save

- Create a diverse portfolio

- Learn the market's long-term cycles.

His latest newsletter starts with a checklist of six things that distinguish a bubble. Without detailing them here, they include

- High prices, as indicated by traditional measures of value

- Unsustainable conditions

- An overwhelming bullish sentiment

- Many new and “naïve” (his words) stock buyers

- A high proportion of purchases bought with debt

- A lot of forward and speculative purchases to bet on share price gains

Updating his January note (covered below by my colleague Matt Buchanan), the primary change this year has been the overextending of the “bubble stocks” – some of which have burst.

Tech stocks have been widely regarded as being in a bubble. And on the key issue of whether the tech selloff is finished, Dalio suggests no.

“Just because they aren’t at a bubble extreme doesn’t mean they are safe or that it’s a good time to get long. In fact, US stocks in aggregate still look overvalued by our measures,” he said.

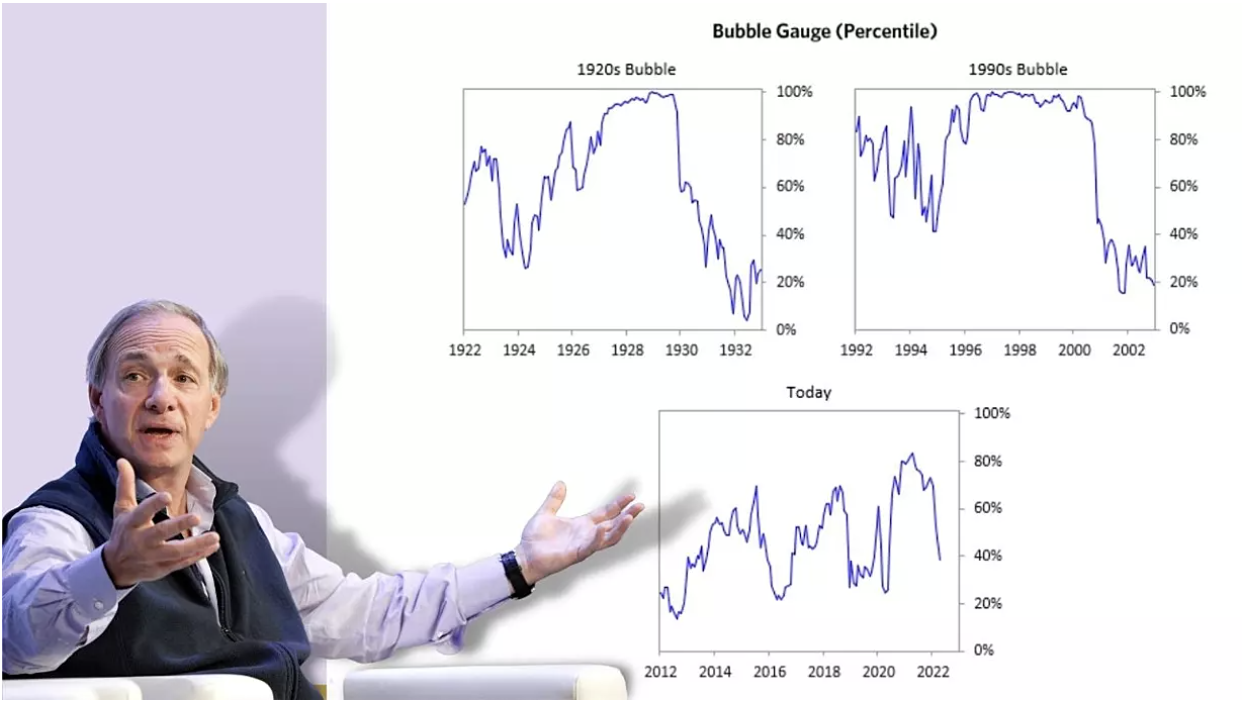

Using some handy charts to illustrate, Dalio discussed the “bubble slice.” This shows how a basket of emerging tech bubble stocks performed versus the S&P 500 over various points in time.

These are “classic” bubble conditions

Everything, down to the effect of tightening (interest rate rises), in the current environment, has echoes of the 1920s.

Another of his standout comments was about the number of new buyers in a market as an indicator of a bubble.

“This gauge shot above the 90th percentile in 2020 due to the flood of new retail investors into the most popular stocks, which by other measures appeared to be in a bubble. More recently, we have seen meaningful moderation in the pace of retail activity in the markets—it’s now back around pre-COVID averages,” said Dalio.

Other points include:

- The bullishness of sentiment

- Whether purchases are bought on leverage

- How many buyers have extended forward purchases?

On this last point, Dalio explains how it provides an indicator of whether investor expectations are too optimistic.

“In the equity markets, I look at indicators like capital expenditure—whether businesses (and, to a lesser extent, the government) are investing a lot or a little in infrastructure, factories, etc.

"It reflects whether businesses are extrapolating current demand into strong demand growth going forward. This gauge is at the 40th percentile, similar to other gauges.”

Conclusion: What does all this mean?

This isn’t something that should change your broad investment strategy. The above views should only influence tactical changes.

“Either way, bubbles more often overcorrect (sell off more than the fundamentals would suggest) versus just settling back to normal levels. But I wanted to pass along these updated readings to you in light of what’s now going on in the markets,” Dalio said.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

3 topics