Rio buy-back looks attractive, but beware the scale-back

On 22 September 2017, Rio announced a A$2.5B share buy-back which includes A$700M as an off-market buyback and the balance being allocated to Rio Tinto’s existing on-market buyback.

On the 5th October, the Buy-Back Booklet was issued providing more details about the buy-back. The buy-back will have a $9.44 capital component, with the balance being a fully franked dividend. The buy-back will be based on a tender, with investors tendering to sell shares at a discount of between 6% to 14% below market price.

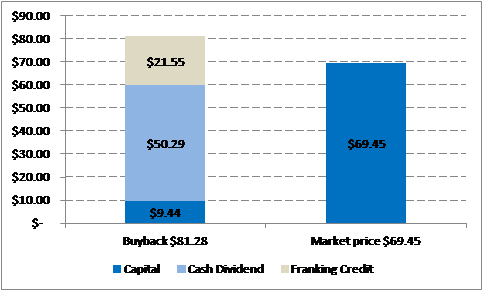

We have analysed the value of the buy-back for pension/tax-exempt and superannuation funds using the closing price of Rio Tinto on October 31 of $69.45 – see Chart 1 below. Using $69.45 as a guide (the actual price used for the buy-back will be the volume weighted average price of Rio Tinto shares in the five trading days up to and including November 10) the maximum 14% discount would equate to a $59.73 buy-back price. With the capital component being $9.44, the other $50.29 would represent a fully franked dividend, which would have a $21.55 franking credit attached. For a tax-exempt Australian investor, we estimate the buy-back at a 14% discount would be worth approximately $81.28 (disregarding the time value of money), representing about $11.83 or 17% more than the market price of Rio Tinto.

Chart 1 - Estimated value of the Rio Tinto buy- back for tax exempt investors using October 31 close

Source: Plato, Telstra Calculator

The value of the buy-back for other investors will depend on the tax situation of each investor. We would expect the buy-back to be of some value for 15% tax rate Australian investors, but significantly less that the 17% number for tax-exempt investors. The precise value will be determined by investor circumstances and the deemed capital value that the ATO will issue after the close of the buyback.

Given that we estimate the buy-back is valuable for both tax-exempt and 15% tax rate Australian investors at the maximum discount rate, and given the small size of the buy-back relative to Rio’s current market capitalisation (approximately 2%), we would expect the final buy-back price to be set at the maximum 14% discount to market price. We would also expect, based on a similar RIO buy-back in 2015, that the buy-back will be heavily oversubscribed and thus investors would be likely subject to potentially large scale-back (other than small investors as there is a guaranteed minimum buy-back allocation of 75 shares) – that is only a small portion of shares tendered would be successfully bought back in the buy-back. So whilst we expect the buy-back to be quite valuable for tax-exempt Australian investors such as charities and pension phase superannuation, we would expect the gains to be had to be scaled back significantly.

Please note that this analysis depends very much on the particular tax status of the investor. We would suggest individual investors should seek professional tax advice based on their individual tax circumstances.

For further insights from Plato Investment Management, please visit our website

3 topics

1 stock mentioned