S&P 500 climbs on strong earnings, ASX 200 set to rally, RBA pause in focus

ASX 200 futures are trading 54 points higher, up 0.73% as of 8:30 am AEDT.

Major US benchmarks climbed on resilient results from Intel, Exxon Mobil and Amazon, the Fed is likely to hike rates by another 25 bps on Wednesday while the market is betting on an RBA pause on Tuesday, China's manufacturing PMI unexpectedly fell into contraction in April and a closer look at how the ASX 200 performs in May.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

- S&P 500 closed at session highs and up 0.87% last week

- Major events this week include US ISM Manufacturing (Tues), RBA rate decision (Tue), May FOMC meeting (Wed), Apple earnings (Fri) and nonfarm payrolls (Fri)

- Fed rate hike probability sits at 78.9%, according to CME's FedWatch tool

- Vast majority of market gains driven by only seven tech stocks (FT)

- Investor reaction to earnings muted despite resilient consumer spending (Bloomberg)

EARNINGS: RECAP

265 S&P 500 companies have reported. Here are some quick stats about reporting season so far.

- Blended earnings growth rate of -3.7% compared to expectations of -6.7% last month

- 79% beat consensus EPS expectations, above the one-year average of 73% and five-year average of 77%

- 74% beat consensus sales expectations, above the one-year average of 70% and the five-year average of 69%

EARNINGS

Intel (+4.0%): Revenue beat, better-than-expected loss, Q2 EPS view slightly light but revenue in-line with consensus expectations. Revenue fell 36% year-on-year in the first quarter, the largest year-on-year decline in the company’s history (going back to 1985).

"We are seeing increasing stability in the PC market with inventory corrections, largely proceeding as we had expected. However, the server and networking markets have yet to reach their bottoms as cloud and enterprise remain weak.” – CEO Pat Gelsinger

Exxon Mobil (+1.3%): Double beat, finished the quarter with US$32.7bn in the bank.

- "Following a record year, ExxonMobil delivered the highest first-quarter earnings in our history even as energy prices and refining margins moderated from the fourth quarter.” – CEO Darren Woods

- "In the first quarter, we saw continued strength in energy prices and refining margins. Crude prices moved down on higher global inventory levels, yet held within the top half of the 10-year range.”

Amazon (-4.0%): Double beat, AWS earnings grew 16% year-on-year, Q2 revenue expected to be US$127-133bn or grow between 5-10% compared to a year ago. The stock rallied 11% in the five minutes after it released earnings after the close, only to fall back to breakeven shortly after.

- "The uncertain economic environment and ongoing inflationary pressures continue to be a factor and we believe it's continuing to drive cautious spending across consumers.” – Brian Olsavsky

- “Customers continue to evaluate ways to optimise their cloud spending in response to these tough economic conditions in Q1 and we are seeing these optimizations continue into Q2 with April revenue growth rates about 500 bps lower than what we saw in Q1."

Snap (-17.1%): Double miss, daily active users rose 15% year-on-year to 383 million, revenue fell 7% – the first year-on-year decline in the company’s history.

ECONOMY

- China manufacturing PMI unexpectedly fell into contraction in April (Reuters)

- US consumer spending flattens, core inflation still hot (Reuters)

- Japan industrial production stronger but manufacturing in technical recession (Kyodo)

- Tokyo CPI surprises to the upside (Bloomberg)

- South Korea March factory output rises by most in nearly three years (Reuters)

- Eurozone Q1 GDP shows marginal growth at the start of 2023 (Reuters)

-

UK business confidence at highest level in almost a year (London Times)

Deeper Dive

S&P 500: Strength or Sell

The S&P 500 has rallied back to a 2-month high. Should investors be buying into strength or fading it? Here's what the pros are thinking:

- Goldman Sachs: "... market breadth has contracted to one standard deviation below average for the first time since 2020. .. Following 9 sharp declines of a similar magnitude since 1980, the S&P 500 has posted below-average subsequent returns and larger peak-to-trough drawdowns.”

- Wells Fargo: "We continue to reiterate our stance that earnings estimates on Wall Street are still too high as we look through this year and into early 2024 ... we believe the S&P 500 Index will largely trade in a range this year. Currently, the index is trading towards the top end of the 3,700 - 4,200 range we envision."

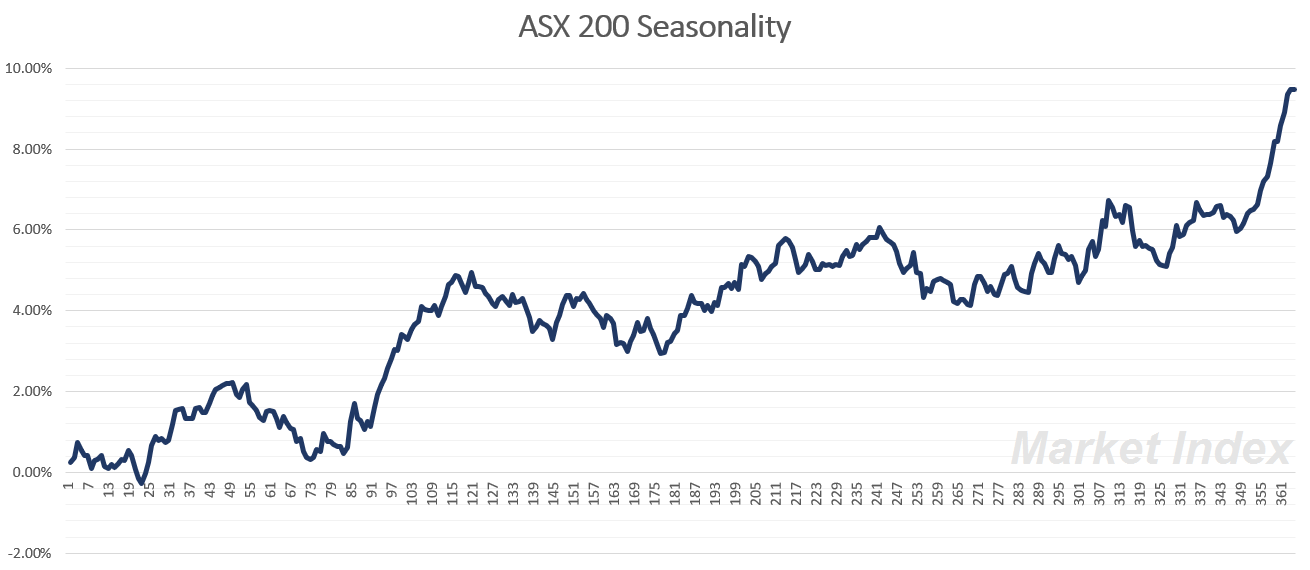

Welcome to May: Sell and go away?

May, June and September are the seasonally worst months of the year, based on average ASX 200 performance between June 1992 and March 2023. For these three months, the ASX 200 down a respective -0.58%, -0.68% and -1.20% on average.

May 1 is the 121st day of the year, which coincides with the seasonal top we typically see in the first half. Just something to be weary of.

China's PMI: Manufacturing Contraction

China posted Manufacturing and Services PMI data for April over the weekend.

- Manufacturing unexpectedly sank to 49.2 from 51.9 in March

- Services eased to 56.4 from 58.2 in March

The Manufacturing PMI hit the lowest level since China's post-pandemic reopening late last year and well-below consensus expectations of 51.5. Some of its sub-indexes were also very depressing.

- New orders dipped to 48.8 from 53.6

- New export orders fell to 47.6 from 50.4

- Steel industry PMIs fell to 45 from 48.4

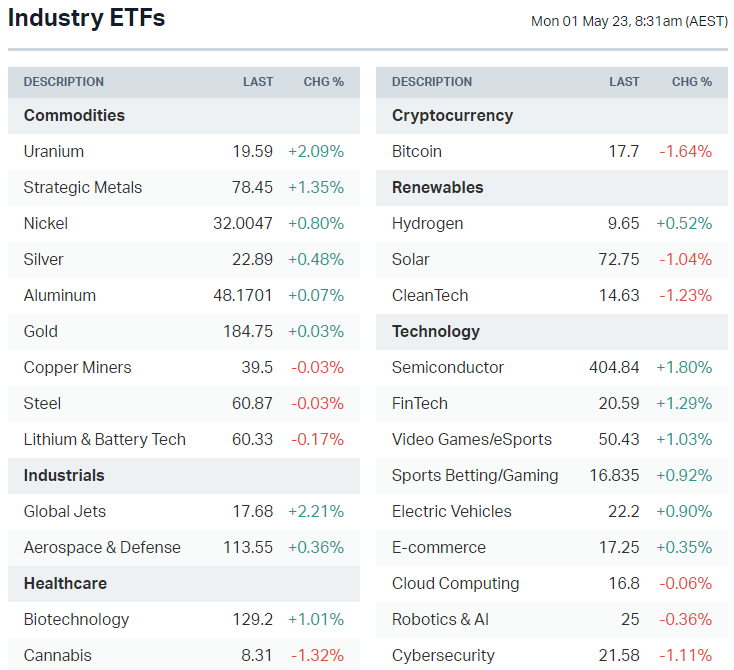

Sectors to Watch

Iron ore: It will be interesting to see if the above data has an impact on iron ore spot prices and/or miners on Monday.

Energy: Energy was the best performing S&P 500 sector last Friday, thanks to a 2.5% bounce in oil prices and record earnings from Exxon Mobil. Could we see some follow-through strength for names like Woodside and Beach Energy?

Uranium: The Global X Uranium ETF was up 2.1% overnight, close to a two month high. Local names rallied last Friday, including Deep Yellow (+9.2%), Boss Energy (+9.1%) and Paladin Energy (+4.8%).

Key Events

ASX corporate actions occurring today:

- Trading ex-div: No companies but a long list of ETFs. Check them out here.

- Dividends paid: Harvey Norman (HVN) – $0.13

- Listing: None

Economic calendar (AEST):

- 3:00 pm: Japan Consumer Confidence

- 12:00 am: US ISM Manufacturing PMI

This Morning Wrap was first published for Market Index by Kerry Sun.

1 contributor mentioned