Seven reasons why Australia should avoid a recession

Economic and financial commentary has been particularly gloomy of late, with talk of a “dire”, “grim”, “bleak”, “perilous” and “confronting” outlook. The problems are well known: high inflation; particularly high and still rising energy prices; central banks aggressively raising interest rates; a high risk of recession globally; the war in Ukraine, along with other geopolitical risks; and the downturn in China. One could be forgiven for thinking that a recession in Australia is inevitable in the next year.

Returning inflation to the 2-3% target is of utmost importance as the 1970s experience highlights that failure to do so will lead to even worse economic conditions and a continuing rough time in investment markets. And the surge in inflation is more than just supply constraints flowing from the pandemic, the war in Ukraine and floods, as demand is running well above supply in the Australian economy.

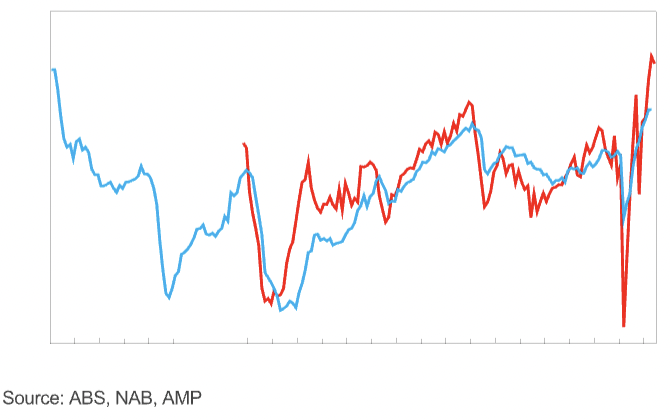

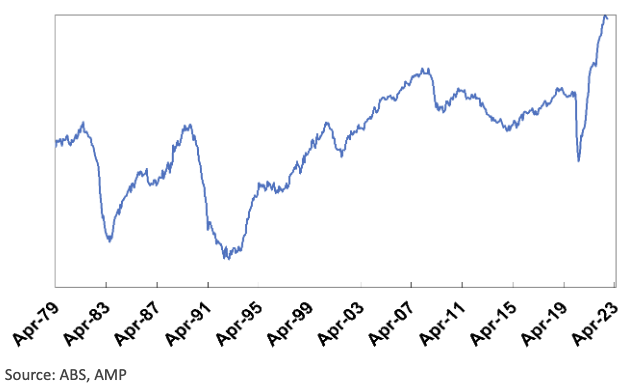

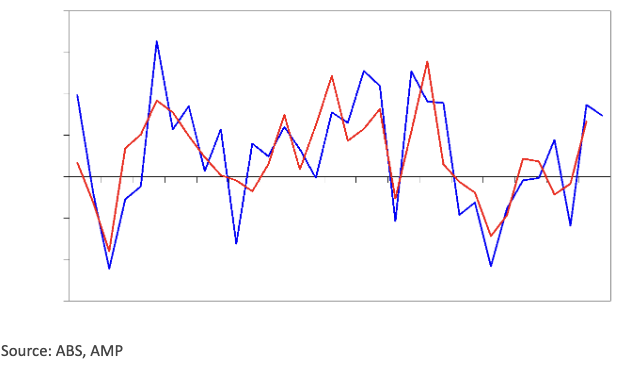

This is evident in very high capacity utilisation rates and very low unemployment (see the next chart).

For the labour market, it's also evident in a high ratio of job vacancies to unemployment. This has meant that the “jobs gap” in Australia (defined as labour demand less labour supply) has closed to nearly zero for the first time in over 40 years (see the next two charts).

The longer the very tight labour market remains, the greater the chance that wage growth will surge in excess of the three-point something that is consistent with inflation in the 2-3% target range.

To bring demand in the economy back into line with supply some economic slowdown is required to help get inflation back down. Hence the RBA has been raising interest rates.

With households most vulnerable to higher interest rates due to high levels of household debt and the double whammy from falling real wages, consumer spending is set to slow sharply. And RBA Governor Lowe has noted on several occasions that “we are traveling along a narrow path here" in terms of being able to return inflation to target and avoid a recession.

But it’s not inevitable that Australia will slide into recession. Assuming there is no further significant flare up in geopolitical problems (such as a war over Taiwan), this note looks at seven reasons why Australia should be able to avoid a recession.

#1 The business investment outlook is reasonably solid

Business investment plans for the year ahead remain strong. The ABS capital spending intentions survey is up about 15% from a year ago. It’s likely this partly reflects the higher costs of investing, but it’s also consistent with high levels of capacity utilisation, reasonable business conditions and confidence, and some easing in supply chain pressures. Real business investment is expected to grow by around 5% over the year ahead.

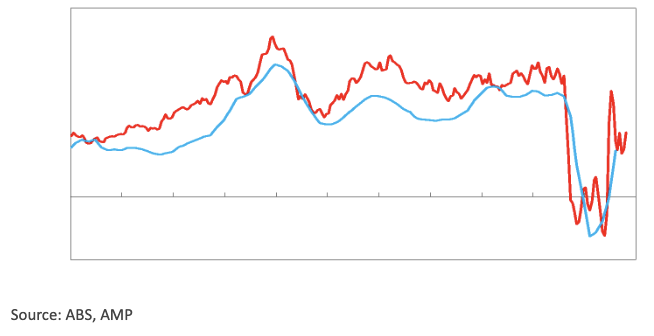

#2 There is a large pipeline of home-building work

From their high last year, approvals to build new homes in Australia have fallen about 25% reflecting the end of the HomeBuilder grant and rising interest rates. While this points to a downturn in home building, it's likely to be cushioned because there is a large pipeline of work yet to be completed with home completions yet to catch up to the surge in home building approvals through the pandemic (see red circled area in the next chart).

This has been due to poor weather and shortages of labour and building materials. The large pipeline of work yet to be done will likely provide a floor for home building, preventing a plunge in dwelling investment that would normally flow from a 25% fall in approvals.

#3 High energy prices are boosting national income

While the surge in energy prices is a huge hit to household budgets, it's providing a big boost to national income via the earnings of energy companies.

This is evident in strong trade surpluses and contributed to a $48 billion improvement in the budget deficit last financial year and $42 billion this financial year. This in turn is helping reduce the budget deficit and providing greater fiscal flexibility for the Australian Government.

#4 The Australian Dollar will plunge if global recession leads to a sharp fall in commodity prices

So far this year the $A is down 11% against the $US but is unchanged on a trade-weighted basis (ie against an average of currencies as other currencies have fallen more against the $US than the $A has). But if global economic conditions collapse leading to a sharp fall in Australian commodity prices and hence our export earnings (which would push down inflation globally and in Australia) it’s likely that the $A will fall sharply.

This in turn will help support the Australian economy by making our exports more competitive as they did in the Asian crisis, tech wreck and the GFC.

Alternatively, Chinese growth, after surprising on the downside this year could surprise on the upside next year. A key drag this year has been its zero COVID-19 policy. But there are several signs that it's heading towards an easing with the People’s Daily running an article downplaying long COVID-19; a relaxation of PCR test requirements in some regions.

Pfizer’s vaccine is being made available to foreigners in China, and some regions building new makeshift hospitals. It's looking likely that the easing could come early next year. If so, this could result in a sharp rebound in Chinese growth as the stimulus measures of the last year would then be allowed to work. This in turn would boost global growth and benefit Australia.

#5 Immigration is rebounding rapidly

A surge in new visas for arrivals as the backlog is worked through and in monthly data for net permanent and long-term arrivals points to a rebound in immigration levels.

Consistent with this the Budget is projecting net immigration of 235,00 from this financial year consistent with pre-pandemic levels. This follows negative net immigration in 2020-21.

The surge in immigration will help ease the labour shortage and tight jobs market evident in the first two charts in this note. Which in turn will help head off a surge in wages growth to levels well beyond those consistent with the inflation target.

#6 Inflation may be less of a problem in Australia

It’s all very well to say the economy is resilient, but that may just mean that the RBA will have to raise rates by more than otherwise to slow demand enough to get inflation down. In other words, the previous considerations are necessary to help avoid recession but are not sufficient.

So this brings us to inflation and here there are reasons for optimism that the RBA won’t have to raise rates too much further (and not to the 4%-plus that the money market is assuming but which would most likely tip us into recession):

First, Australian wage growth is far lower than in other countries.

Second, at least our energy prices have not been doubling or more, unlike in Europe.

Third, longer-term inflation expectations are still consistent with the inflation target which should make inflation a lot easier to bring under control than it was in the 1980s when high inflation was entrenched.

Fourth, while the Australian labour market is very tight, risking a wages blowout, this is in large part due to the absence of immigrants. Unlike in other countries, labour force participation is above pre-pandemic levels and the return of immigrants will ease worker shortages.

Fifth, the simultaneous monetary tightening by central banks risks a sharp slowing in global growth and inflationary pressures that Australia will benefit from, reducing the amount the RBA will need to tighten by.

Finally, US upstream price pressures are slowing which should benefit Australia which is following US inflation with a six-month lag.

#7 The RBA has opted to move into the slow lane

Much will come down to how aggressive the RBA gets in raising rates. It has noted that it “will do what is necessary to” return inflation to target. But it’s also noted that it is seeking to do this “while keeping the economy on an even keel.”

After an initial run of rapid rate rises that returned the cash rate to more normal levels it has since slowed the pace down to better assess their lagged impact, allow for the global downturn, and hopefully strike “the right balance between doing too much and too little.”

In motoring parlance, “speeding kills” – the initial acceleration in rates was necessary to catch up to inflation but to continue at that pace would run the risk of a serious accident that tips us unnecessarily into recession.

Concluding comment

Some may wonder why I haven’t noted the strong jobs market as a reason why we should be able to avoid recession – the reason is that jobs are a lagging indicator. They were strong prior to the early 1990s recession too!

Some may also argue that many households are protected by large mortgages and saving buffers - but many households aren’t, so I decided to not rely on that one too. But the key is that there are enough other reasons why, although economic growth is likely to slow sharply from 3% this year to around 1.5% next year, we should be able to avoid a recession.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

1 topic