Why you should fear the big bad bear

Investors today face a challenging dilemma. The economy is staring down the barrel of the biggest recession since the 1930s, while equity prices appear closer to boom territory than bust. So, do we trust that the central bankers and governments of the world can solve all our problems, and jump on the risk bandwagon – or, “don’t fight the Fed” in other words? Or, is it time to embrace our inner pessimist and flee risk assets altogether? But with equity prices rallying strongly, and cash offering negative returns after inflation, the opportunity cost of staying out of equity markets is high.

To get a better understanding of how to navigate the situation, I reached out to Kate Samranvedhya, Deputy Chief Investment Officer at Jamieson Coote Bonds; Anton Tagliaferro, Investment Director at IML; Jerome Lander, Portfolio Manager at Lucerne Investment Partners; and Donald Amstad, Head of Investment Specialists for Asia Pacific at Aberdeen Standard Investments.

In this part 2 of Livewire's exclusive Bulls vs Bears series, they tell us what’s driving the rally, explain the risks markets aren’t pricing in, and where to invest today. (In case you missed the backstory on this series from my colleague Bella Kidman, please click here).

What’s driving markets?

The first question that pops up when trying to wrap your head around markets is, what’s sending the prices up? The oft-quoted culprits are liquidity from central banks – creating new money and using it to buy financial assets – and rescue/stimulus packages from various governments around the world.

"Share prices have been driven higher both

locally and globally by hopes of a quick return to normality once the COVID-19 virus

is under control and also by huge amounts of liquidity in the system," said Anton from IML.

While these two factors are no doubt highly influential, there appears to be more to the story.

Some of the price gains look to be perfectly rational. It’s not hard to see why a company like Amazon, for example, has rallied. Kate from JCB also pointed to cloud computing stocks, which have performed well as people all over the world have adapted to “working, shopping, streaming, and even investing from home.”

But there might be a side effect to locking people in their homes, closing the casinos and pokies, and paying them to not work. Platforms like Robinhood in the USA, which target less experienced, lower net worth clients, have seen huge booms in trading activity since March. In May, ASIC published analysis of trading activity during the COVID period and found:

“The COVID-19 period has revealed a substantial increase in retail activity across the securities market, as well as greater exposure to risk. We found that some retail investors are engaging in short term trading strategies unsuccessfully attempting to time price trends. Trading frequency has increased rapidly, as has the number of different securities traded per day, and the duration for holding the securities has significantly decreased: indicating a concerning increase in short-term and ‘day-trading’ activity.”

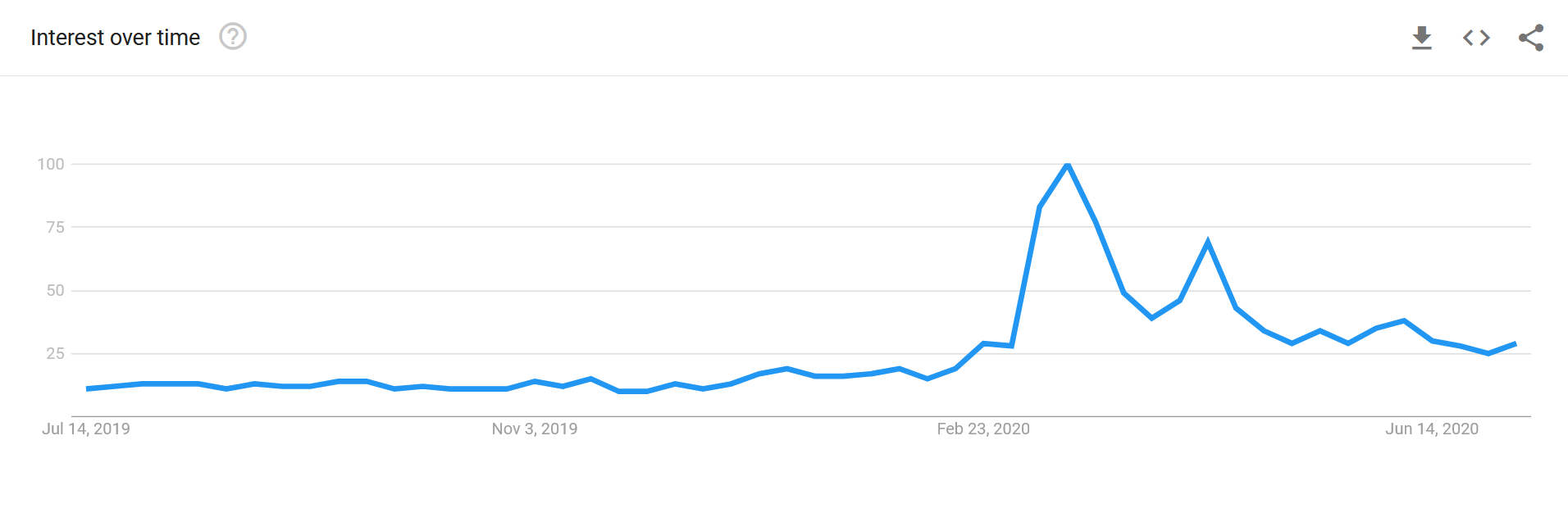

Google Trends data – Interest in term “How to buy stocks”

Jerome from Lucerne was also concerned about action in the stock market.

“Substantial speculative capital has entered stock markets for short term trades, in many cases bidding up the price of insolvent and obviously near worthless companies,” he said.

After entering bankruptcy on 22 May, Hertz's shares fell to a low of 40 cents. But over the coming weeks, the share price staged a stunning comeback, rallying to as high as $6.97 – more than twice the share price before fears of bankruptcy were raised. Amazingly, the company was planning at one stage to issue new shares, which the prospectus described as ‘potentially worthless’. Thankfully, the regulator put a stop to that.

Jerome also worries about speculators playing ‘Greater Fool theory’. “Even if prices are too high today, there will be someone willing to pay a higher price tomorrow while liquidity is ample, and hence that the bubble will continue for a little longer. Of course, that is all well and good until reality bites and the bubble is pricked once again,” he said.

Risks that aren’t being priced in

When risks are well known and understood, they’re generally accounted for in the price of financial assets. It’s the risks that are poorly understood, or being ignored, that you need to be wary of. Donald from Aberdeen sees several key risks that aren’t being priced in today:

First, the pandemic could be worse than expected. This appears to be playing out as we speak, as the USA and the world are setting new records for COVID-19 cases daily. Many places that had controlled the outbreak initially, are now struggling as numbers rise and lockdowns ease. California, Texas, Victoria, Israel, and Kazakhstan are among the regions that have reimposed restrictions after having previously lifted them.

“The depth and length of the recession is highly uncertain because of the potential for re-ignition of infections when lockdowns are lifted, and the extended timeline expected for a vaccine,” Donald said.

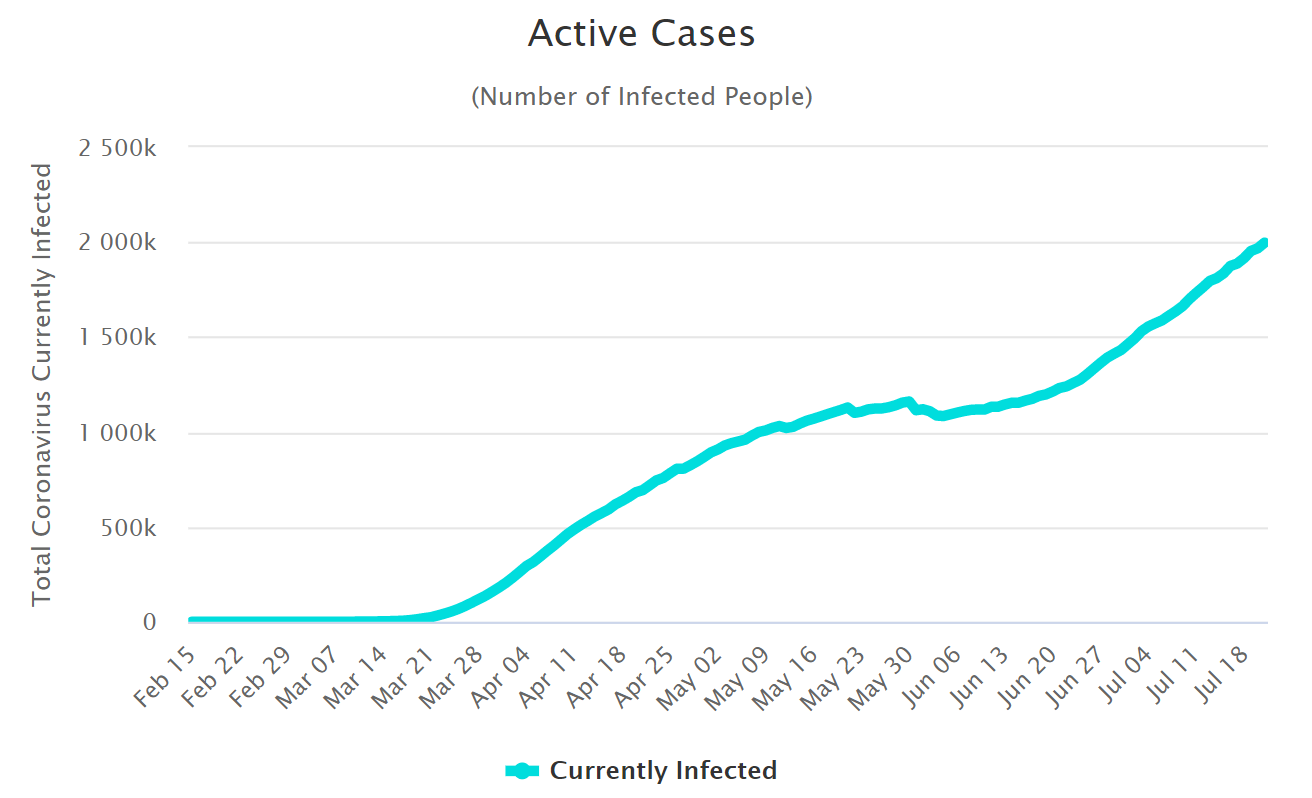

Active COVID-19 cases in the United States

Another area investors might be underestimating the impact is unemployment. While in Australia, official unemployment has only jumped from 5% to 7.4%, this number does not include anyone on JobKeeper who’s currently sitting at home being paid by the government. It is also masked by a 3.2% drop in the number of people in the workforce, and a 4.5% increase in underemployment. Despite this, the official unemployment rate is at the highest level it's been since the 90s.

Source: Australian Bureau of Statistics

“The unemployment rate in the key states of New York, California and Florida currently sits between 14-16%. Never mind all that – risk assets continued their ascent, with global stock markets up by 2 to 3% and corporate bonds enjoying another strong month of spread tightening in June,” Donald told us.

He also raised the possibility of higher taxes if the Democrats win in November, and a rekindling of the trade war if Trump is struggling on the issue of the economy.

Jerome from Lucerne raised a long list of concerns, chief of which is the potential failure of monetary and fiscal policy to continue supporting markets. He says this has created “one of the biggest dispersions between the fundamentals and market pricing of all time.”

“We still haven’t established favourable underpinnings for real economic growth. Governments can’t realistically solve a debt problem with more debt, even if they will keep trying to kick the can down the road. Government interference in markets makes them less productive and entrenches low growth. We are arguably living in poorly run Ponzi economies and an epic era of fake and unsustainable wealth,” he said.

Finally, for Kate from JCB, the end of rescue package measures presents a major risk. In the absence of a widely available vaccine in the next 12 months (which she said would be a “medical miracle”), life will look very different for most people for a long time yet.

“Some companies may not be profitable in a new normal and owners of corporate bonds and equities of these companies will bear the consequences. Policies are here to buy time, so people and companies can avoid sudden death and adapt to a new future. Policies are not meant to keep zombie companies hooked on life support forever,” she told Livewire.

The problem with the bull case

The optimists' case for markets appears built around a number of key assumptions:

- Support from governments and central banks will carry us through the short-term impacts,

- The virus will be successfully controlled and contained,

- These two factors together will give the economy the chance to begin a true recovery.

Upon closer inspection though, these assumptions run the risk of breaking down.

Kate from JCB raised concerns that we are now “in a super debt cycle – on turbo”. While the debt cycle had been long leading into this crisis, the recent developments have extended the length, while dialling up the intensity.

“What’s unique about this crisis is that every country sees deterioration of their public finances. Fitch recently downgraded Canada from AAA to AA+. Should credit quality or supply of debts threaten a meaningful rise in bond yields, that would test the fragility of high equity valuations as well,” she said.

Similarly, Donald from Aberdeen is worried about the sustainability of the current path; “I don’t feel the strong positive correlation between equity market prices and central bank balance sheets are sustainable.”

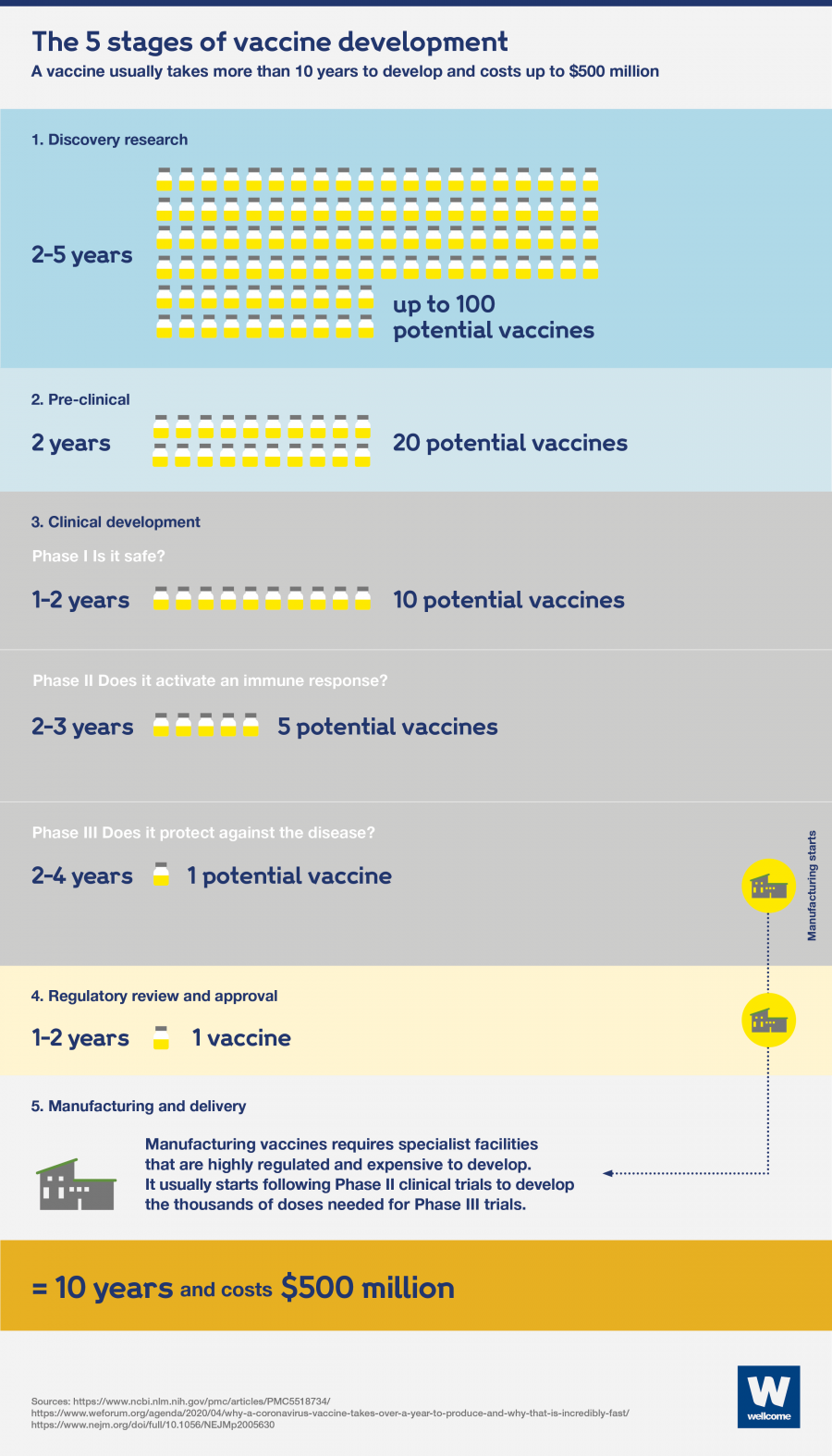

Recent outbreaks and resurgences across the world call into question the ability of governments and health authorities to maintain control of the virus while keeping economies open and functioning. Meanwhile, a vaccine could be further away than many people hope (see image below).

Dr Jerome Kim, Director-General of the International Vaccine Institute told CNBC in June:

“When we are used to five-year time frames, to see something go into human testing on March 17 is really a remarkable thing. Does this guarantee success? Not necessarily. Vaccine development is characterised by a high failure rate – often 93% between animal studies and registration of a product.”

What will the 'new normal' really look like?

Even in a best-case scenario, where the virus is controlled and people return to work over the next few months, the world has been permanently changed. Perhaps the most obvious example of this is the work-from-home trend.

I surveyed 10 managers and HR experts in June on their expectations for working from home after COVID-19 has been contained. They expect 70% of people to work from home at least 1 day per week, with a total drop in daily foot traffic of 35% from pre-pandemic levels.

This agrees with a survey conducted by the Boston Consulting Group and published by ABC News, which suggested 60% of people wish to split their time between the office and home, with most opting for two or three days per week of each.

Mandi Prager from MP Group recently discussed this in a Livewire post:

"Many of the corporates I am speaking with are extending their working from home arrangements indefinitely, with staff allowed into the office one week per month on rotation. If this becomes a longer-term trend, vacancy rates will go up, rents will go down, cap rates will soften, and this is where meeting those pre-COVID bank loan covenants may become an issue."

While cities would no doubt adjust over time, the sudden loss of 30% of daily foot traffic could have devastating consequences over the short to medium term. Small businesses that rely on that foot traffic could be forced out of business, and starting a new business in the suburbs might not be straightforward.

Offices and restaurants aren't the only ones facing challenges. Anton from IML is also concerned about the future profitability of our banks:

"It’s fairly hard to get a clear sense of what a return to ‘normal’ is likely to be for many sectors. If we have an extended period of high unemployment, then this will reduce consumer spending, which could weigh heavily on future economic growth. The Banking sector, for example, is unlikely to be as profitable as in recent years. Lower credit growth, lower net interest margins, and an increase in bad debts are likely to pressure the banks’ profitability for the foreseeable future. This will lead to a lower return on equity and a material reduction in dividends compared to what many people are accustomed to receiving," he said.

Getting a balanced picture

In this article, I’ve argued for the bear case. While central banks have provided extraordinary liquidity, this has simply served to drive up the prices of risk assets. At current levels, the bull case would need to play out perfectly to justify prices, yet many of the central assumptions of the bull case face significant challenges over the month ahead.

In the coming days, my colleague, Vishal Teckchandani, will publish an article arguing for the bull case. After that, Bella Kidman will publish the top investing ideas from both camps. Follow their profiles by clicking their names, then the “follow” button, to be notified when Vish and Bella post their wires.

The Bull versus Bear series so far

This article concludes our four-part series, exclusively written for Livewire Markets subscribers. Here are links to the other wires:

- PART 1 - Bulls are bucking, bears are hunting

- PART 2 - Why you should fear the big bad bear

- PART 3 - A retest of the March lows? The bears are kidding themselves

- PART 4 - Where to invest if you're a bull or a bear

3 contributors mentioned