Signal or Noise: "This is the biggest signal we're going to get"

Financial markets have rarely been more exciting than they are right now. And while equities get most of the attention, the real action is in global bonds.

The US 10-year yield is at its highest since April 2008. The Australian 3-year yield recently fell the most in a day since the Global Financial Crisis after the Reserve Bank of Australia shocked the world by hiking the cash rate by less than expected. Global bonds are having their fourth-worst year in more than 300 years of market records. And don't even start us on the rollercoaster for European-domiciled assets.

Then, there's this chart. The Merrill Lynch Option Volatility Estimate Index, known to professionals as MOVE, is the bond market's equivalent of the VIX. The index is used as a forward indicator for moves in interest rates as well as general volatility in the bond market. And if you thought the VIX is an amazing chart, then have I got news for you.

Check this out: The MOVE Index

By now, I'll bet you can guess what this month's episode of Livewire's Signal or Noise is about - the global bond market. This episode looks at where we've been and the implications for portfolio strategy and asset allocation.

Once again, I am joined by AMP senior economist Diana Mousina. This month, they are also joined by two veterans of the Australian bond market:

- John Likos, director at BondAdviser

- Jasmin Argyrou, head of fixed income and economics at Credit Suisse Wealth Management

The team tackles the following topics:

- The RBA's 25 basis point hike

- The Bank of England's extraordinary intervention

- Is the 60/40 portfolio in trouble given the global bond bear market?

THE debate

Topic 1: The RBA's 25 basis point hike - policy pivot or grave mistake?

Diana - SIGNAL - Diana (and Shane Oliver) were one of the few economists predicting the Reserve Bank would take a step down in its rate hiking path. She believes the pivot is going to stick because Australian households simply have too much debt. A 3%+ cash rate, in her view, would be enough to break the housing market and hence, the economy.

John - NOISE - John believes the move only puts the Reserve Bank further behind the curve, and certainly behind our global peers. There's nothing wrong, he argues, with a pause but a pivot means we take the slower route to where the terminal cash rate should be.

Jasmin - NOISE - Jasmin and her team believe the Reserve Bank's terminal cash rate should be around 3.35%. While she sympathises with Diana's concerns about household indebtedness, she can't help but think of how tight the labour market is.

Are Australian asset values going to find a floor as a result of this move?

Diana - It's difficult to say because global factors play such a large role in where and how Australian assets move. She argues that Australian equities will eventually outperform, but not before a rough period in the short term.

John - He argues a global recession will impact Australia in a significant way. If the pivot did place a floor, he thinks the floor will be "soft" and "easy to break through".

Jasmin - She shares part of Diana and John's view, arguing global factors will play too much of a role in where Australian asset values go. Unless inflation surprises in the best way possible, it might be difficult to see this land sticking.

Topic 2: The UK economy's confidence crisis

John - SIGNAL - This is the biggest signal of the show, in John's opinion. He believes the UK's confidence crisis demonstrates how fragile the global financial system's infrastructure is in the post-COVID era.

Jasmin - SIGNAL - The UK has the unenviable position of being in a fiscal and current account deficit (watch the video for a quick rundown of what those two things mean). She argues the "twin deficit" problem, compounded by higher borrowing costs, will leave the Bank of England no choice but to hike rates even higher than where they want them to be.

Diana - NOISE - The situation will eventually be resolved. But Diana's view of the Bank of England is similar to her thoughts on the Reserve Bank - the endgame will not be nearly as high as markets fear.

Topic 3: The global government bond bear market

Jasmin - NOISE - First things first, don't set and forget your portfolio. She argues that bonds will, over the medium to long term, come back into vogue and provide the hedge it has generally provided in the past. For now, it's a strong income source in a world where TINA (there is no alternative) has effectively retired.

Diana - SIGNAL - Bond yields can still go up in the short term, but the medium term will prove why bonds have their place in a portfolio.

John - NOISE - Firstly, is a 60/40 portfolio relevant anymore? After echoing Jasmin's words on being nimble, John argues bonds have proven to be resilient. In particular, look for floating rate notes which provide a safe place to hide. (For his full definition on "bonds" versus "duration", watch the video.)

THE charts to watch

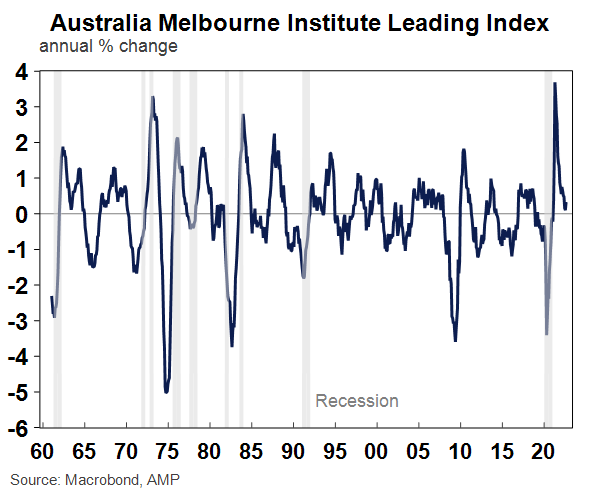

Diana's Chart: The Westpac/Melbourne Institute Leading Index

How do you reconcile extremely strong economic data and depressing consumer confidence? The answer is this chart - the Westpac/Melbourne Institute Leading Index. While it's not at recessionary levels yet, that might change if the cash rate goes too high.

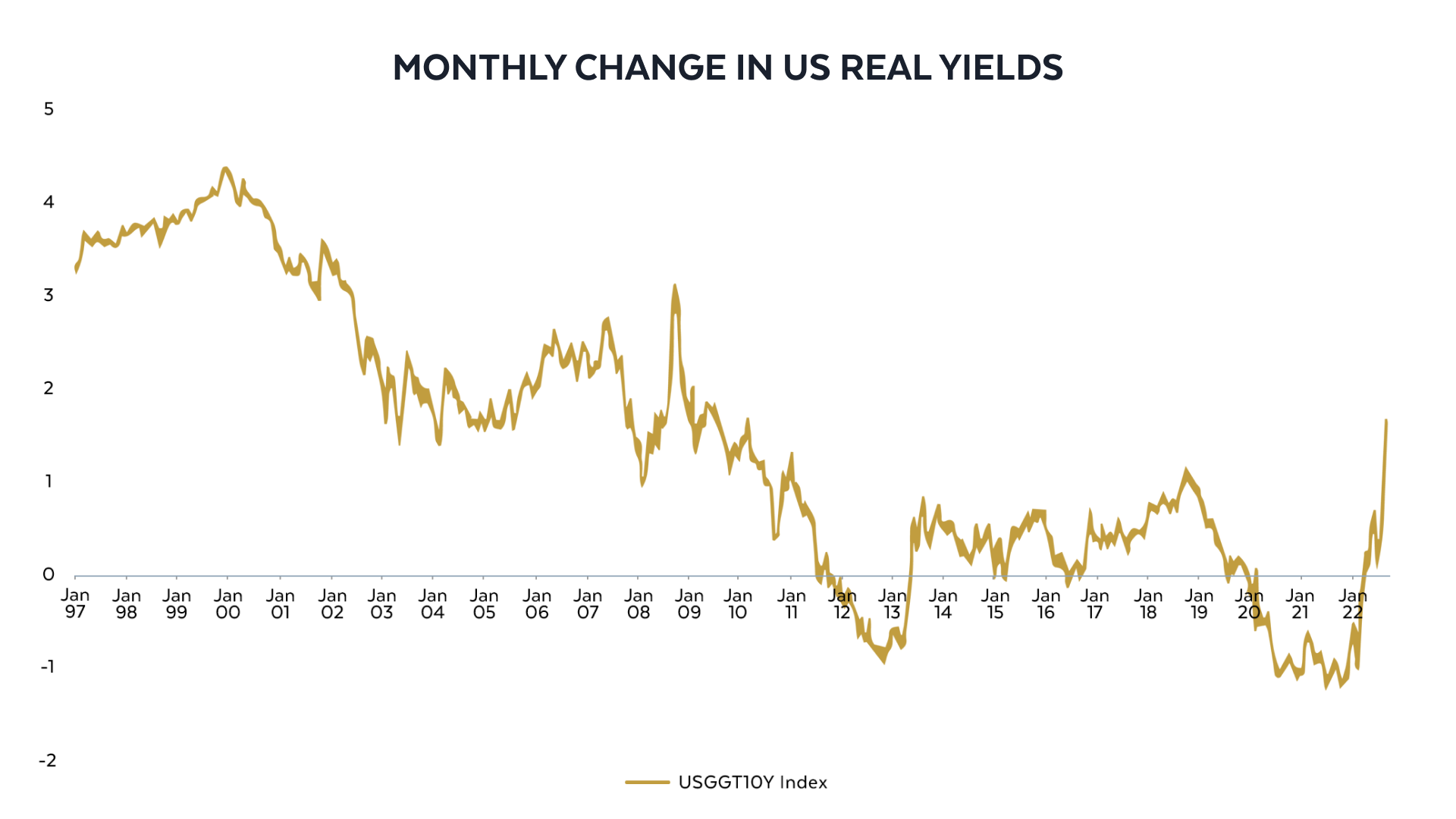

John's Chart: US 10-year real yields

Real yields are closely watched by professionals, and John argues that the return to positive real yields for the first time since the COVID-19 crash is a significant move. John says it means that makes bonds look more attractive - and it revises all the other potential asset classes' valuations in turn.

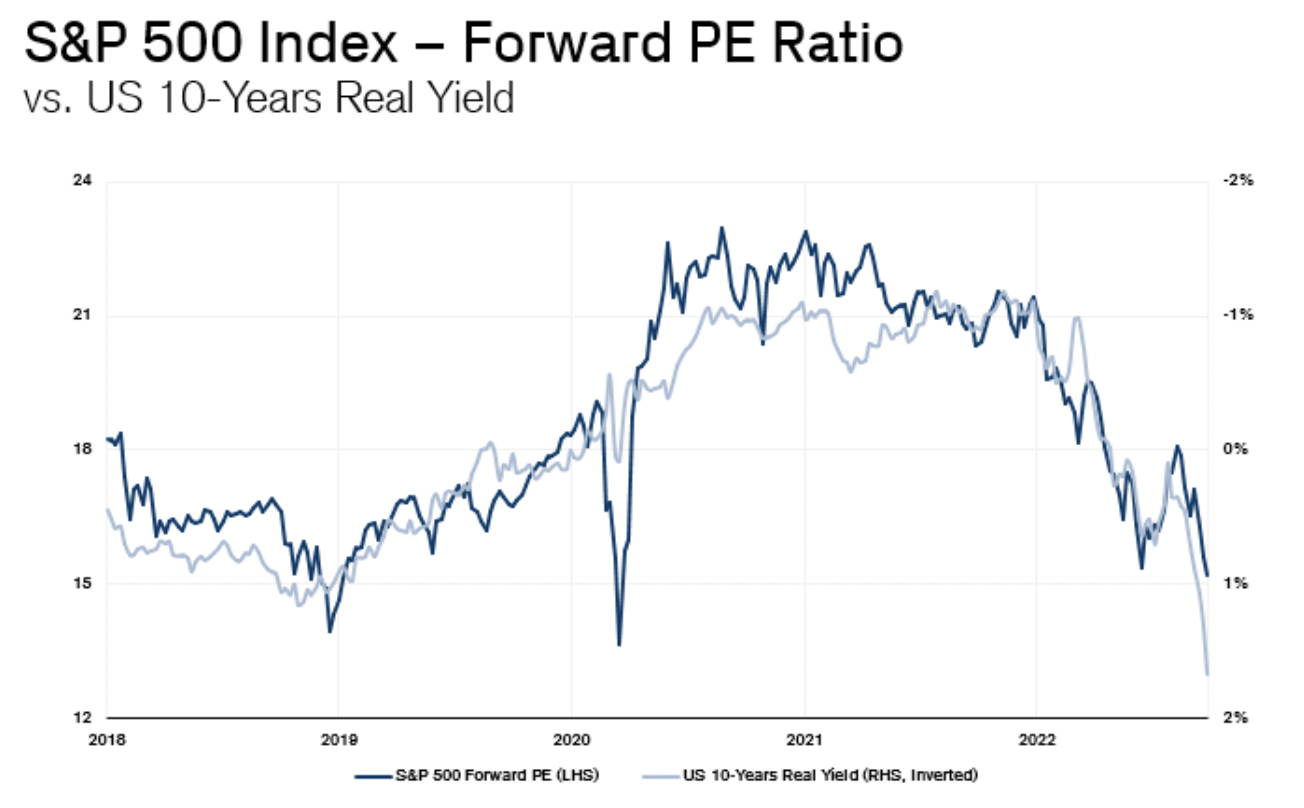

Jasmin's Chart: US real yields vs S&P 500 forward earnings

Credit Suisse has an underweight recommendation in global equities, and this chart explains why. Jasmin says the chart shows the correction in real yields hasn't translated to equity valuations just yet. In general, Jasmin says, equity markets are unattractive at the moment and this chart is part of the reason.

Enjoying Signal or Noise?

Give this wire a like if you've enjoyed the discussion and hit follow to be notified when new episodes are released.

If you're not an existing Livewire subscriber, you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

2 topics

3 contributors mentioned