Smart (or not) Parking?

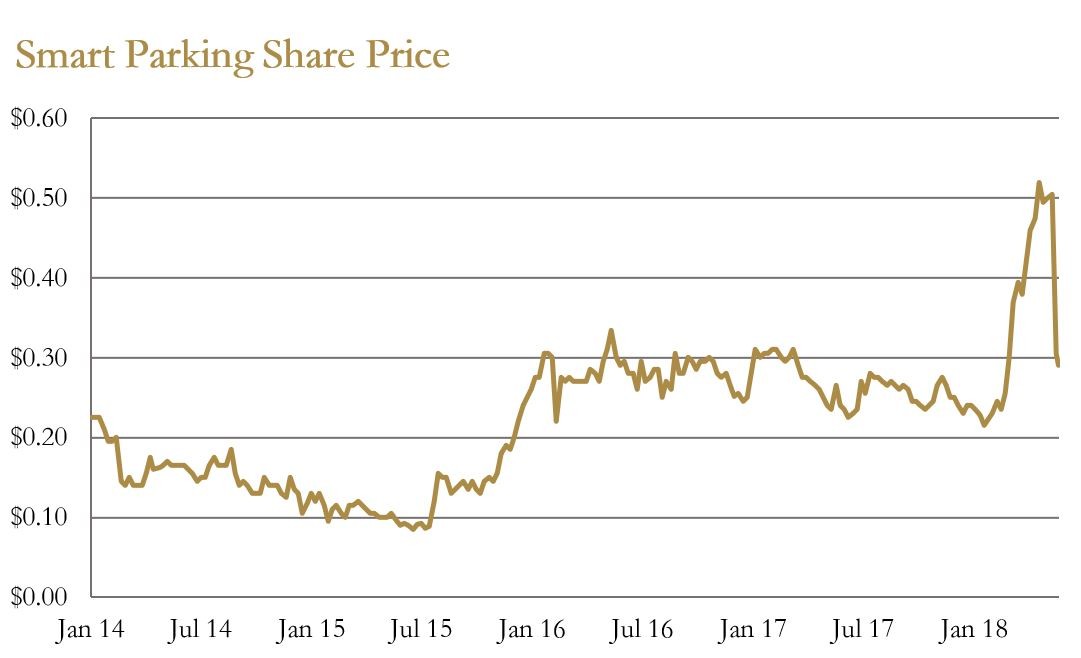

The Australian Shares Fund used to hold parking services provider Smart Parking (SPZ). We invested via a $0.15 per share capital raising in February 2014. Since then the company’s UK parking lot management business has lurched from crisis to crisis and the sexy technology business remained loss making. It was a frustrating journey.

After four years we sold at about $0.25, with the last of our holding disposed of in January this year. That isn’t the worst investment we will make. But it didn’t feel great when the share price traded above $0.50 three months later.

Today the stock price is back at less than $0.30, thanks to a short announcement released last week. Clearly shocking to newer investors, announcements like this were a somewhat regular feature of the past four years.

Infringing below expectations

So what went wrong? The number of parking infringement notices will be “impacted by 25%” this quarter. This is a great example of a poorly worded announcement. Management later confirmed they still expect to issue 10% more notices than last year, just 25% less than they had expected. The reasons given on the call were not comforting – poor weather in the UK (ever heard of that one before?), unpowered cameras and client caused delays.

More alarmingly in the short term, local management in the UK parking management business was dismissed. Management was spending a little too long at lunch and putting it all on the company card. They were also telling head office that things were better than they were. Thankfully this seems limited to progress on installations and not financial results.

But this is the same management team that a few years ago was seen as fundamental to turning the UK business around. The head of the UK business, Ben Johnson, was paid more in cash than Smart’s managing director last year.

The bull case

Before we explain our scepticism, it is worth understanding what the bulls are excited about.

Many UK parking lots generate revenue by fining vehicles that overstay their welcome. Due to the manual nature of existing systems, the percentage of infringers who were fined was low.

Enter Smart Parking with a simple formula. Find a willing parking lot owner, agree a commercial arrangement and spend £15,000 on cameras and other equipment to fit the site out. With the new technology you can fine 100% of overstayers and collect £72,000 in revenue per year from each lot. Pay some costs and keep £50,000 per year. Easy.

Smart claims it can add 15 sites per month to its existing portfolio. That’s $9m of incremental earnings per year. An estimated 40,000 potential sites in the UK implies a very long runway. Even at the $180m market cap implied by a $0.50 share price this sounds good, right?

Too good to be true

Yes. Too good. Getting your investment back in four months is not normal. And it especially isn’t normal in a competitive market. There are companies willing to do this work at much lower returns on their investment. And they have.

Smart will be issuing the same number of infringements this quarter as they were issuing almost two years ago. Two large clients made up half the infringements back then. They are gone.

Car park users are also not stupid, and getting fined 100% of the time isn’t fun. It is perfectly logical to expect an initial explosion in infringement notices to be followed by an explosion in compliance rates. Could this be an explanation for those sub-expectation infringements notices?

The technology option

And then there’s the technology business. It supplies software and street hardware that allows councils to monitor occupied parking spaces. The past 12 months has seen announcements of new contracts with Hamilton, Cardiff and Hobart councils and a preferred supplier agreement with Telstra (TLS).

In theory it allows drivers to find available parking and pay for it on their smartphones. Anyone who has driven around Bondi for an hour looking for a park will know why that sounds sexy to investors. The only problem is that it sounded sexy back in 2013 too. In the month of October 2013 alone, Smart announced deals with Westminster, Rotorua and Bondi’s Waverley council. You can check the financials for yourself. Let’s just say it didn’t amount to much.

Hopeful for success

CEO Paul Gillespie and CFO Richard Ludbrook have worked tirelessly to resurrect this business. Computershare (CPU) founder Chris Morris is chairman, owns 31% of the company and has been generous to his fellow shareholders (anyone looking to structure a minority friendly capital raising, go back and look at how Smart Parking did it in 2014). We genuinely hope to see this business deliver on its promise.

Hope is not, unfortunately, a key ingredient for investment success. Its history suggests this is a a very challenging business and we will be cheering them on without our client’s money on the line.

Further insights

If you are interested in receiving the Forager monthly and quarterly reports, please register here.

1 stock mentioned

.jpg)

.jpg)