Spectre of rising inflation and higher interest rates puts private debt in the limelight

The distinct advantages of private debt — such as floating interest rates with downside protection — must look appealing to investors seeking safe and stable income streams in a world wary of inflation and central bank intervention.

Traditional low-risk income classes continue to disappoint and investors must take shelter elsewhere.

This is the first of three Q&As on private debt, an increasingly popular option for income investors. In this wire I talk to Lucie Bielczykova, associate portfolio manager, Revolution Asset Management.

Bielczykova explains the challenges for investors in traditional income assets, and outlines the various forms of private debt and the associated risk spectrum, with reference to noted Australian companies including Arnott's Biscuits, MYOB and Healthscope.

She outlines the three key factors that drive returns in fixed income assets — term, credit quality and liquidity — and how private debt managers think about them, and discusses the pipeline of opportunities at Revolution, including mergers and acquisitions, and a developing form of incentivised debt linked to sustainability outcomes.

Keep an eye out for the next two parts in this series, where I talk to key people from Metrics Credit Partners and Qualitas.

Is all private debt the same? We often hear how diverse the global equities universe is, and we also hear a little about diversity of global credit — but what about private debt?

The private debt universe is large, spanning many forms of corporate and consumer credit.

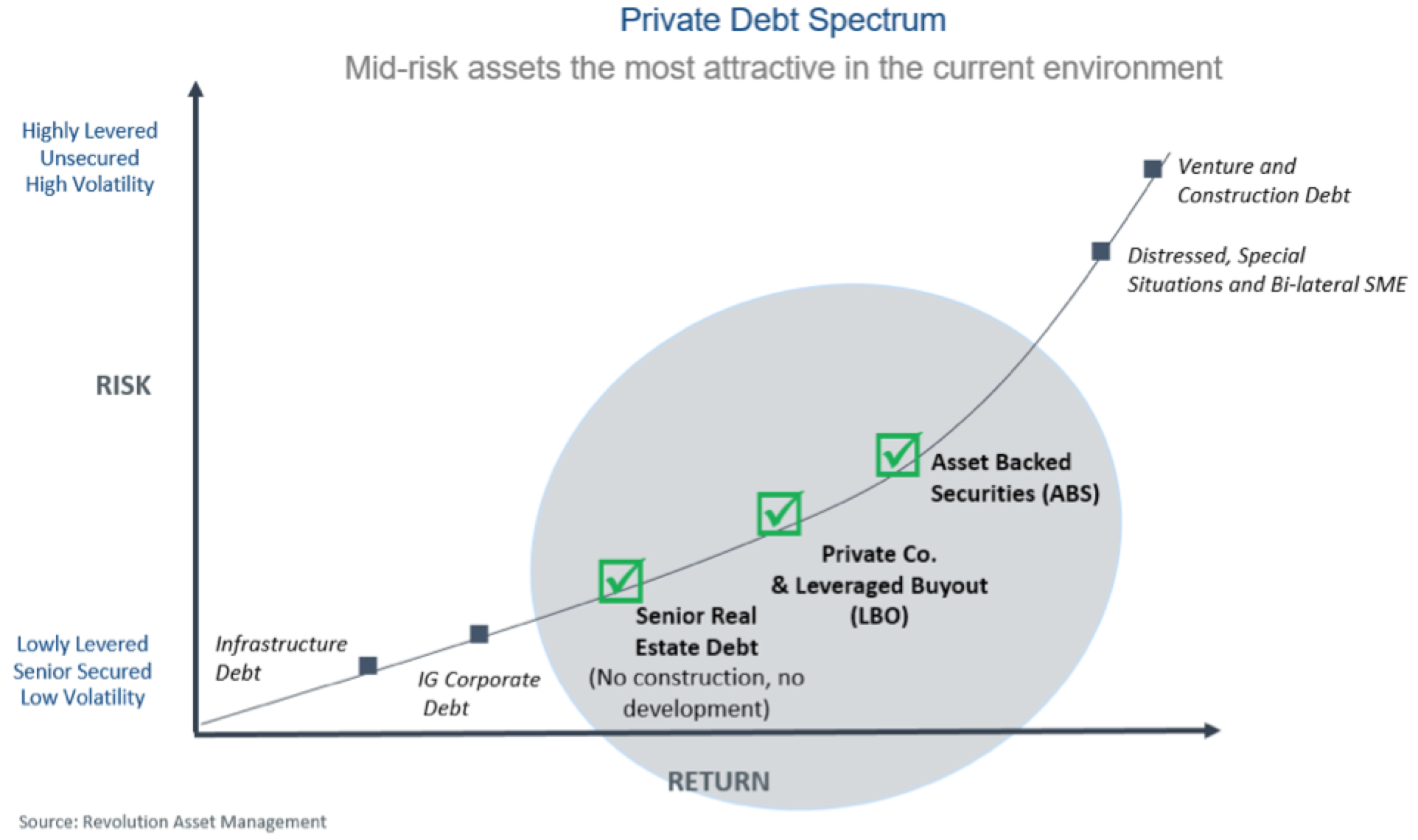

There are many pockets of the market, ranging from infrastructure debt, with a very low risk and return profile, all the way through to very high risk distressed debt, bilateral loans, to small to medium sized businesses, venture capital funding, and construction debt.

On the lower-risk side of the spectrum, lenders provide first-in-line senior secured loans to core infrastructure assets, cash-flow producing commercial property, or market leading companies. Examples include Arnott's Biscuits, found in 95% of Australian households; MYOB, a leading accounting software provider; and Healthscope, Australia's second-largest private hospital operator.

On the higher-risk side of the spectrum, lenders may finance a local small business that shuts its doors when the owner goes on holidays; companies that are, or are about to go bankrupt or are restructuring; loss-making early stage venture-capital companies, which have a much larger chance of failing than surviving; or a thinly capitalised property developer relying on the property market to keep going up.

None of these lending scenarios is better or worse — they are just very different propositions from a risk and return perspective, and play completely different roles in an investor’s portfolio.

In Revolution Asset Management's view, the most attractive sub-sectors of Australian and New Zealand private debt markets at present are in the middle of the risk spectrum.

These include private company and leveraged buyout funding, and private and public asset-backed securities.

Revolution's strategy in these parts of the market is to target defensive cash-producing assets that can provide investors with capital protection and the potential for a stable income stream when executed with strong credit discipline. Investors are starved of this in the current environment.

How are you able to focus on floating rate, and why is this the place investors want to be right now?

In the current low interest rate environment, the outlook for traditional fixed income assets is negative. Investors face multiple challenges:

- Low absolute yields

- The risk of rising inflation and interest rates around the world, including domestically

- Increased volatility in public markets.

Traditional fixed income assets have historically played the defensive role in portfolios, providing yield, diversification and capital protection. They relied on interest duration to generate returns, which provided strong tailwinds to these assets when interest rates were low and falling.

The prolonged period of falling interest rates has brought us to a point where these traditional assets are now earning negative yields after inflation. As the risk of inflation rises, these yields may become even worse.

So the traditional assets that investors relied upon for defence, income and capital protection are no longer providing these benefits. They are actually losing value in real terms as a starting point.

The outlook is even worse when you think about the path from here, because in an environment of rising rates and inflation, these traditional assets are also set to incur capital losses as interest rates increase and duration asset values fall.

As such, investors need to be increasingly mindful of their exposure to this risk, because what their portfolios benefited from historically is set to hurt performance in the period ahead. And this is where floating rate assets such as private debt can help.

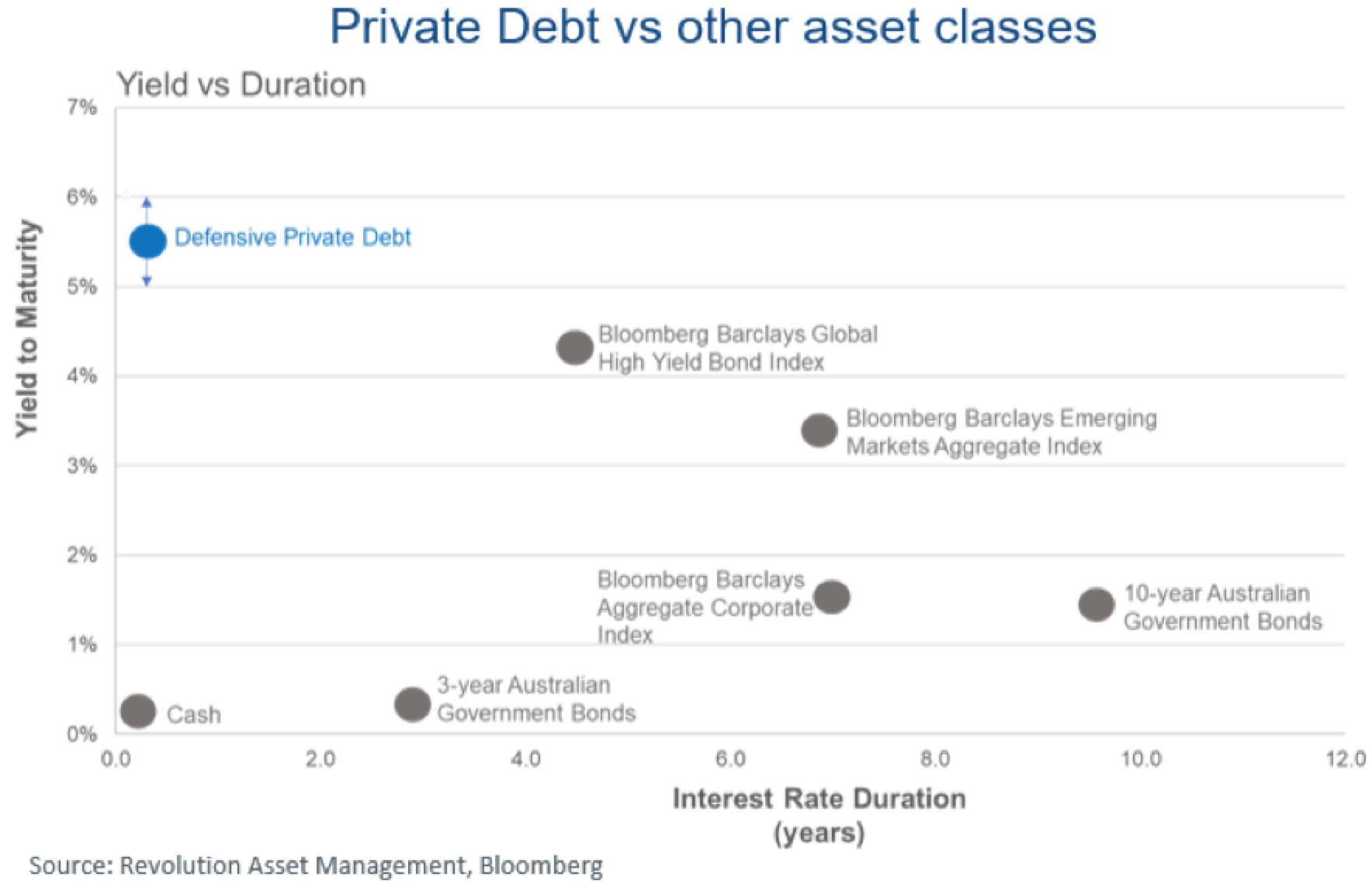

Private debt is well suited to investors seeking that defensive allocation with capital preservation and stable income. The characteristics of floating rates are among the key reasons for the attention being paid to private debt recently.

When compared to traditional fixed income, floating rate assets have an embedded protection against inflation and changes in interest rates. The yield of floating rate assets is anchored to short-term interest rates.

Therefore, should interest rates rise, the cash yield on private debt assets will also increase without any impact on capital, as opposed to traditional fixed rate bonds, which incur capital losses when interest rates increase.

The asset class has other advantages, including attractive yield, low volatility, capital protection, and structural protections through seniority and security — and in some cases protective covenants.

Combined, these factors form a compelling reason for investors to consider allocations to defensive Australian and New Zealand private debt.

What are some of the pros and cons of floating rate assets like yours versus the other big areas of credit markets: corporate bonds and sovereign bonds?

When compared to the traditional areas of the fixed income market, such as government or corporate bonds, one of the key advantages of floating rate assets such as private debt is that investors don't take any interest rate risk, also known as duration, to generate returns.

Whereas traditional assets would have benefited historically from falling rates, duration has the opposite effect in a rising rate environment.

Floating rate assets such as private debt, on the other hand, don't suffer capital losses when interest rates rise and instead participate in any increase in interest rates.

Most private debt assets also have embedded rate floors, which is a key advantage over other floating rate assets.

This means private debt investors are protected if central banks take rates to negative, because the anchor rate stays at or above zero, effectively increasing the margin earned.

Overall, this results in private debt maintaining its yield through the economic cycle. This is why we refer to private debt as an all-weather asset class that offers attractive defensive yield with capital protection, diversification benefits, low volatility and structural protection.

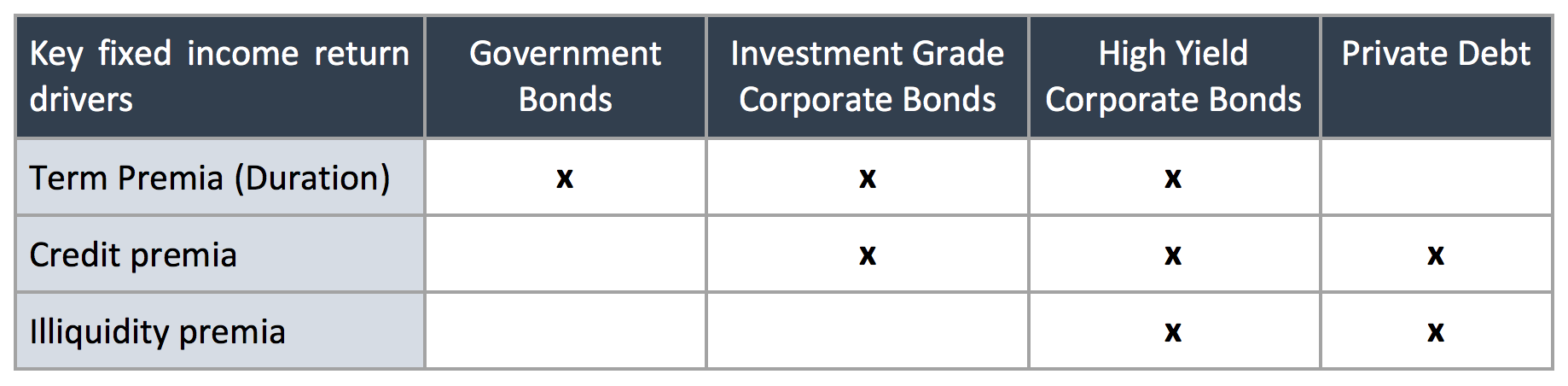

Generally, there are three key drivers of returns in fixed income assets:

- Term premia (interest rate risk, duration)

- Credit premia (credit quality, risk of default)

- Illiquidity premia (ability to buy and sell without penalty over the life of the asset/prior to maturity).

Traditionally, investors would increase risk by going down in credit quality or extend duration with inherent interest rate risk to earn yield above risk-free assets.

Assets with high credit quality, such as government bonds and investment grade corporate bonds, are typically highly liquid in a normal market environment, although liquidity can decrease in periods of market volatility.

Private credit targets high quality floating rate credit assets with structural protections through seniority, security and covenants, and utilises the liquidity lever to earn additional yield.

Liquidity seems to be a keyword when you’re talking about any type of fixed income asset. Given you’re in the real estate space especially, how liquid are the debt assets of property, including asset backed securities and leveraged buyouts?

Some investors view illiquidity as an impediment, while others view it as an opportunity to earn additional yield.

The ability to earn higher yield is a trade-off between the three key fixed income return drivers mentioned above.

Private debt utilises the liquidity lever to earn a premium. Therefore, defensive private debt is well suited to investors focused on capital preservation who are willing to give up some liquidity.

As such, private debt is an illiquid asset class, although liquidity within the sector varies according to the underlying asset.

Infrastructure debt, for example, is very long term, whereas corporate leveraged buyout debt and asset backed securities are typically much shorter term.

A typical leveraged buyout might have a 5-7 year loan term, but in practice these loans get repaid or refinanced much earlier — typically within three years.

Accordingly, the expected life of these assets is around that mark, and well-diversified portfolios will have an even shorter expected average life.

Some liquidity exists, but private debt strategies should be thought of as illiquid allocations.

In that way they are similar to strategies of private equity, where it is generally understood that investments cannot be bought and sold. With publicly listed Australian or global equities, however, holdings can be readily traded.

The same principle applies in the fixed income world when considering private debt versus government or investment grade corporate bonds.

What’s the most recent credit deal you were involved in and are there any similar-sized activities ahead?

Revolution's focus is on leveraged buyout funding, private and public asset-backed securities, and stable commercial real estate assets. We do not fund construction or development.

There has been a lot of activity in both leveraged buyout and asset backed securities markets recently, and Revolution has a strong pipeline of private debt assets.

There has been a boom in mergers and acquisitions in Australia. M&A activity in 2020-21 was about triple the level of 2020 and 40% higher than the five-year average.

These mergers and acquisitions are typically equally funded by debt and equity, so every private equity dollar deployed in the market requires around the same amount of private debt funding.

This strong activity is expected to continue into 2022 as Australia's borders reopen, and international bidders are expected to join the party.

Additionally, large local superannuation funds have become active in domestic M&A, adding large amounts of capital.

For these reasons, we expect the market to remain strong into 2022.

Similar levels of activity have been seen in other pockets of the market. Domestic funding of warehouses via asset backed securities has been booming as well. Revolution is one of the biggest mezzanine funders in this market.

We have also seen similar activity levels in the sustainable debt market locally. Australian and New Zealand ESG debt issuance increased two-fold in volume in the 2021 year to date compared to last year, driven mainly by sustainability linked loans. These loans have ESG-linked key performance indicators built into them.

Revolution recently participated in a loan which has a two-way margin adjustment linked to sustainability KPIs. If the company meets its sustainability targets, nothing happens. If it exceeds the targets, it is rewarded with a lower interest rate (the margin is adjusted downwards).

On the other hand, if the company fails to meet its targets, it is punished with a higher interest rate.

In our view, transactions that incorporate ESG initiatives will account for a larger part of the booming loan market in the period ahead, as investors turn their attention to environmental and social issues.

Learn more

Revolution Asset Management (Revolution) is a specialist investment manager established to provide institutional, wholesale and professional investors with access to the Australian and New Zealand private debt market. For further information, please visit their website.

4 topics

3 contributors mentioned