Sprint-start…slowing to a jog

A relaxation of lockdowns and substantial support from policymakers have elicited an impressive and co-ordinated rebound across global economies. But, while this has pushed our short-term forecasts higher, we’re not convinced it heralds a V-shaped recovery. Rather, we expect the pace of growth to slow through the second half of 2020, with the crisis still set to deliver sizeable permanent damage to economies over the long term. Moreover, country-level performance gaps are opening up, reflecting the relative success of policymakers in containing Covid-19 outbreaks.

Based on the latest data, our tracking estimate now shows a 23% collapse in global GDP growth in annualised terms over the first half of 2020, slightly better than we had expected in June. Moreover, the initial rebound seems to be impressive, stoking optimism for a rapid V-shaped recovery.

We’re more pessimistic. First, Covid-19 is likely to continue disrupting activity, especially in those countries still battling to contain the virus. Second, the crisis has wreaked severe damage on balance sheets, labour markets, confidence and investment. Third, a fading fiscal impetus in many markets also suggests the harder miles might lie ahead.

US – too hasty?

The US moved quickly to reopen its economy in May, prompting a swifter-than-expected rebound in growth. However, this has come at the cost of surging new infections in many states, prompting several of them to reverse their reopening, and making consumers more cautious in these hotspots. Consequently, we have materially revised down our growth expectations to show a sharp slowdown through the summer.

Emerging markets – still battling

Many emerging market (EM) countries are also struggling to contain the pandemic. Not just Brazil, but large swathes of Latin America report rising levels of infection, as do India and South Africa. These worrying trends are disrupting domestic activity, leaving growth quagmired. Improving global trade should provide some relief to these more export-sensitive economies. However, on its own, it’s unlikely to be strong enough to deliver a V-shaped recovery.

Europe and Japan - a measured approach

Japan and Europe have had greater success in avoiding a second Covid-19 wave, through a combination of effective virus suppression, stronger test-and-trace regimes and careful reopening. Their more measured easing of restrictions has allowed their economies to rebound without the same public health consequences. This has prompted us to upgrade our short-term growth forecasts for these regions. However, we don’t expect these initial growth spurts to maintain the same pace. Lockdown policies cannot be fully reversed, while households and corporates are likely to remain cautious, especially given their weakened finances.

China – efficient response

Recent news from China has exceeded expectations. Along with some other East Asian countries, it has shown the benefits of effective virus management, particularly around testing and tracing. Official Chinese growth figures certainly look V-shaped. There are, however, questions over the plausibility of these estimates. Our in-house activity tracker suggests the official data is overstated. And, even if it’s correct, there are still reasons to expect some long-lasting damage to growth.

Our global forecasts

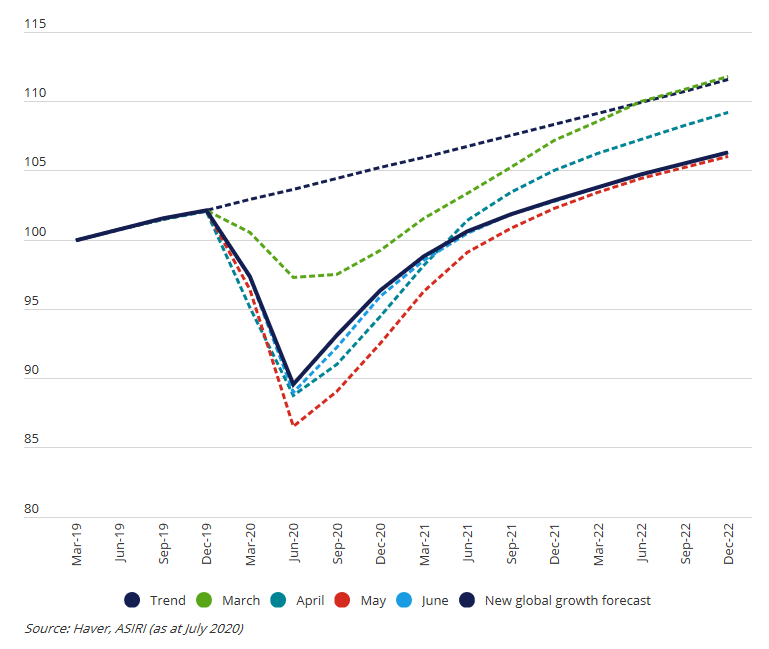

Bringing these strands together, we have modestly raised our 2020 global growth predictions to -6.9% year-on-year, from -7.4% in June. However, we haven’t extrapolated the robust short-term trends into a V-shaped recovery. Instead, we expect the global rebound to moderate over coming months, only regaining its pre-Covid peak in the second half of 2021. Worse, we continue to factor in some long-term scarring to the global economy. This means activity will never fully catch up with the trend-path expected before the crisis struck.

Chart 1: Our global growth projections: still not expecting a ‘V’-shaped recovery

Regional differences widening out

Cross-regional disparities are becoming increasingly evident. Economies that are successfully suppressing the virus and carefully relaxing lockdown measures look better-placed to enjoy a slow but steady recovery. Those unable or unwilling to take these steps are in for a bumpier ride. Therefore, the global growth picture will become far less synchronised, potentially creating opportunities among relative winners and losers.

The global growth picture will become far less synchronised, potentially creating opportunities among relative winners and losers.

Low inflation, low interest rates to continue

We have seen a sharp slowdown in inflation rates on account of lower energy prices and weaker core price growth. Inflation is expected to remain sluggish over coming years, reflecting the significant labour market damage done through this crisis. Meanwhile, central banks seem in no rush to raise interest rates, and many are poised to offer further support through additional asset purchases and credit easing. A probable exception is China, where the rapid recovery in official data and renewed focus on financial stability might temper monetary stimulus.

Uncertainty around our forecasts

The risks to our forecasts currently look balanced. Alarming Covid trends in some countries underline the risk of a second wave of infections. On the positive side, it’s possible the recent upswing in activity could continue to beat expectations. Moreover, there has been encouraging progress in the search for a Covid vaccine. An effective vaccine that can be rapidly approved, manufactured and distributed would do the most to transform our forecasts – both in terms of pace of recovery and long-term damage.

Written by James McCann, Senior Global Economist, Aberdeen Standard Investments

Never miss an insight

Keep up to date with Aberdeen Standards latest thinking by hitting the follow button below.

4 topics

.png)

.png)