Structural dividend changes in the Australian stock market

Today, the ASX trades on a cash dividend yield of just 3.3%, which is close to historical record lows. With income scarce, market participants are reacting strongly to dividend announcements. Companies paying more than expected are rewarded, while those paying less are heavily sold off.

The structural change: from buybacks to special dividends

Until October 2022, companies often returned excess franking credits via off-market buybacks. These were highly efficient for pension and superannuation phase investors (on 0% and 15% tax rates) and participation decisions could be made after the buyback was announced, enabling investors to lock in both franked income and positive total returns.

This changed in October 2022, when off-market buybacks were banned. The ban has created a structural shift in how companies distribute surplus capital.

In the new environment:

- Off-market buybacks have largely been replaced by special dividends

- To benefit from special dividends, investors must be positioned ahead of the announcement

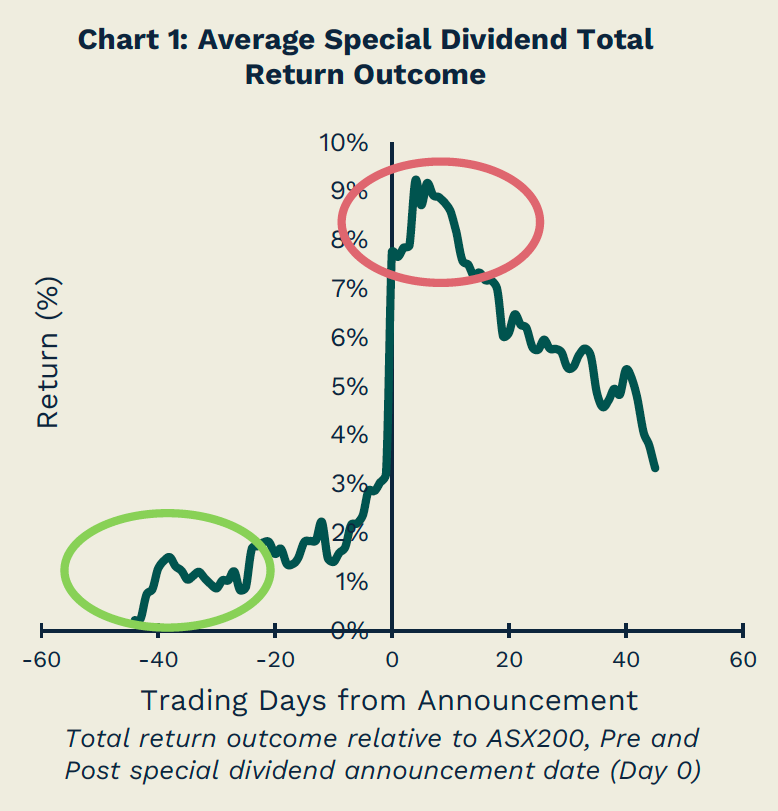

- Buying after an announcement is risky (as outlined in Chart 1, of the 24 special dividends paid by companies since the ban, stocks purchased post-announcement have underperformed the market over the following 45 trading days by an average of over 4%)

Source: Bloomberg, Iress, Solaris. Basket of 24 special dividends announced from October 2022 through to 31 July 2025. Total return includes franking, cash dividend, capital performance relative to ASX200 Franking Credit Adjusted Total Return Index. Fees and trading costs are not taken into account. Past performance not reliably indicative of future performance.

A competitive advantage

This forward-looking approach enables:

- Assessment of both the ability and willingness of companies to declare special dividends

- Investment in the “green zone” of Chart 1 (above) - often 40+ days before announcements - capturing the income, franking, and capital growth benefits.

- Avoiding the “red zone” of Chart 1 - where reactive investors buy after announcements and typically suffer underperformance

Since October 2022, the Solaris Australian Equity Income Fund has been positioned ahead of an array of special dividend announcements, supporting income generation as well as capital growth - a clear demonstration of its forecasting ability and disciplined process.

This proactive approach is a competitive advantage compared with reactive income strategies.

Why this approach is attractive for Australian income investors

Our strategy is designed for tax-aware investors with a dual objective of generating quarterly income (including franking) and capital growth.

It focuses on both:

- Income generation

- Capital growth (focused on growing portfolio values into future periods supporting future income steams over 5 and 10-year horizons)

While the equity market is volatile, dividend income from Australian shares has historically outpaced inflation and provided investors with significant income as well as franking benefits.

A forward-looking framework is required for this to continue into the future.

The dividend landscape in Australia has structurally changed: off-market buybacks are gone, and special dividends now dominate the capital management plans of listed companies.

Investors must be positioned ahead of announcements; buying afterwards may generate income but is likely to erode capital and returns.

Out team at Solaris has a competitive advantage: its forecasting framework and experienced team have positioned the fund ahead of a significant number of the special dividends since 2022.

Solaris’ focus is on income generation and long-term growth: rather than “selling the farm” to generate income. Income-seeking investors need to allocate capital to productive companies to grow the “farm’s yield” for years to come.

3 topics