Sunset Strip > Trading Day Wrap From Blue Ocean 20170811

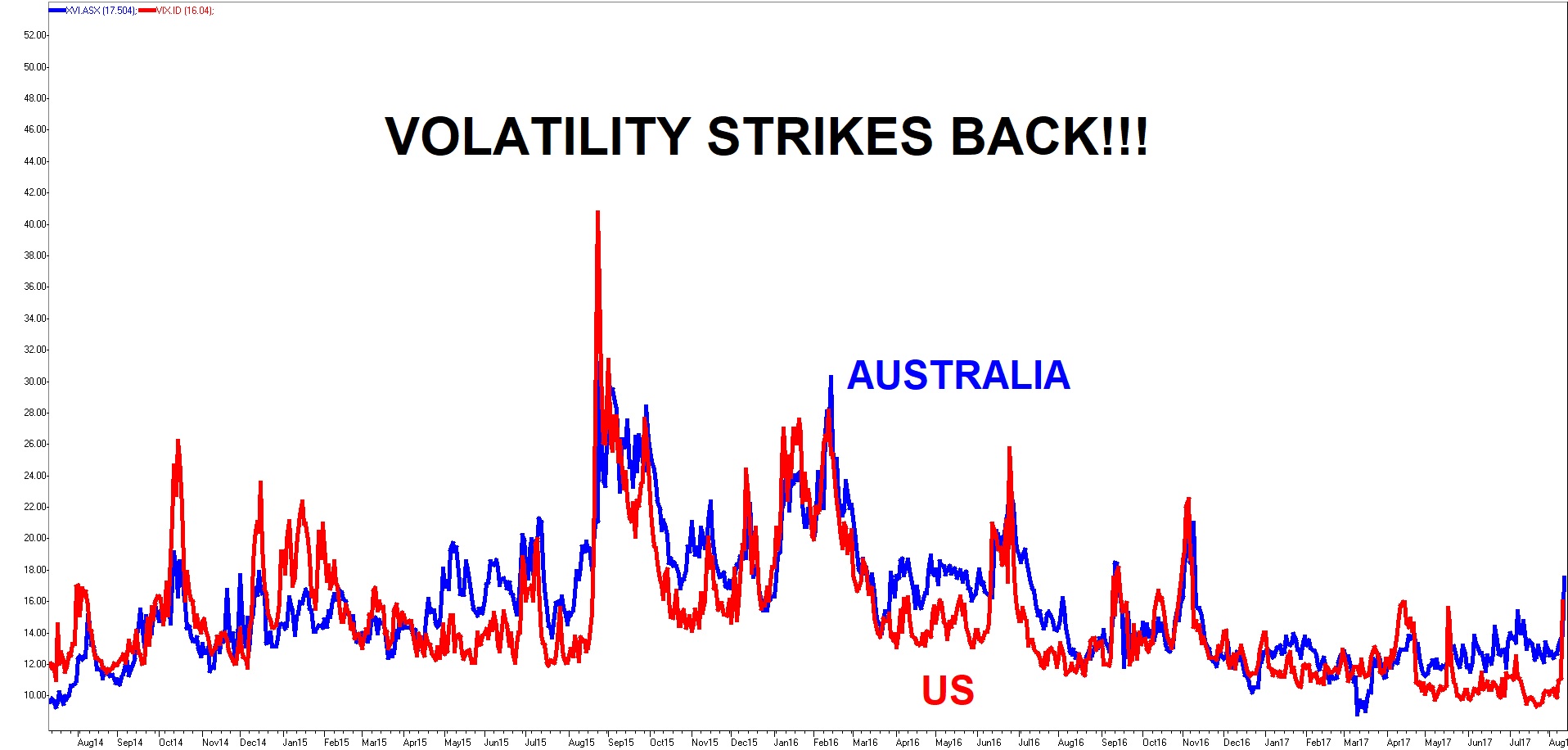

Local market was smacked down from the open on geopolitical risk…even the slight recovery after the morning fall withered away in the afternoon. DOW down over 200 and NASDAQ was snapped 2%. Safe haven investing was in play as bonds and gold bounced while equities were on the chopping block. VIX bounced 45% in the US…but still below Cuban missile crisis level (i.e. 25% higher). Historical trends point to more downside risk for market and upside risk for VIX. The data overall was pointing to a US market driven profit taking in August and we were alerting investors to prepare for the past week. We continue to see this as a short term pullback and a buying opportunity in a week. RBA updated the market that wage growth will remain weak and the next rate movement will be higher…and they have hope for strategy and will remain MIA for a while. Summary of US/NK fake war > US can’t attack NK unless they attack first. NK will not attack as they will be destroyed. NK leadership will collapse faster than Iraq under any attack but China will not allow US to take control of NK…void if NK attacks first. The only option left for US is to create a fake war and threaten to invade and hope for a deal. The only problem with this strategy is that “Arguing publically with unhinged leaders have never worked. They will pull you down to their level and beat you with experience”. Trump is dealing with someone who can play unhinged even better than he can. So...let the games begin. Australia has played its part in legitimizing the fake war and expect a few more leaders to do the same. But while China is around…without an attack by NK, US will not be changing NK leadership anytime soon!!! Russia/Syria deal all over again…nothing to see here. But markets will ramp up scare factor and move past by the end of next week. The best performing sectors were Gold, Utilities and Staple while the worst performers were Retail, Metals & Mining and IT. On the sector/stock front….(1) CBA looks like ACCC wants to dance and it’s not taking no for an answer…more pressure on CEO (2) VTG bounced hard on TLS agreement extension (3) WGX, BDR and GOR bounced on the spot gold movement higher (4) ACX bounces on short covering driven by result optimism (5) RCR continues to win more work as sector turns positive…one of our preferred sector and preferred stock picks (6) BBN ran into more bashing as the store rollout growth story experiences like for like store sale decline (7) LYC ran into profit taking with market after recent outperformance (8) SIG delivers a similar downgrade to API and gets the same treatment (9) AAC was smacked on management change driving uncertainty (10) REA result with write downs underwhelms the market.

Click here for the full report.

9 topics

13 stocks mentioned