Tariffs, policy, and valuations

Tariff trouble

First is the policy outlook. The decision by President Donald Trump to delay many of his tariffs suggests there is some form of ‘policy put’, triggered by adverse market moves. Bilateral deals would avert the worst of a trade war and be positive for investor sentiment. As important is less pressure on the Federal Reserve – it’s close to meeting its mandates of low unemployment and stable prices; investors will want to know it can do its job without prejudice. But valuations may need to adjust given the US equity risk premium remains much lower than in other markets. Finally, investors should take encouragement from history which suggests initial corrections of 10% or more have been followed by positive one-year returns, most of the time. The US is not cheap yet but investors should see positive performance given a sufficiently long holding period.

European Bonds: Much ado about nothing

There is currently a rather wide gap between perception and reality. Investment research conveys the impression that we’re in the middle of market turbulence. While this might be the case for a few specific asset classes, European fixed income markets tell a different story, at least gauged by their performance. Year-to-date, European government, corporate and high yield bond returns are all slightly positive and within a 0.3%-1.0% range. Despite the European Central Bank’s three rate cuts in 2025 to date and a further 65 basis points in cuts priced in by year-end, Germany’s March fiscal shock to European government bond markets has somewhat watered down broad fixed income performance. Looking ahead, investors are likely to consider the possible increase in government bond issuance alongside improved valuations, particularly in the credit space. For example, European high yield spreads have retraced almost 50% of the widening occurred between early March and early April, while still trading above their 2024 average.

A pivotal time

Japan's economic transformation has been notable. At a macro level, its 2024 exit from negative interest rates and a positive wage-price cycle has been in the making for over 30 years. Its interest rate differential and weaker yen has boosted the attractiveness of exports. At the micro level, companies have achieved a remarkable turnaround, increasingly casting aside former well-established practices of no wage hikes and no price increases. Corporates are becoming more productive and profit oriented. Additionally, Japan's focus on sectors like robotics, automotive, and green technology has contributed to increased foreign allocations. Government encouragement for households to shift more savings into equities has equally played a role. The external environment has also been favourable, with global growth staying resilient. Looking ahead policymakers face a fine balancing act of maintaining a favourable gap between rates and growth, while confronted with weaker global growth, tariff uncertainty and a strengthening currency. That said, minding the immediate volatility, Japan’s renaissance represents a longer-term fundamental shift.

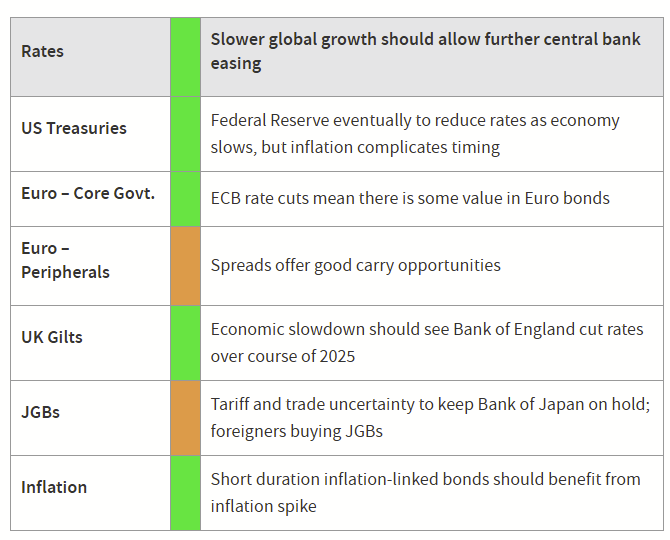

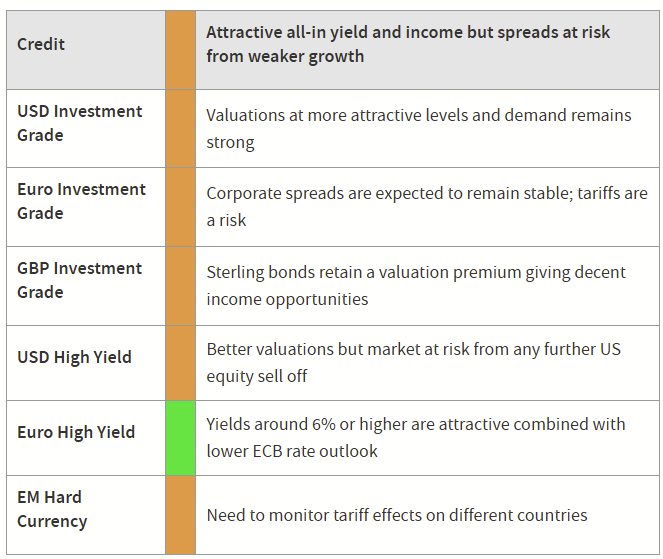

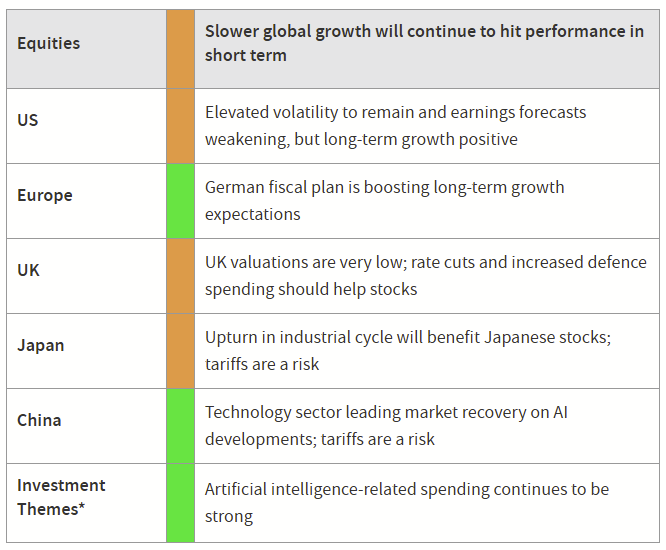

Asset Class Summary Views

Views expressed reflect CIO team expectations on asset class returns and risks. Traffic lights indicate expected return over a three-to-six-month period relative to long-term observed trends.

CIO team opinions draw on AXA IM Macro Research and AXA IM investment team views and are not intended as asset allocation advice.

*AXA Investment Managers has identified six themes, supported by megatrends, that companies are tapping into which we believe are best placed to navigate the evolving global economy: Technology & Automation, Connected Consumer, Ageing & Lifestyle, Social Prosperity, Energy Transition, Biodiversity.

5 topics