The art of the turnaround

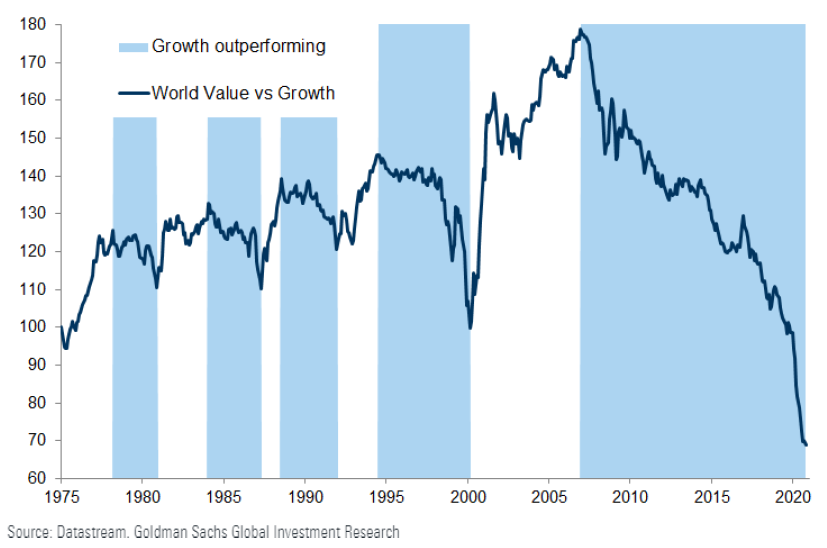

Much has been written about the great value rotation in the past few weeks. To be fair, despite many predicting the premature death of value investing it was probably a matter of when, not if, given the extent of growth’s outperformance over value since the GFC and the valuation extremes seen in respective baskets in mid-October, as referenced in the chart below.

Several US investment banks were banging the value drum pre-US election. The conditions were ripe with the US 10-year marching towards 1% and the outlook for economic growth post-pandemic looking rosy into 2021 with the low base effect. While the blue wave did not eventuate a promising vaccine from Pfizer did. To date those that advocated the switch are on the right side of it, the question remains around the duration.

Seasonally, this is a time when losers tend to outperform as well. One well known technical strategist refers to this as the Robin Hood effect. Sell your winners, and cover underweights amongst the losers. Whether it is a cyclical rotation, a mean reversion between value and growth stocks, or a seasonal trend, the jury is out as to how it ends.

The Small Ordinaries Index - famous or infamous

For an Australian small-cap manager, the concept of a value stock is quite a conundrum. By their very nature stocks that make up the Small Ordinaries Index are typically emerging businesses, earlier in their maturity and stages of growth. Small-cap investors have been rewarded for identifying potential future market leaders that are exposed to structural growth trends. At some point in a company’s lifecycle and assuming management gets the strategy right and earnings follow, a small-cap becomes a mid-cap and eventually a large cap. On the flip side, the Small Ordinaries Index is the place where former market darlings come crashing back to reality. On most occasions, growth stalls, end markets mature, investors exit, and the stars fade.

A good fund manager can decipher between those management teams who have inherent quality but have made a misstep. A less experienced manager may be lulled into a poor-quality business on the optics that it is cheap. Deciphering a genuine mistake versus the beginning of the end, is an artform but is it what makes a good value investor?

Defining value

It probably comes down to how you define value. The founding father of value investing is undeniably Benjamin Graham. Teaming up with David Dodd, they released the 1934 classic Security Analysis, where investors were introduced to concepts such as intrinsic value and earnings power and the importance of a ‘margin of safety’ as a requisite condition. A growth manager may argue those principals are not just tools in a Value manager’s wheelhouse and every manager regardless of style, should adopt similar principles. Rather than pontificate on what is value and how it works, the quantitative experts at UBS have back tested value factors over the past 20 years, with some interesting results.

Does value really work in small caps?

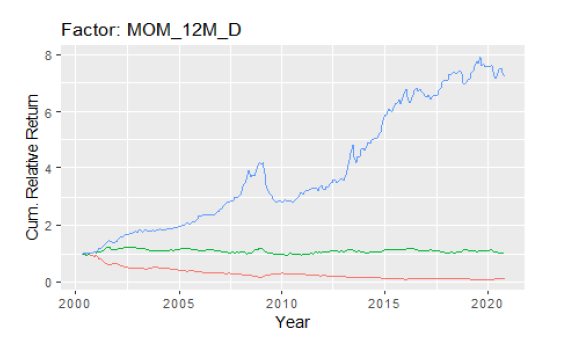

In short yes, but it all depends on which factor you use. Unsurprisingly trailing 12-month price momentum is the best performing factor, but one which is fraught with volatility. Once the losers have been trawled over and bid up, the market will wait with bated breath as to whether consensus earnings estimates can be met. If the “e” was overstated, the “p/e” may also appear artificially depressed. Interestingly the UBS Quant team flags trailing free cash flow yield as the most sustainable value factor that will look after you year in year out. Worth noting also when examining some of the more traditional value metrics - both forward & trailing earnings yield (the inverse of the P/E ratio), as well as when combined with trailing book yield (the inverse of Price / Book) have delivered uninspiring returns over the last 20years.

Probably most telling from the analysis from the UBS Quant team is that momentum as a factor (Last 12-month returns), has outperformed an equal weighted Small Ordinaries benchmark by a factor of 8.

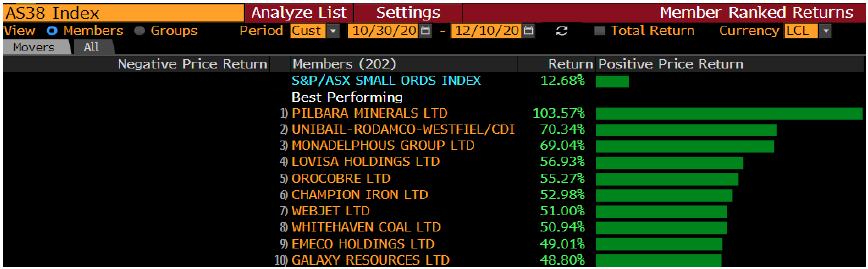

When value works, what tends to outperform?

In a risk-on rally, you will see value and high beta (stock responsiveness vs market moves) names outperform. A quick scan of the winners in the last 6 weeks, clearly articulate this point. But notably, the value + beta chart profiles for the most part are quite choppy over longer duration, as risk-rallies tend to come to an abrupt end. The UBS Quant team point to combining value + quality as the strategy for duration, whereby cumulative returns are less volatile and outperform their beta + value counterparts.

Value + quality = turnaround

It is easy to buy a business with momentum. Everyone likes a stock going up. But small cap mangers have often built reputations on backing a turnaround and buying early. A turnaround frequently keeps to the below script.

A former market darling missteps (issues a warning on the outlook) and is punished severely by investors as future growth expectations are reset, and a multiple that was once justified for the ‘quality of management, the track record of execution, the expectation of earnings upgrades’ is promptly bought back to earth. The register usually full of like investors turns over, as the dreams can no longer be realized and what’s left is what some investors may characterise as a value opportunity and for others its banished to the archives never to be invested in again.

If you were like the many investors caught up in the falls of Slater & Gordon, Speedcast or Vocation, I could go on, I liken it to a relationship breakdown. When you have been burnt by a former love, it is incredibly hard to go back to see if they have actually changed. The examples above were broadly not salvageable, but there are plenty of companies that have been. To even consider backing a turnaround, you need an open mind.

Why does the market engage?

As alluded to above investors are frequently drawn to 12-month underperformers when searching for value in their universe. Not surprisingly a future turnaround might start in this camp after its fall. There will be those who advocate a discounted stock price, while there will be those who refuse to entertain the thought.

Overcoming the emotional barrier can be hard. Traumatic share price falls can leave a terrible scar on an investors psyche.

Normally the catalyst is change. Board renewal, new management, asset divestment, new shareholders or even the kitchen sink – a euphemism for significant accounting treatment e.g. significant write downs or restructuring charges. Finally, a new PowerPoint presentation and a strategy day rounds out the checklist. Argus-eyed investors recognize these corporate developments and almost always go back for a second look.

I asked the team at Eley Griffiths Groups as to who they would nominate as the greatest turnarounds, we came up with following list - Cleanaway, Vocus, Elders, Lynas Corporation, Navigator (post GFC), Accent Group & failed IPO Temple & Webster. At the top of the list would be Cleanaway (nee Transpacific Industries).

Wearing your heart on your sleeve and your reputation on your pocket

I recall a trip to Brisbane in 2015 with the team. We like so many other small cap investors were there to see the darlings of the day - Mantra, G8 Education & and future F1 race car tech play PWR. On our back up list was Transpacific. We had lost track whether their HQ was in Brisbane or in Melbourne. A sleepy industrial, that acquired the former Brambles waste management business at the peak in 2007 from its relatively brief PE owners, had almost collapsed during the GFC under a debt burden of around US$2.1 billion. The market had disengaged with the lack of strategic direction, despite management’s attempts to simplify the business with the divestment of the commercial vehicle, and its NZ waste businesses a few years earlier.

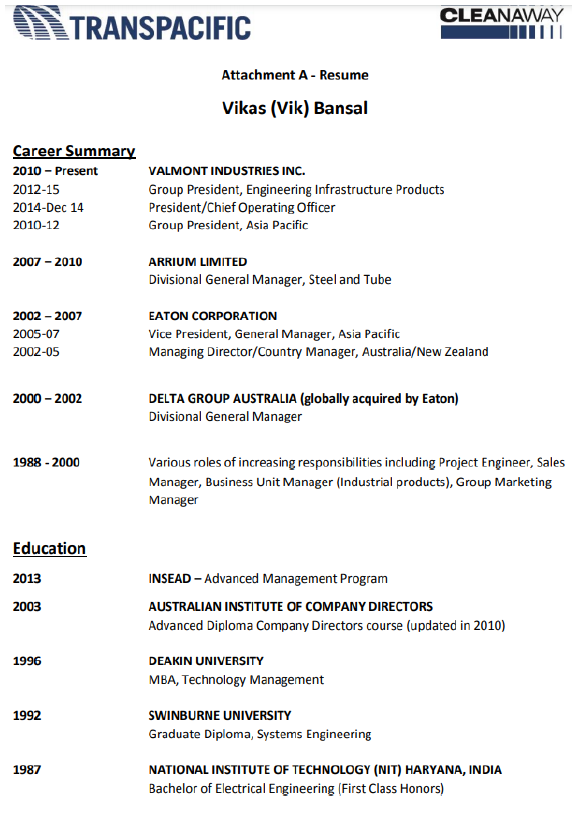

In July of that year, a Mr Vik Bansal was appointed, a relative unknown to listed corporate life hailing from the US where he had successfully orchestrated the turnaround of NYSE listed Valmont Industries. Very rarely do you see a complete CV attached to an ASX release, it certainly pricked our curiosity that this leader was going to be about full disclosure.

A year later we started to see the beginning of what this turnaround would entail. Revenue & EBITDA growth for the first time in 3yrs was remerging for Australia’s largest waste management company. A name change, a unified brand, a more consistent approach to customer service, cost out, improving capital discipline was just the start.

For EGG, we always liked the industry structure. The Cleanaway of old, had at times been financially irresponsible, was over geared, had chased market share and ultimately did not behave like an industry leader. Upon Vik’s arrival, he made it clear he needed to get his own house in order first and better control the capital spending. What began as a cost out strategy, migrated to reducing churn/driving revenue growth and operating leverage, while at the same time Vik articulated the medium to long term strategy positioning Cleanaway in the virtual circle of waste. Once the market got comfortable that earnings growth could be delivered Vik was given the endorsement to acquire.

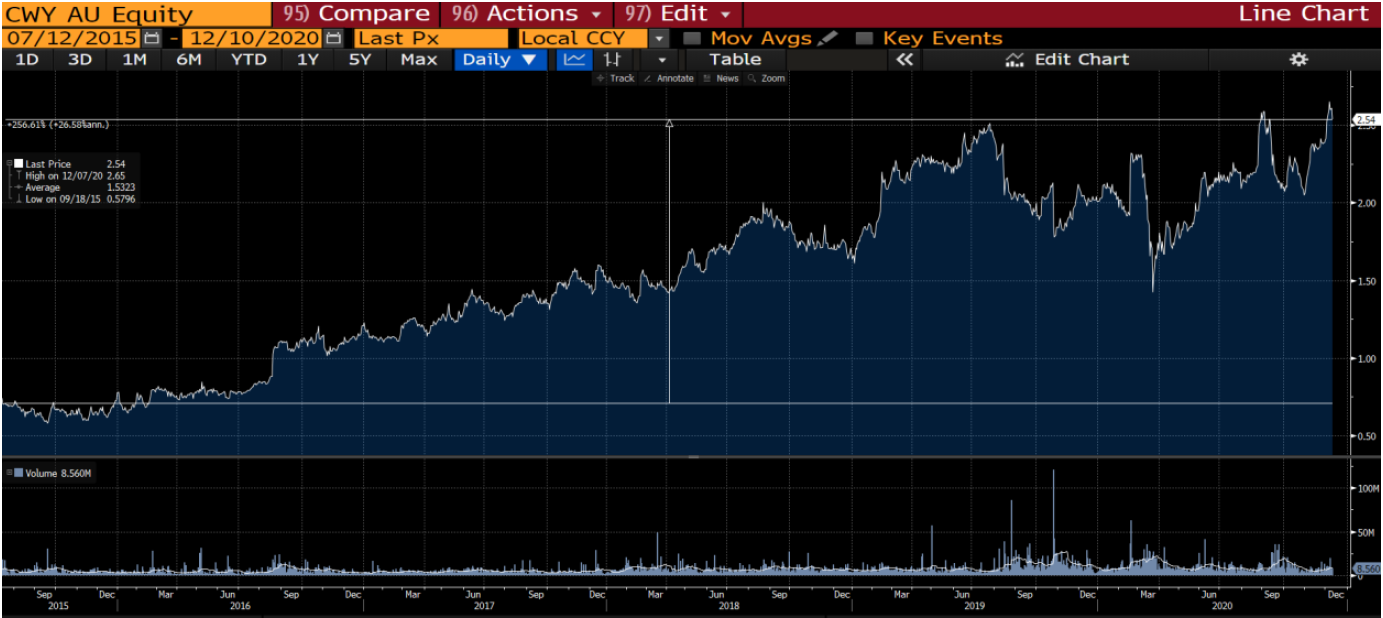

With Vik still at the helm and the second chapter of strategy plan underway, the turnaround is now complete, and company is well positioned for the next leg of growth. Total Shareholder Return is a crude reference for success but owning CWY from the beginning of Vik’s tenure would have delivered you +26% annualised over the last 5 years, or a +200% premium to owning the Small Ords over the same period.

It’s not a straight line.

Turnarounds aren't usually smooth sailing, typically they take longer, cost more and require a significant amount of patience. Investors will engage early with a charismatic CEO and an impressive Venn diagram that can articulate TAM, but if the earnings trajectory fails to turn fast enough, the stock can fall foul of the market. Several management teams have started well but underestimated the magnitude of the challenge to turn the Queen Mary and bring the investors along for the ride. In some cases, the problem is not the management team or operating model, it is a business which has been superseded by newer technology or disrupted by a challenger with a better mouse trap.

Flexigroup has had a few false starts as has Fletcher Building, Myer & Invocare. Several turnarounds have started promising such a Emeco, Noni B, Helloworld, but succumbed to structural headwinds, commodity cycles or pandemics.

Some are underway. The Reject Shop is embarking on at least its 3rd turnaround, BWX under David Fenlon’s stewardship is expanding distribution, improving margin and driving $ per kilo. Blackmores is also early stage and one to not lose sight of, while Whitehaven albeit not a turnaround per se is staging its 3rd comeback, largely on the back of improving coal prices.

When a business has been built through acquisition and been subject to multiple management iterations in its lifetime, it takes time to unwind, unpack and decipher the assets with true value, and realize the earnings potential.

From darling to detested

It was easy to see why the market fell in love with Vocus in the early days. A charismatic Founder CEO, a sector where an oligopoly had reigned, but at the time was struggling to keep up with the changing needs of the customer. A challenger brand emerged with a customer centric, service focus and there was an opportunity to consolidate the space, get scale and take market share from the incumbents. In the early days, the market liked the acquisitions, in many cases debt funded with significant accretion and synergies. Multiple Data centers, a NZ presence in FX networks, Amcom was transformational in mid-2015, Vocus was on a roll. However, the merger with M2, that saw Vocus enter the consumer broadband space, was the ultimate turning point for the stock. Burdened with debt and the structural change that was occurring in the consumer market (NBN rollout) saw organic growth vanish. Key management departed and the equity value fell to an 5yr low of $2.22 in early 2018.

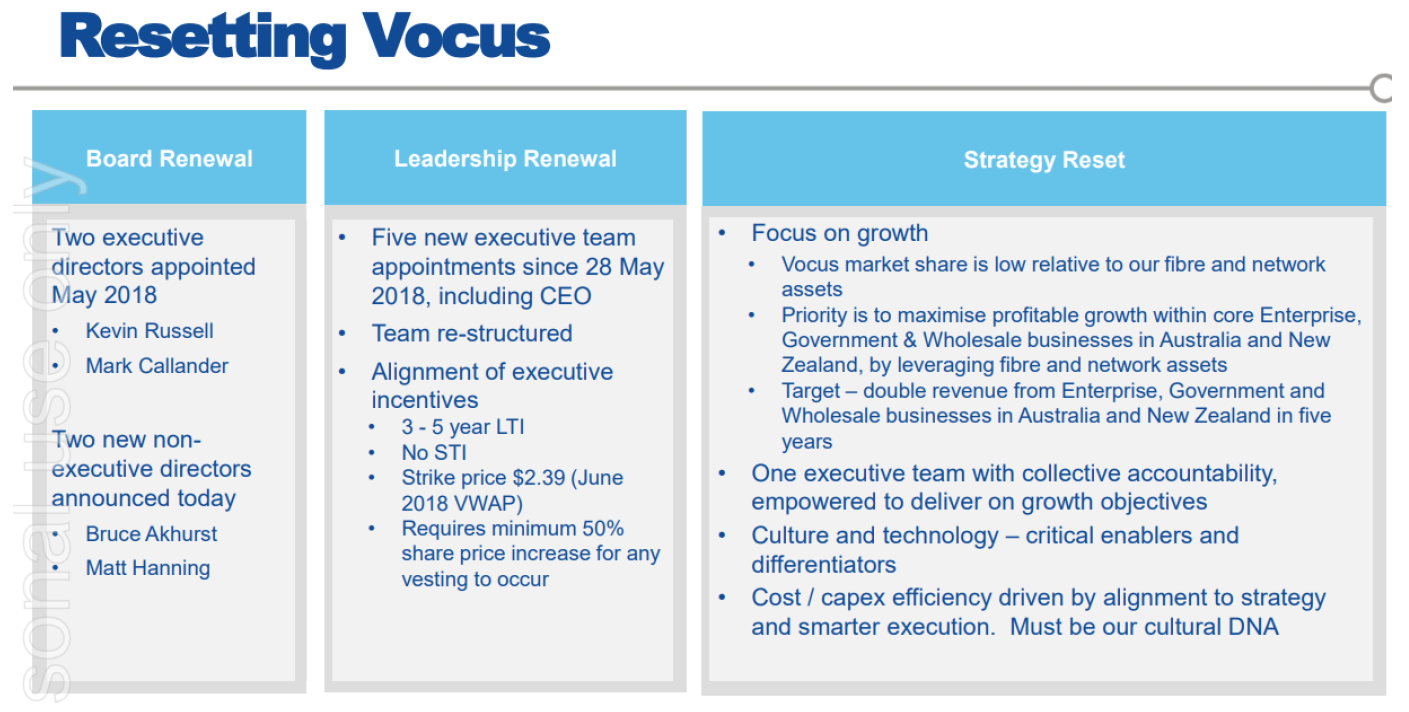

In the turnaround playbook, board renewal begins, and new management is appointed. The market is undoubtedly curious as to the candidate, but many fallen angels are brushed aside for some time as focus shifts to the next shiny company with momentum. After months of speculation a Scottsman with vast experience at the major Australian telcos was drafted in to lead the charge in repairing Vocus. At the FY18 result there was no big strategy deck, the message was simple ‘Vocus primary focus going forward is sustainable, profitable growth’. When you have one of the best fibre network infrastructure assets in the country and its significantly underutilised, fixing distribution to drive revenue was key.

As often is the case when a market darling falls, vultures circle to see what can be salvaged. There were two corporate approaches to take Vocus private that both fell through and the market began to question what they had seen during due diligence.

To his credit Kevin Russell has stuck to script. Rightsizing the executive team, fixing the accounts, demonstrating the quality of the core Network services business and its ability to grow, and emphasizing to the market the opportunity that lies ahead.

Two and a bit years into the process, the turnaround is close to the final quarter. Sales have improved in the core network services business, Enterprise, Government and wholesale are re-engaged, the New Zealand business is up for sale and there are green shoots emerging within the consumer division. To the board and management’s credit an emergency capital raising was never undertaken during the Covid19 crisis and the quality of the cashflows, have meant excessive leverage is now also no longer an issue. For investors that joined the register at a similar time to Kevin’s appointment, an annualised return of around 22% over the past two-and-a-half years is very impressive.

Boiling it down why this turnaround has been successful in a relatively short time frame is that Vocus, at its heart, has a very good product in the network services division and operates in a good industry structure. It was a challenger with a strategic plan to take market share from the incumbents. Having the right leader is just one of the ingredients, a strong and clear vision is ultimately required for success.

What does success look like?

The success of a turnaround is hard to quantify. Total Shareholder Return is a crude metric of success, but more tangible improvements include better transparency, predictability of earnings, confidence in financial accounts, incremental returns on equity and a track record of delivery over multiple periods. In the case of Vocus it is still underway, but success is evident. For Cleanaway and Elders the proof is probably in the shareholder return metrics. It is easy to see why investors engage as most fundies would characterize themselves as optimists, and hence hope that good businesses can be saved. At its core, people like to back the underdog. Fund managers are often enticed by the sizzle but require the steak to be good eating over a reasonable period of time.

It will not happen overnight

As for where to now for value, I think it comes down to your view on the macro-outlook. The rotation has been sharp, losers have been bought, and the relativity vs growth is nowhere near as extreme as it once was. Investors will continue to debate whether Netflix kill cinemas, Tesla kills the Internal Combustion Engine or social media kills traditional media. It will not be an overnight phenomenon, and there will be opportunities for investors to make money through adopting traditional value disciplines when sorting the wheat from the chaff. The old way of doing something may not be the wrong way.

The COVID Beneficiary darlings of 2020, could well be those discarded in 2021 as vaccines rule the world and we adopt some normality. Don’t lose sight of quality businesses that have mis stepped or just struggle to comp the success of previous years. A discounted valuation may present the perfect entry point to back the next turnaround.

Access Australia's most compelling companies

Eley Griffiths Group is a specialist at focusing on small and emerging companies in Australia. Their investment process and team have delivered consistent outperformance through all market conditions for 15 years. To find out more, click the 'contact' button below.

1 topic

14 stocks mentioned