The asset class to hedge inflation

“Investing puts money to work. The only reason to save money is to invest it” – Grant Cardone

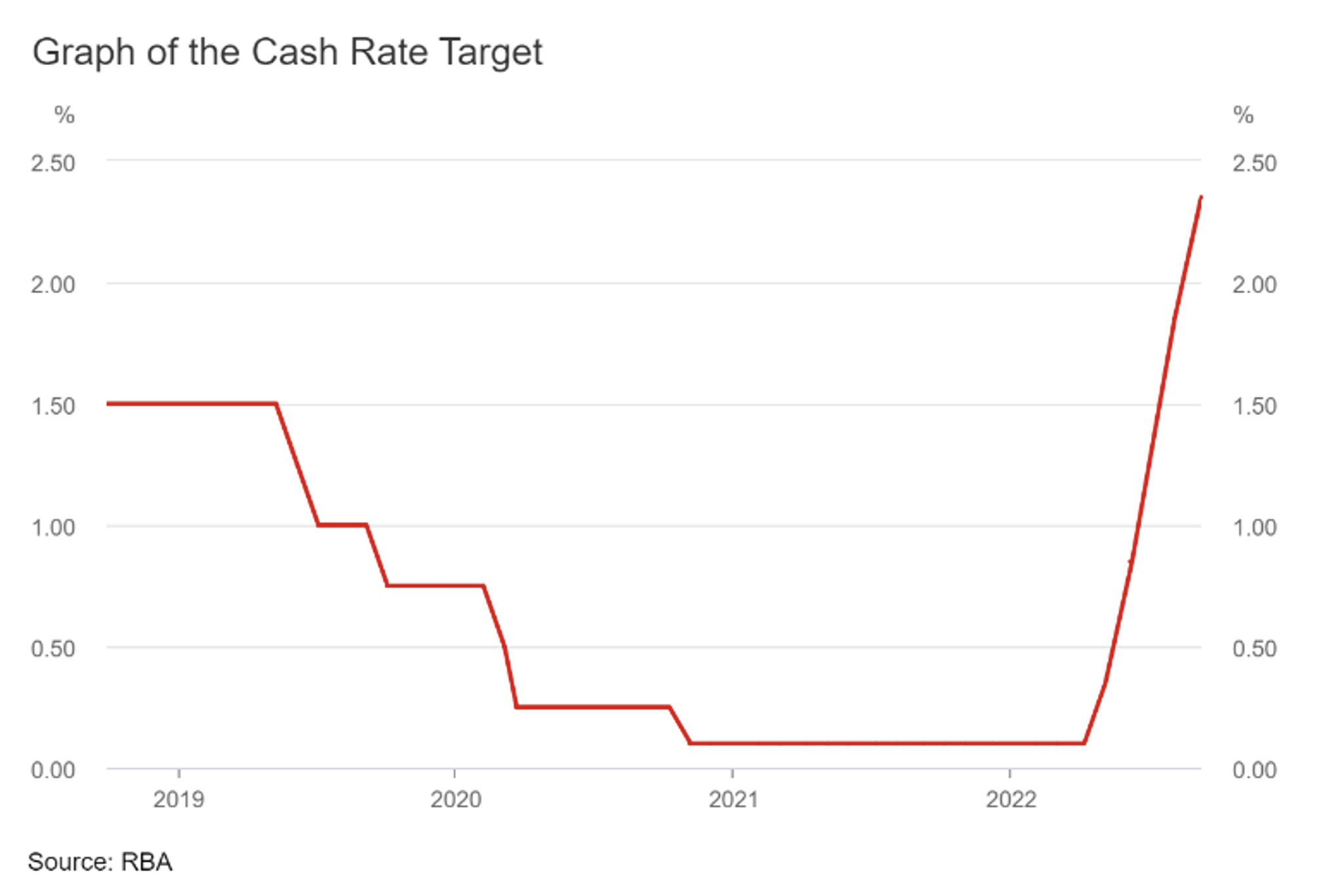

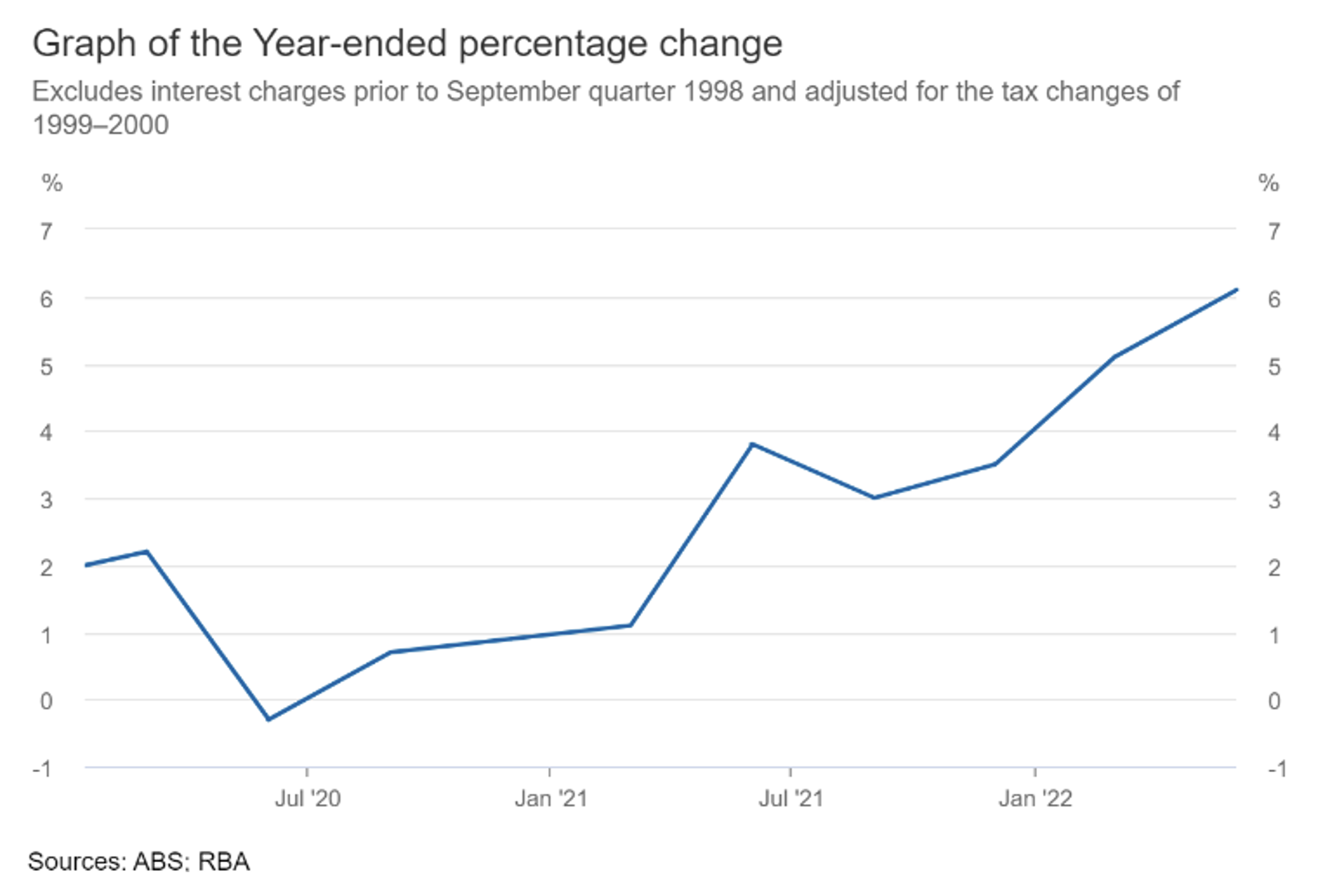

Surging inflation is a reality all individuals, investors, companies, governments, and central banks have had to deal with recently. With core inflation remaining high, and inflation expectations and wage negotiations following energy prices higher, the increasingly complex nature of the current inflationary environment we find ourselves in is proving increasingly harder for central banks to rein in.

The complexities of resolving this primarily supply-side-driven inflation and the clear insufficiencies of monetary policy to do so have highlighted the importance of including a hedge against inflation in every investment portfolio. Fortunately, alternative assets provide inflation-hedging benefits that are either contracted or natural.

Infrastructure exemplifies the inflation-hedging characteristics that certain alternative assets can offer. Infrastructure refers to investments in a wide range of essential services and facilities that are necessary for the efficient functioning of economies and societies.

Investments in infrastructure can take a variety of forms, such as investments in:

- economic infrastructure (e.g. solar or wind farms, telecommunication towers, toll roads, and airports),

- social infrastructure (e.g. correctional facilities and schools), and

- industrial infrastructure (e.g. wastewater treatment facilities for industrial companies). Infrastructure assets are typically characterised by long-term contracts where cash flows are linked to the consumer price index (CPI) and therefore rise with inflation, providing a built-in inflation hedge.

Additionally, such contracts are typically made with highly creditworthy counterparties and infrastructure assets are often monopolies or have high barriers to entry, ensuring that cash flows are highly defensive and able to be serviced through periods of economic distress. Therefore, infrastructure assets can serve as an inflation hedge and provide valuable income throughout periods of high inflation by ensuring cash flows rise concurrently.

Many natural resource assets have long been touted as inflation hedges due to their intrinsic value, tending to perform well when prices for consumer goods are on the rise (source: Preqin, 2022 Preqin Global Natural Resources Report). Timber, for instance, is a natural resource investment that is a well-regarded inflation hedge. As timber assets grow, they can be turned into cash flows.

The inflation-hedging characteristics of timber are derived from the many uses of wood in the real economy, with uses ranging from building materials to paper and fuel. The higher demand for end products drives higher inflation and simultaneously leads to higher demand for wood and ultimately higher wood prices, providing timber with natural inflation-hedging characteristics.

It is also worth mentioning that many alternative asset classes have an in-built interest rate hedge, which is a crucial consideration given that raising interest rates is typically the primary tool central banks utilise in response to inflation. Private debt instruments are often structured as floating rate instruments, with cash flows, therefore, increasing in tandem with rising interest rates and therefore indirectly, in tandem with rising inflation.

Many alternative assets serve as a powerful inflation hedge, which the current macroeconomic environment has highlighted as a crucial consideration for an investment portfolio. Such inflation-hedging characteristics can either be contracted or natural.

WAM Alternative Assets (ASX: WMA) is a listed investment company that seeks to democratise alternative asset investing for retail investors through its listed investment company (LIC) structure, which provides retail investors with access and regular liquidity to an area previously only largely accessible by institutional and high net worth investors, allowing them to benefit from the inflation-hedging characteristics of many alternative asset investments.

Learn more

WAM Alternative Assets provides retail investors with exposure to a portfolio of real assets, private equity and real estate. The company aims to expand into new asset classes such as private debt and infrastructure. For further information, please visit their website.

2 topics

1 stock mentioned