The big moves overnight: what, how and why?

Livewire

Overnight, we have seen a rally for Treasuries and the biggest surge in major U.S stock indexes since March. We have seen the NASDAQ 100 gain 3.2%, the S&P500 gain 2.3%, and the NYSE Composite gain 1.88%. Across other asset classes, we have seen:

Currencies

- The yen added 0.1% to 113.65 per dollar

- The offshore yuan rose 0.2% to 6.9388 per dollar

- The Bloomberg Dollar Spot Index fell 0.6%

- The euro advanced 0.7% to $1.1367

- The British pound gained 0.6% to $1.2827

Bonds

- The yield of 10-year Treasuries held at 3.06%

- The 2-year yield slipped two basis points to 2.81%

- Australia’s 10-year bond yield held at 2.62%

Commodities

- West Texas Intermediate crude fell 2.5% to $50.26 a barrel

- Gold rose 0.5% to $1.221.51 an ounce

What was the catalyst?

Warren Buffet has famously quoted:

“Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.”

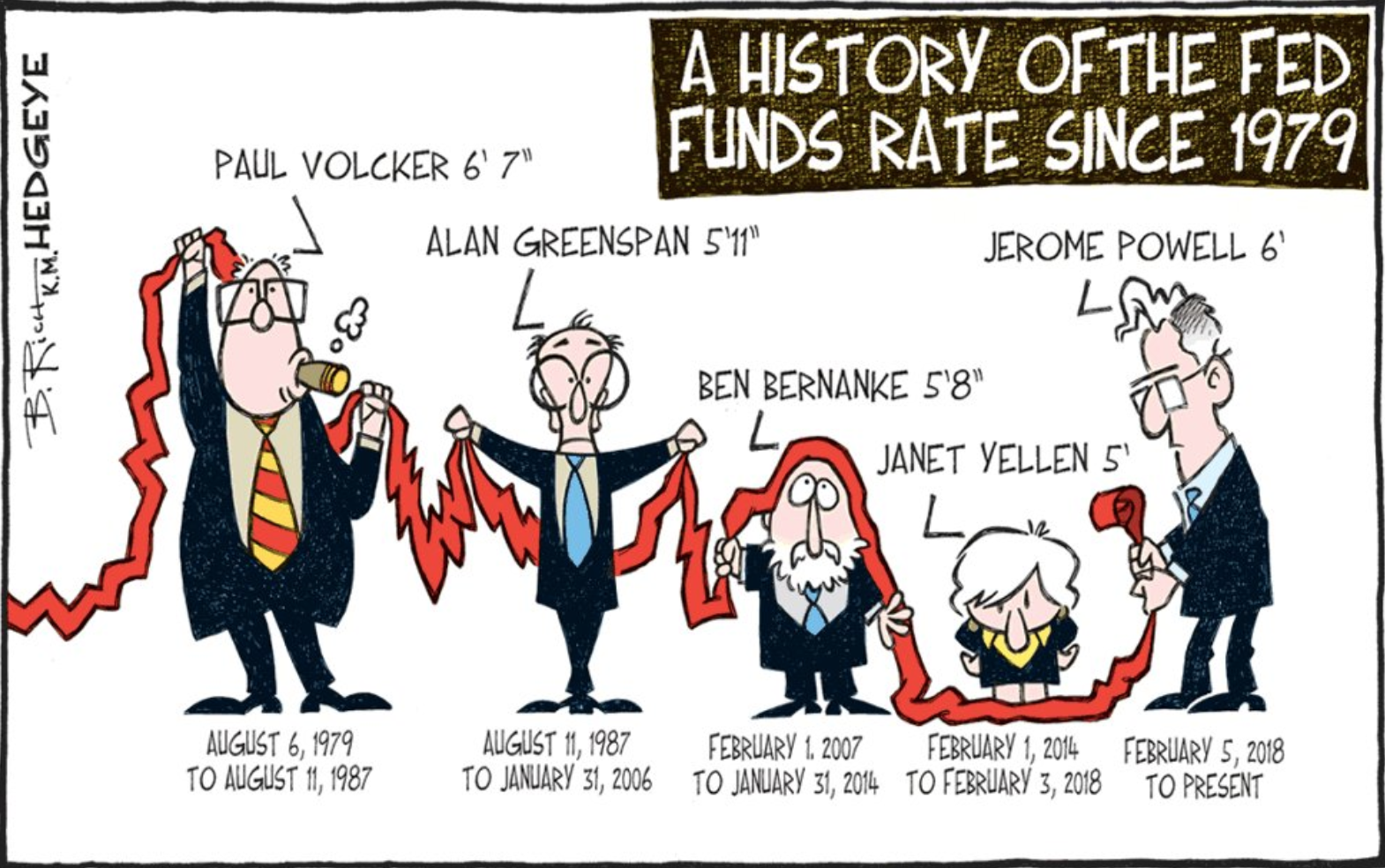

Arguably, we have seen the impact of what higher expected interest rates can do to asset prices by looking at “Red October”. Speaking on October 3rd, Federal Reserve Chairman, Jerome Powell laid down hawkish remarks on the direction of interest rates:

“We may go past neutral. But we’re a long way from neutral at this point, probably.”

Yesterday, Powell issued to the press that rates were just below a range of estimates of the so-called neutral level.

“Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy‑‑that is, neither speeding up nor slowing down growth. My FOMC colleagues and I, as well as many private-sector economists, are forecasting continued solid growth, low unemployment, and inflation near 2 percent”

Powell’s “just below” description seems to have tempered the markets read of a more aggressive hiking cycle.

Though, it should be noted that Powell spoke a day after President Donald Trump renewed his criticism of the Fed’s recent policy, saying he wasn’t “even a little bit happy with my selection of Jay”. In the context of poor mid-term results and Trump spruiking his responsibility for stock market gains (not this year), one may ask whether or not this is a political move or a fundamental shift in monetary policy.

What do you think? Share your thoughts with us in the comments below.

Jerome's speech can be found here.

3 topics

Livewire News brings you a wide range of financial insights with a focus on Global Macro, Fixed Income, Currencies and Commodities.

Expertise

No areas of expertise

Livewire News brings you a wide range of financial insights with a focus on Global Macro, Fixed Income, Currencies and Commodities.

Expertise

No areas of expertise