The biggest surprise from today's inflation print

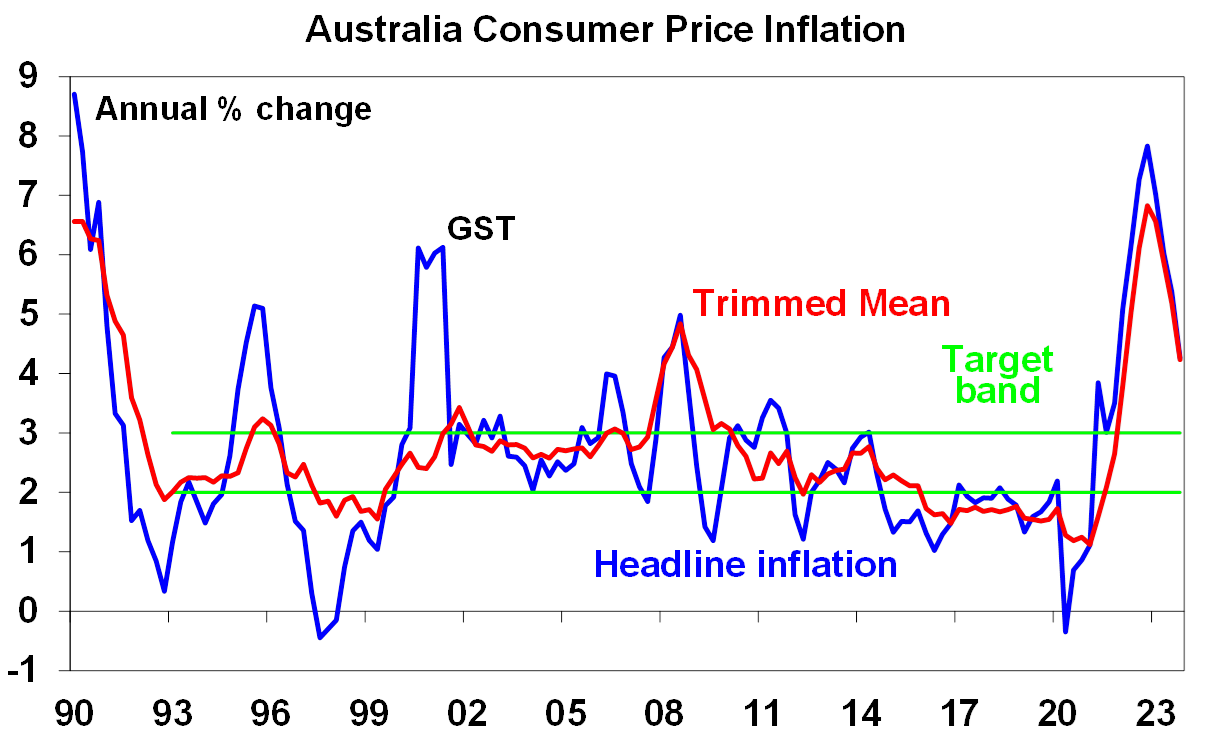

September's quarter inflation data was higher than expected. The headline consumer price index rose by 1.2% over the quarter (slightly higher than consensus and our own estimates of 1.1%) and annual growth slowed to 5.4% from 6% last quarter.

Inflation peaked at 7.8% in the December quarter last year and has slowed significantly since then, but there is more work to do to bring inflation back to the Reserve Bank of Australia’s 2-3% target.

The inflation data today was slightly above the Reserve Bank of Australia’s latest forecast of annual growth of 5.3% which was published in the August Statement on Monetary Policy.

Source: Bloomberg, AMP

The bigger upside surprise today was in the core readings of inflation – mainly the “trimmed mean” which is the RBA’s preferred measure and was up by 1.2% over the quarter (above consensus estimates of 1% and our own forecast of 1.2%) which took annual growth to 5.2% and was up from a 1% rise last quarter. Annual growth in trimmed mean inflation slowed to 5.2% from 5.9% last quarter and is lower than the peak of 6.8% in December last year.

However, this is quite a miss from the RBA’s forecasts of 4.8% annual growth and we think will concern the central bank because it could indicate that inflation is proving too “sticky”. The other measure of core inflation the “weighted median” rose by 1.3% over the quarter (up from 1% last quarter) and annual growth slowed to 5.2% from 5.4% last quarter.

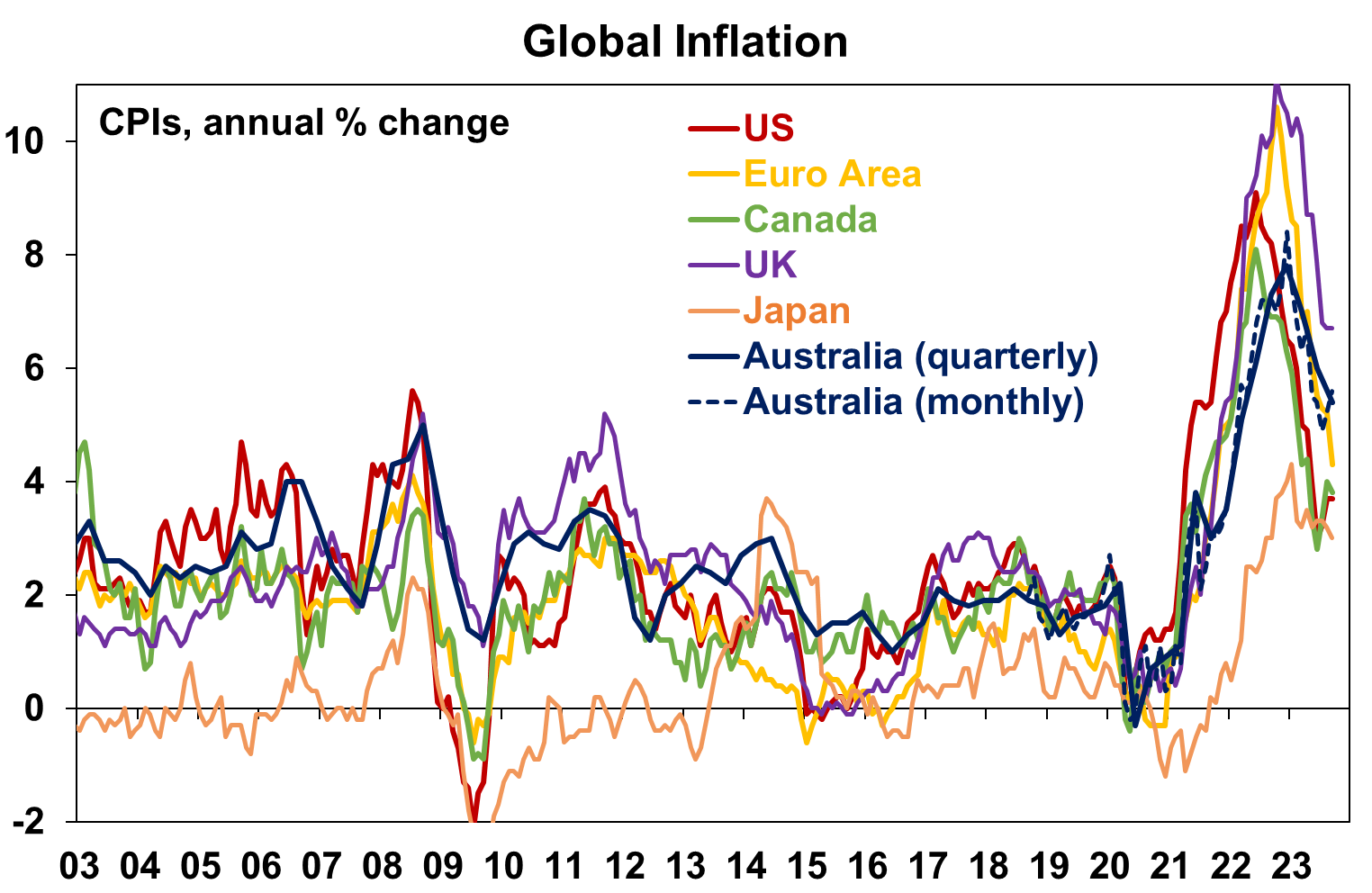

Australia’s inflation outcomes are in line with our global peers (see the chart below). Australian inflation peaked around 6 months later compared to the US so is also taking longer to decline on the way down.

.png)

Source: Bloomberg, AMP

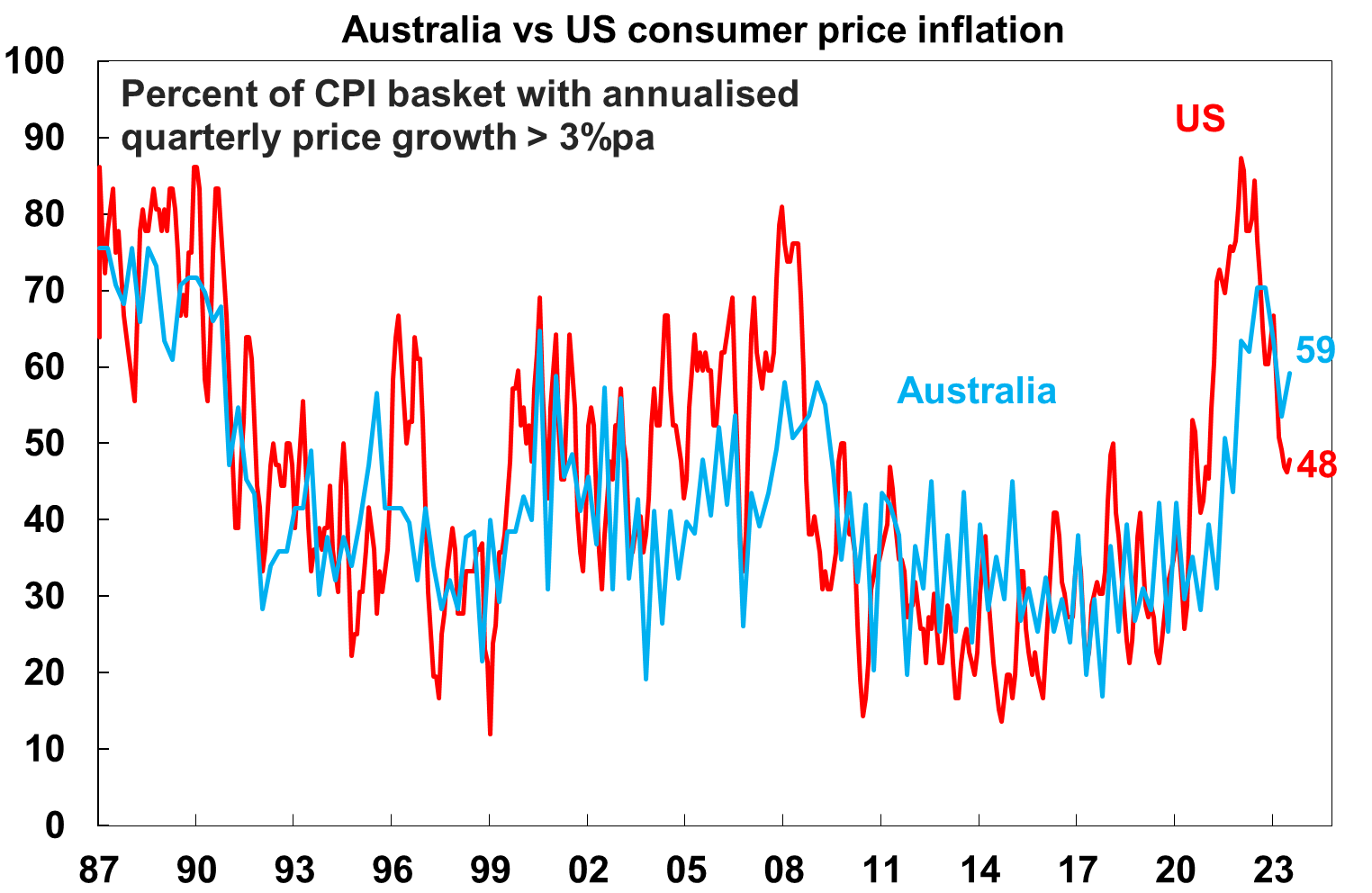

The breadth of price increases above 3% per annum increased in the September quarter (see the chart below) after steadily falling in prior periods with 59% of CPI baskets having annual inflation above 3%.

Source: ABS, AMP

The breadth of price increases above 3% per annum increased in the September quarter (see the chart below) after steadily falling in prior periods with 59% of CPI baskets having annual inflation above 3%.

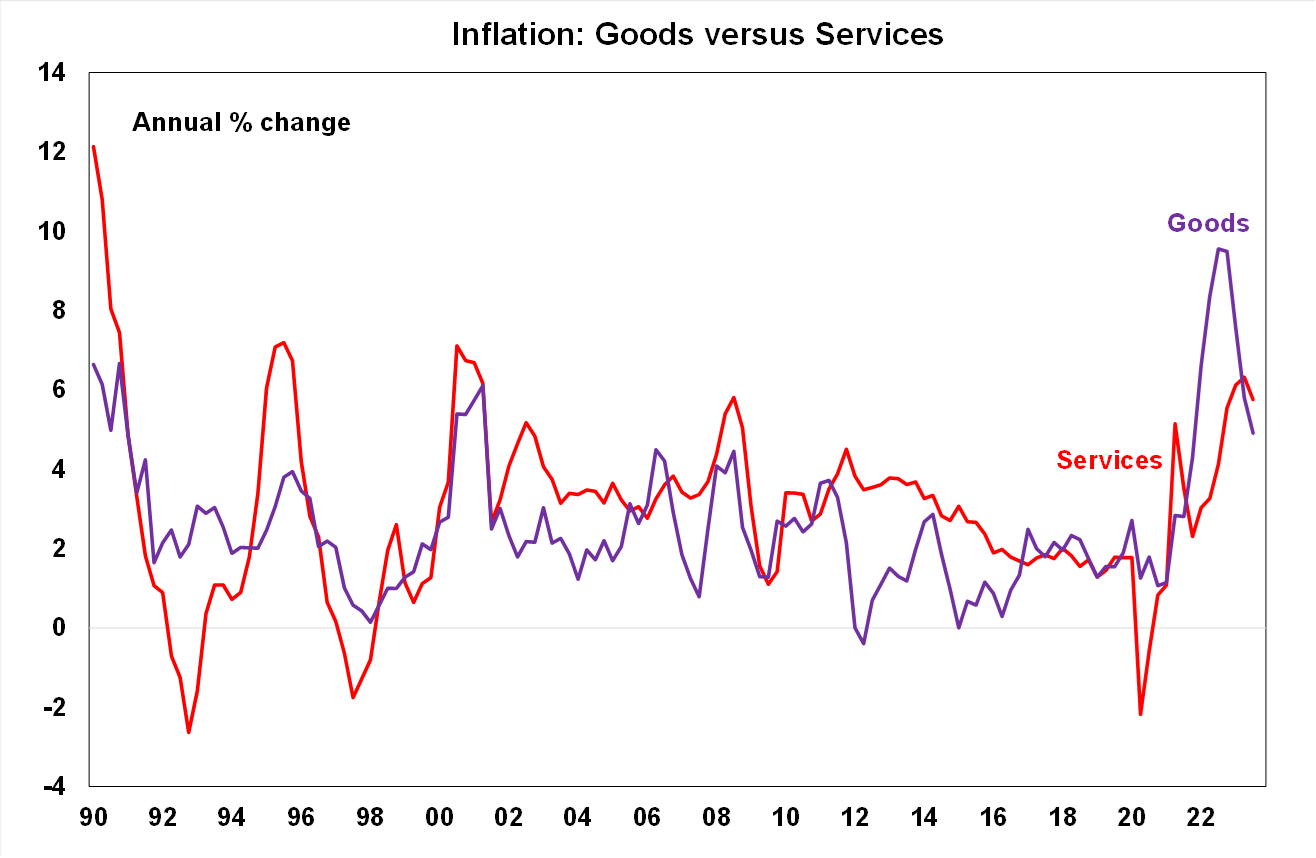

Goods versus services inflation

To understand the many moving parts of inflation we think it’s worthwhile looking at the difference between goods and services prices given the arguments around transitory goods inflation and sticky services prices.

Goods prices rose by 1.2% in the September quarter and are up by 4.9% over the year, well down from their peak of 9.6% in September 2023. Goods inflation has proved somewhat transitory as goods inflation related to the pandemic-fuelled increases in consumer demand and supply disruptions have now abated. However, goods prices are still running well above normal historical levels (see the chart below).

.png)

There are continued signs of slowing across many goods prices in the September inflation figures, in line with lower discretionary consumption, including:

- Lower fresh food prices, with fruit and vegetables down by 6.4% compared to a year ago due to a warmer winter that improved supply conditions and meat prices up by only 2.2% year on year;

- Clothing and footwear prices (which were up by 0.4% over the quarter) with components like garments down by 0.7% over the year;

- New dwelling purchase by owner-occupiers (a proxy for building construction costs) up by 5.2% over the year, down from over 20% price growth in 2022;

- Household furnishings like furniture (up by 2.3% year on year compared to over 11% last year) with major household appliances down by 0.6% compared to a year ago;

- Motor vehicle prices were up by 4% over the year, down from over 7% in 2021.

Offsetting some of this lower goods inflation was the rise in petrol prices which lifted by 7.2% in the September quarter and are up by 7.9% over the year after being much lower in the prior 6 months due to the lift in oil prices. And now the concern is that petrol prices will rise further due to the conflict in the Middle East which saw an initial rise in oil prices by around $5USD/barrel to $88USD/barrel but prices have declined since then.

However, we see the current circumstances of the rise in petrol prices as different to the multiple commodity supply shocks in 2021/2022 when higher prices related to supply disruptions were able to be passed on to consumers because household budgets were strong and households wanted to spend with the post-Covid reopening and high accumulated savings buffers.

Meanwhile, services prices rose by 1% over the September quarter and are 5.8% higher over the year, only down slightly from a peak of 6.3% year on year in the previous quarter. The RBA ‘s concern has been that services inflation will prove to be sticky and non-transitory and today’s data does give some weight to this concern as many parts of services still have high inflation as a result of consumer spending shifting more towards services over the past two years and as high services are in line with elevated wages growth:

- Meals and takeaway meals were up by 2.1% over the quarter;

- Rents were up by 7.6% over the year to September and would have been higher had it not been for the Commonwealth Rental Assistance. Rents were expected to remain high given the tightness in the renal market;

- Electricity was up by 4.2% over the September quarter and 14.5% over the year and prices would have been higher if it were not for the Energy Bill Relief Fund rebates which started in June 2023 (without the rebates electricity prices would have risen by 18.6% over the quarter);

- Gas prices were up by 1.4% over the quarter 15.4% over the year, although this is lower than the March and June quarter;

- Personal services inflation remains elevated with cleaning, repair and hire of clothing up by 6.2% over the year and hairdressing up by 6.7% over the year;

- Medical services like medical and hospital services rose by 6.3% year on year and dental services were up by 4.9% year on year;

- Motor vehicle services costs rose by 3.2% over the quarter due to a rise in various administration fees and charges;

- Postal services rose by 14.2% over the year;

- Insurance costs are 14.7% higher than a year ago and financial services are 6.9% higher.

Some services prices have seen some slowing which is encouraging:

- Domestic holiday travel fell by 2.5% in the September quarter and have fallen for two quarters in a row and international holiday travel rose by only 0.5% in the September quarter;

- A big 13.2% fall in childcare costs over the quarter occurred because of the Federal Government’s lift to the Child Care Subsidy which also resulted in a 2.6% fall in pre-school and primary education costs.

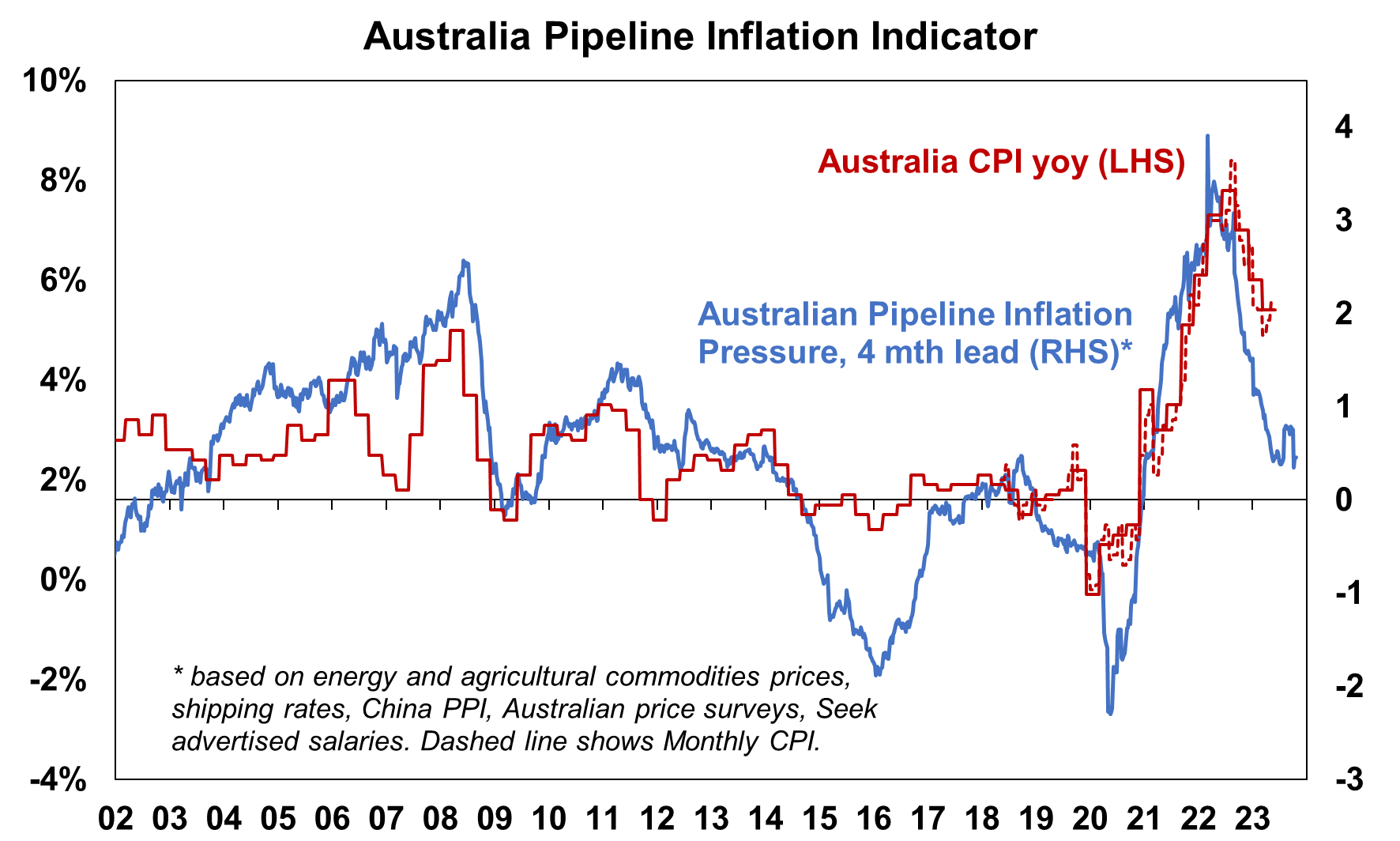

- While services prices look elevated, it’s important to keep in mind that services prices lagged goods prices on the way up so are naturally also lagging on the way down. Our forward-looking inflation indicator (see the chart below) is pointing to further downside to inflation which accounts for commodity prices, global shipping rates, producer prices and price indicators from business services. However, the slowing in inflation is probably not occurring as fast as the RBA would like.

Source: ABS, AMP

Implications for the RBA

The November Board meeting has historically been a meeting when interest rates were changed because it occurs after the third quarter inflation data and around the time when the RBA staff update their economic forecasts which are presented to the RBA Board.

Today’s inflation data provides some reasons for the RBA to be slightly concerned about the inflation outlook. Governor Bullock said this week that the RBA “will not hesitate to raise the cash rate further if there is a material upward revision to the outlook for inflation” and today’s data may see the RBA upgrade their medium-term inflation forecasts which would mean it will take even longer for the central bank to bring inflation back within its 2-3% band beyond its current forecast of 2025.

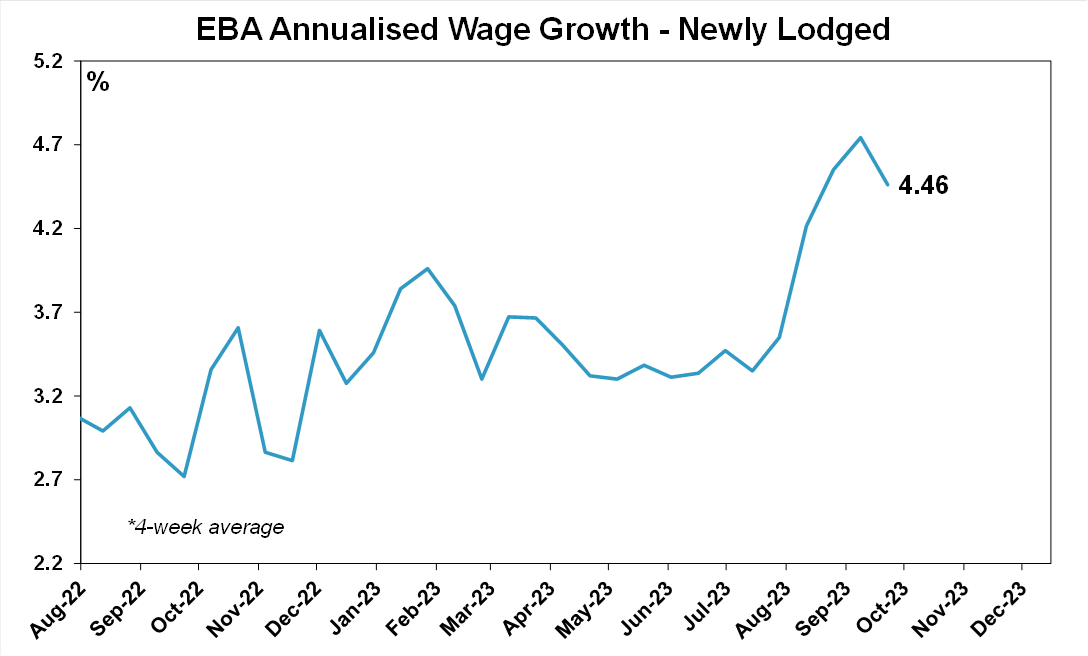

Some favourable inflation news this week was that the latest data from the Enterprise Bargaining Agreement (EBA) looked better, with newly lodged EBA wages growth down to 4.5% from 4.7% which is still elevated but is not continuing to rise.

Source: Fair Work Commission, AMP

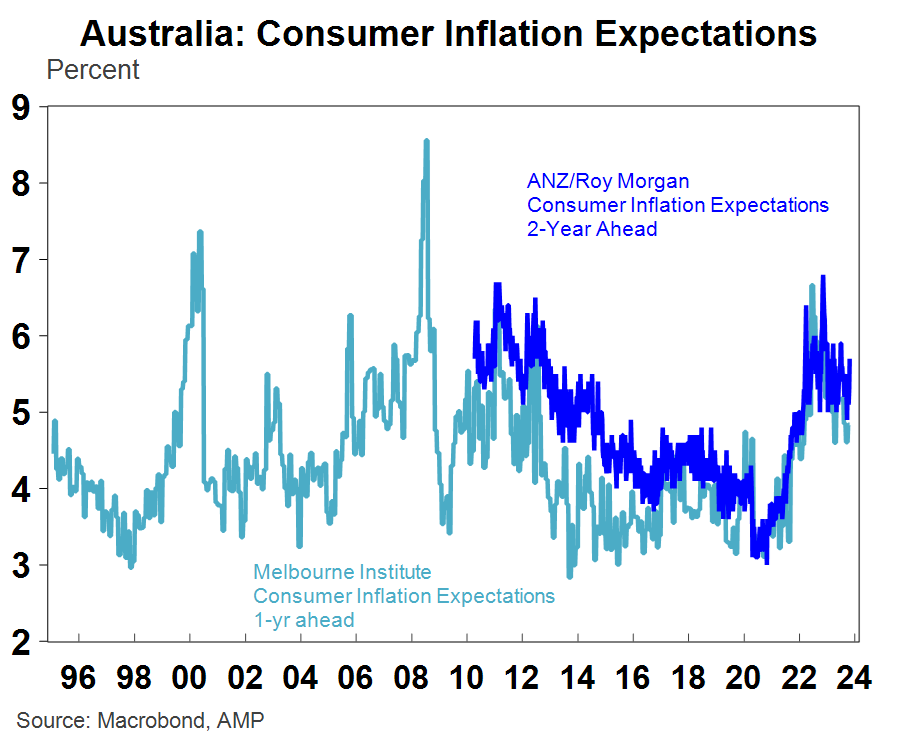

And while near-term inflation expectations are still elevated this reflects current inflation figures rather than an expectation of future inflation. There is no sign that consumers expect inflation to breach the 2-3% medium-term inflation target.

While we think that RBA needs to allow more time for the full lags of monetary policy to work through the economy and risks a significant slowing in economic growth in 2024 if it continues to raise interest rates, we think today’s inflation figures will cause some concern for the central bank and is likely to push the RBA over the line to hike the cash rate by another 0.25% at its November meeting taking the cash rate from 4.1% to 4.35%. But, Governor Bullock speaks tomorrow before the Senate Economics Committee in Canberra and may provide some more colour on the central bank’s view of today’s inflation figures before the November meeting on the 7 November.

4 topics