The energy transition is changing everything - and these companies are riding the change

Working with the energy transition isn't a smooth trajectory, but a set of steps as our economy shifts its energy sources.

Sometimes that shift is towards legacy assets. Take Eraring Power Station in NSW. Owned by Origin Energy (ASX: ORG), currently supplying around 25% of that state's power, it was slated to cease operations and close down in August 2025. But that's now not so clear, as the team from Macquarie notes,

"The NSW Government check-up on the Energy Road Map. Slow progress on Central-West Orana Renewable Energy Zone (REZ) with first energy expected to be from FY28, and barriers for new renewables to join the grid are increasing the need to keep coal longer to sustain energy demands."

While energy experts believe the governments talks with Origin about Eraring "will likely result in a deal which sees taxpayers compensating the company to extend the coal plant's life" according to Macquarie, they note that "the accelerated onset of Renewable Energy Zones (REZ) and energy storage development will be pivotal in terms of justly transitioning away from coal to achieve net zero targets."

Customer demand for transition energy sources leads to innovation

At other times, driven by customer demand, the shift will be towards new energy sources. Orica (ASX: ORI) is working with Origin Energy on the Newcastle Hydrogen Hub (HH), as Macquarie explains.

"This relates to 55MW hydrogen plant which = 25kt of potential green ammonia or 7% of KI's 350kt ammonia production. In the long term, the HH could provide a low carbon alternative feedstock for ORI’s ammonia manufacturing (replacing natural gas with renewable hydrogen) as well as providing alternate revenue sources via green ammonia exports to Asian customers. In turn this is a potential offset to long term structural decline in Hunter Valley coal market"

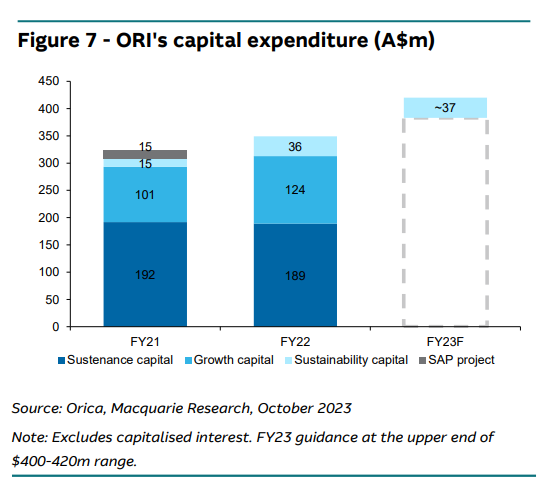

Orica expects to make its final investment decision in 1H CY24. With ~$88 million in sustainability capital allocated from FY21 to FY23, including $52.5m for tertiary

abatement projects, this expenditure is just one part of its overall capex.

Bluescope Steel (ASX: BSL) is also looking to make a transition from gas to hydrogen. As Macquarie notes,

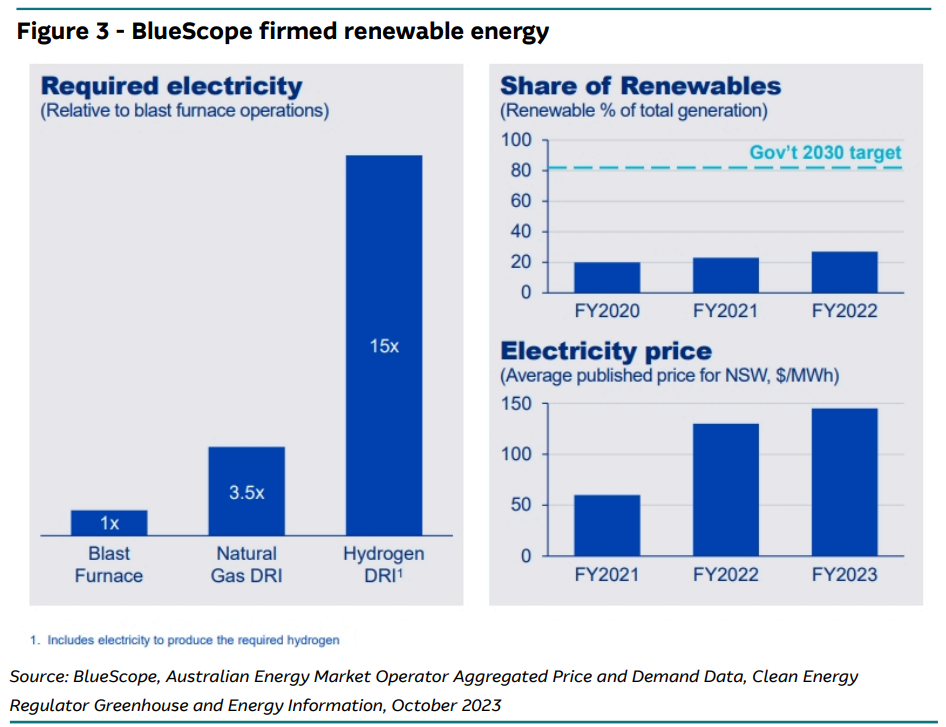

"BSL aims to be net zero by 2050, however noted dependence on several enablers including the development of iron-making technologies to be firmed by accessible and affordable renewable energies and access to green hydrogen. In order to power lower emission steel-making, large quantities of renewable electricity and transmission upgrades will be necessary in comparison to existing blast furnace technology."

Just how much energy is required to make this transition can be seen in the figure below. BSL is not expected to make the transition from gas until 2030.

One way Bluescope is seeking to reduce its carbon emissions is to use natural gas direct reduced iron (DRI) which could cut its emissions by 60%. It is collaborating with Rio Tinto (ASX: RIO), to explore DRI and how it can be applied to Australia's Pilbara blend of ores in conjunction with development of electric smelting furnaces. Macquarie also notes

"Bluescope is also pursing technology collaborations also with Tata Steel, thyssenKrupp Steel and POSCO. It also has the CSIRO (Hadean) hydrogen electrolyser and Green Gravity lab trial."

Up, up and away

Aviation fuel is also undergoing a shift towards sustainable aviation fuel. Macquarie notes that while the Australian government is considering blending targets or mandates for sustainable aviation fuel (SAF) or else low-carbon fuel standards, Qantas (ASX: QAN) is already using SAF sourced overseas for its commercial flights to London, and expects to use SAF to power flights to Los Angeles and San Francisco in FY2025.

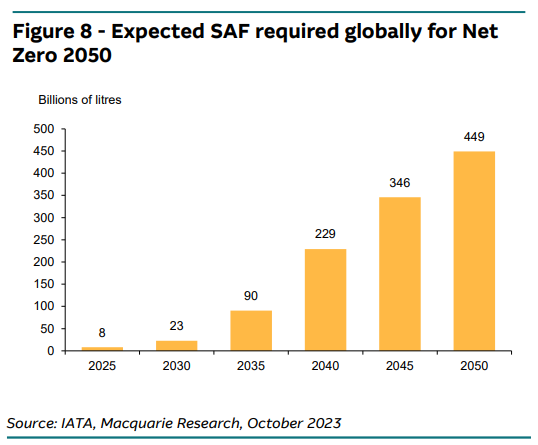

The 300 airlines affiliated with the International Air Transport Association (IATA), responsible for 83% of air traffic, have committed to net zero by 2050. Achieving this via the use of SAF requires a step change in the amount of SAF produced, as Macquarie's research shows.

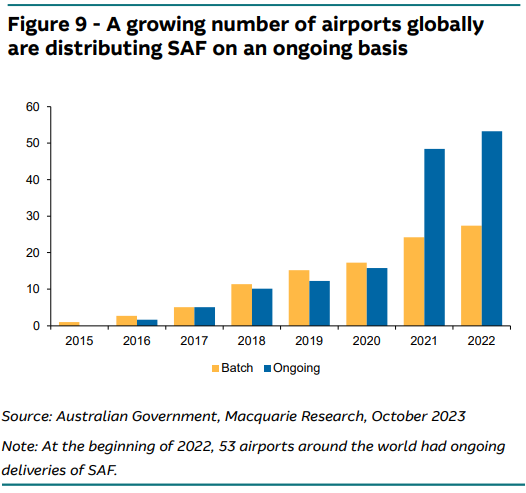

It also requires more airports to distribute that fuel. This is already happening, with the figure below showing the tangential growth in airports offering this on an ongoing basis.

Transition and diversified mining

The significant group of investors who make up the Climate Action 100+ have released the first Net Zero Standard for Diversified Mining. With input from companies in the sector - Anglo American (LON: AAL) BHP Group (ASX: BHP), Glencore (LON: GLEN), Rio Tinto (ASX: RIO), South32 (ASX: S32) and Teck Resources (NYSE: TECK) - and the identification of key transition resources (lithium, copper, graphite, tellurium, nickel, cobalt and neodymium) and a list of other key transition materials - Macquarie notes:

"The standard aims to assist investors in evaluating progress of diversified mining companies as they work towards achieving net zero emissions."

Companies within Macquarie's coverage to whom this benchmark can be applied include not only BHP, RIO and S32, but also Allkem (ASX: AKE), Champion Iron (ASX: CIA), IGO (ASX: IGO), Iluka Resources (ASX: ILU), Mineral Resources (ASX: MIN), Piedmont Lithium (ASX: PLL) and Resolute Mining (ASX: RSG).

Recommendations

In a separate note, Macquarie has an OUTPERFORM rating on Allkem, Champion Iron, IGO, Iluka and Piedmont Lithium. As my colleague Sara Allen notes in this wire, it has increased its holdings of BHP in its portfolio in light of its views on where we are at in the growth cycle and its impact on commodities.