The free money experiment is over - what happens now?

Cast your mind back to March 2020, when the coronavirus pandemic was shutting the world down. To save the economy and thousands of SMEs from going bankrupt, the Australian government dished out $320 billion in fiscal funding and stimulus payments. In addition, the Reserve Bank slashed interest rates twice in a month and purchased hundreds of billions in government bonds.

Between interest rate cuts and government bond purchases, the RBA pumped an extra $120 billion into the economy.

That figure is six times the allotment given during the depths of the Global Financial Crisis in 2008. Furthermore, those bond purchases kept on occurring until as recently as February 2022, creating even more liquidity in the economy. Finally, the $120 billion figure does not include the measures to make loan servicing costs cheaper for the banks or the costs of yield curve control.

All this is to say, the actual figure is probably a lot higher.

Then, in May of this year, the RBA dropped a bombshell that caught millions of mortgage holders and an industry of economists a little off guard. It increased the cash rate by 25 basis points to 0.35%, and added this line to its statement:

The Board judged that now was the right time to begin withdrawing some of the extraordinary monetary support that was put in place to help the Australian economy during the pandemic.

It is this line that will be the subject of this wire - what the professionals call quantitative tightening. After some explanation of what QT is and how it's supposed to work, we'll discuss the challenge of pulling it all off with Dr Isaac Poole, CIO at Oreana Financial Services.

What is it and how is it going to work?

Quantitative tightening (referred to here on in as "QT") is essentially the exact opposite of quantitative easing (referred to here on in as "QE"). QE is the process I described in the introduction to this story - the flooding of cash into the financial system. Thus, QT is the reversal of that flood. Think of it as the "drying out" after the two-year-long flood.

"QE mattered on the way down for rates because there was an effective lower band. That is not the case on the way up. So watching this space is not going to be quite as boring as watching paint dry," Dr Isaac Poole, CIO at Oreana Financial Services says.

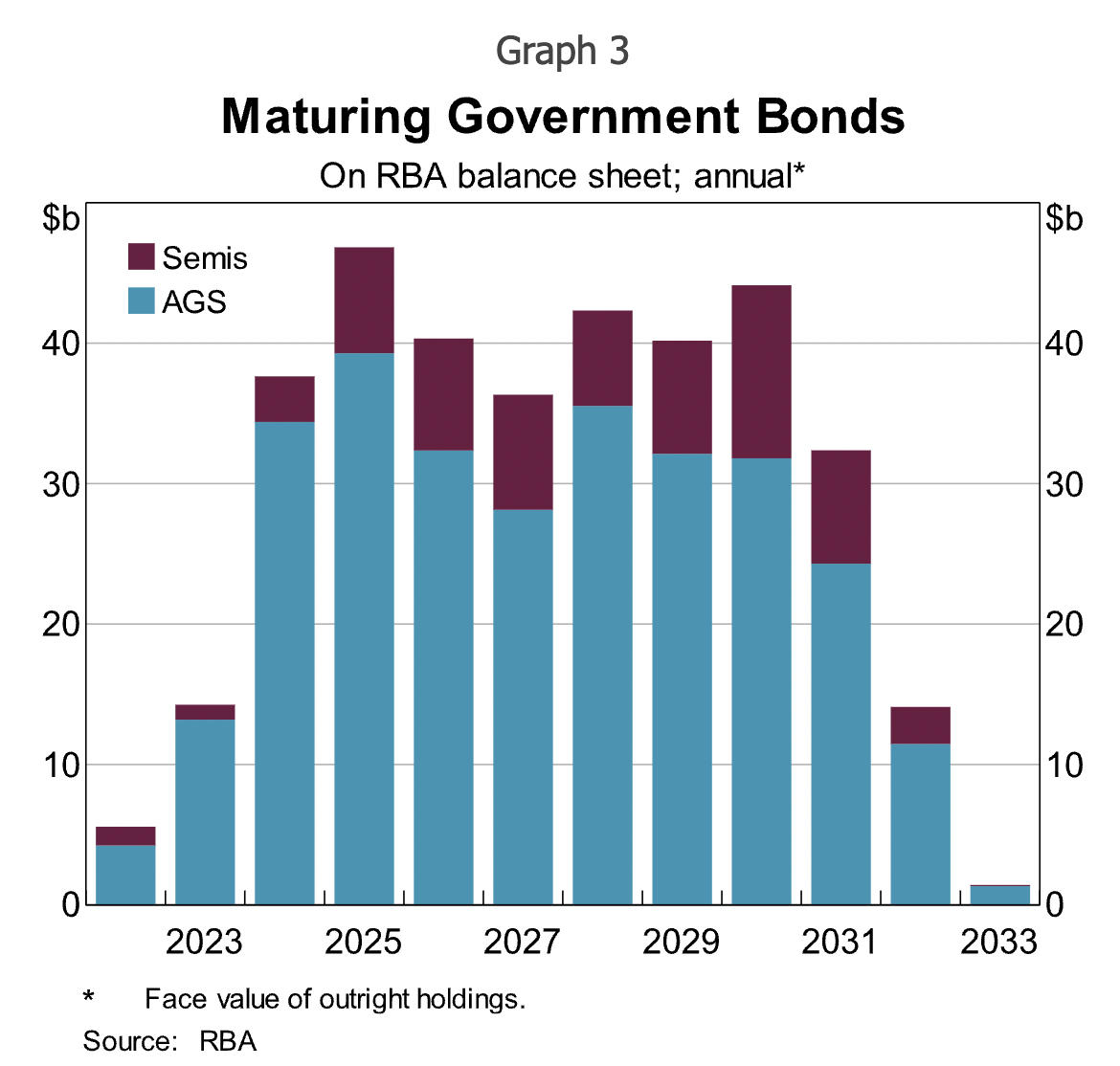

So how are global central banks going to achieve this? In short, global central banks will let the bonds they purchased reach maturity (i.e. let the bond reach its repayment date) and run off their balance sheet (i.e. not reinvest the interest plus principal it earned from that bond).

Remember, central banks had to buy these bonds to create more money supply. If you like, you can think of it as intentional magic. Now, the unwind process is such that the Treasury will pay the RBA/Federal Reserve/whoever at the date of when the bond expires. This process will also be more or less the same around the world. By not reinvesting the cash they've made, they are effectively making the money disappear.

The dates for those occurrences in Australia are noted in this chart from the RBA, which obviously didn't want to make their opinions on the State of Origin known:

Sounding all too complicated?

It is. It's also not going to be an easy task. In Australia, the unwind total is at least $120 billion while in the US, the total is US$9 trillion. And in the UK, the figure is £1 trillion but a recent interview with Reuters caught more than a few people's attention:

Isaac sees the challenge very differently, arguing the consensus around persistent inflation is "lazy" and "baffling". He is calling for the Federal Reserve to actually pause its rate hike path in order to avoid creating a new kind of recession.

"It's not a pivot. They don’t need to cut. But if they hike to the levels the markets were pricing, then they will cause an entirely avoidable recession sooner than necessary," Isaac argues.

Could we have avoided this whole crisis?

Many market professionals have argued we could have avoided the bulk of the current economic situation if central banks had started this process sooner. The idea is that central banks should have been more cognisant of the impact of their bond purchasing programs, and what the impact of those extra billions in stimulus meant for the economy. After all, a period of free money in a locked-down world was going to be used eventually - it was just a matter of how and when. Indeed, this is where the phrase "behind the curve" has come from.

The timing of commencing QT also has a big impact on interest rate expectations and asset prices.

"QT may increase the term premium on government bonds. But even with some term premium from QT, it will be the cash rate that dominates. And we think that increase to a lower level than the market anticipates," Isaac says.

But what about the pace of the wind back? Does it matter, or is it more pertinent to ask when will it matter?

"The speed matters only if central banks dump bonds indiscriminately and spook the market. We are a long way from that, though," Isaac says.

So where should you invest?

The short answer? Fixed income and plenty of it. After more than a decade of being in the investment doghouse, bonds are presenting attractive opportunities. Where the professionals differ, is with regard to which maturities you should buy.

"We moved to a neutral position on government bonds in June. It was just too compelling. Government bonds went from being highly underweight in our portfolios to being a meaningful diversifier, income generator, and downside protection. And for what it is worth, we think they will be critical whether we get a deep recession (not our base case), or if we achieve a soft landing," Isaac says.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

3 topics