The Great Unwind

Our summer holiday unwind is now well and truly behind us with our local reporting season in full swing. However, the other great unwinds that have captured investors’ attention recently are the withdrawals of extraordinary stimulus measures and the global unravelling of growth stocks. The extent that this unwind will continue has been a contentious topic, like many others so far this year (Russia-Ukraine tensions… for example).

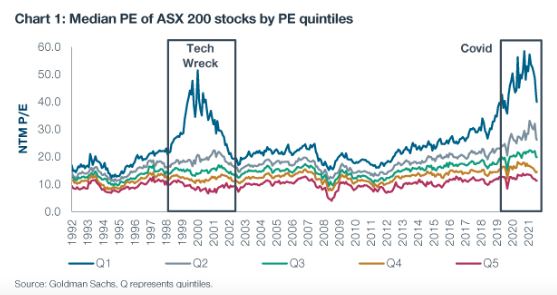

Excess policy measures bred some valuation excesses. The gap between the top 20% of PEs and the next 20% rose to levels not seen since the Tech Bubble (Chart 1). With the handbrake being squeezed on excess stimulus, it is not surprising to see excess valuations correct.

These areas of excess will likely be those that take the longest to recover, just as they did during the Tech Wreck. As Warren Buffet once said, it is only when the tide goes out that you discover who has been swimming naked.

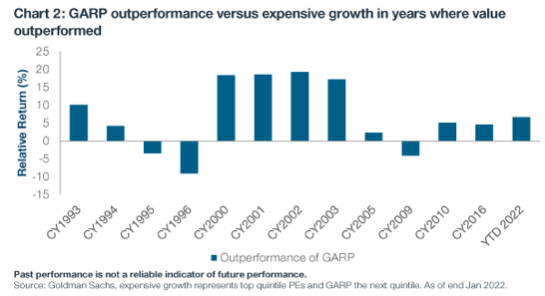

At the same time, the falling tide of excess stimulus has also hurt a lot of the more modest growth names (or what some refer to as “Growth At A Reasonable Price (GARP)”) that to us still represent quality businesses.

In turn, the recent sell-off has also presented good opportunities to take advantage of, rather than de-risk and reduce exposure entirely. During periods where value has outperformed, these GARP names have beaten their more expensive counterparts (Chart 2).

Looking ahead, we believe the unwind of monetary and fiscal policy excesses will continue. We have written in the past about the real risk of a policy error by the Fed if it hikes too aggressively into a downturn.

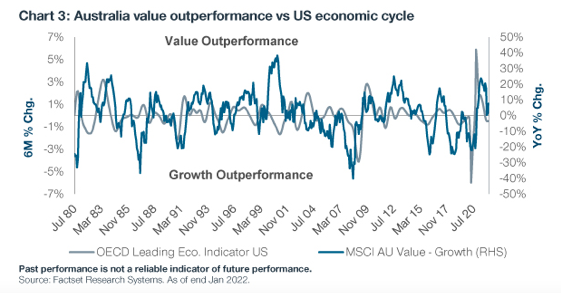

Most leading indicators already point to an economic downturn both here and in the US. In effect, significant stimulus recreated the traditional boom-bust economic cycle. We have witnessed the boom, next it will be followed by the bust. We want to be underweight value and overweight growth when this happens.

Longer-dated yields also suggest rates will not rise significantly in this cycle. Shorter-term rates have already risen and central banks are now simply following market expectations with many, particularly the Fed, well-behind the curve on fighting inflation. Such an environment has typically been positive for growth, which makes sense, as when investors are concerned that the broader economic landscape is weak, they will seek out names that can deliver the growth needed for their portfolios.

Overall, in an era of excesses being unwound and some mean reversion, we prefer not to be too far out the risk spectrum. We believe that by spreading our risk between areas of attractive growth and quality names, based on fundamentals, we can potentially deliver the most consistent outcome for our clients. Similarly, we hope that any excesses accumulated from indulging over the holiday period will also mean-revert.

Invest with confidence

T. Rowe Price focuses on delivering investment management excellence that investors can rely on—now and over the long term. Hit the 'follow' button below for more of our investment insights.

2 topics

1 contributor mentioned