The Match Out: Another +100pt week, commodities lead the ASX higher into the weekend, Whitehaven impresses

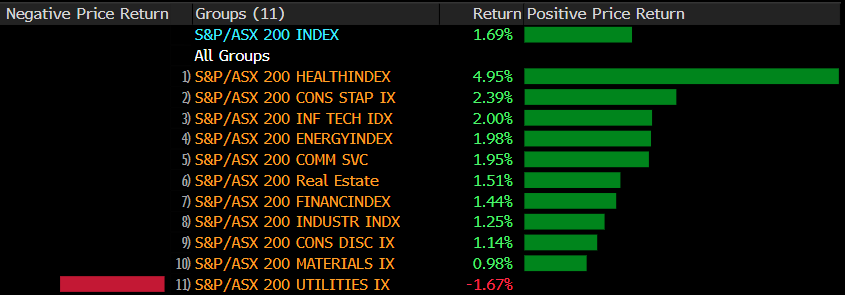

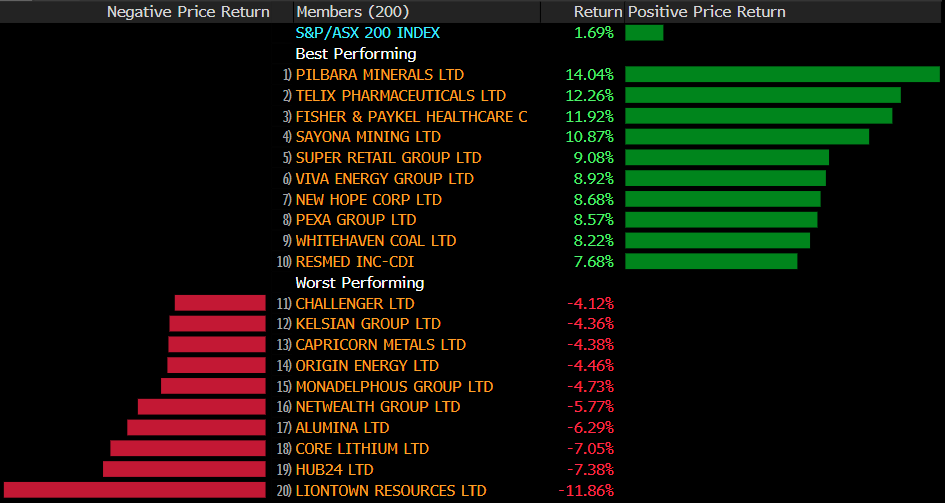

The ASX punched new 8-month highs for the fifth consecutive session today with the bulls outlasting some lunchtime wobbles to trade higher into the close. It was the commodity sectors of energy and materials leading the charge, and impressively carrying the index as less than half of the shares in the ASX200 closed higher on the day. Telcos were the main drag on the index, but most surprising was a fall in the Financials despite the green session. The ASX climbed more than 1% for the week for the third consecutive time, adding 124pts / +1.69%.

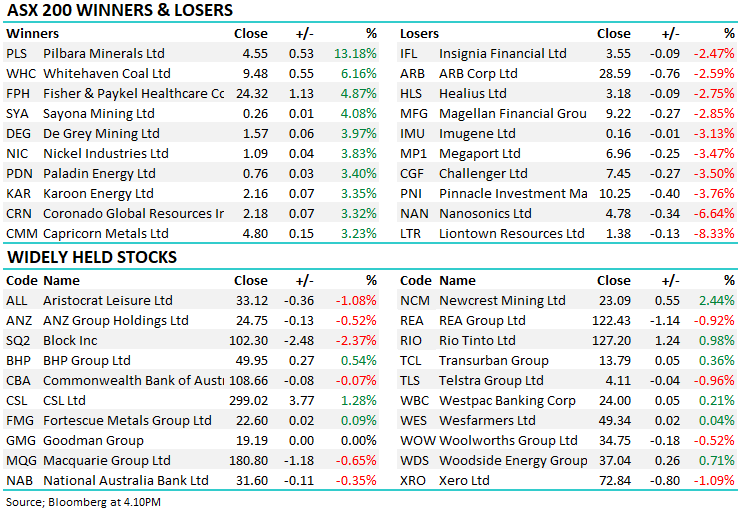

- The ASX 200 finished up +16pts/ 0.23% at 7452

- The Energy sector was the standout today, rising 1.40%. Materials (+0.86%) and Healthcare (+0.68%) were also strong

- Communication Services (-0.91%) was the weakest sector today, followed by Consumer Discretionary (-0.50%) and Financials (-0.28%)

- Whitehaven Coal (WHC) +6.16%, one of the reasons Energy was strong today, announced a strong 2Q production set. More on that below.

- Pilbara (ASX: PLS) +13.18%, rallied to a 5-week high on their own production update out yesterday. Spodumene production was up 10% QoQ and prices for their product remained strong after a review of offtake agreements.

- Fisher & Paykel (ASX: FPH) +4.7%, the NZ-based healthcare company revised FY23 revenue higher following strong demand late in 2022 thanks to an early US flu season and better than expected China demand.

- Liontown (ASX: LTR) –8.33%, struggled after saying costs to deliver their Kathleen Valley project would be higher than expected, likely leading to further capital raises.

- Iron Ore was 1.12% higher in Asia today and Rio Tinto (RIO) saw the best of the gains as a result, up 0.98%

- Gold was strong overnight, but gave back $US8 today to US$1924. Northern Star (NST) was up more than 3% on the move

- Asian stocks were also strong today, Japan’s Nikkei up +0.35%, Hong Kong Hang Seng 1.22% and China 1.80%. Most markets in the region will be closed on Monday for the Lunar New Year.

- US Futures are pointing to a positive end to the week, S&P500 +0.22% and the Nasdaq futures are +0.

ASX 200 Chart

Whitehaven Coal (WHC) $9.48

WHC +6.16%: the largest coal stock on the ASX traded to new YTD highs today following a solid 2Q production update. Despite battling continued wet weather, the company managed Run of Mine production of 4.84mt, up 21% qoq to see EBIT at $2.6b in the first half. Prices came off, but they are still earning a strong margin at the average price for the quarter of $527/t. They maintained cost and production guidance for the year and noted they have seen strong demand come through for shipments in the back end of this half which should see prices remain robust.

Sectors this week

.png)

Stocks this week

Broker Moves

- Nanosonics (ASX: NAN) Cut to Hold at Morgans Financial Limited; PT A$5.19

- Dexus (ASX: DXS) Cut to Hold at Jefferies; PT A$8.63

- Stockland (ASX: SGP) Cut to Hold at Jefferies; PT A$3.87

- Charter Hall Retail (ASX: CQR) Raised to Buy at Jefferies; PT A$4.32

- Northern Star (ASX: NST) Cut to Accumulate at CLSA; PT A$13

- Challenger (ASX: CGF) Cut to Sell at Citi; PT A$7

- Alumina (ASX: AWC) Cut to Sell at Citi; PT A$1.50

- BHP Group (ASX: BHP) Cut to Hold at Morgans Financial Limited; PT A$47

- Silex Systems (ASX: SLX) Cut to Speculative Buy at Canaccord; PT A$4.69

- Netwealth (ASX: NWL) Cut to Hold at Jefferies; PT A$14

- Nanosonics (ASX: NAN) Cut to Sell at Bell Potter; PT A$3.85

Major Movers Today

Have a great night,

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

13 stocks mentioned