The Match Out: ASX cools on hotter than expected employment, Corporate Travel prints a big ticket

The market finally cooled today with a stronger-than-expected March employment report the catalyst which increases the chances of the RBA going one more time, although our expectation is they’ll sit tight at 3.60% come the May meeting. This flies in the face of what most economists expect, although market pricing is more in our corner, pricing only a ~10% chance of a further move. The ASX saw the best of the day early, before tapering off into the afternoon session – not surprising after a very solid run over the past 3-weeks.

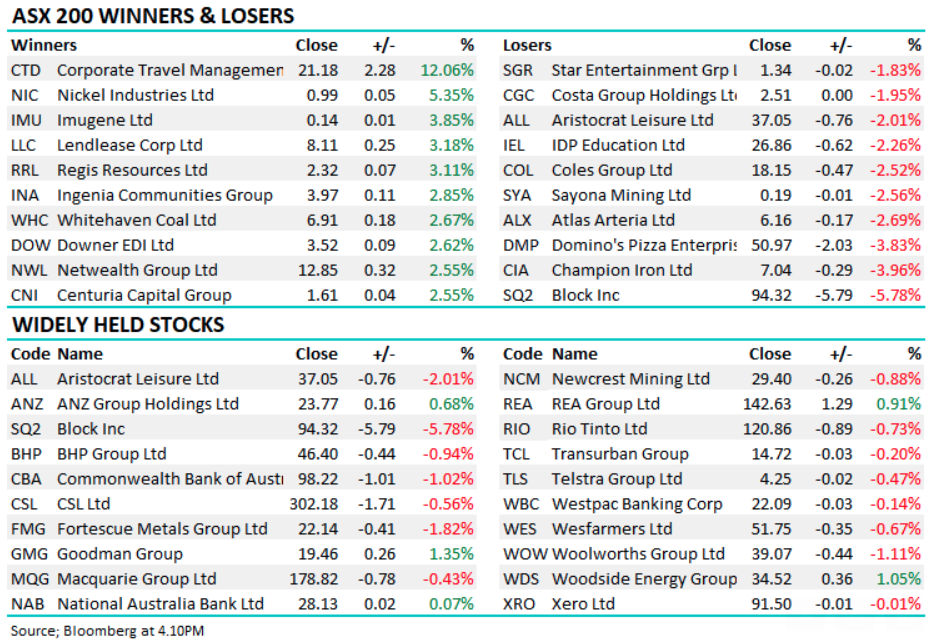

- The ASX 200 finished down -20pts/ -0.27% at 7324

- The IT sector was best on ground (+0.99%) while Energy (+0.88%) & Real-Estate (+0.54%) were also strong.

- Consumer Staples (-1.19%) and Consumer Discretionary (-0.65%) the weakest links.

- The unemployment rate stayed steady at 3.5% thanks to +53k jobs being added in March, above the +20k expected.

- We sent out Portfolio Performance Reports for March today for our Market Matters Invest Portfolios

- The Active High Conviction Portfolio (aligned to Flagship Growth) added +2.16% in March outperforming the ASX200 Accumulation Index by 2.24%. It has done 21.46% pa for the past 3 years – Read the update here

- The Active Income Portfolio added +0.06% in March, underperforming its absolute return benchmark of +0.63% - Read the update here

- Corporate Travel (CTD) +12.06% was a star performer today after winning a large contract with the UK home office – more on this below.

- Sandfire Resources (ASX: SFR) +2.21% continues to defy gravity, the strength is hard to question and we remain patient holders for now at least. Credit Suisse upgraded to a Neutral call today having been a SELL and $5 PT since January. Ouch!

- Wesfarmers (ASX: WES) -0.67% sold their last remaining piece of Coles, offloading their 2.8% stake worth $688m at $18.50 overnight – Coles closed at $18.15, a good trade by WES!

- Whitehaven Coal (ASX: WHC) +2.67% bounced back after yesterday’s production downgrade.

- The recovery in Dominoes (ASX: DMP) -3.83% faltered today and while the stock is up ~17% from last month’s lows, it’s still ~36% below its 12-month high – not one for MM.

- Centuria Capital (ASX: CNI) +2.55% has been a position that has hurt our Income portfolio, and while we’re always conscious of what the market is telling us, we think this remains very undervalued for the quality and optionality within their business – and ~$1.60 remains a compelling entry into CNI. We’re currently down ~20% on the position, while we are taking our book, this is a BUY in our view at current levels.

- Iron Ore was knocked ~3% lower in Asia today weighing on Fortescue (ASX: FMG) -1.82% & RIO -0.73% while BHP was down -0.94%

- Gold was up US$5 in Asian trade today, settled $US2020 at our close.

- Asian stocks were mixed, Hong Kong down -0.67%, Japan +0.36% while China fell -0.31%

- US Futures are marginally higher, up around +0.10%

ASX 200 Chart

Corporate Travel (ASX: CTD) $21.18

CTD +12.06%: The corporately focussed travel management company rallied to 8-month highs today on the back of a big contract win with the UK Home Office. The deal will see Corporate Travel manage the Bridging Accommodation & Travel Services contract for 2 years, with an additional 1-year option for the client which is estimated to do $1.5b in total transaction value (TTV) per year, which is huge. To put this in context, CTD did $4.2b in TTV for the first half, this deal represents around 17%. Corporate Travel is well established in the region with a dedicated internal team ready to go. Travel, both international & domestic, is expected to continue to rebound and surpass pre-COVID levels in 2024.

Broker moves

- Westpac Raised to Neutral at Macquarie; PT A$23

- Bendigo & Adelaide Raised to Buy at Citi; PT A$9.75

- South32 Raised to Outperform at Credit Suisse; PT A$4.65

- Northern Star Raised to Outperform at Credit Suisse; PT A$14.50

- Sandfire upgraded to Neutral at Credit Suisse; PT A$6.65

- Regis Resources Raised to Outperform at Credit Suisse; PT A$2.70

- IGO Raised to Buy at Goldman; PT A$13.90

- JB Hi-Fi Raised to Neutral at Goldman; PT A$44.50

- LGI Ltd. Rated New Hold at Bell Potter; PT A$2.56

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

7 stocks mentioned