The Match Out: ASX enjoys a pullback in bond yields, Portfolio Performance for February

Markets @ Midday: Daily podcast each trading day at lunchtime – Listen Here

A choppy session that saw the best of it early thanks to a bullish session overseas where stocks continue to climb the wall of worry. Interest rate-sensitive sectors were the driver today with Aussie 3-year yields off 9bps underpinning buying in retail, IT and Property sectors ahead of key central-bank updates headlined by the RBA tomorrow (+25bps expected) & Fed Chair Jerome Powell’s semi-annual testimony to the US Senate on Wednesday.

- The S&P/ASX 200 added +45 points / +0.62% to close at 7328.

- Consumer Discretionary (+1.95%), IT (+1.77%) & Property (+1.7%) the standouts today.

- Energy (-1.14%) and Utilities (-0.43% the biggest drags while Materials (-0.25%) also underperformed.

- Market Matters Portfolios had a tougher month in February versus a very strong January where the Growth Portfolio put on more than 8%.

- The Flagship Growth Portfolio fell -2.3% (index -2.45%) – this portfolio is +18.75% in FY23 versus the index +13.80% & on a 3 year view it’s tracking +14.12% v Index +7.93%

- The Active Income Portfolio fell (-1.67%), is +8.82% FY23 to date and +10.01% over 3 years.

- The Emerging Companies Portfolio fell -4.24%, is +11.84% FY23 to date & +7.23% over 3 years (v small ords +4.24%)

- The International Equities Portfolio was flat, is +13.44% FY23 to date & ++12.90% over 3 years.

- GQG Partners Inc (ASX: GQG) +1.38% Reports a fall in FUM from $92bn in Jan to $90.8bn in Feb.

- Magellan Financial Group (ASX: MFG) +2.3% – saw net outflows of $0.8bn from $46.2bn in Jan to $45.4n in Feb – MM saw net inflows, but not the full $800m that MFG lost unfortunately!!!

- Portfolio Manager Harry Watt discussed the sector this morning and our thoughts around this – Watch Here

- A few stocks caught our eye today, particularly in the Tech sector – Xero (XRO) +3.7% and looks very good here, Altium (ASX: ALU) +1.22% was higher today despite trading ex-dividend – one of our largest holdings in the Growth Portfolio.

- James Hardie (ASX: JHX) +3.35% was also strong and one we like at this depressed level – we think buying around $30 here will pay dividends over the next 12 months or so.

- Aussie Broadband (ASX: ABB) +1.48% is a stock Harry highlighted in a Webinar last week (

- ) - ABB looks ideally positioned from here and it remains our largest holding in the Emerging Companies Portfolio.

- Coal stocks hit again with Newcastle Coal Futures off ~3%, this dragged down Whitehaven Coal (ASX: WHC) -2.14%, New Hope Corp (ASX: NHC) -2.77% although Bowen Coking Coal (ASX: BCB) +7.69% bucked the trend after a tough period where it looked like a few big sellers are now done there.

- Silex Systems (ASX: SLX) -1.18% has been whacked post a recent capital raise (which Shaw was involved in). We didn’t participate, however now it’s trading ~17% below the placement price it’s looking more interesting for our Emerging Companies Portfolio.

- Iron Ore fell ~3% in Asia, front month coal now ~US$188.90

- Gold was subdued, -US$2 to $US1855 at our close.

- Asian stocks were mixed, Hang Seng was up +0.30%, the Nikkei in Japan put on +1.25%, while China fell -0.74%

- US Futures are up a touch

ASX 200 Chart

Lynas Resources (ASX: LYC) $7.45

LYC-4.49%: slipped to a 4-month low today before recovering somewhat, though it is still down 14% over the past 3 months. The recent weakness largely stems from Tesla (TLSA) announcing they were working on replacing the rare earth materials in their EVs to reduce costs. While they are committed to the comment, it was hard to pinpoint the technology required to replace the rare earth materials used within the engine. Additionally, EVs are just one application of Lynas’ products which are vital in a range of applications in clean energy generation & distribution, while Tesla is just one EV manufacturer. There is a very broad range of analyst price targets in the market for Lynas at the moment, ranging from a sell at $6.70 and the highest buy at $12.78. We think the sell-off has been overdone on fears the company’s Kalgoorlie plant ramp-up will take longer than expected with Lynas managing inventory well to limit any downside in the event there is a production gap come 1 July when their Malaysian licence conditions change.

Broker Moves

- Macquarie Telecom Raised to Buy at Goldman; PT A$73.30

- Region Group Raised to Neutral at Macquarie; PT A$2.52

- Sonic Healthcare Raised to Buy at Citi; PT A$36

- Pro Medicus Raised to Neutral at Citi; PT A$61

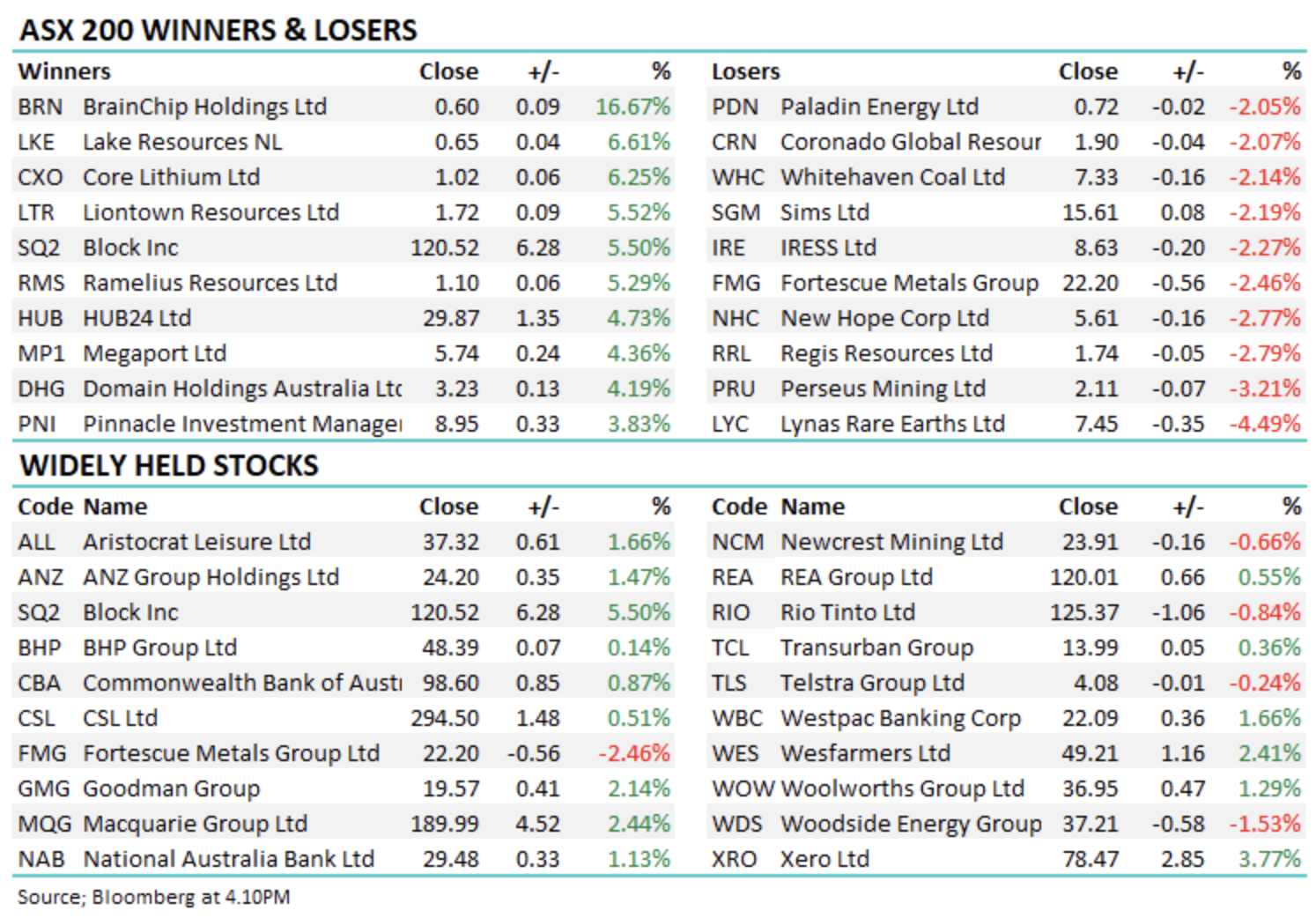

Major Movers Today

Enjoy your night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

10 stocks mentioned