The Match Out: ASX hits five-month high as inflation behaves, Mineral Resources up on quarterly result

Markets @ Midday: Market Matters Midday update with Harry Watt – Listen Here

The ASX hit a five-month high today thanks largely to inflation that again went in the right direction, while strength across the commodity stocks continued on the expectation of Chinese stimulus. There was a slew of company news to keep markets on their toes as well, less than a week out from the start of reporting season.

- The S&P/ASX 200 gained +62pts points / +0.85% to close at 7402

- Materials (+1.83%) was the best on the ground. Tech (+1.15%), Consumer Discretionary (+1.08%) & Financials (+1.08%) were the best of the rest.

- Real Estate (-0.49%), Healthcare (-0.49%) and Utilities (-0.34%) were the only sectors lower.

- Softer-than-expected inflation data saw bond yields and the Australian dollar lower, stocks higher and now the rising probability of a pause to local interest rates on Aug 1.

- The Aussie Dollar lost 0.8% in a heartbeat before edging up by the close, settling at 67.61 US cents.

- Mineral resources (ASX: MIN) +4.05% was higher after reporting largely inline production results – more on that below

- Sports software & data company Catapult (CAT) +5.71% hit a multi-year high after saying it expects to turn free cash flow positive in financial 2024 – a tough few years for CAT but things are improving.

- The same was true for Kogan (ASX: KGN) +9.97% as they hit a 52-week high after its trading update showed green shoots. Inventory levels were a major issue for the company not that long ago, now down 57% in 12 months.

- Corporate Travel (ASX: CTD) +0.91% had a choppy session after reshaping (only slightly) FY23 earnings guidance. In Feb they guided to EBITDA of $160-$180m before sharpening the pencil today saying it will be $165-$170m, although consensus was already at $165m. A bit of nothing update really.

- Austal (ASX: ASB) -10.51% downgraded guidance from a profit of $538m to a loss of $US0-10m – a large change in expectations. The downgrade was on the back of lower efficiency rates on their steel ship builds and specification changes impacting US rescue ship contracts. The stock recovered from lows after trading -22% early.

- Rio Tinto (ASX: RIO) +1.37% edged higher before they report 1H results, looking for revenue of $US25.8bn, Net Profit of US$5.7bn, EPS of $US3.57 & a $US2.00 dividend.

- Iron Ore continues to trade higher, adding -3.53% defying concerns around a looming uptick in supply with the focus on China stimulus, Fortescue (ASX: FMG) +2.28% higher as a result.

- Gold was marginally higher at $US1967 at our close.

- Asian stocks were softer, Nikkei holding up the best with a drop of -0.13%. Hang Seng was down -0.53% at our close

- US Futures are largely flat.

- In the US overnight. Microsoft (NASDAQ: MSFT) and Alphabet (NYSE: GOOG) reported after mkt, both were better but Alphabet got the gong trading +6% higher after hours, while Microsoft fell ~3%.

- Tonight will be dominated by the Fed’s decision on interest rates, it will be a big (positive) surprise if they don’t hike with around a 98% probability of a higher cash rate priced in.

- Tomorrow night we have a bunch of companies we own in our International Equities Portfolio reporting, including First Solar (NYSE: FSLR), Peabody Energy (NASDAQ: BTU), Brunswick (NASDAQ: BC-A) and Chipotle Mexican Grill (NASDAQ: CMG).

ASX 200 chart

.png)

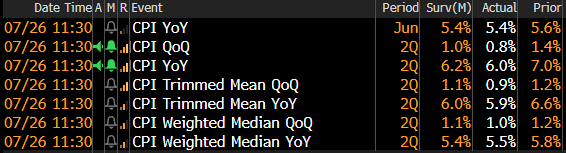

Inflation data

Inflation data for June out at 11.30am today came in below expectations and the market now believes the RBA will pause on rates this coming Tuesday. For June, prices increased 5.4% YoY (below 5.6% exp) while QoQ the 0.8% rate was below the 1.0% economists had tipped. Inflation peaked in December 2022 at 8.4% and if we (roughly) annualise the QoQ run rate we get a figure of 3.25%, and its falling – this is clearly good news.

In terms of the composition, we saw goods inflation continue to decelerate, although services inflation remains an issue. Food inflation +7.0%, Housing +7.4%, Holiday and travel 12.9%, Insurance +8.5% while core inflation (ex-volatile items and travel) was still up +6.1%.

Interest Rate Futures are now (only) pricing a 17% chance of an August hike with just 20bps of further tightening priced in by the market. There is a growing possibility that 4.10% will be the peak of this cycle, and if not, 4.35% is odds on, before we start talking interest rate cuts later in the year.

- Bond yields fell, as did the AUD while stocks rallied.

Australian Inflation Data for June – Source Bloomberg

.png)

Mineral Resources (MIN) $73.82

MIN +4.05%: Rallied today despite a quarterly update that was generally in line. Mining Services volumes were largely as expected, ditto for Iron Ore although they said costs would be at the higher end of the guided range (US$73-81/t). In Lithium, Spodumene shipments were a touch low but chemical sales were in line for the quarter & full year, while they also gave some more colour around their decision to amend the deal with Albemarle which was announced earlier in the week. We ultimately think this is a good move from a balance sheet perspective and gives MIN more optionality around the business.

Global Lithium (GL1) $1.72

GL1 +6.85%: while there was some recovery across lithium stocks today, Global Lithium saw a stronger-than-sector move higher thanks to a resource upgrade at their Manna deposit near Kalgoorlie in WA. The latest resource estimate increased to 36Mt of lithium at a grade of 1.13%. This is a 25% increase in lithium with a 13% increase in grade mostly coming from unconfirmed assay results from the 2022 exploration program. This upgrade to the resource follows the recent announcement regarding significant strikes of rare earth elements. The company will continue to expand the resource with a further 50,000m of drilling to get underway, likely to lead to another upgrade next year if results are similar, while a Definitive Feasibility Study is running concurrently.

.png)

Broker moves

- Mader Group Cut to Hold at Moelis & Company; PT A$6.31

- ASX Cut to Underweight at Morgan Stanley; PT A$55.55

- Pilbara Minerals Cut to Hold at Morgans Financial Limited

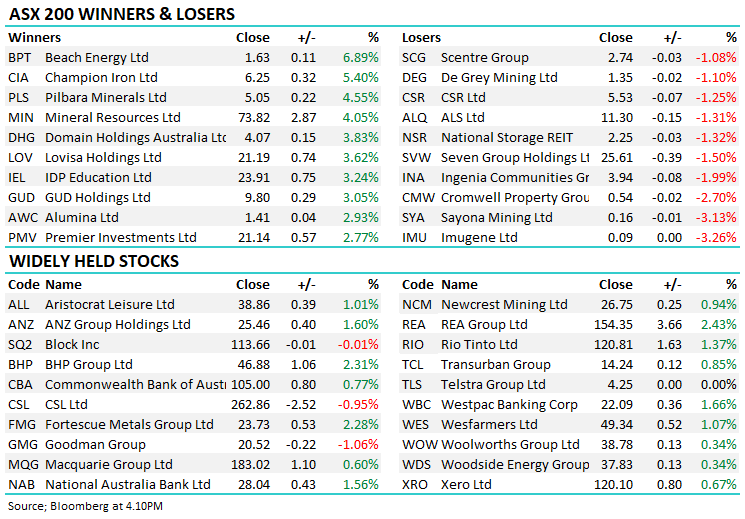

Major movers today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

3 topics

12 stocks mentioned