The Match Out: ASX holds 7500 on the back of Materials strength, Pinnacle (PNI) tumbles on downgrade, Flight Centre (FLT) returns from halt

- The ASX 200 finished up +25pts/ +0.33% at 7501

- The Real Estate sector was best on ground (+1.37%) while Industrials (+0.70%) & Materials (+0.68%) were also strong.

- Energy (-1.16%), Tech (-0.42%) and Utilities (-0.09%) were the only sectors to close lower.

- Pinnacle Investment Management (ASX: PNI) -7.21%, copper a downgrade by UBS today, in line with our views that FUM flows may disappoint this reporting period. We took a profit on our position today.

- The Reject Shop (ASX: TRS) +1.71%, CEO announced his departure for personal reasons after just 7 months. The company said 1H revenue is likely to climb 4% and EBITDA around 12% while sales for the first few weeks of 2023 were strong.

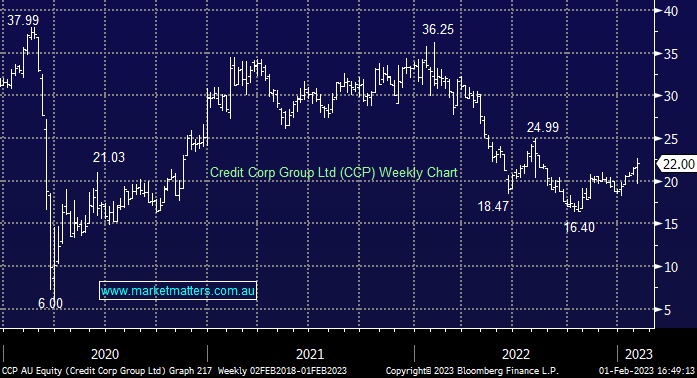

- Credit Corp (ASX: CCP) +1.66%, first half results today were a little disappointing, however, the stock rallied after the company maintained FY guidance.

- Flight Centre (ASX: FLT) +8.09%, returned to the market after successfully raising $180m to fund the acquisition of UK based Scott Dunn. More on FLT below.

- Nufarm (ASX: NUF) -1.86%, hosted their AGM today, reiterating long-term targets remain achievable. The market was less impressed with the detail at the AGM, giving the company no benefit of the doubt here.

- Iron Ore was ~0.4% lower in Asia today though not seeming to bother the big miners with BHP (ASX: BHP), Fortescue (ASX: FMG) and Rio Tinto (ASX: RIO) all closing higher

- Gold was flat in Asian trade today, settled $US1927 at out close.

- Asian stocks were also strong today, Hong Kong down +0.36%, Japan +0.11% while China was up +0.32%

- US Futures are all trading lower, around -0.25% for the S&P500 Futures.

ASX200

Weekly Video Update - Portfolio Performance

- Flagship Growth Portfolio: January +8.9%, FY23 20.96%

- Active Income Portfolio: January +3.18%, FY23 10.51%

- Emerging Companies Portfolio January +8.36%, FY23 15.51%

- International Equities Portfolio January +6.46%, FY23 12.94%

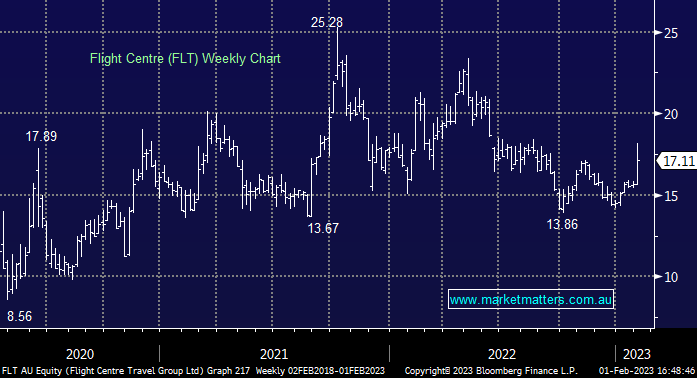

Flight Centre (ASX: FLT) $17.11

FLT +8.09%: rallied after completing a big $180m raise to help fund the acquisition of UK’s Scott Dunn. The company said the acquisition will be EPS accretive in the mid-teens while also giving them more leverage to the UK market as well as increased exposure to luxury holidays. Scott Dunn did ~$200m in transaction value and $51m in revenue last year with more than 70% of bookings coming from the UK. Flight Centre expects 1H revenue of $1b, EBITDA of $95m while guidance for the full year was $250-280m EBITDA, in line with expectations. The raise was completed at $14.60/sh with retail holders now eligible to bid into the Share Purchase Plan (SPP0 at the same price).

Flight Centre (ASX: FLT)

Credit Corp (ASX: CCP) $22.00

CCP +1.66%: 1H report for the debt collection company was out this morning with the stock initial negative reaction overrun by the session’s end. Net profit for the half fell 30% to $31.8m on the back of US restructuring costs and higher provisioning. These costs are likely to unwind into the second half, with provisioning seemingly conservative at this stage. CCP has struggled to buy debt ledgers given the current health of debts globally, however this has also helped recoveries. The company stuck to full year NPAT guidance but lifted their ledger investment highlighting the need to pay up here.

Credit Corp (ASX: CCP)

Broker Moves

- Liberty Financial Group Ltd Raised to Outperform at Macquarie

- Pepper Money Cut to Neutral at Macquarie; PT A$1.70

- Top Shelf International Cut to Market-Weight at Wilsons

- Resolute Mining Raised to Buy at Canaccord

- IGO Cut to Sell at Canaccord; PT A$13.50

- Charter Hall Long WALE Raised to Buy at Ord Minnett; PT A$4.87

- Deterra Cut to Hold at Canaccord; PT A$5.10

- Lifestyle Communities Cut to Hold at Ord Minnett; PT A$18.25

- Megaport Cut to Hold at Canaccord; PT A$6.30

- Gold Road Cut to Underperform at RBC; PT A$1.50

- Harvey Norman Cut to Neutral at JPMorgan; PT A$4.70

- Coles Group Cut to Underweight at JPMorgan; PT A$16

- Beach Energy Cut to Underperform at Macquarie; PT A$1.45

- Beach Energy Raised to Add at Morgans Financial Limited

- Universal Biosensors GDRs Cut to Speculative Hold at Bell Potter

- Neuren Cut to Speculative Hold at Bell Potter; PT A$8.60

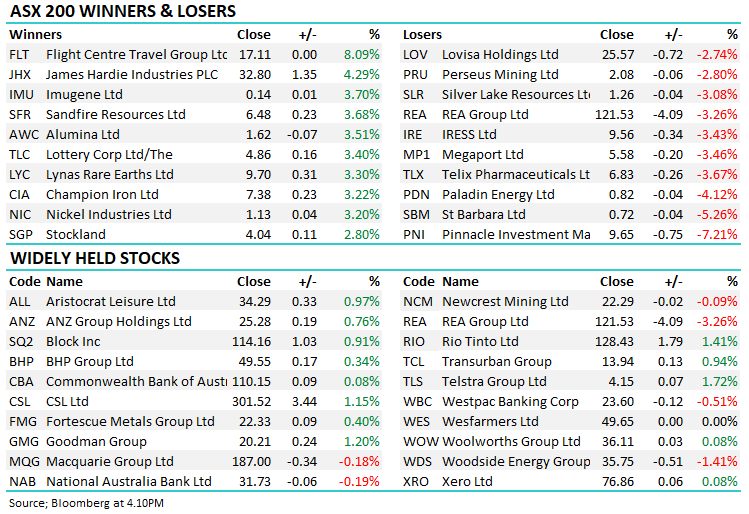

Major movers today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

8 stocks mentioned