The Match Out: ASX nudges into positive territory for the quarter

End of month and end of quarter today and it’s been a challenging one to say the least, with a raft of macro-economic landmines to navigate through. However, when the bell rang this afternoon, the ASX 200 had finished up +0.74% having traded in a big ~10% quarterly trading range. The Energy sector put on +25% in the March quarter, the IT stocks fell by -14% showing the two extremes, however there was a lot happening in between these outliers.

Today the market closed a tad lower, it was strong early before a sell-off took hold post lunchtime ahead of a big MOC order that saw the ASX fall -20 points in the match out – the intra-day chart below highlights this well.

- The ASX 200 finished down -14pts/ -0.20% at 7499

- The Materials sector was best on ground (+1.46%) while Communications (+0.73%) & Industrials (+0.17%) were also strong.

- IT was down (-2.18%) and Consumer Discretionary (-1.30%) were the weakest links.

- For March, the ASX 200 rallied +5.68%, the strongest March since 2009 and the best monthly gains since November 2020,

- It’s not often that the Utilities sector rallies 9.04% in a month, particularly against a backdrop where interest rates have risen so sharply.

- Energy +8.58% & Materials were also strong while Healthcare's +1.20% move was the weakest link.

- For the quarter, the Australian 3 year bond yield has moved from 0.80% to 2.33% - you don’t see that every day!

- Iron Ore was ~2.5% higher in Asia today supporting Fortescue (FMG) +4.34%

- Gold was down ~US$9 to ~US$1923

- Asian stocks were lower, Hong Kong down -1.29%, Japan -0.54% while China was off -0.59%

- US Futures are marginally higher.

ASX 200

ASX 200 quarterly review

A very choppy quarter for stocks with the ASX trading in a ~10% range ending marginally higher. Selling at the wrong time over the past 3 months would have been very costly.

Australian 3 year bond yields

Australian 3 year bond yields started the period around 0.80% and finished it at ~2.33%. That is simply a huge move in bonds

Broker Moves

- Lunnon Metals Rated New Speculative Buy at Foster Stockbroking

- Hotel Property Rated New Hold at Barclay Pearce Capital

- Aussie Broadband Cut to Hold at Jefferies; PT A$5.60

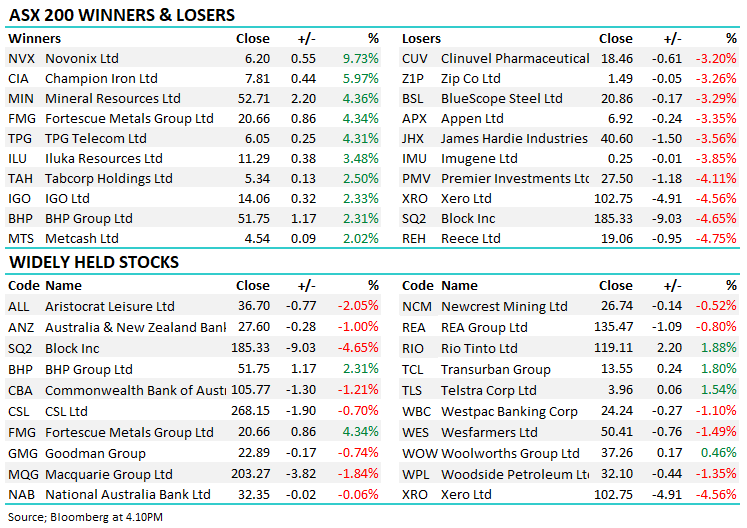

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

3 topics

6 stocks mentioned