The Match Out: ASX pulls back, Macquarie rallies, Weekly Video Update

The market opened on the backfoot again this morning with Futures down around 60 points early before rallying from the lows – it’s been the playbook for the last week, it seems, although today we did finish below the session highs.

COVID continues to dominate the news flow, the bickering between the States is getting old – FFS, we don’t need political BS to end a pandemic that has cost so many people and businesses so much.

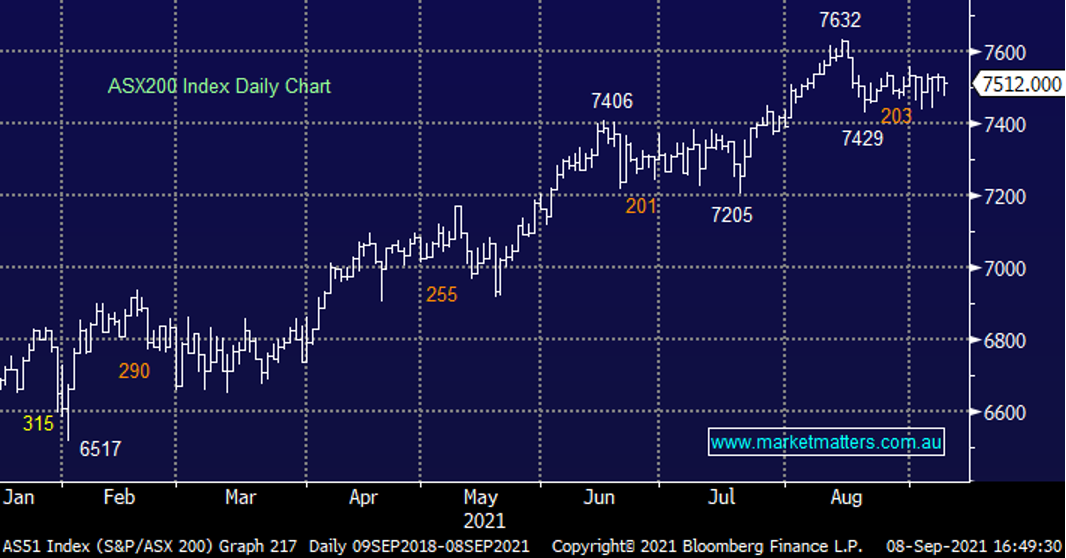

- The ASX 200 finished down -18pts / -0.24% to 7,512

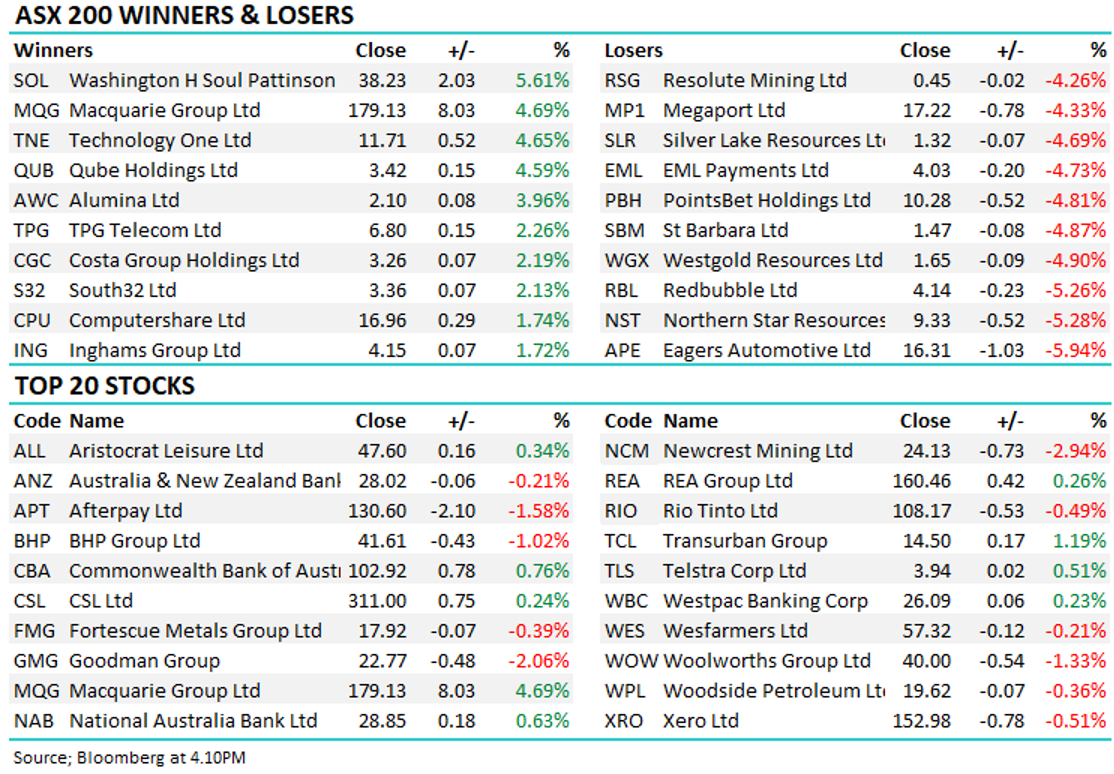

- Financials gained 0.61% back in play, thanks to a good update from Macquarie (ASX: MQG), Property -1.27% lagged

- We made some changes across the Emerging Companies & ETF portfolios today, taking a good profit on Paladin (ASX: PDN) and recycling capital into a new position + added to an existing – the Trade Alert Available Here. Uranium has clearly been hot the last few weeks as Uranium prices have hit the highest point since March 2015. We think there is more to play out here, however, in the short term, the sector is overextended.

- The AFR writing today “Welcome to the Great Electrification Gold Rush, which is driving an investment and deal-making frenzy in Australia’s mining sector that’s unlikely to stop any time soon” has us nervous about this trade in the short term. These types of quotes are indicative of crowded trades on the long side – much like when I talked to the AFR a few weeks ago flagging 8,000 for the ASX 200 – the index quickly pulled back 200 points! When traders/investors only see only upside, sharp snapbacks can often happen.

- Qube (ASX: QUB) gained 4.59%, which caught my eye today after the company entered into a binding agreement to acquire the Newcastle Agri Terminal for $90 million. QUB is buying the terminal from existing shareholders CBH, Viterra Australia, Riverina and CTC Terminals. We like QUB.

- Fortescue (ASX: FMG) dropped 0.39% and broke through $18 today to close $17.92 down from its $26.58 recent high. While it’s gone ex-dividend in that time, this is still a big move on the downside, and the iron ore miners are now back on the MM radar.

- Aussie Broadband (ASX: ABB) is back on the boards today after raising $114 million through Shaw. The stock closed 3.67% higher at $4.80 versus its $4 raise price. There is a share purchase plan (SPP) to come for existing holders.

- Crown Resorts (ASX: CWN) gained 1.64%, edging back towards the price it was before Blackstone lobbed its initial bid, closing today at $9.91. We still think it’s worth around $12 or $13.

- Gold was back below $US1800/oz overnight and was trading at $US1,795 at our close, thanks to a bounce in the US dollar overnight, the gold miners hit today.

- Iron Ore Futures were flat in Asia today.

- Asian markets were mostly lower although Nikkei in Japan put on 0.9%

- US Futures aren’t offering much of a lead.

ASX 200 chart

Weekly Video Update

In this week's Market Matters Video Update, James has a chat with Martin Crabb, CIO at Shaw to talk equity markets post reporting, valuations and Martin throws up 3 stocks worth a look here.

Click Here To View and remember to ‘like’ the video & subscribe to the Market Matters YouTube Channel. We post videos weekly.

Macquarie (MQG) $179.66

MQG +4.69%: Rallied today (for the ninth straight day, which is its longest run since 2015) after providing 1H22 guidance which was above current consensus. MQG is now expecting 1H22 to be slightly weaker than 2H21, to put that into context, Macquarie reported net income of $2.03b in 2H21 (up from $985 million in 1H21) and current expectations were a number down around $400 million half-on-half, which given the rhetoric today is too conservative, particularly given they usually under-promise and over-deliver. Strength in commodities and global markets division plus the sale of the UK commercial and industrial smart meter portfolio also contributing. On 20 times FY22 earnings, it’s expensive, especially when we consider overseas comps JP Morgan (JPM) 12 times, BoA on 13 times, Goldmans on 8 times, Morgan Stanley on 14 times, we’d prefer to own them at this point. MM is neutral MQG at current levels, preferring overseas investment banks.

Macquarie Group (MQG)

Broker Moves

- Hansen Tech Raised to Buy at Shaw and Partners; PT A$6.20

- NobleOak Life Rated New Overweight at Barrenjoey; PT A$3

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after market close, follow my profile to be notified when the latest report is live.

1 topic

6 stocks mentioned