The Match Out: ASX recovers to finish slightly lower, Afterpay smacked on voting delay, Woolies takes on Wesfarmers in API deal

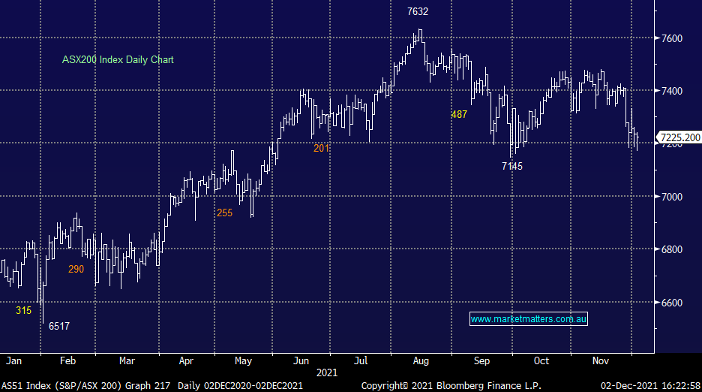

A soft session in the US saw the local market face to face with a fall of around 100 points, as futures dropped like a stone. But the worst of it was seen even before our equity market even opened. The local index was soft when trading opened, sitting at a much more palatable -67pts/-0.9% before a swift recovery kicked in – and by the afternoon, it was making an effort to close higher on the day. In the end it wasn’t to be, though strong buying out of the day’s low is encouraging for equities in the near term.

- The ASX 200 finished down -10pts/-0.15% at 7225.

- Tech was in the firing line today, delivering by far the worst sector performance, though largely attributed to Afterpay’s (ASX: APT) struggles.

- The vote on Afterpay’s takeover by Square (SQ US) has been delayed due to a hold up by the Spanish Court, which is yet to grant approval. A vote on the deal could be delayed until next year, the deadline for approval by the Spanish Court not until late February.

- Woolworths (ASX: WOW) joined the race to buy pharmaceutical retail and distribution business Australian Pharmaceutical Industries (ASX: API), squeezing its way into the books after Wesfarmers (ASX: WES) had it all but over – more on that below.

- Crown (ASX: CWN) rejected Blackstone’s bid on the same day The Australian newspaper reported Star Group (ASX: SGR) is taking another look.

- Aussie Broadband (ASX: ABB) announced its deal to acquire Over The Wire (ASX: OTW) – a deal flagged a few weeks ago. We recently added ABB to the Emerging Companies Portfolio.

- Gold was down marginally today, -$US4 to $US1776 at our close.

- January Iron Ore Futures were flat in Asia today.

- Asian markets were mixed, Nikkei -1.35%, Hong Kong +0.14% while China was flat.

- US Futures are higher, S&P now up +0.56% while Nasdaq Futures lag a touch, +0.47%.

ASX 200

Australian Pharmaceutical Industries (ASX: API) $1.735

API +16.05%: The bidding war for Australian Pharmaceutical Industries heated up today as Woolies entered the fray, trumping Wesfarmers’ existing bid by 13%, amounting to a 17% premium to API’s closing price yesterday. The owner of brands such as Priceline was trading at around $1.10 a share before the bidding war erupted with Sigma (ASX: SIP), Wesfarmers and Woolworths (ASX: WOW) in the mix. Today’s bid from WOW was pitched as an all-cash bid at $1.75.

Australian Pharmaceutical Industries

Crown Resorts (ASX: CWN) $11.02

CWN +0.73%: Reports this morning that Star Entertainment was back looking at Crown saw the stock marginally higher today. Management also announced it has granted Blackstone non-exclusive due diligence which, as Crown put it, will allow the PE firm to finalise a more palatable offer in excess of its current $12.50 proposal. While we think the risk/reward looks good for CWN at around $11, it seems unlikely Blackstone will overpay for the operating business, due to their clear property focus with physical assets their primary modus operandi. But Star sees obvious operational synergies in a tie-up and that, in MM’s view, is where the real upside would lie.

MM likes the risk/reward in CWN around $11.

Crown Resorts (ASX: CWN)

Broker moves

- SiteMinder Ltd Rated New Overweight at Barrenjoey; PT A$8

- Immutep Rated New Buy at Jefferies

- Worley Raised to Overweight at Morgan Stanley; PT A$12

- RAM Essential Services Rated New Outperform at Credit Suisse

- Fortescue Rated New Overweight at Barrenjoey; PT A$20

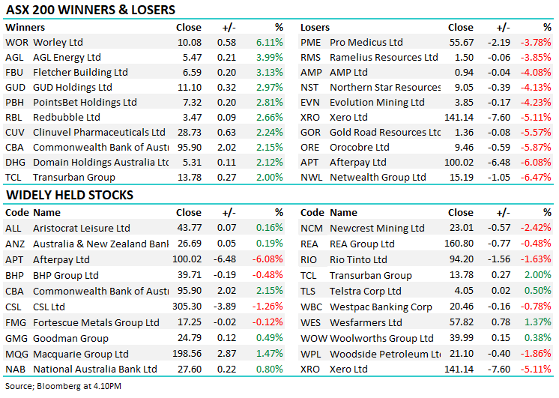

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

8 stocks mentioned