The Match Out: ASX trickles lower, Banks drag, AGL Energy (AGL) rallies

An eventful week in markets came to a close with the ASX down a touch, although we did see a spirited fight back from an early sell-off with the ASX 200 rallying +32pts from the day’s low. Banks on the nose still but more companies finished in the green than the red – some corporate activity implying that it’s not all doom & gloom out there!

- The ASX 200 finished down -13pts/ -0.19% at 6955

- The Utilities sector was best on ground (+0.73%) while Materials (+0.56%) & Consumer Discretionary (+0.19%) were also solid.

- Financials (-1.15%) and Energy (-0.34%) the weakest links.

- Gold stocks enjoyed a solid session today as spot gold is threatening the ~US$2000 level – we think it’s a matter of time until it breaks out. Newcrest (ASX: NCM) +1.78%, Evolution (ASX: EVN) +2.78% & St Barbara (ASX: SBM) + 4.03%.

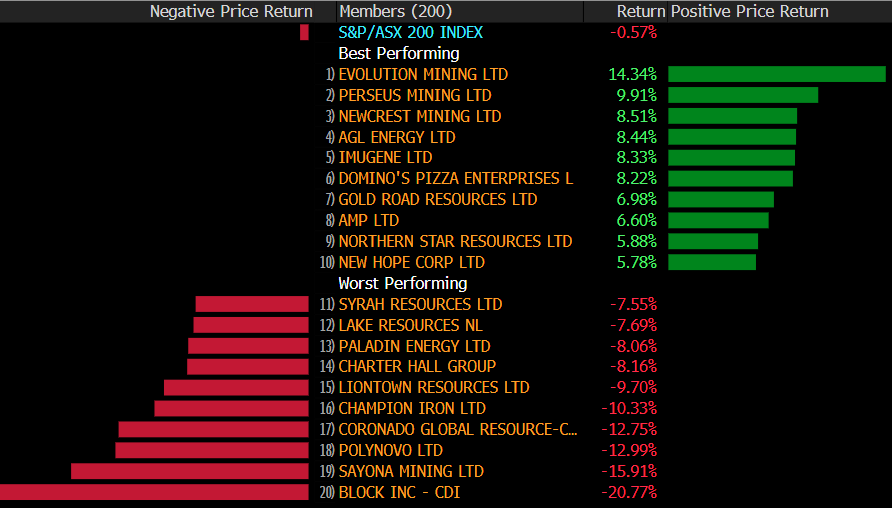

- Nice to see MM hold 4 of the top 10 winners for the week (& 1 loser) as the market lost 0.57% overall – not a bad effort considering.

- AGL Energy (ASX: AGL) +5.97% upgraded by Barrenjoey this morning to buy equivalent - the market is slowly turning more bullish on this as the bulge brackets move past the recent miss in earnings – FY24 and beyond is really what counts here. We own it in our Income Portfolio.

- Estia (ASX: EHE) +14.1% received a takeover offer by Bain Capital at $3, a 28% premium to last however it rallied for the 2 days before the announcement was out – more loose lips perhaps!

- Block (ASX: SQ2) -18.4% whacked on a short report from Hindenburg Research, who claim that Block facilitated scammers who took advantage of government stimulus programs during the pandemic.

- Aussie Broadband (ASX: ABB) -2.18% hit on a broker downgrade, with JPM cutting from Buy to Hold. This follows ABB upgrading in 1H23 rallying to ~$3.30 and now having given up -10% since results – we like ABB, our biggest weighting in the Emerging Companies Portfolio with the telco delivering +30% organic growth (revenue line) year on year. It was down ~6% early on today.

- SRG Global (ASX: SRG) +4.29% has enjoyed a stellar bounce back from weakness, Harry bought that well for his Emerging Companies Portfolio this week.

- Iron Ore was a touch lower in Asia today.

- Gold was up overnight to ~US$1997 before tracking down -US$6 in Asian trade today, settled $US1991 at our close.

- Asian stocks were lower, Hong Kong down -0.46%, Japan -0.22% while China was off -0.57%.

- US Futures are all up, around +0.20%

ASX 200 Chart - Intraday

ASX 200 Chart - Daily

Sectors This Week – Source Bloomberg

Stocks This Week – Source Bloomberg

Broker Moves

- Aussie Broadband (ASX: ABB) Cut to Neutral at JPMorgan; PT A$3.40

- Eagers Automotive (ASX: APE) Raised to Buy at Bell Potter; PT A$15.25

- Lifestyle Communities (ASX: LIC) Lifestyle Communities upgraded to overweight from underweight at Barrenjoey

- OFX Group (ASX: OFX) Group downgraded to market-weight from overweight at Wilsons

- AGL Energy (ASX: AGL) upgraded to overweight from neutral at Barrenjoey

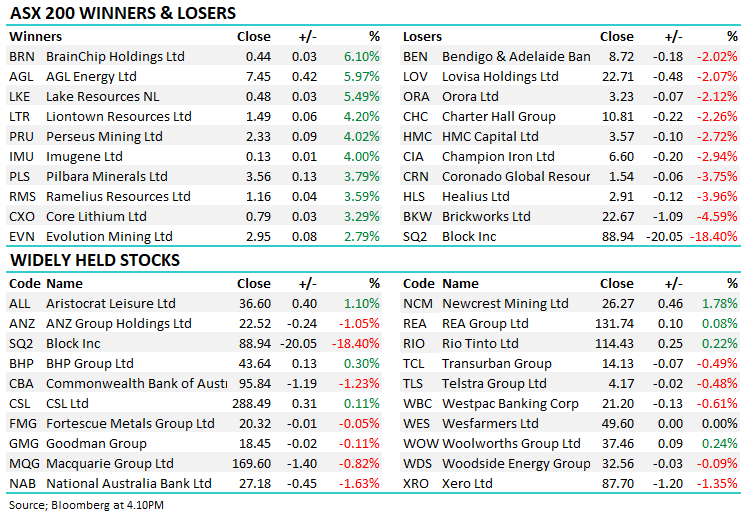

Major Movers Today

Have a great weekend

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

11 stocks mentioned