The Match Out: Equities Slide into the weekend, QBE to 3-year highs on a good result

The local market followed the overnight lead today as rising bond yields weighed on risk assets. The end of the market more leveraged to rates – Tech and Real Estate – were some the hardest hit while Energy was also under pressure as coal names continued their slide. Two sectors managed gains today despite the weakness, being Utilities and Consumer Staples. The index saw its second consecutive weekly drop of more than 1%, falling 86pts / -1.17%, though the bulk of the drop came in the Financials as more sectors traded higher.

- The ASX 200 finished down -63pts/ -0.86% at 7346

- The Utilities sector was best on ground (+1.04%) while Consumer Staples (+0.33%) was the only other gainer..

- Tech (-2.29%), Energy (-1.78%) and Real Estate (-1.74%) the weakest links.

- Lithium stocks had a tough day, IGO -3.63%, Pilbara Minerals (PLS) -5.33%

- Coal was likewise as Whitehaven’s (ASX: WHC) lower-than-expected dividend yesterday has created some chatter about concern from within about Coal prices, and the likely impact on earnings for the 2H

- Westpac (ASX: WBC) +0.09%, finished marginally higher on their 1Q print. Numbers were ok, but lacked some detail.

- Baby Bunting (ASX: BBN) -6.1%, traded down after saying they saw a decline in year-to-date comparable store sales growth + announced the resignation of CEO Matt Spencer.

- QBE Insurance (ASX: QBE) +7.39%, rallied the most in more than 2 years after forecasting a combined operating ratio for 2023 of about 93.5%, saying insurance market conditions remain strong.

- Inghams (ASX: ING) -0.36%, battled back from their early lows after saying net income for the first half- year was -55% YoY sighting inflation pressures were still playing out. Plenty of negativity already in the price here.

- Iron Ore was one of the few bright spots, up +1.3% in Asia today though only Rio Tinto (RIO) benefitted, gaining +0.47%

- Gold struggled today, falling -0.5% / -US$10 in Asian trade today, settled $US1826 at out close.

- Asian stocks were weak. Hong Kong is down -0.55%, and Japan -0.70%.

- US Futures are all down, S&P500 -0.45% and the Nasadaq -0.6%

ASX 200 Chart

QBE Insurance (ASX: QBE)

QBE +7.39%: a strong session for the insurer after a big beat at the FY result. NPA of $770m was well ahead of the consensus of $653m driven by better-than-expected investment performance and supported a ~10% beat at the dividend line with the company to pay US30.4cps. The Net Earned Premium (NEP) was only a 1% beat while Gross Written Premium (GWP) and Core Operating Ratio (COR) were pre-released. Guidance was in line, looking for GWP growth of mid to high single digits, while COR is expected to fall slightly to 93.5%. The company also noted they have reduced reinsurance cover, but did include a new contract to protect long capital impacts – it’s getting harder for the insurers to move risk off the books here.

Westpac (ASX: WBC)

WBC +0.09%: Quarterly update today with limited financial details, although what we saw seemed okay. Their capital position, credit quality and funding are all inline with what you’d expect. They didn’t provide details about cost management, which is an important driver for WBC as they improve efficiencies. While we like ANZ & NAB in the space given 1. Valuation & growth via Suncorp & 2. A focus on business banking respectively, Westpac (WBC) is trading on the cheap side of history, about 1 standard deviation below its norm for both price to book & P/E as shown below.

Sectors This Week

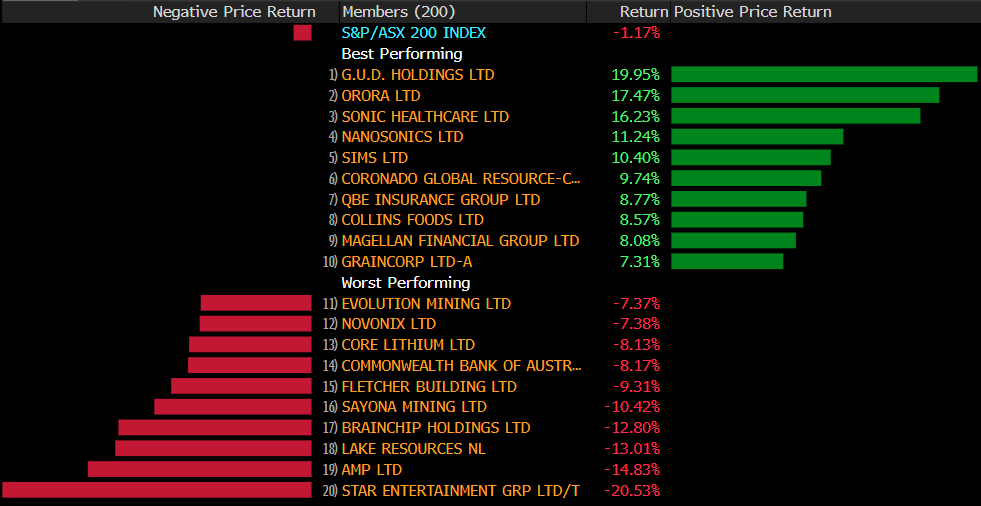

Stocks This Week

Broker Moves

- Charter Hall Retail Cut to Hold at Moelis & Company; PT A$4.27

- Origin Energy Cut to Reduce at CLSA; PT A$6.80

- Coles Group Raised to Positive at Evans & Partners Pty Ltd

- NRW Holdings Cut to Neutral at Citi; PT A$2.80

- Southern Cross Media Cut to Hold at Canaccord; PT A$1.15

- Orora Raised to Overweight at Jarden Securities; PT A$3.55

- Codan Raised to Buy at Canaccord; PT A$6.18

- Growthpoint Cut to Neutral at Credit Suisse; PT A$3.60

- Newcrest Cut to Neutral at Credit Suisse; PT A$24

- NRW Holdings Cut to Neutral at Macquarie; PT A$2.50

- Steadfast Cut to Neutral at Evans & Partners Pty Ltd; PT A$5.80

- Codan Cut to Accumulate at CLSA; PT A$6.50

- Goodman Group Cut to Hold at Jefferies; PT A$21.35

- Newcrest Cut to Hold at Jefferies; PT A$26

- Orora Cut to Neutral at Evans & Partners Pty Ltd; PT A$3.35

- Whitehaven Cut to Hold at Bell Potter; PT A$8.15

- Sonic Healthcare Raised to Add at Morgans Financial Limited

- Orora Raised to Add at Morgans Financial Limited; PT A$3.75

Major Movers Today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

5 stocks mentioned