The Match Out: FY24 starts on the front foot, the dogs are starting to bark!

The first session of FY24 was a positive one for local stocks with the market grinding consistently higher throughout the day to close on session highs. There seemed to be an overarching trend today that saw some of the ‘FY23 dogs’ attract buying with the discretionary retailers the most obvious example at a sector level – perhaps confidence is growing around a ‘soft landing’ as inflation cools and central banks look to a least pause on rates – we’ll get more insight tomorrow as Dr Lowe announces the RBA’s decision on rates at 2.30pm, the market only factoring in an ~18% probability of a hike.

- The ASX 200 finished up +42pts/ +0.59% at 7246

- The Consumer Discretionary sector was best on ground (+1.41%) while Materials (+1.08%) & Utilities (+1.05%) were also strong.

- IT (-1.45%) and Healthcare (-0.14%) the weakest links.

- Redox (ASX: RDX) -5.1%: The first IPO to raise more than $100m since mid-last year, and the first float with a $1bn + market cap since the end of 2021, fell on listing today.

- United Malt (ASX: UMG) +8.64%: Rallied after the French grains trader Malteries Soufflet agreed to buy them for about $1.5bn in cash, equating to $5 per share.

- Calix (ASX: CXL) +4.56% said capex spend at Pilbara’s demonstration processing plant will be brought forward ahead of the Final Investment decision later this month in a positive sign that it will lead to a full-scale project.

- Austin Engineering (ASX: ANG) +7.27% confirmed it had received the outstanding orders that led to a downgrade in May. The company said its order book remains robust leading to a strong start to FY24.

- Gold stocks had a solid session, Newcrest (ASX: NCM) +2.46% and is now trading at a 3% discount to the implied Newmont bid amount which is worth $27.97 for NCM shareholders like ourselves. NCM closed $27.07 today.

- Retailers caught our eye, Bapcor (ASX: BAP) +4.21%, JB Hi-Fi (ASX: JBH) +2.54% & Super Retail (SUL) +3.41% - money dropping into the sector which is 3% short sold which is high.

- Interesting trade in Costa Group (NYSE: CGC) +9.56% with the stock getting bid up 16c in the match – something happening there? Takeover??

- Our two most recent purchases have found some love, with Magellan +2.74% to $9.75 & Lendlease (ASX: LLC) + 1.94% to $7.90 – we think there is growing appetite in the market for turnaround opportunities.

- Global Lithium (ASX: GL1) +4.49% rallied on news that Develop Global (ASX: DVP) has made an agreed takeover offer for Essential Metals (ASX: ESS) supported by shareholder Mineral Resources (ASX: MIN) who is also a 12.9% shareholder in Develop. In April MIN blocked IGO and Tianqui from bidding for ESS. The multiples here make GL1 look cheap, while MIN could well switch attention to GL1, where it already holds an 8% stake.

- Telstra (ASX: TLS) +0.47% said it has partnered with Elon Musk’s satellite service Starlink to provide home phone and broadband services to regional Australians – we are long TLS in our income portfolio, although we are now questioning how much more there is left in the tank – can we use capital better elsewhere?

- Downer (ASX: DOW) +2.68% announced a $540m contract win in NZ – this is another turnaround play worth looking at.

- Iron Ore was ~1.5% lower in Asia today providing a headwind to Fortescue (ASX: FMG) +0.41% & RIO +0.70%

- Gold was up overnight before tracking down -US$5 in Asian trade today, settled $US1914 at our close.

- Asian stocks were solid, Hong Kong up +1.90%, Japan +1.54% while China was up +1.29%

- US Futures are mixed, but small moves across the board.

- There is a half-day trading tonight in the US before the market is closed tomorrow night for Independence Day.

ASX 200 Chart

Lindsay Australia (ASX: LAU) $1.10

LAU -3.51%: trucking and agricultural services business announced a small bolt-on acquisition today of WB Hunter to expand their rural merchandising reach. The $34.6m acquisition of the 8-store rural supplies, agricultural services and trade essentials business is expected to be high-single digit accretive pre-synergies, picked up at ~6x FY24 EBIT. Lindsay also noted that EBITDA for FY23 is now expected at the upper end of the $85-90m range. The bulk of the company’s earnings come from its transport segment with road and rail services, a segment that could benefit from last week’s CPI data which showed a significant drop in the cost of Automotive Fuels.

Broker Moves

- Link Administration Cut to Neutral at Citi; PT A$1.60

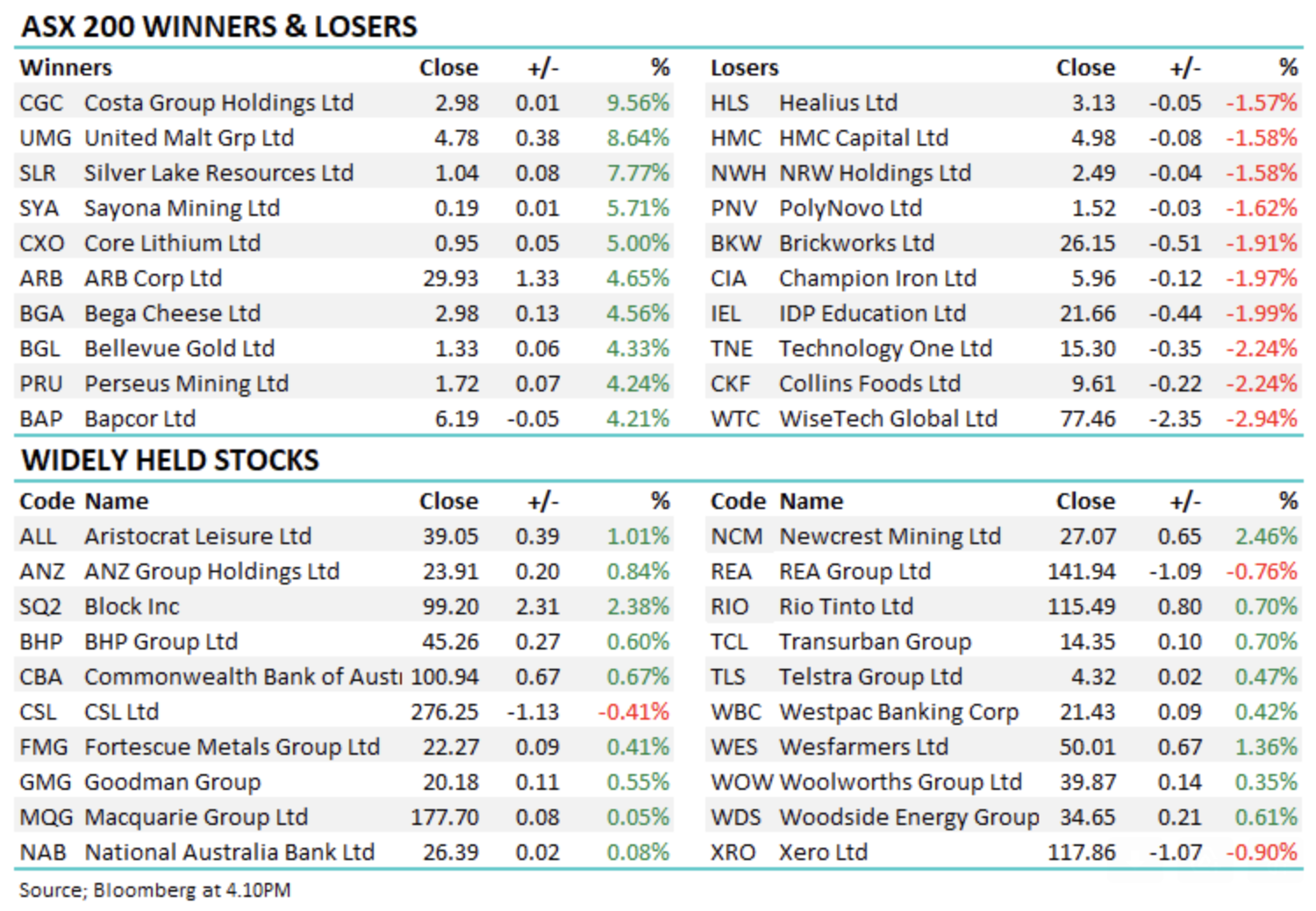

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

17 stocks mentioned