The Match Out: Market rallies as bearish sentiment leaks, Megaport (MP1), Dusk (DSK) and Iluka (ILU) all rally on strong updates

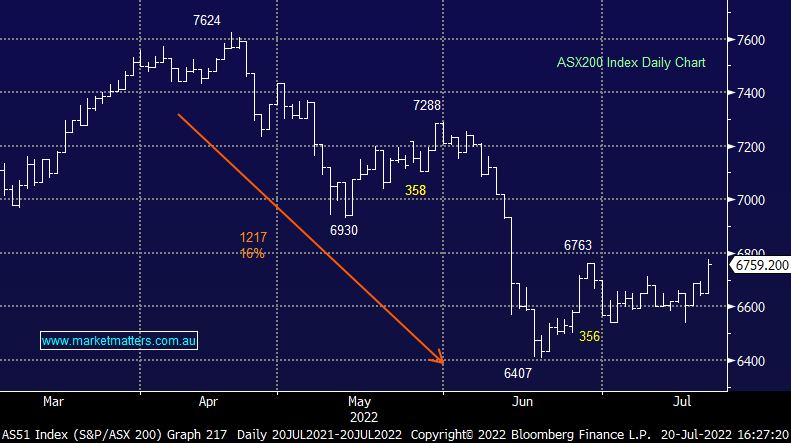

Finally, the ASX popped on the upside just as the BofA’s latest survey of fund managers showed a ‘dire level of investor pessimism’ with the title of the report authored by their Chief (normally bearish) Strategist Michael Hartnett a very fitting way to describe the current mood of markets…’I’m so bearish, I’m bullish”. Money was desperate to get back into risk assets and equities caught a bid today as a result. The small cap index finished more than 2% better today while the ASX200 had its best session since the early days of the new financial year.

- The ASX 200 finished up +109pts/ +1.65% at 6759

- The Tech sector was best on ground (+3.77%) while Materials (+2.50%) & Real Estate (+2.24%) were also strong.

- All sectors closed higher, though Staples (0.36%) and Healthcare (+0.76%) were the only two with a gain of less than 1%.

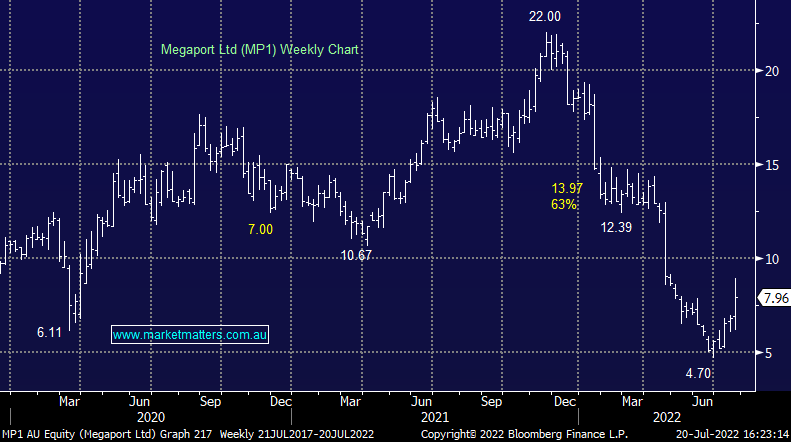

- Megaport (MP1) +23.03%, ripped as they released a strong quarterly – the ~10m shares / 6% of the company held short had a tough day.

- I was on Ausbiz this morning covering fund managers, Iron Ore stocks and a few other bits and pieces – Click here to watch

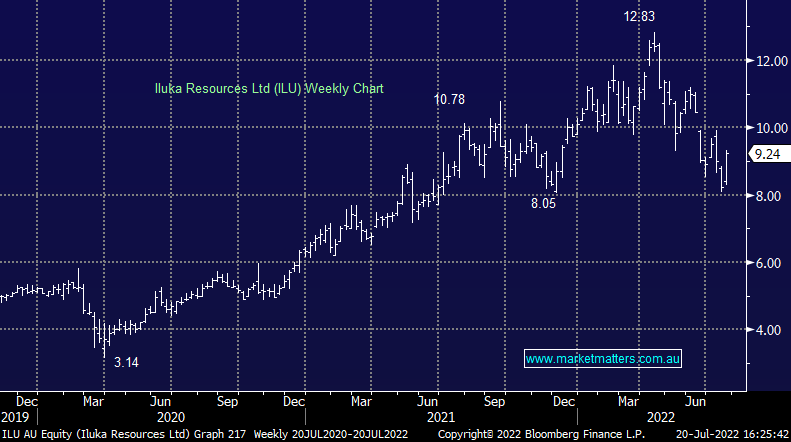

- Iluka (ILU) +7.19%, rallied on a strong production report and a bullish outlook for Mineral Sands prices.

- Paladin (PDN) +10.16% had a better day following their positive update + muted reaction yesterday, Uranium stocks rallied overnight which helped.

- Dusk (DSK) +8.88% had a great session, the 2nd retailer in two days to beat bearish market expectations in an FY22 trading update this morning – go the candles!

- HALO (HAL) +40% - a stock we’ve been hard on since it listed at $1.20 and quickly fell to 22c rallied today on no news, but also no real volume, $32k of stock through but at least it has stopped falling.

- Iron Ore was flat in Asia today though that didn’t stop Fortescue (FMG) from rallying more than 5%

- Gold was flat overnight at $US1712 before tracking down -US$6 in Asian trade today, settled at $US1706 at our close.

- Asian stocks were also strong today, the Nikkei outpacing other markets to rally 2.67%.

- US Futures are all up, around +0.40%

ASX200

Iluka Resources (ILU) $9.24

ILU +7.19%: A strong quarterly production update today from the leading mineral sands company globally with their products being used in all sorts of applications, from paints to tiles, batteries and many essential things in between. Prices remained high as supply stayed tight, a theme we expect to continue over the medium term even though Chinese property has been weak. Moreover, CY22 has seen Iluka announce and commence delivering on two major portfolio moves, the first a pivot into Rare Earths (think Lynas) and the 2nd the demerger of Sierra rutile which was acquired in 2016 but now will be jettisoned as the company focuses on its Australian mineral sand and the new rare earth business. Today’s positive commentary on the pricing environment is also good for Strandline (STA), a position we have in the Emerging Companies portfolio which is now only ~4mths away from the first production.

Illuka Resources (ILU)

Megaport (MP1) $7.96

MP1 +23.03%: the network connectivity business was out with their 4th quarter update today with the company’s performance bouncing back after a slow start to the year. Revenue in the final 3 months was up 10% on the third quarter, adding 533 new ports and posting a positive EBITDA in the quarter for the first time. After only growing monthly recurring revenue (MRR) by $300k in the third quarter, they added $1.2m to MRR in the final quarter with sales initiatives bearing fruit again. MRR is now up 43% in the year and revenue was 40% higher than FY21, a far better outcome than what was expected when they disappointed the market in April, though shares are trading near the same level now.

Megaport (MP1)

Dusk (DSK) $2.33

DSK 8.88%: the candle & home fragrance retailer looks to come in ahead of expectations at their full-year result following a strong FY22 update today. Sales are expected to hit $138m, and while down 7% on FY22, it remains 37% above FY20. LFL sales fell 10.% in the year after comping some strong FY21 numbers and battling store closures. EBIT is expected around $26.5m which is an 8% beat to consensus. Overall the business looks in good shape for the new financial year with 131 stores, a strong online offering and a decent inventory level.

Dusk (DSX)

Broker Moves

- Ezz Life Science Rated New Buy at Lodge Partners

- Medibank Private Rated New Buy at Jefferies; PT A$3.90

- Nib Rated New Hold at Jefferies; PT A$7.90

- Orora Cut to Neutral at Jarden Securities; PT A$3.60

- Amcor GDRs Cut to Neutral at Jarden Securities; PT A$17.60

- Mader Group Rated New Neutral at Barrenjoey; PT A$2.80

- JB Hi-Fi Raised to Buy at Citi; PT A$47

- AGL Energy Raised to Overweight at JPMorgan; PT A$10.60

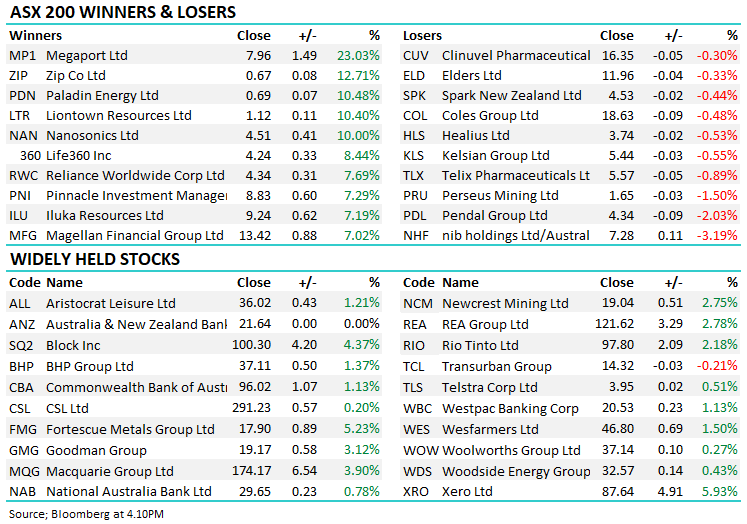

Major Movers Today

Enjoy your night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

6 stocks mentioned