The Match Out: Market ticks lower, more pain for Magellan, Audinate upgrades

The market kicked off a new week on the backfoot today with weakness in technology and other growth-related stocks weighing on the broader market, offset by continued strength in the Energy sector.

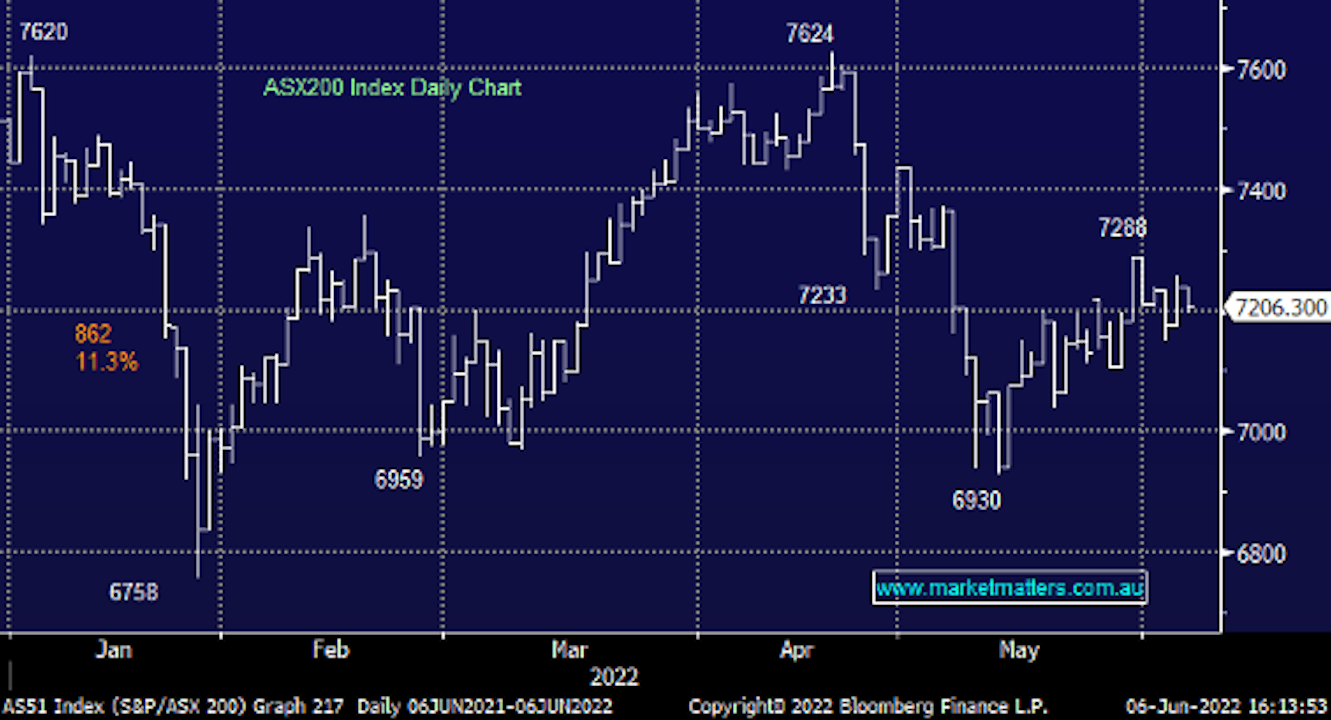

- The ASX 200 finished down -32pts/ -0.45% at 7206.

- The Energy sector was the best on the ground (+2.13%) while Utilities (+0.69%) and Healthcare (+0.17%) were also positive.

- IT (-1.55%) and Communications (-1.11%) the weakest links.

- The RBA meets tomorrow and the market is pricing in a 28 basis point hike, versus the consensus for 25 basis points, with a few expecting a more aggressive 40 basis points.

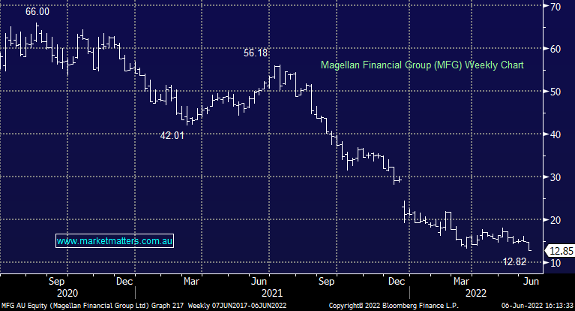

- The pressure on listed fund managers continued today with Magellan (ASX: MFG) down -13.93% on further outflows. More on MFG below.

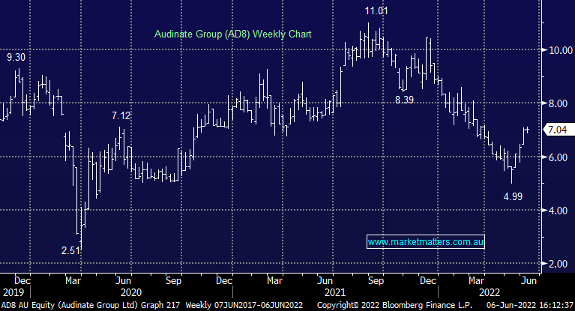

- Audinate (ASX: AD8) +0.57% upgraded earnings guidance today.

- Car makers overseas are starting to talk more favourably around chip shortages which has positive ramifications for a raft of manufacturers.

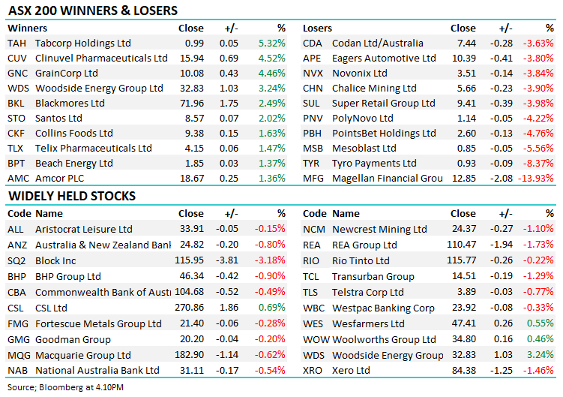

- Energy stocks continued to rally – Santos (ASX: STO) +2.02% while Woodside (ASX: WDS) put on a more impressive +3.47%.

- Liontown Resources (ASX: LTR) -2.76% fell despite announcing an offtake agreement with Tesla – these agreements are notoriously rubbery.

- Blackstone Resources (ASX: BSX) entered a trading halt following some interest from Vingroup. Watch this space for some (hopeful) fireworks.

- The suite of CBA Hybrids traded ex-distribution today, which explains some of the price declines.

- National Australia Bank (ASX: NAB) also launched a new Hybrid which will trade under code NABPI. The guided margin of 3.15% to 3.35% over the bank bills equates to a grossed-up yield to first call near 7%. Email jgerrish@shawandpartners.com.au if you’d like to participate in the Bookbuild (some limitations apply but we’ll do our best to assist).

- Iron Ore was ~2% higher in Asia today – Chinese re-opening supporting prices.

- Gold was up flat in Asian trade, ticking around $US1853 at our close.

- Asian stocks were all higher, Hong Kong up +1.49%, Japan +0.43% while China was up +1.11%.

- US Futures are all up, around +0.60%, FTSE Futures are outpacing the gains in the US – the backdrop for trade tonight looks positive despite our late sell-off.

ASX 200 chart

MFG -13.93%: The pain/frustration in MFG continues with further outflows prompting another decent sell-off in the stock today pushing it to the lowest close since 2014. They said that Funds Under Management (FUM) at the end of May was $65.0bn down from $68.6bn in April. To give some context on this number, FUM peaked at around $110 billion and while lower performance fees have an impact on earnings now and in the future given high water marks, it has been an extreme share price reaction with the stock down more than 70%. Was MM surprised by today’s slide? Partially, however recent FUM updates had given some indication that outflows had slowed, and a new status quo may have been established, however, that view took a hit today with announced flows. There is no doubt MFG is cheap on around 7 times earnings with a market cap of $2.4 billion relative to $65 billion in FUM, which is why we are not selling our small position in the Income Portfolio. But until we see confirmation (multiple months) where FUM flows are stable or positive, we will not average our position which, marked to market, sits at less than 1.5% of the portfolio.

Magellan Financial Group

Audinate (ASX: AD8) $7.04

AD8 +0.57%: a positive sales update from the Audio-Visual hardware & software company failed to really ignite the share price. Audinate now expects revenue of over $US30 million in FY22 after positive momentum in March and April continued throughout May. The guidance sits at least 5% above consensus expectations for the year and shows the company has continued to navigate short supply in the semiconductor industry positively. Missing from the release was an update on gross margins, which were running beyond 75% at the end of April, but are expected to fall as higher input costs flowed into the cost of goods sold, though pricing increases have been pushed through the suite of Audinate products.

Audinate

Broker moves

- Worley Cut to Neutral at Goldman; PT A$14.90

- Woodside Energy Raised to Overweight at Morgan Stanley; PT A$40

- Appen Cut to Neutral at Citi

- Transurban Cut to Neutral at Credit Suisse; PT A$13.60

- Healius Raised to Buy at Citi; PT A$4.30

- Healius Cut to Sector Perform at RBC; PT A$4.40

Major movers today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

2 topics

7 stocks mentioned