The Match Out: Stocks off the boil again as 75% of the market ends lower

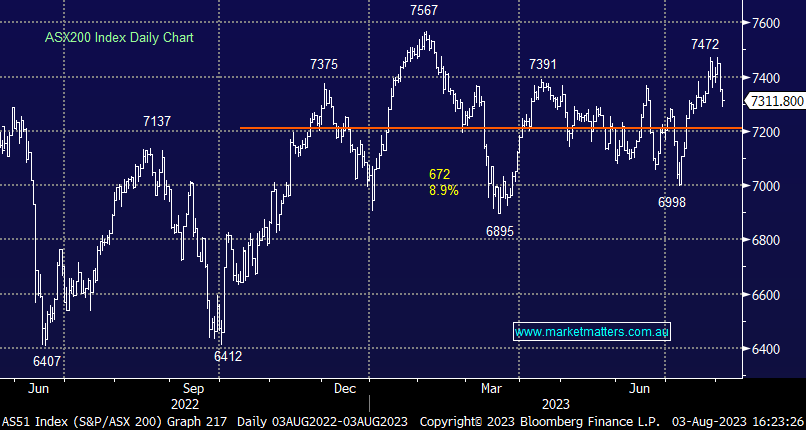

The ASX was down in line with overseas markets, although the selling was far from aggressive and we did bounce off the session lows. US Futures were subdued while Asian stocks were more mixed after a poor session yesterday.

- The ASX 200 finished down -42pts/ -0.58% at 7311

- The Communications sector was best on ground (+0.19%) and the only sector to finish higher, while Staples (-0.01%) & Consumer Discretionary (-0.19%) outperformed broader weakness.

- IT (-1.63%) and Materials (-1.06%) the weakest links.

- Not a lot from a reporting perspective today although we hold Resmed (RMD) that reports tomorrow. Download the Market Matters Reporting Calendar Here

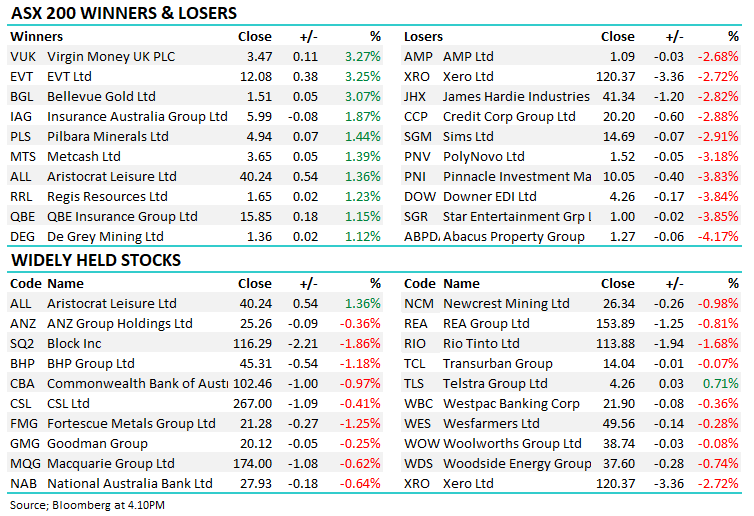

- Downer (ASX: DOW) -3.84% fell after writing down assets, although the turnaround in the underlying business is progressing well under new leadership.

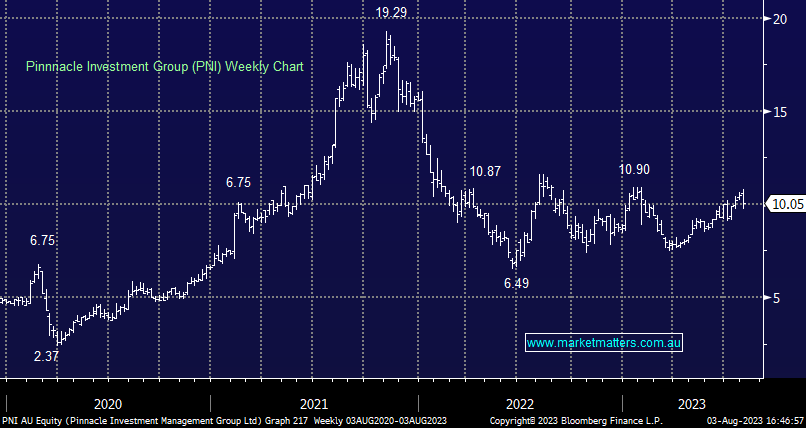

- Pinnacle (ASX: PNI) -3.83% fell despite beating on earnings after the market yesterday.

- Solvar (ASX: SVR) -34.1% pre-reporting FY23 numbers look in line with expectations for the auto finance company, however guidance for FY24 was ~40% below expectations. The company flagged a number of measures including reducing the loan book in NZ which will weigh profits.

- Woodside (ASX: WDS) -0.74% fell on a broker downgrade by JP Morgan, they also cut Santos (ASX: STO).

- Star Entertainment (ASX: SGR) -3.58% is back trading at $1 – the counter-trend rally is now over it seems.

- Virgin Money (ASX: VUK) +3.27% had a 3Q trading update overnight and reconfirmed guidance- the rare bright spot on our market today.

- Bill Ackman of Pershing Square (we own his fund in our International Equities Portfolio given its big discount to NTA – the Herbalife effect maybe!), thinks long-term debt looks overbought from a supply/demand perspective, saying long-term interest rates will need to go higher given the large volumes of issuance needed.

- He’s shorting 30-year Treasuries to enact the view, calling it a hedge against equity returns. That is particularly true for long-duration stocks that are more influenced by long-dated yields. Certainly something to ponder further as the yield curve steepens.

- Bill saying….“There are few macro investments that still offer reasonably probable asymmetric payoffs and this is one of them + the best hedges are the ones you would invest in anyway even if you didn’t need the hedge. This fits that bill, and also I think we need the hedge”

- Insurance stocks are a beneficiary of a move like this – most did well today with QBE Insurance (ASX: QBE) +1.15% and IAG +1.87%.

- Iron Ore was knocked ~3% lower in Asia although the miners were down less.

- Gold was down overnight on $US strength before it tracked sideways today, settled $US1933 at our close.

- Asian stocks were okay Hong Kong up +0.45%, Japan fell -1.37% while China rallied +0.47%

- US Futures are down a touch.

ASX 200 Intraday

ASX 200 Daily

Pinnacle Investment Management (PNI) $10.05

PNI -3.83%: the investor and fund support company announced their FY23 results after market yesterday, coming in with a small beat to estimates. Profit was flat compared to FY22 at $76.5m, ~5% above the consensus of $72.8m while the dividend was broadly in line. Net flows for the 2H were strong for Pinnacle’s affiliate funds and total FUM was supported by strong markets. This was also propped up by Pinnacle itself, with the company drawing down $100m from a CBA debt facility to invest in affiliate funds with Metrics and Coolabah seeing the most love.

We like their model, backing good, independent fund managers with investment in the fund’s management business, and in the funds themselves. It promotes alignment and sends a great message to the market. However, they’ve juiced up this strategy by drawing debt to do it, meaning PNI is backing the manager’s ability to perform above the cost of capital, taking alignment to another level, and increasing the risk in their model as a consequence.

The other interesting aspect here is the funds they’ve chosen to invest in, one run by a manager that has ~60% of their book exposed to developer financing and other property-related activities, the other into funds run by a property bear who believes the mother of all default cycles has begun!

Broker Moves

- Control Bionics Cut to Hold at Morgans Financial Limited

- De Grey Mining Rated New Outperform at RBC; PT A$1.80

- Orica Raised to Buy at Citi; PT A$17.45

- Woodside Energy Cut to Underweight at JPMorgan; PT A$36.30

- Santos Cut to Neutral at JPMorgan; PT A$8.30

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

8 stocks mentioned