The mining company riding the tailwinds of renewables and supply chain shifts

It’s perhaps natural to be concerned by the growing risk of conflict as Russia continues to pursue its attacks on Ukraine and as China sets its eyes on Taiwan. The conflict between democracy and autocracy is set to define a period of heightened tensions between these two camps. Over the last few decades, China became the manufacturer to the world as businesses eager to boost profits outsourced manufacturing to take advantage of the lower cost of labour. This transition has left many businesses in the West now largely dependent on cheaper manufacturing and processing in countries such as China. However, governments are now becoming increasingly concerned of the geo-political risk to their supply lines.

The world is now in the process of creating Supply Chain 2.0, to ensure security of supply, in which this inflationary transition will see companies in the West bring back processing of key commodities and manufacturing to ensure supply of critical goods and services.

Governments and companies in the West are now starting to ask themselves, what value do we attach to security of supply?

Investors had largely ignored this value assuming profit margins would supersede all borders. COVID-19 provided a glimpse to how nations can react in times of turmoil by overriding the market to buy and store critical supplies of vaccines and medical equipment with disregard for other nations.

Governments are now in the process of stepping back into the market to ensure critical products can be secured and made domestically and reduce the reliance on countries such as China.

Taking a big picture approach, we see the longer-term value of owning what is one of the few Western processing companies and miners of rare earths materials. The US currently has no processing capacity for rare earths, which is an obvious concern. Lynas Rare Earths Ltd (ASX: LYC) is in the process of building a processing facility in Texas which is expected to be operational by 2025. We view Lynas as a long-term investment for a balanced portfolio set to benefit from the reduction in carbon emission as economies invest in renewables and electric vehicles.

What are rare earths, and what makes them rare?

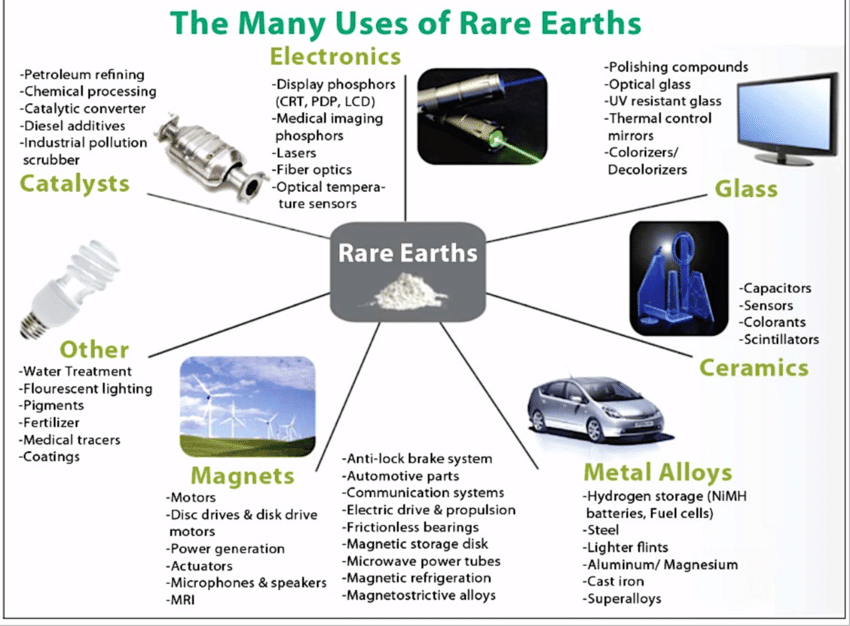

Before I go into the merits of Lynas, it would be appropriate to outline what rare earths exactly are. Rare earths are a group of 17 chemically similar elements and are somewhat hard to distinguish between. Each of these elements have different uses. For example, neodymium is used in smartphones and powerful magnets for electric vehicles (EVs) and wind turbines, praseodymium is used in aircraft engines, and lanthanum is used in oil refining.

Source: Recapture strategic value chains in the rare earth market, Kadir Ider, Berlin School of Economics and Law (June 2015)

Despite being called rare earths, they are not exactly rare. In fact, the rare earth cerium (Ce) is more common than copper. What makes them rare is the fact that these elements are very dispersed across the earth’s crust and not commonly found in concentrated ore deposits. This makes most of the rare earths in the ground commercially unviable to mine, so standalone rare earths mines are indeed rare.

The world’s premier rare earths mine outside of China

Lynas owns the world’s largest rare earths mine outside of China, which is the Mount Weld mine in Western Australia’s Kalgoorlie region. This simple fact provides two compelling reasons to invest in Lynas. Firstly, as a major rare earths producer, Lynas is well positioned to benefit from key megatrends such as the adoption of EVs and renewable energy, both of which use these key materials as inputs. In addition, a premium is added when you consider that China produces and processes the vast majority of the world’s rare earths and that major countries and companies are seeking to diversify away from this supply concentration.

Rare earth based permanent magnets will help the world reach net zero emissions

The first point centres on the world’s transformational shift towards net zero emissions. This shift requires massive investment, including the eventual replacement of a large portion of the global car fleet and carbon-emitting energy generation sources. Rare earths will play a key role in this change, which is why demand is expected to increase from 250,000 tonnes this year to over 500,000 in the early 2030s. Underlying this projection is the fact that rare earths are a key input in powerful permanent magnets, which are a component of EVs and wind turbines. The most widely used type of permanent magnet are neodymium magnets (NdFeB), with the associated major rare earth input being neodymium (Nd), as well as dysprosium (Dy) and traces of praseodymium (Pr).

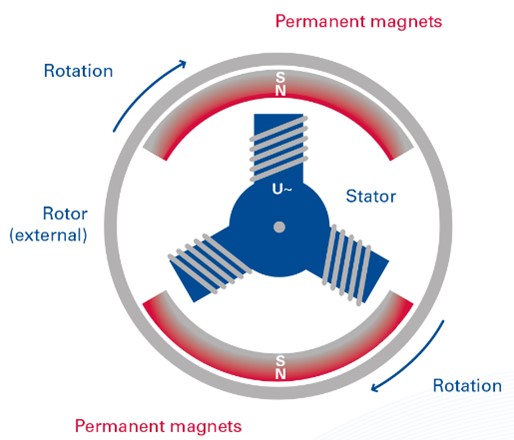

In wind turbines, rare earth based permanent magnets are far superior to alternatives, which gives us confidence that rare earths will be a key beneficiary of the growth in development of wind energy. Unlike electromagnets, permanent magnets do not require an external power source as they generate their own magnetic force. Essentially, rare earths based permanent magnets are lighter, produce more power, use fewer parts, and require less maintenance. This is why the EU Joint Research Centre estimates that permanent magnets will be used in more than 70% of wind turbines.

Source: Vensys

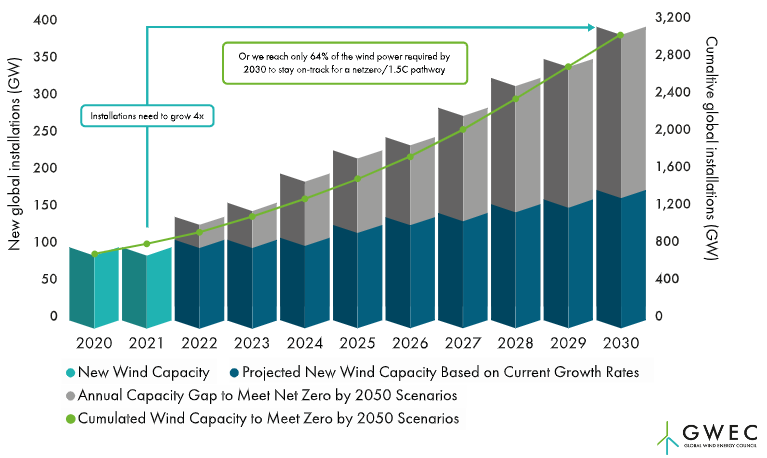

If rare earths have a share in 70% of the growth of wind turbines, it is important to consider what this growth is. According to the Global Wind Energy Council, global wind power accounts for 837 gigawatts (GW). Under current policies, 557 GW of new capacity is forecasted to be added in the next five years, which gives an annual compound growth rate of 10.7%. Whilst this already seems significant, this is considerably short of what is required for the world to stay on track to meet net zero emissions by 2050, and we expect policy development to be conducive of further ramps up in production.

Source: Global Wind Report 2022, Global Wind Energy Council (April 2022)

Rare earths based permanent magnets are also a superior input in EVs for similar reasons, which is why nearly 80% of EV motors use permanent magnets. Alternatives such as induction-based motors require an electric current as an external power source, which draws much more power from the battery pack, resulting in less range. On the other hand, the natural magnetic force generated by permanent magnets increase the power density (torque) of these motors by 2-3 times.

With an abundance of literature, models, and forecasts accounting for the massive growth in EVs, it is very significant that rare earths are a factor in up to 80% of this growth. Growth has been ramping up in recent years, where according to statistics from the International Energy Agency, EV market share of new car sales increased from just 0.9% to 8.6% from 2016 to 2021. There is ample evidence which indicates that this accelerated growth will continue. Just look at the policies around the world that is encouraging the take up of EVs, such as California’s regulators banning the sale of internal combustion engine (ICE) vehicles by 2035, or numerous prominent automobile manufacturers flagging a shift away from ICE vehicles and towards EVs. Deloitte expects that EVs will account for 32% of annual new car sales by 2030, and that EV sales will increase from 2.5 million a year in 2020 to 31.1 million by 2030 (Electric vehicles: Setting a course for 2030, July 2020).

Diversifying away from the concentration of supply in China

Not only are there strong tailwinds for rare earth producers in general, but there is also particular value in being the only major producer of rare earths outside of China amidst the backdrop of deteriorating trade relations. As China mines over 60% and processes approximately 80% of the world’s rare earths, the supply risk of these critical minerals is highly concentrated. We have already seen a glimpse into the consequences of a rare earths supply shock. In 2011, China restricted rare earths exports to shore up its own domestic supply, resulting in neodymium and dysprosium prices increasing by approximately 750% and 2000%, respectively.

Adding to this risk is the fact that China is increasingly shifting its diplomacy away from friendly trade relations with Western nations. With tensions not expected to fade away anytime soon, a key risk is that China would leverage its rare earths supply as a diplomatic tool. This is not just unfounded speculation. In 2010, China restricted rare earths exports to Japan due to tensions over disputed territory. Furthermore, in 2019, a state-run news agency Xinhua published an editorial titled “US risks losing rare earth supply in trade war,” which alludes to China’s recognition of their ability to leverage their control of global rare earths supply.

Even if China doesn’t go down this path, there is a perception that this is a vulnerability, which has encouraged other major countries to attempt to diversify their supply reliance away from China. This has already benefitted Lynas, with the US Department of Defence awarding the company a US$120 million contract for the construction of a heavy rare earths separation facility in the US. This is in addition to US$30 million granted to Lynas for its light rare earths separation facility, which will be co-located with its heavy earths counterpart. This will reduce America’s almost complete reliance on China for the processing of rare earths.

Lynas is expanding its capabilities and capacity

Lynas’ management team recognises the growth runway for rare earths, and are currently investing in expanding its capabilities and capacity. Lynas is in a healthy position to invest in these expansions as it maintains a strong balance sheet, sitting on a net cash position of $780 million. In addition to planning a new facility in the US, Lynas is already building a processing facility in Kalgoorlie, in the same region as its Mount Weld mine. This is in addition to its Malaysia processing plant. Lynas is also investing in expanding capacity at its Mount Weld mine.

The production capacity for the crucial elements of neodymium praseodymium (NdPr) will expand from 7,000 tonnes per annum to 12,000 tonnes per annum. The mine has a long life reserve, with a resource estimate of 55.2 million tonnes at an average grade of 5.3% total rare earth oxides (TREO), and a reserve estimate of 18.9 million tonnes at an average grade of 8.3% TREO. These are quite high average grades.

Its valuation isn’t too expensive given the long-term tailwinds

After the share price has surged in recent years, investors may be wary that its shares have become expensive. Although it would certainly be nice to invest in this company at a cheaper valuation, when you consider the structural increase in demand for rare earths, as well as the premium assigned to being the largest producer outside of China, Lynas still appears to have value trading at a P/E of 14x.

This is particularly the case with the share price down roughly 20% from its peak due to concerns about operational issues at its processing plant in Malaysia and a downturn in discretionary spending on products that use rare earths, such as smartphones. However, we see this price weakness as an opportunity. Lynas is diversifying its processing operations, and we choose to look past cyclical weakness as smartphone purchases will eventually recover and not negate the long-term structural growth in EVs and wind turbines.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

5 topics

1 stock mentioned