The only part of your equity portfolio that can't go negative

John told investors back then that value investing with a focus on the only part of a portfolio that can't go negative could be a salvation. The one part of a portfolio that can't go negative? Dividends. On Tuesday 26 July, John told an audience in Sydney, it has become a matter of preservation.

John and the investment team at Epoch manage the Epoch Global Equity Shareholder Yield (Unhedged) Fund, also available hedged, which focuses on investing in value companies with sustainable and growing streams of dividends. This approach meant that Epoch were among the very few global equity managers who offered a positive 1 year return for FY2022. The Epoch Global Equity Shareholder Yield (Unhedged) Fund offered 1 year returns of 4.63%, ranking them in our top 5 performing global fund managers for 2022.

The invasion of Ukraine changed everything.

“Investors should expect slower growth and higher inflation with an environment of tremendous uncertainty,” says John.

There are many different factors at play, predicting market activity has become an even more complicated activity – inflation could go either way with implications for rates. If a recession hits, it could be mild or severe. Even the ongoing ramifications of covid-19 remains an unknown, particularly considering at this stage, China has continued with a zero-covid policy which continues to disrupt supply chains.

Duration matters in periods of rising interest rates

Just as with fixed income, in periods of increasing interest rates, investors should be looking at shorter duration products in terms of company shares too. Long duration might look like a company that pays no dividends, has low earnings and free cashflow. Such companies typically sit in the high growth category and many technology companies might be in this space. Short duration might look like a company that consistently pays sustainable dividends, has high free cashflow and might be focused more in the value category, such as consumer staples.

“Higher inflation and bond yields compared to the 2010s comprise a headwind for long-duration assets, including speculative tech, biotech, and venture capital. In addition to greater volatility and a forceful rotation in sector leadership, expect equity markets to deliver lower prospective returns relative to that experienced since the GFC.”

Dividends matter more than many realise

As John has previously said to Livewire,

“Dividends are the only component that cannot turn negative. They have been a stabilising factor for returns every year, going back as far as reliable data exists.”

In inflationary environments with rising interest rates, investors need to find a way to grow (in order to preserve their wealth) as well as generate income. Generally speaking, long term drivers of returns are earnings and dividends.

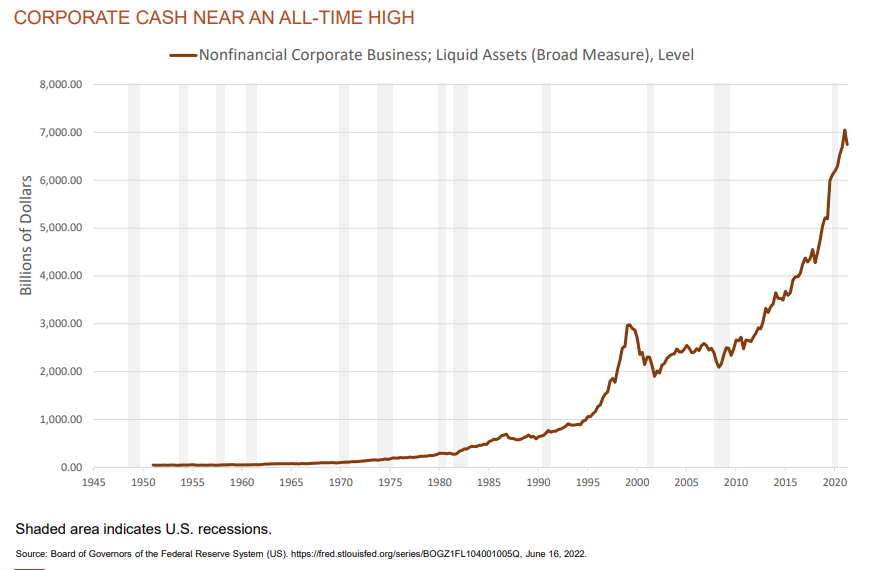

John anticipates dividends may actually grow despite the uncertain environment pointing to the near all-time high levels of corporate cash and that more than 50% of that cash is expected to be allocated to dividends and buybacks in the next two years as shown in the following two charts.

Further to this, companies which offer dividends typically exhibit lower volatility making them ideal candidates to consider in uncertain times. Just consider the charts below which analysed companies in the MSCI World which demonstrated that those companies with either stable or growing dividends displayed the lowest volatility as measured by standard deviation while offering higher returns.

Can falling valuations in growth be a value opportunity?

While some value investors may be looking at the valuation drops across the NASDAQ100 and view this as the time to invest in some of the big tech names like Amazon (NASDAQ: AMZN), Epoch are steering well clear. Once again, dividends are the main answer to why. Most of the growth tech stocks, like Amazon or Meta (NASDAQ: META), don’t pay dividends and therefore don’t fit Epoch’s view on value.

Now is not the time for growth

“Investors should think more about being defensive than jumping with both feet back into growth.”

Epoch are value investors, so it should not come as a surprise that John is a firm advocate of the importance of focusing on longterm value and quality in stock selection as a defensive strategy. Value may have been out of fashion for the past decade of bull market exuberance, but it’s definitely back in vogue now.

Interested in more information about Epoch’s investment philosophy and strategy?

You can also find out more about Epoch’s strategies in the discover funds section of Livewire:

4 topics

3 stocks mentioned

2 funds mentioned

1 contributor mentioned