The pockets of opportunity in a noisy market

Keep it simple, stay optimistic, take a long-term view and don't get carried away with the noise of daily news flow. That's sage advice from Wilsons' David Cassidy, who draws on over two decades of experience guiding their client portfolios through short term market gyrations.

I recently sat down with David to see if I could tease out a few insights into how he is building portfolios against the current backdrop of rising bond yields, surging energy prices and economies that are exploding out of lockdown.

David explains why he is taking a counter-consensus view on an energy sector crippled by a lack of investment. The popular narrative is that companies with exposure to fossil fuels are dead and buried. However, the energy transition will likely be drawn out over decades and will be peppered with episodic price surges.

"If you look at energy markets longer term, there's been no capital expenditure on traditional oil and gas for more than seven years now," he says. "So I think the system will tighten up, progressively."

The key issue, according to David, is that soaring prices aren’t enough to incentivize investment into an industry with a dire long-term outlook. While the talk is all about switching to cleaner sources of energy, the reality is that the process is likely to be drawn out for decades.

"There is a bearish scenario for oil demand and even gas demand but it's a 20, 30, 40 year story," he says. "In the near term, I think it's actually, perversely, quite a bullish story for oil and gas markets."

David also outlines the three primary reasons he is upbeat about the outlook for Australian equities and shares some of the 'quality' names within Wilsons' portfolios.

And in place of an allocation to traditional fixed-income David explains why he is bullish on alternatives, highlighting a fund manager that is delivering stellar returns without the correlation to equity markets.

Topics discussed

- 0:52 - Introducing Wilsons

- 2:45 - How David thinks about implementing an investment strategy

- 4:46 - Are rates and inflation set to move higher

- 7:24 – Why high energy prices could be here to stay

- 12:11 – Three reasons to be optimistic on Australian equities

- 15:59 – Why David likes alternatives and one manager that passed his filters

- 17:40 – The five Ps of finding a good manager

- 18:44 – David's core principles for investing

Edited transcript

James Marlay

Hello, and welcome to this exclusive interview brought to you by Livewire Markets. My name's James Marlay. I'm a co-founder of Livewire and I'm joined today by David Cassidy, Head of Investment Strategy at Wilsons.

David has the unenviable task of having to put together the full strategy top-down, understand all of the moving parts of the economy, and think about how that might play out into the investment portfolios that Wilsons oversee.

It's obviously a big job, and with markets at a really interesting point — we've got rates rising; we've got energy prices rallying — I thought it would be a great time to get David to have a chat about how he's seeing things.

David, great to have you in today, and welcome to Livewire.

David Cassidy

Thanks James.

Marlay

First of all, tell us a little bit about yourself and Wilsons.

Cassidy

I head the investment strategy group at Wilsons. We set the investment strategy for the private wealth division of Wilsons.

We invest across asset classes, so part of our job is to set the strategic and tactical asset allocation for the private wealth business. We also select what we think are the best managers in each asset class. And finally, we also advise on direct investment, particularly into Australian equities. We set Australian equity direct share portfolios.

We're trying to add value three ways:

- Smart asset allocation

- Smart manager selection

- Stock selection.

Wilsons has three businesses with a fair bit of synergy:

- We've got the private wealth business that I spend most of my time working for.

- We have a stockbroking business, both private wealth stockbroking but also an institutional stockbroking business which is primarily focused on small and mid-cap equities. We have a fairly substantial research capacity in small and mid-caps.

- We have a corporate finance business that advises and IPOs emerging companies.

From a private client perspective, what you get from Wilsons is hopefully a well-structured, multi-asset portfolio.

You get direct stock advice and model portfolios, but also the ability to access interesting and emerging company IPOs. We think that's quite a nice mix.

Marlay

If we're to talk about you for a moment — a really lengthy career with UBS, 14 years, and prior to that, JP Morgan.

Tell me about the investing lessons that you've picked up along the way.

Cassidy

I like to keep it pretty simple. I'm focused on not getting too carried away with the noise.

Obviously, I watch the markets very closely every day, every week, but try not to get carried away with the excessive pessimism and optimism the markets can swing to from day to day, week to week.

It's pretty obvious, but I think it's important to focus on the medium to long-term. That's why I'd like to stay diversified in terms of setting strategies.

I'd probably stay on the optimistic side of the argument most of the time, within reason.

Equities in particular have a history of going up more than they go down. I think it's easy to get bearish when you're watching markets for a long time and looking at that wall of worry.

But I think it's an important lesson to not get too bearish on markets. There's a time to get bearish, but for most of the time I think it's good to stay relatively optimistic.

For the last 25 years or so, the general commentary has almost always been that equities look expensive. That's been the case since the mid 90s.

That's only really been right a couple of years out of the last 25. It's a good lesson to not get overly bearish but at the same time stay diversified.

Marlay

We talk about markets looking expensive right now. A classic example is we've come out of a trough.

Markets have rallied really well and we're now talking about all-time highs for many markets again. And for the first time there is some concern that interest rates might start to push higher.

I'm keen to understand what your base case is on the outlook for inflation and how you're factoring that into the way that you're building portfolios.

Cassidy

The bears would say, "Well, we've been spoilt for the last 25, 30, 40 years." In terms of the inflation and interest rate backdrop, we've had low inflation and continually falling interest rates.

So it is a key question: are rates finally going to move up decisively? Is inflation going to move up? From the perspective of inflation, I am on the transitory side of the argument.

I don't really like that word, but I think it is a fairly good descriptor of what's going on at the moment.

You can look at a lot of the inflation that's bubbled up in the last six months around the world and make a pretty good argument that it is transitory.

A lot does seem to be linked to the pandemic. There's supply chain disruption; there are some unusual swings in demand that have been caused by the closing down and opening up of economies.

If we move forward a year, is inflation going to be higher or lower? I've got a pretty high conviction it's going to be lower than it is at the moment.

You've got US core inflation at about 4%. I think it's going to be more like 3%, possibly 2%.

There's more of an argument about the trend rate of inflation — has that shifted on a 3-5 year view? It's possible it is going to be higher than we've been used to for the last three, five, 10 years.

I do think the sheer size of the stimulus that's been put into economies everywhere does mean you'll probably get more inflation over the medium-term than we're used to.

I think policy makers are going to let economies run on the hot side over the next few years. So I think labour markets will tighten up. You've got energy markets that I think are going to be structurally tight.

So I don't think there's a regime shift coming. A lot of people are saying it's back to the 70s.

I don't think that's the case, but I do think inflation will trend a little bit higher over the medium-term.

And therefore I think bond yields are going to prove to be too low. It's just a matter of how high and how quickly.

I think it'll be moderate and gradual, but I don't like bonds at current levels.

Marlay

You mentioned that energy prices are feeding into the inflation we're seeing.

And I know you've put together a detailed report looking into the drivers of these prices. Take me through the key findings.

Cassidy

Energy markets are interesting in that, unlike a lot of the other inflation pressures we're seeing at the moment, you can't really lay the blame on the pandemic, to a large extent.

There are transitory factors in what's going on in some of these energy markets, particularly gas and thermal coal, but I'd call it more episodic than transitory.

There's been a lot of bad luck with weather around the world. And there's been some difficult policy choices being made in regards to the energy pivot to green energy. It's proving a difficult balancing act.

There was really no wind in Europe for a couple of months and they have quite a reliance on wind power.

About 25% of the UK's energy demands come from wind, and if the wind's not blowing, they've got to turn to gas.

Unfortunately, Europe was running super low gas inventories, I think in part because carbon pricing discourages gas production. They've had to suck in a lot of gas from Russia, in particular.

That's caused a spike in gas prices. At the same time, look at China. It flooded in the coal pits, and there was a drought in the hydroelectric areas. So they've had an energy problem.

At the same time, they've been waging a trade war with Australia and have not wanted to take our coal, so they've caught themselves in a vice.

It was a bit of Murphy's law — what could go wrong did go wrong.

But if you look at energy markets longer term, there's been no capital expenditure in traditional oil and gas for more than seven years now. I think the system will tighten up progressively, particularly if we get good growth over the next few years.

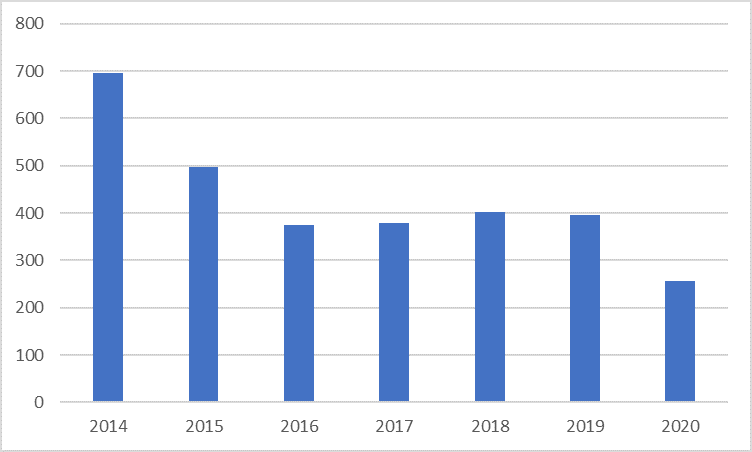

Oil and gas capex in US$ billions

We'll be more prone to these spikes when the weather doesn't behave itself or that sort of thing. And I think the trend for oil and gas prices is probably higher over the medium-term.

I don't think you're really looking at peak oil demand for another 10 years at least. Gas peak demand is probably a lot longer down the track.

From that perspective, energy prices are going to be pretty buoyant on average over the next five years, possibly longer.

Marlay

It's interesting because it goes against the popular narrative in the market, which is the energy transition. It's almost the contrarian play that's rolling out in front of us, isn't it?

Cassidy

Yeah. I think there is a bearish scenario for oil demand and even gas demand, but it's a 20, 30, possibly 40-year story. In the near term, I think it's actually perversely quite a bullish story for oil and gas markets.

Marlay

And within the portfolios and the strategies that you're putting together on the underlying equity exposures, is that something you're looking to get exposure to?

Cassidy

Yeah, we're have been overweight the Aussie energy sector within our Aussie equity portfolio for some time now.

It was not looking like a great call a few months ago, but it's come home with a wet sail in the last little while, and I still think that's the right way to be positioned over the next few years.

We also like some of the big global integrated oil companies — massive free cash flows are coming out of some of those companies. Look at something like Royal Dutch Shell, generating a 16% free cash flow model this year.

From that perspective, we think energy is probably not a contrarian play now. It certainly was, but I think it's a counter-consensus play on a medium-term view.

Marlay

I think the thing people are trying to understand is, as you alluded to, how long can higher prices be sustained, and is there additional risk to the upside?

You have a chart showing the lack of capital expenditure that's gone in because it's been disincentivised and there are firms that don't want to be associated with that kind of investment.

Cassidy

It started in 2014 and it collapsed last year, partly because of COVID, but also because this intensification of the green energy pivot has discouraged conventional capital spending in oil and gas.

Marlay

I want to dig into your latest asset allocation framework and the areas you're tilting towards and away from.

I'm going to start with Australian equities because you've got a long, deep background in that space and it's also one of the parts of the global market that you're relatively optimistic about.

Talk me through a couple of reasons to be optimistic on the outlook for Australian shares.

Cassidy

It's a pretty simple thought process really. That's a 12-month call.

We basically made that call in early October on the back of the prospective opening up of NSW and Victoria, which is a large chunk of the Aussie economy.

That reopening theme we thought would help the economy reaccelerate over the next year. It would help profit growth and probably be supportive for the Australian dollar as well.

On that basis, we did want to play that reopening theme. I'd also say Australia's probably a little bit less sensitive to a rising bond yield than, say, the US market.

And as I said, we think the Aussie dollar, particularly against the US dollar, is probably going to be on the strong side over the next six to 12 months.

They're probably the three main reasons we're at least cyclically positive on Australia at the margin versus global equities.

Marlay

In terms of specific sectors or even strategies, have you got a preference for growth or value managers?

Are there any particular sectors where you expect to get better performance?

Cassidy

Once you have a cyclical bias for value in terms of being optimistic on the global economy, thinking that long rates will move up over the next one or two years, that probably puts a bit of a tailwind behind value, at least cyclically.

We always hold a mixture of value and growth managers, but we're probably holding more value exposure than we would normally at the moment.

In terms of the Aussie direct portfolio, we always try to hold a core of quality companies as ballast to the portfolio.

It's probably more quality rather than value and growth, so CSL, Resmed, Macquarie, Aristocrat, James Hardie; that seven or eight really high quality companies typically forms the base of our portfolio.

Then we take some opportunistic positions around that core.

We were overweight in banks last year and early this year. We pulled that back to a more neutral position, but we did put on an energy overweight about a year ago. We've kept that.

The other thing we try and do is utilise our small-cap research expertise, so we always have a few interesting small-cap ideas in the model portfolio.

Telix is a small company with a molecular cancer solution that we really like, and it's done really well for us.

We always have a few small-cap ideas based on the Wilsons research in the portfolio as well.

Marlay

Looking outside the Australian equity allocation, which I think many of our viewers are comfortable with, you mentioned earlier that the fixed income was not an area where you were finding value at the moment, particularly in bonds.

One of the ways people have been looking to get some uncorrelated returns away from equities is by introducing alternatives.

Now, it's a broad church. There are a lot of things that can sit in that alternatives bucket.

But when I looked through the return expectations behind your equity allocations, you had your highest expectations coming out of that alternatives allocation.

Talk me through what sits under alternatives and give us an example of one of the ways that you're playing that — a strategy and a manager that gets past your filters.

Cassidy

For alternatives, it's really anything that's not a vanilla fixed interest or equity exposure. So it would include private equity, private debt, hedge funds or absolute return funds.

Primarily equity but also potentially fixed interest, unlisted property and unlisted infrastructure, and also potentially commodity investments, whether it be gold or some sort of basket of commodities. That's the mix for us in terms of alternatives.

In terms of something that cuts to the heart of what we're trying to achieve in alternatives, we're looking for uncorrelated sources of return.

What we were looking for this year was a genuine market-neutral equity fund that won't behave like the equity market behaved, but offered genuinely uncorrelated risk and return.

The holy grail is to find someone who can deliver equity-like returns. Let's call it 8, 9, 10%, with no correlation to equities.

We'd put in Allium Market Neutral Fund. They've got a good track record of around 10% total return with very low volatility and minimal drawdowns. They were actually up last March when markets were down 20, 30%.

If you can find a genuinely skilful market-neutral fund, that's a good addition to a alternatives allocation.

Marlay

What processes do you go through in that search for the holy grail? Give me an insight into the manager selection process.

Cassidy

We call it the five Ps:

- Performance

- Process. The performance of funds is important, but do we understand the process? Is it repeatable?

- We take note of the people.

- How does it fit within the portfolio? That's the diversification or lack of correlation benefit that it brings to the fund.

- Price. How much does it cost us to access the manager? And how are the incentives structured for the manager?

Marlay

When it comes to putting together portfolios, what lessons can leave with other people?

Cassidy

It's a motherhood statement, but you do have to take a long-term view. There are times when things are going to look not so great, but you've got to take a medium to longer-term view.

We always try and preserve capital, so we are running diversified, multi-asset portfolios. But markets can get excessively optimistic or excessively pessimistic.

Stick to your process and do not get too caught up in the day-to-day pessimism or optimism, but particularly pessimism.

Marlay

Thanks very much for coming today. It's been a pleasure to catch up.

Cassidy

Great to talk to you, James.

4 topics

1 stock mentioned

1 contributor mentioned