The re-emergence of financials, retail and travel

In recent weeks the wheels have been turning on a market rotation following positive news on COVID-19 vaccine developments. We now enter 2021 with confidence that it will be a year in which we see a continuing rebound in global economic activity with vaccine adoption acting as the accelerant.

However, it’s important to remember that in the immediate term there could be some further uncertainty, at least until the next reopening catalyst – most likely to be Emergency Use Authorisation for the vaccines. Further, investors should keep in mind that certain behaviours won’t revert to what we once knew as ‘normal’.

So, how can global equity investors take a pragmatic approach to reopening exposures in some of the more beaten down sectors, including financials, retail and travel?

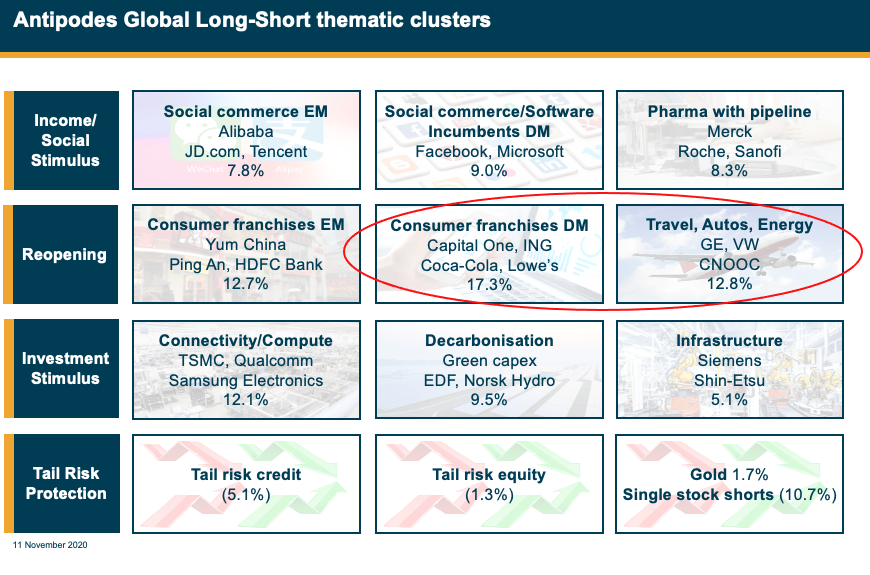

Andrew Baud (Antipodes Consumer & Domestic Services Developed Markets Portfolio Manager) and I discussed our approach to investing in the reopening and the compelling opportunities in today’s market in the latest episode on Antipodes' Good Value Podcast. We take a deep dive into our exposure to developed world reopening beneficiaries, which has increased roughly 5% since the end of September to around 30% of the portfolio. This has come at the expense of our global defensives which have fallen 5% to around 26%.

You can listen to the full episode here, or continue reading my synopsis on the financials, retail and travel sectors below.

Financials

Investors should focus on robust retail banking franchises where credit costs have been low, as consumers have been well-supported by income stimulus and government support, and franchises which aren’t being disrupted by savvy fintechs.

Capital One Financial and ING are two compelling investment propositions. Both dominate their respective markets – credit cards in the US for Capital One and mortgages in Northern Europe for ING - with incredibly cheap valuations.

Capital One is the only large US bank fully transitioning to the cloud, which will be completed in 2021. This will give Capital One greater ability to innovate its product offering and better assess the credit risk of its customers.

ING was arguably the original technology disruptor, with its predominantly online business model.

Both companies are valued at potential sustainable payout yields of more than 10%, which includes dividends and buybacks. Once regulatory approval to restart capital distributions has been granted, this should be a clear catalyst for a re-rating in the new year.

Retail

Ecommerce has increased from 15% of total US retail sales at the end of last year to 25%, as lockdown and social distancing pushed consumption online. Even in a reopened environment, online retail penetration is not falling back to 15%. An example of a change in consumer behaviour triggered by COVID, that's here to stay.

There’s been a permanent shake out across the retail landscape, particularly retailers dependent on mall foot-traffic. We’ve seen a handful of high-profile bankruptcies in the US, such as Nieman Marcus (a premium end department store chain not dissimilar to David Jones in Australia) and JC Penny (a mass market department store chain). In our portfolio we’ve focused on retailers that can seamlessly straddle both the offline and online worlds – otherwise known as omnichannel operators.

A good example is Ulta Beauty, one of the largest specialty beauty chains in the US. It’s a similar beauty concept to Sephora or Mecca here in Australia but stands apart for providing both mass and prestige brands to consumers under the one roof.

The beauty industry grows at a fairly predictable rate of 3-4% p.a, but we think Ulta can do better than that by taking more market share, largely at the expense of department stores and a very long tail of smaller market participants. COVID forced Ulta to shut down its 1,200 stores, but the business was well placed from earlier ecommerce platform investment. Its online sales have grown triple digits but Ulta also remains a reopening beneficiary as customers get back to their stores for the unique advice and experience from testing products and getting treatments.

Another retail holding is Simon Property Group, a premium outlet centre and mall REIT in the US (think Westfield in Australia).

Our view is that retail space in the US will consolidate into distinct formats that enable omnichannel retailing. Premium malls and premium outlet centres will be survivors, and we think Simon Property Group is a good way to capture exposure to this because of its scarce premium real estate assets.

In terms of the US retail market, premium A-grade or better malls represent less than 25% of total malls and more than 30% by selling space. Simon Property Group has over 40% share of the premium malls and outlets in the US making it a go to partner for US retailers. The Simon portfolio earns over 80% of its Net Operating Income from A-grade or better rated premium properties.

Adjustments will occur in the retail industry. Some Simon tenants will disappear, as they have during prior retail cycles, but they’ll be replaced by other retailers looking for access to high traffic real estate. Whilst waiting for sentiment to improve, Simon pays a sustainable 6% cash dividend yield.

Coca-Cola is another great reopening play. Coke generates just over 40% of its global revenue from on-premise consumption – cafes, restaurants, bars and entertainment/sporting venues. These have all been shuttered thanks to lockdown and social distancing.

As well as a reopening opportunity, Coke is distinctive from most other consumer staples by retaining strong influence over its bottler supply chain, right up to delivery and stocking customer shelves. This helps the business to keep distribution costs low, maintain customer relationships and sustain pricing power.

As reopening gathers pace, we think Coke will grow faster than its peers again and should benefit from a relative re-rating.

Travel

Antipodes has grown its travel related exposures to around 4% of the portfolio. But investors need to be selective when considering this sector.

In our view, domestic travel comes back before international, and we don’t think business travel mean reverts – so companies that are overly dependent on business travellers may end up being future value traps.

GE is a stock we have had in the portfolio for some time, and we’ve always liked it for its global aerospace engines business which, prior to the pandemic, accounted for around two-thirds of earnings. The jet engine business is a lucrative global oligopoly, where GE has 70% share of smaller, narrow-bodied planes – which makes it well positioned for a revival in domestic travel.

The company also has a 50% share of the wide-bodied plane market.

We think booking.com will also be a key travel beneficiary and it’s not dependent upon a return to international travel. We used the sharp sell-off in the stock as an opportunity to include it in our portfolio.

Developed Market reopening clusters

Want to learn more about investment opportunities in global equities?

Antipodes Partners is an award-winning value-orientated global equities manager, offering long only and long-short investment strategies. Visit our website or click the 'contact' button below to find out more.

4 topics

1 contributor mentioned

.jpg)

.jpg)