The recent change in the Australian credit cycle may only be temporary

One of the interrelationships often utilised by investors in more credit heavy portfolios is that interest rates will provide a level of protection against ‘risk off events’; i.e. a widening in credit spreads[i]. Accordingly, the level of total risk associated with being structurally overweight credit is mitigated by the interest rate duration within a portfolio. Unfortunately for investors this relationship has broken down over the last couple of years thereby increasing the level of return volatility in such credit heavy portfolios. On a positive note for investors in Australian fixed income portfolios there are grounds for believing that this change in dynamics may be temporary.

One of the core sources of return enhancement within fixed income portfolios is the incorporation of a structural overweight to credit spreads. Such an overweight will tend to be more structural in nature as it provides investors with one of the more predictable premiums which can be earned in fixed income markets. This is especially true in markets such as Australia where the credit exposures tend to be relatively ‘high quality’; i.e. exhibit low default risk. A ‘high quality’ exposure to credit spreads means that the major risks faced by investors are the ‘mark to market’ impacts arising from movements in credit spreads. It is in this context that the traditional negative correlation between interest rates and credit spreads becomes more important factor for investors as a means of reducing overall risk within a portfolio.

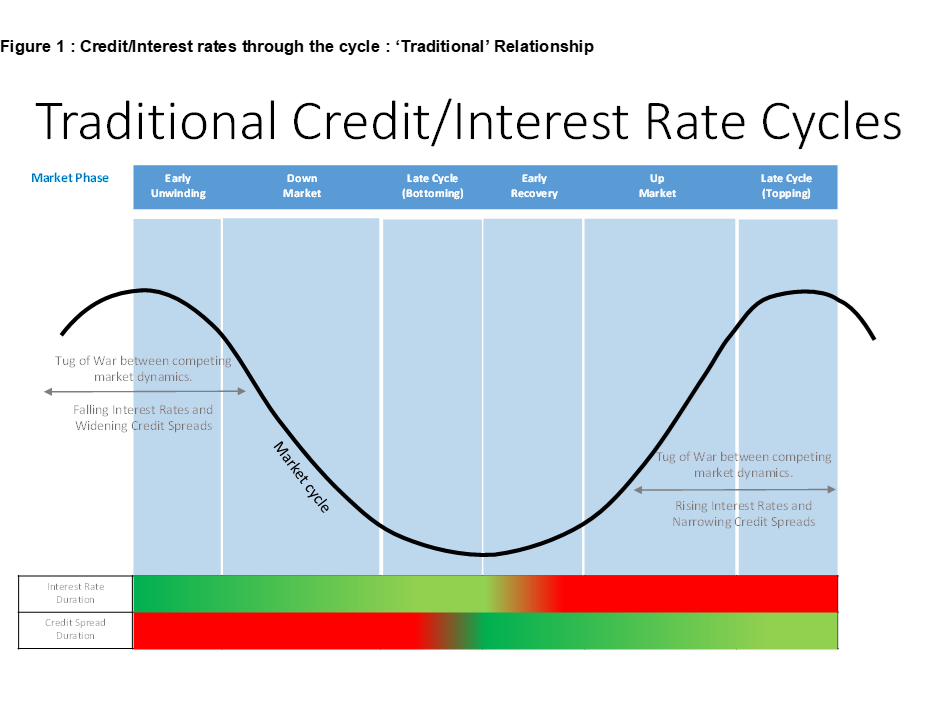

The key to the existence of the relationship is the link between monetary policy and the economic cycle. As maintaining economic stability is part of most central banks objectives there will be a tendency for central banks to manage monetary policy to “lean” against the cycle. Given such a bias, over an economic cycle, increasing bond yields are associated with central banks raising official interest rates which is indicative of stronger expected economic conditions and hence positively impacts the fundamentals for corporations and credit spreads; i.e. credit spreads contract as bond yields rise. The opposite holds for declining bond yields which in turn are associated with central banks reducing official interest rates in response to deteriorating economic growth and hence are negative for credit spreads; i.e. credit spreads expand as bond yields decline. The result of this tendency for central banks to “lean” against the cycle is the generation a negative relationship between interest rates and credit spreads over a traditional economic cycle.

While such a relationship sounds good in theory, in practice are credit spreads and interest rates interlinked? For Australia this can be answered by considering the correlation between changes in the credit spread on the Bloomberg AusBond Bond Credit 0+ Index and changes in the yield on duration matched Australian Commonwealth Government bonds. The correlation between changes in bond yields and credit spreads from January 2011 - Dec 2019 was -0.30. Such a negative correlation highlights that over this period there was, what may be termed, a traditional relationship between interest rates and credit spreads. The statistical analysis also highlights that importantly this relationship changed in the post 2019 period as the Reserve Bank of Australia (‘RBA’), and central banks globally, began to implement quantitative easing to offset the deflationary impacts associated with COVID. The correlation between changes in interest rates and credit spreads from Jan 2020 – April 2022 shifted to become positive at +0.12. In contrast to the pre 2020 environment, bond yields and credit spreads didn’t act as risk diversifiers but rather their movements reinforced each other increasing overall risk within fixed income portfolios.

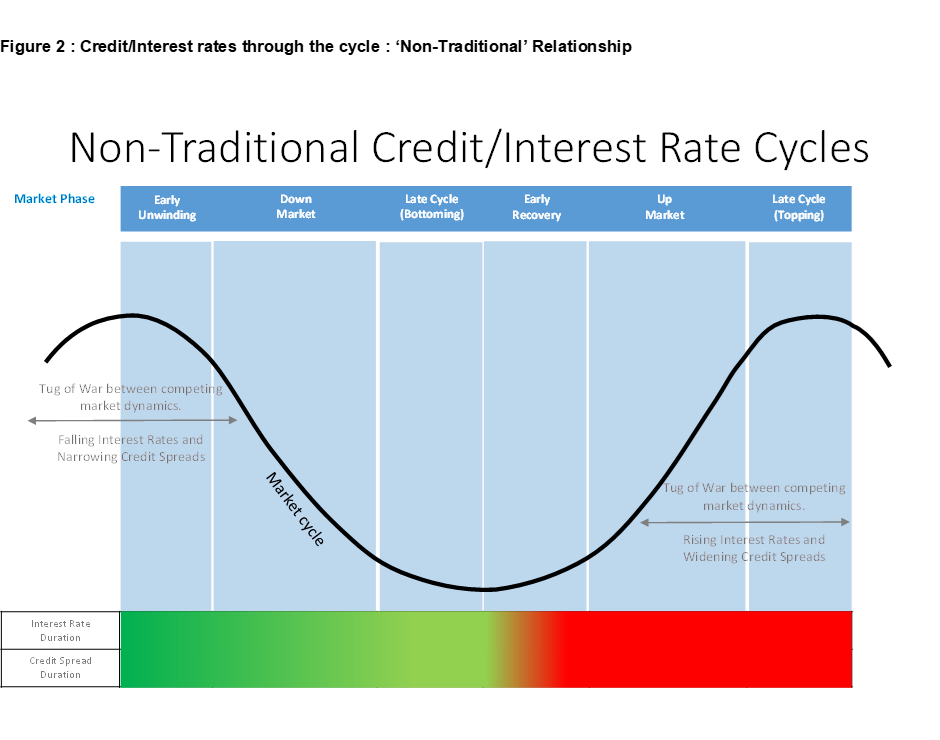

The change in the relationship between interest rates and credit spreads seen in the post 2019 period is largely due to the change in the approach to implementing monetary policy by many central banks associated with the adoption of quantitative easing. More specially the channels for implementing monetary policy changed with the more explicit targeting by central banks of stability within the financial markets themselves as a means of managing the economic cycle. Critically under the non-traditional relationship movements in credit spreads are no longer simply a by-product of the central banks use of monetary policy to “lean” against the traditional economic cycle. Rather credit spreads are being used directly by central banks as a specific target of monetary policy and a lever by which to implement and maintain accommodative monetary policy. With lower credit spreads being a specific target of monetary policy then the more accommodative central banks desire monetary policy to be the more they intervene directly within credit markets to lower the spread on such securities. Conversely, less accommodative monetary policy is likely to deliver both rising credit spreads and interest rates. It follows that under such a ‘non-traditional’ framework for implementing monetary policy investors will find that as central banks lower and then raise interest rates the interlinkage with credit spreads will differ materially from what would traditionally be expected. Rather than the negative correlation which investors may be used to, under a non-traditional approach to setting monetary policy there will tend to be a positive correlation between interest rates and credit spreads. Ironically, in contrast to the traditional cycle, in a non-traditional cycle the investor requires less, not more, interest rate duration to offset the strategic overweight to credit spreads and thereby reduce total portfolio risk.

For most fixed income portfolios the experience of the last couple of years has been one of heightened volatility in returns as the traditional relationship between interest rates and credit spreads has failed to hold. Most significantly as the RBA has set about normalising interest rates investor returns have been hit with the ‘double whammy’ of both higher bond yields and widening credit spreads. On a more positive note for investors this change in dynamics has been largely driven by the approach to quantitative easing adopted by central banks globally where credit spreads are seen as another policy tool. Consequently, as central banks move toward a ‘normalisation’ of monetary conditions investors should benefit from, not only higher yields, but also the likelihood that the more traditional relationship between interest rates and credit spreads will re-establish itself.

[i] Credit spread is broadly defined as the additional yield earned over the Australian government bond yield as compensation for the increased default and liquidity risk assumed by the investor. It should therefore be considered as the additional risk premium required by investors.

4 topics

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...

Expertise

Clive Smith is an investment professional with over 35 years experience at a senior level across domestic and global public and private fixed income markets. Clive holds a Bachelor of Economics, Master of Economics and Master of Applied Finance...