The red hot method professionals are using to thump the ASX and ETF investors

The latest fund manager performance surveys shows Australia's top stock pickers are thumping the indices, and the flood of passive money in exchange traded funds tracking them, by using the same approach to turbocharge their returns.

Surprisingly, the method catapulting active fund managers to the top of the performance charts is so simple, any normal investor could try it.

Think of the it like the tale of two hunters in the woods being chased by a ferocious bear. One hunter stops to put on his trainers, and his partner tells him it's pointless as you cannot outrun the bear. To which he replies, 'I don't need to outrun the bear, I just need to outrun you'.

.jpg)

The bear is the index all investors want to beat. The partner believes it's pointless to try and outpace the index, as the passive money is destined to join the bear.

And the smart money is the fund managers prepared to change their shoes - or the rules of investing - by targeting stocks before they're added to the index to beat both the bear and passive money.

According to the founder and chief investment officer of Forager Funds Management, Steve Johnson, the passive money phenomenon is now "distorting markets" so much that it's something active investors have no choice but to consider if they want to get ahead.

Johnson should know. After his Forager Australian Shares Fund returned 21.7% before fees over the 12 months to March 31, to beat the returns of 123 other equity managers in the Mercer tables by a decent margin, and smash the 2.6% return from the S&P/ASX 300.

Making money is all that matters

Also remember that stock markets are Machiavellian, as whatever method works is the best. At the same time they're also Darwinian, as everyone tries to beat each other in any legal way possible, which now includes getting ahead of the passive money.

We can also see that markets will always react to price anomalies, such as those created by exchange traded index funds, if there's money to be made.

Another top stock picker known for its competitive approach and relentlessly focusing on how to get to the top of performance tables is Regal Funds Management.

Its Regal Australian Small Companies Fund is the number two ranked fund for performance over the past 10 years to March 31, according to the latest Mercer Investment Survey.

Regal is openly on the record that one of its best investment strategies has been to change its shoes (or as it says, change lanes from the market's motorway) to outpace the index and less-sophisticated passive money.

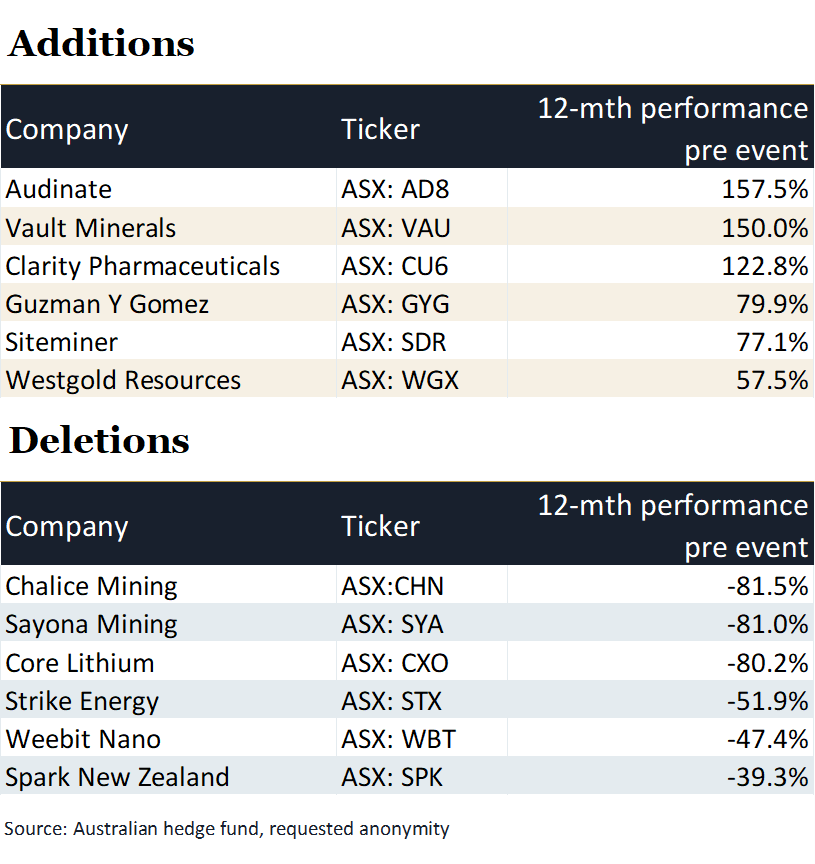

Check out the below table of how ASX small and mid-cap stocks have performed before they were added to an index, and how they performed after they were deleted from an index.

The table shows the huge money to be made by smart investors once they decide what will be added to an index and bought by passive index-tracking funds afterwards.

Vice-versa applies once it's evident the passive index funds will need to sell a stock if it's deleted from an index that they're required to track. Some hedge funds will also short these stocks to generate extra alpha, as they effectively bet the prices will fall.

Today, more and more sophisticated investors actively look for companies likely to qualify for future index inclusion based on their operating success, which translates into rising market caps likely to push them into indices, assuming they meet minimum liquidity requirements.

However, that doesn't mean private stock pickers or mum and dad style investors should exclude themselves from taking account of this important new market dynamic, or even seeking to profit from it.

5 topics

9 stocks mentioned

.jpg)

.jpg)