The world just changed narrative is bulls#1t

COVID-19 has been an issue for weeks. The bond market realised it. Forex markets realised it. So don't give me the "Italy changes everything" bulls#1t. And spare me your "black swan" nonsense*.

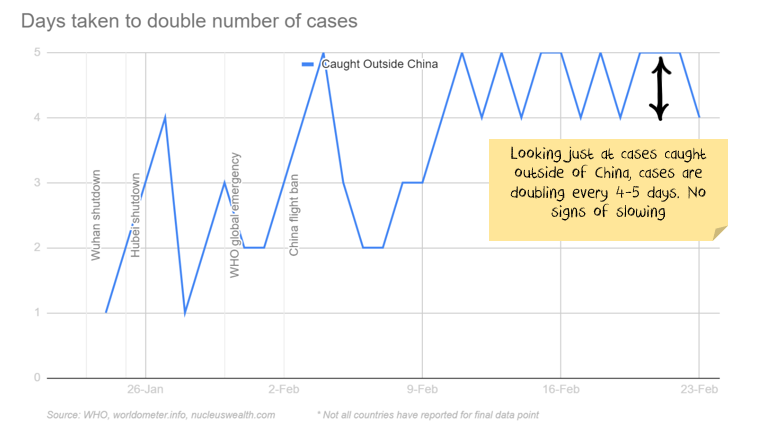

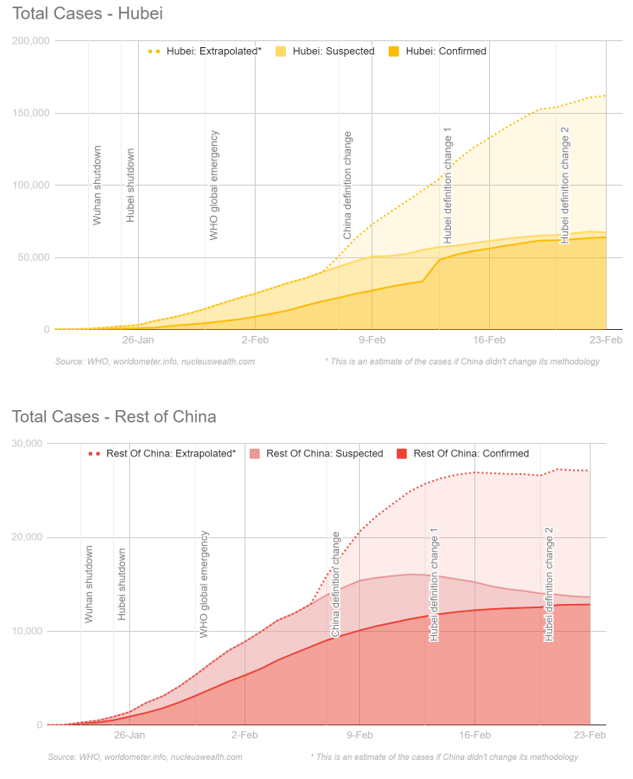

The reality is that very little has changed with the growth of COVID-19 over the last few days. If we look only at cases caught outside of China:

- three weeks ago, cases were doubling every five days

- two weeks ago, cases were doubling every five days

- now, cases are doubling every five days

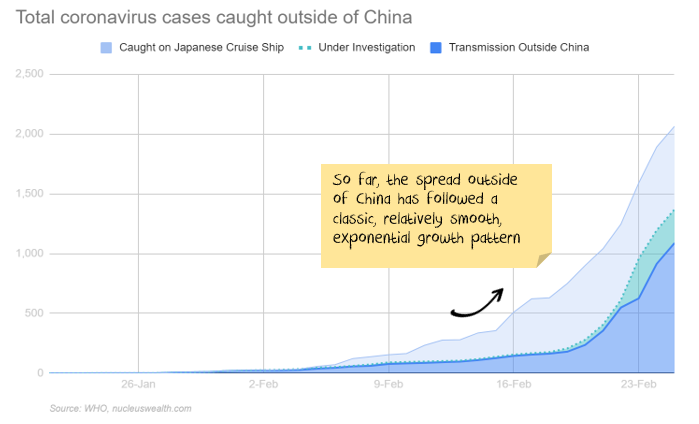

That is what a contagious disease does. The growth in cases transmitted outside of China is following the kind of pattern you would expect:

We know the disease is incredibly virulent - the Diamond Princess showed that. We also know that a vast number of patients show little or no symptoms, which means that it spreads easily. We have enough evidence to suspect that the disease is airborne.

We also know the key risk of an epidemic is when hospitals are over-run with patients and can't properly treat the patients. That is why the mortality rate in Hubei is 5x higher than in the rest of China. And that is why China has put strict quarantines and bans. And that is why Italy has followed suit.

The best hope for countries is to dramatically limit human interaction. This will save lives. It will also have a significant effect on the economy.

Truimph of the optimists?

The returns over the last twelve months highlight the issue of remaining too conservatively positioned. Anyone huddling in cash following the bloodbath in share markets at the end of 2018 missed the upside of being more active with asset allocation.

We made some significant changes to our portfolios three weeks ago to become much more defensive. So, are we making the same mistake now by staying in cash?

Maybe. But given two significant risks markets are facing, we are prepared to weather some short term regret. The payoff is hedging the most substantial risks we have seen since the financial crisis.

- Global share markets have been trading on 20-year valuation highs with very few signs of growth. Even recent falls do not make markets cheap.

- The worst outcome from selling shares now is that we miss out on shares returning to unsustainable “tech-wreck” level valuations.

- The best outcome is we miss a massive drawdown from any one of a range of economic risks.

Non-linear risks

A non-linear risk is one where the downside becomes exponentially worse past a point of no return. Driving along the edge of a cliff is a good analogy. If you were 10 metres away from falling off or 10 millimetres, the outcome is the same: you survived. But go just that little past the edge, and you reach a point of no return.

There are two significant non-linear risks. Maybe neither of them eventuate, and the world will carry on not knowing that it was 10 millimetres away from disaster. But, the chance of either occurring continues to increase with each passing day.

Risk 1: Debt Crisis

We know:

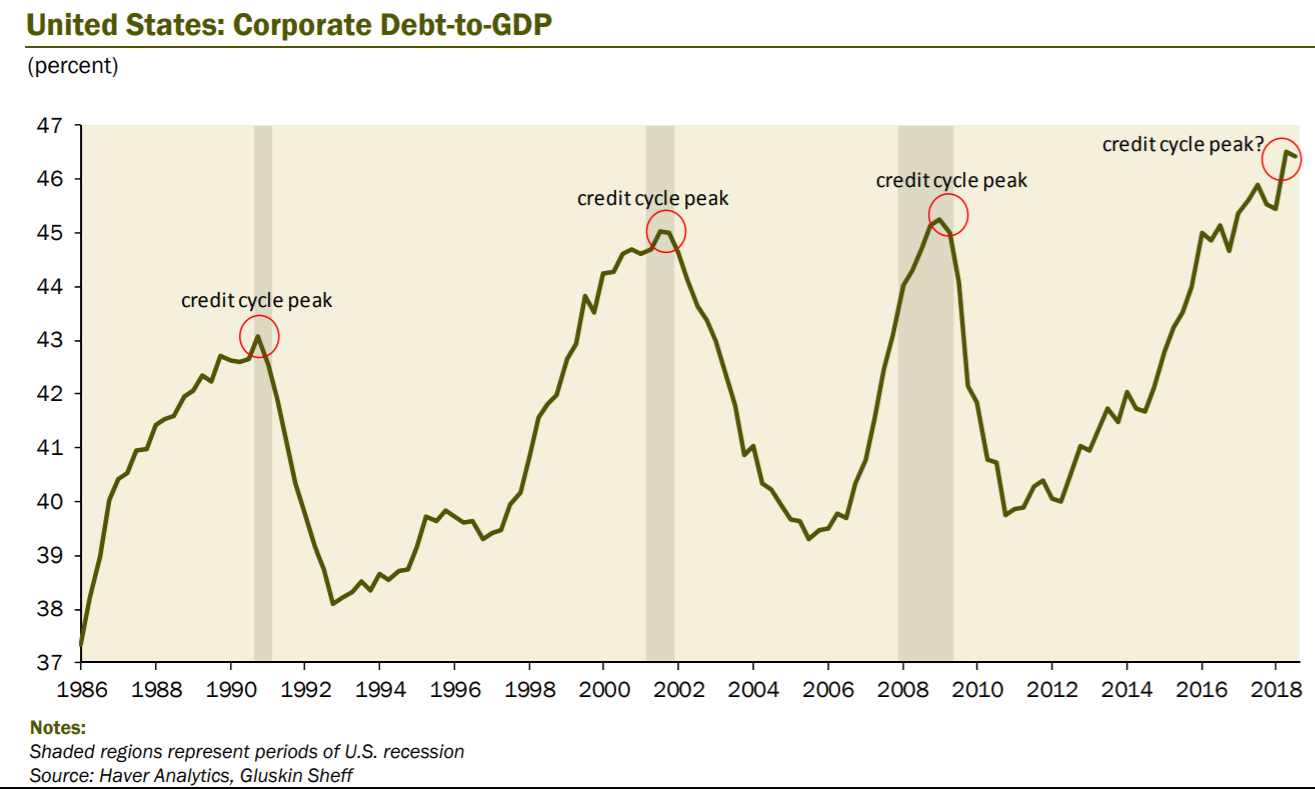

- Corporate debt is at all-time highs

- Many companies run “just in time” inventory and have very little slack in the supply chain

- The end of the corporate debt cycle almost always results in a recession

- There is a supply shock already coming for companies with operations in China from shutdowns and quarantines

- At the same time, there is a demand shock starting to unfold for companies dependent on Chinese demand from closures and quarantines

- Some small companies are already folding, after just a few weeks of China shutdowns

The risk is a wave of company defaults from companies that are overleveraged and reliant on either demand or supply from China.

Debt crises are inherently non-linear. Companies go bust all the time, but don’t create a debt crisis.

However, if (a) loans are being offered too cheaply and (b) there are enough defaults (or one or two large, high profile defaults), then:

- the interest rates increase in the corporate debt market as participants remember the risks

- loans become harder to get and/or rollover

- this will mean other companies will also default

- interest rates will go even higher, loans harder to get

- and so on, spiralling into a debt crisis.

China, South Korea, Italy, Iran and probably other countries have already locked in months of weak consumer demand, quarantines and shutdowns. This risk is a clear and present danger to markets – regardless of the further spread of COVID-19.

Risk 2: Global Pandemic

Viruses are the ultimate non-linear risk. The word pandemic literally describes an exponential outbreak of a virus across multiple countries.

The initial stages of an outbreak are basically the only time you have to stop the virus. Once a virus reaches a critical mass of people, it is virtually impossible to stop until it has run its course.

The key at that point is slowing down the virus. The real danger is when hospitals are over-run, and health professionals succumb. With limited staff, beds or respirators, death rates skyrocket.

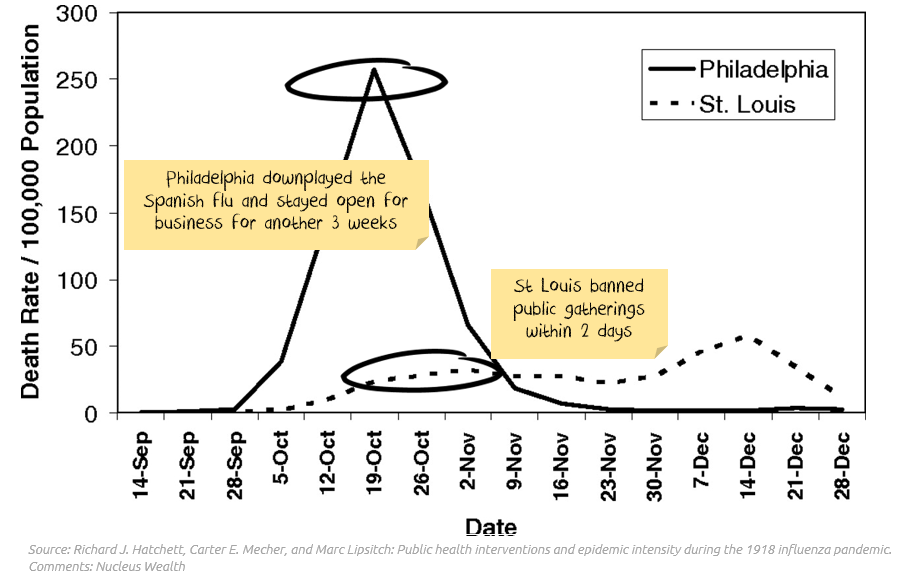

The relative response of two US cities in the 1918 flu pandemic is instructive:

Northern Hemisphere developing countries

Once the virus reaches numbers into the hundreds in a region, then quarantines, bans on public gathering and shutdowns are the only hope to slow the progress and save lives.

There is a significant (and necessary) economic cost to these measures.

This step China has already reached. And not just in the Hubei province, right across China bans and quarantines are restricting the economy.

South Korea and Iran are very likely to reach the same point this week.

Our base case is now that many Northern Hemisphere developing countries will end up in the same position.

Southern Hemisphere / Equatorial developing countries

I’m not sure about tropical countries. It may be that warm weather and sunshine is enough to slow the virus:

India, Indonesia, Malaysia, the south of Vietnam and the Philipines will be the ones to watch.

Our base case is equatorial countries avoid significant outbreaks. But, our faith in that forecast is low. If one of the above succumbs to an epidemic, then it is likely they all will.

Even if contained, there is a relatively high likelihood that in four months, when the southern hemisphere winter starts, other developing countries will see outbreaks.

Northern Hemisphere developed countries

This is the key economic risk.

The handling of cases in developed countries to date has not inspired confidence (except in Singapore). There are many cases of infected patients being sent home from hospitals on multiple occasions before being diagnosed.

Many developed countries are still not even testing for COVID-19. It is difficult to find cases when you aren’t looking.

Italy is the canary in the coal mine. Cases have exploded in the last few days and whether the virus can still be contained in Italy will likely indicate what other developed countries can expect.

A pandemic through developed countries is not yet our base case. But it is not far off. It is a real and significant risk.

Economic Outcomes

The most common bullish argument is:

- COVID-19 is just a bad version of the flu

- There will be so much fiscal and monetary stimulus that stock markets will go higher

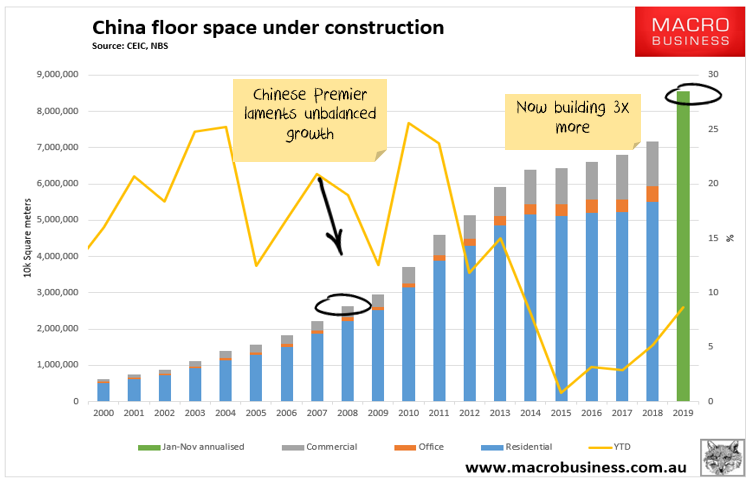

The risk is that China can’t stimulate much harder – they are already building at incredible levels:

And so it is likely the stimulus won’t be enough to replace the lost demand. After being through a complete quarantine/lockdown, my expectation is consumer spending will be muted for months and maybe even years.

If a gigantic government stimulus eventuates, then we will reconsider based on how expensive the market is and how targetted the stimulus is.

Going to ground

Our portfolios “went to ground” at the start of February, selling stocks and investing in bonds/cash/international currencies. Our tactical growth fund has been close to 50% underweight equities for a number of weeks. This is a significant deviation and one that we have not undertaken lightly.

On a stock basis, we cleared out of travel and oil stocks, bought up global consumer staples (in particular health and hygiene), global healthcare, and opted for defensive holdings.

Trading going forward

But that is in the past. The question is what to do from here. Our plan at the moment is:

- Stay focussed on the virus statistics (see here for latest data or here for a more analytical series) to look for changes

- Hold onto cash, foreign currencies and bonds. Patience, patience, patience. Build up our shopping list. We are looking for high-quality stocks are leveraged to the economic cycle that will become cheap. But, we are in no need to rush out and spend.

- Make relative trades. When markets get smashed, relative valuations change, and often good quality stocks become cheap relative to other shares. We like to use market volatility to increase the quality of the remaining shares in our portfolio.

If markets shoot higher, then we will underperform, but we think the trade-off is justified. Downside protection is more important at this point in the cycle than chasing stock markets higher.

* Black Swan Footnote: I hate when people talk about these sorts of events as black swans. A black swan is an event that is not just unlikely but presumed not to be possible. Say you are playing roulette. There are 18 red numbers, 18 black numbers and one green. If the ball lands on green, that is not a black swan! You knew the green number was there, it was unlikely, but the ball clearly could land on green. If the ball somehow got perfectly balanced on the strip between two numbers and the house decided to take everyone's money, that is a black swan - i.e. you didn't even realise that the ball could do that.

2 topics