The year of investing dangerously

2018 was the year of living dangerously as far as the stock market was concerned. The year began with a bang, cheered on by the global growth squad. However, unbridled risk taking eventually led to negative returns later in the year.

Most equity indices around the globe delivered negative returns for 2018 calendar year. Chinese and European stocks peaked early in the year and was heavily sold off with the Shanghai Composite Index down 25% and the Euro Stoxx 50 Index down 14%. The US and Australian markets delivered less taxing returns (-6% for the S&P500 and -7% for the ASX300 Price Index) as bubble conditions peaked around September.

Chasing stocks in the name of quality and growth became a sport for most of 2018. For a while it seemed like the momentum trade was the only way to make money despite our numerous warnings published on Livewire: ‘One of the most dangerous things investors can do’, ‘Witching hour for Cinderella stocks’, ‘Danger flags are waving’, ‘The bubble in quality’, and ‘The real danger lurking in the shadows’.

The bubble in quality and growth stocks was exceptionally clear when observing the PE multiple of the world’s first trillion-dollar company, Apple. For most of 2017, the company was trading around 15x PE multiple (the top end of its historical range). Then in early 2018, something lit a rocket under Apple’s share price. With the share price gathering pace at a faster rate than earnings, its PE multiple expanded exponentially.

Source: FactSet

The growth bubble was ubiquitous. For example, Australia’s growth bellwether, CSL, also experienced a bubble moment when its PE multiple reached stratospheric heights at 37x (highest multiple in 15 years).

Source: FactSet

The 2018 bubble occurred because narrative traps on global growth and rising interest rates led the market astray. For a while, risks were ignored when economic fundamentals were not improving. However, stock prices always mean revert to reflect fundamentals in the long term. Nothing escapes economic gravity.

Global Growth Narrative Trap

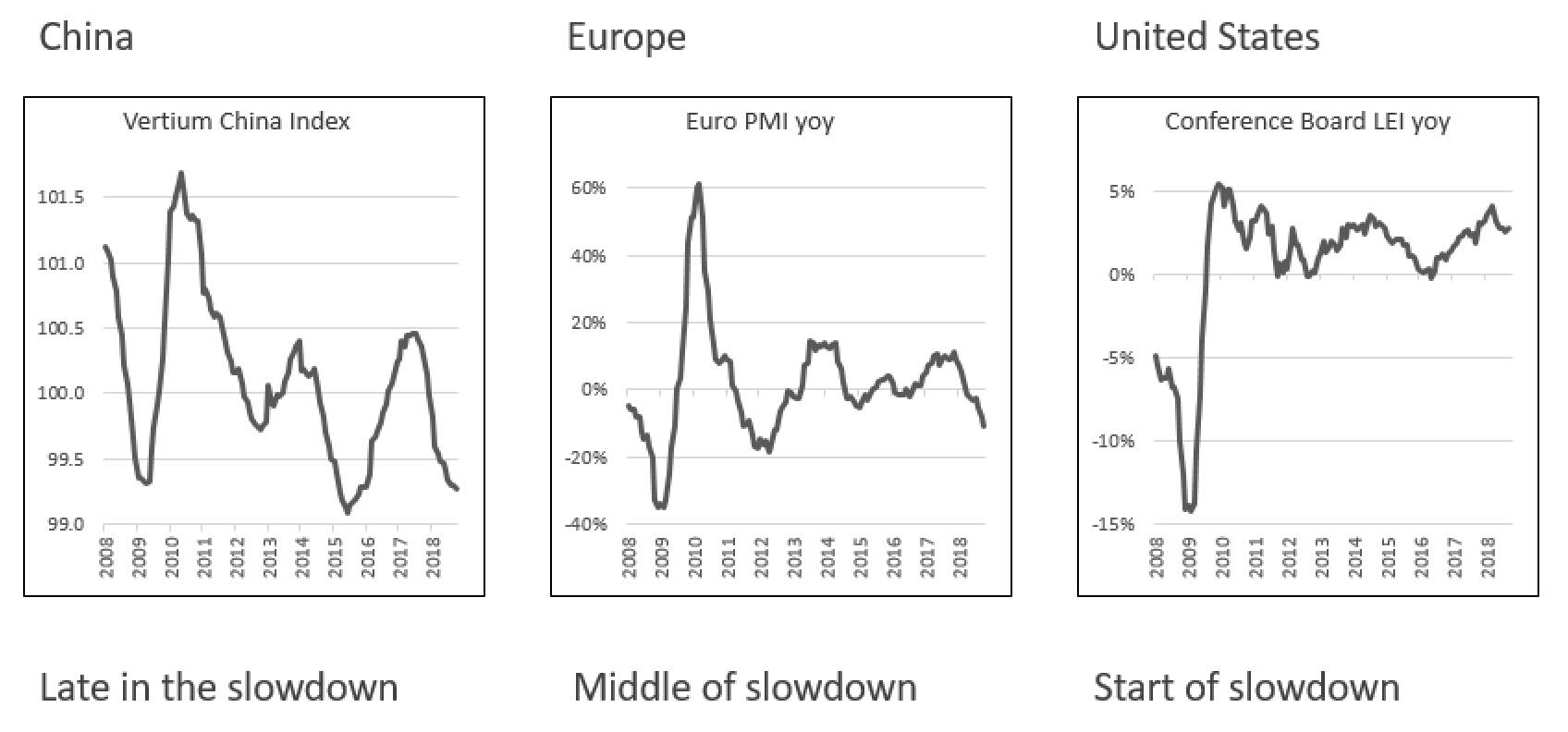

Investors justified chasing growth companies when global growth diverged leading to the perception of growth becoming scarce. China first led the economic slowdown from late 2017 and then Europe followed from early 2018. US economic conditions continued to look robust boosted by a late cycle fiscal stimulus program.

However, the US economy is not an economic island. Problems with the rest of the world sooner or later affects its economy because of their interdependence. History shows that the US economic cycle cannot diverge from other major economies for too long. In this cycle, the US economy was late to the exit party. Over the next few months, US economic data will confirm a slowdown and from then the world will be in a synchronised slowdown.

Source: FactSet, Vertium

Rising Interest Rate Narrative Trap

Another popular narrative in 2018 was to sell bond proxies because of the prospect of rising interest rates. Contrary to popular opinion, rising interest rates affect all securities, not just defensive stocks. While rising interest rates reduce valuations, more importantly, they increase the risk of an economic slowdown. Economic cycles end when rising interest rates eventually pushes economic growth over the edge. When growth expectations are revised down, growth stocks perform poorly while defensives outperform.

Economic law also dictates that slowing economic growth is disinflationary. Commodities exposed to lower demand and rising supply will be in a world of pain. Oil is currently caught in this perfect storm as the Brent price has fallen close to 40% from its peak in October. Consequently, a declining oil price drags down headline inflation.

Buy the Dips?

Now that valuations are cheaper, maybe it is a good time to buy the dips.

While the first phase of the correction has largely played out (valuation multiple derating), the second phase of earnings downgrades is yet to display its full force. In the coming months, economic data will confirm a slowdown. Signs of a global slowdown are beginning to appear in company earnings. For example, Apple first warned of slowing iPhone sales in November 2018 and it appeared to be at the beginning of an earnings downgrade cycle at that time.

Source: FactSet, Vertium

After the price correction in late 2018, Apple looked cheap trading around 12x PE multiple with net cash representing about 15% of its market capitalisation. However, buyers of the dip got punched in the face shortly after. In early January 2019, earnings were revised down again, and its stock price fell 10% after the announcement. What looks cheap can get cheaper in a global slowdown.

Apple will not be an isolated case. If the world’s largest consumer company cannot escape the global vortex then it’s a sure bet that other companies will have a similar experience. Cyclical companies are likely to report negative earnings growth and have their PE multiples expand. Growth companies’ PE multiples will de-rate as their rate of growth slows. Defensive stocks have little earnings risk and typically outperform in this environment.

Furthermore, the European Central Bank and the US Federal Reserve (Fed) will add more fuel to the fire of a deteriorating macro environment. Both central banks have intentions to raise interest rates further via open market operations and quantitative tightening. The Growth Bulls rallying cry of ‘fundamentals are robust’ have now changed to shrieks of ‘stop raising interest rates!’.

While the Bulls may rejoice if the Fed stops raising rates, it will not be enough to stop the macroeconomic snowball gathering pace. History shows that share market volatility will remain high when the Fed pause their rate hikes. Market rallies will be fleeting.

Source: FactSet, Vertium

In summary, the global growth narrative trap resulted in poor stock returns for 2018. More volatility is expected in 2019 when the world moves to a synchronised slowdown. At this stage we do not know if the current slowdown is shallow or deep. Unlike the two previous global slowdowns in 2012 and 2015, the current slowdown is occurring when the US yield curve is fast approaching zero (like it did before the Global Financial Crisis in 2009).

Many stocks are now considerably cheaper than a year ago and priced for misery. However, blindly catching falling knives in this environment may amputate a few fingers. Patience is required to carefully sift through this volatile minefield. When the fundamentals are not deteriorating as much as expected, buying the dips becomes a safer proposition.

1 topic

1 stock mentioned